REGULATIONS ON EXPENSES AND PAYMENT OF EXPENSES

- 1. REGULATIONS ON EXPENSES AND PAYMENT OF EXPENSES No.: HD-HC-08 Time of amendment: 01 Stage of issue: 02 Date of issue: ŌĆ”ŌĆ” Adjuster: Checker: Approver: I. PURPOSE. - To determine expenses for all staff who are currently working at Daian Manpower Company, on business trip domestically and overseas (if any). II. APPLICATION SCOPE. - These regulations are applied to all staff who are working at all factories and branches of Daian Manpower Company. - In some special cases, the regime of expenses and allowances may follow other regulations offered specifically by Board of General Directors at each period. III. DEFINITION. Expenses include regular and popular types of expenses as follows: 1. ŌĆ£Travel costsŌĆØ are the amounts spent to buy flight ticket, train ticket, bus ticket, hire transportation and other eligible amounts for business trip. 2. ŌĆ£Residence feeŌĆØ is the rent for hotelŌĆÖs room, guesthouse (exclusive of hotelŌĆÖs services) applied to business trip within 01 day or more, regardless of time on flight, train, and other means of transport on business trip. 3. ŌĆ£Daily expensesŌĆØ is the fixed amounts for staff that are spent for daily activities during the trip. 4. ŌĆ£Transaction costŌĆØ is the amount used to receive partners and guests of the company. 5. ŌĆ£Other costsŌĆØ is the amounts spent for fax, internet, work-related correspondence, print and copy of documents used for the trip. Page 1 of 8

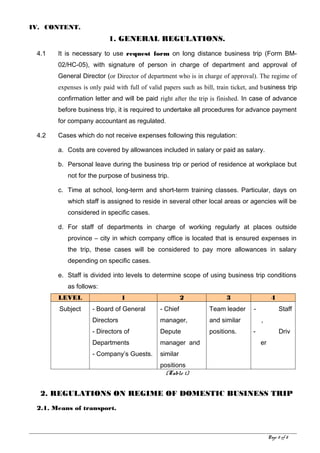

- 2. IV. CONTENT. 1. GENERAL REGULATIONS. 4.1 It is necessary to use request form on long distance business trip (Form BM- 02/HC-05), with signature of person in charge of department and approval of General Director (or Director of department who is in charge of approval). The regime of expenses is only paid with full of valid papers such as bill, train ticket, and business trip confirmation letter and will be paid right after the trip is finished. In case of advance before business trip, it is required to undertake all procedures for advance payment for company accountant as regulated. 4.2 Cases which do not receive expenses following this regulation: a. Costs are covered by allowances included in salary or paid as salary. b. Personal leave during the business trip or period of residence at workplace but not for the purpose of business trip. c. Time at school, long-term and short-term training classes. Particular, days on which staff is assigned to reside in several other local areas or agencies will be considered in specific cases. d. For staff of departments in charge of working regularly at places outside province ŌĆō city in which company office is located that is ensured expenses in the trip, these cases will be considered to pay more allowances in salary depending on specific cases. e. Staff is divided into levels to determine scope of using business trip conditions as follows: LEVEL 1 2 3 4 Subject - Board of General Directors - Directors of Departments - CompanyŌĆÖs Guests. - Chief manager, Depute manager and similar positions Team leader and similar positions. - Staff , - Driv er (Table 1) 2. REGULATIONS ON REGIME OF DOMESTIC BUSINESS TRIP 2.1. Means of transport. Page 2 of 8

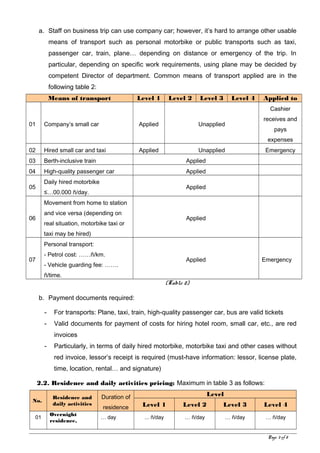

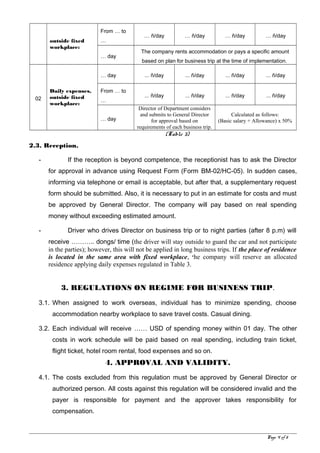

- 3. a. Staff on business trip can use company car; however, itŌĆÖs hard to arrange other usable means of transport such as personal motorbike or public transports such as taxi, passenger car, train, planeŌĆ” depending on distance or emergency of the trip. In particular, depending on specific work requirements, using plane may be decided by competent Director of department. Common means of transport applied are in the following table 2: Means of transport Level 1 Level 2 Level 3 Level 4 Applied to 01 CompanyŌĆÖs small car Applied Unapplied Cashier receives and pays expenses 02 Hired small car and taxi Applied Unapplied Emergency 03 Berth-inclusive train Applied 04 High-quality passenger car Applied 05 Daily hired motorbike ŌēżŌĆ”00.000 ├▒/day. Applied 06 Movement from home to station and vice versa (depending on real situation, motorbike taxi or taxi may be hired) Applied 07 Personal transport: - Petrol cost: ŌĆ”ŌĆ”├▒/km. - Vehicle guarding fee: ŌĆ”ŌĆ”. ├▒/time. Applied Emergency (Table 2) b. Payment documents required: - For transports: Plane, taxi, train, high-quality passenger car, bus are valid tickets - Valid documents for payment of costs for hiring hotel room, small car, etc., are red invoices - Particularly, in terms of daily hired motorbike, motorbike taxi and other cases without red invoice, lessorŌĆÖs receipt is required (must-have information: lessor, license plate, time, location, rentalŌĆ” and signature) 2.2. Residence and daily activities pricing: Maximum in table 3 as follows: No. Residence and daily activities Duration of residence Level Level 1 Level 2 Level 3 Level 4 01 Overnight residence, ŌĆ” day ... ├▒/day ŌĆ” ├▒/day ŌĆ” ├▒/day ŌĆ” ├▒/day Page 3 of 8

- 4. outside fixed workplace: From ŌĆ” to ŌĆ” ŌĆ” ├▒/day ŌĆ” ├▒/day ŌĆ” ├▒/day ŌĆ” ├▒/day ŌĆ” day The company rents accommodation or pays a specific amount based on plan for business trip at the time of implementation. 02 Daily expenses, outside fixed workplace: ŌĆ” day ... ├▒/day ... ├▒/day ... ├▒/day ... ├▒/day From ŌĆ” to ŌĆ” ... ├▒/day ... ├▒/day ... ├▒/day ... ├▒/day ŌĆ” day Director of Department considers and submits to General Director for approval based on requirements of each business trip. Calculated as follows: (Basic salary + Allowance) x 50% (Table 3) 2.3. Reception. - If the reception is beyond competence, the receptionist has to ask the Director for approval in advance using Request Form (Form BM-02/HC-05). In sudden cases, informing via telephone or email is acceptable, but after that, a supplementary request form should be submitted. Also, it is necessary to put in an estimate for costs and must be approved by General Director. The company will pay based on real spending money without exceeding estimated amount. - Driver who drives Director on business trip or to night parties (after 8 p.m) will receive ŌĆ”ŌĆ”ŌĆ”.. dongs/ time (the driver will stay outside to guard the car and not participate in the parties); however, this will not be applied in long business trips. If the place of residence is located in the same area with fixed workplace, the company will reserve an allocated residence applying daily expenses regulated in Table 3. 3. REGULATIONS ON REGIME FOR BUSINESS TRIP. 3.1. When assigned to work overseas, individual has to minimize spending, choose accommodation nearby workplace to save travel costs. Casual dining. 3.2. Each individual will receive ŌĆ”ŌĆ” USD of spending money within 01 day. The other costs in work schedule will be paid based on real spending, including train ticket, flight ticket, hotel room rental, food expenses and so on. 4. APPROVAL AND VALIDITY. 4.1. The costs excluded from this regulation must be approved by General Director or authorized person. All costs against this regulation will be considered invalid and the payer is responsible for payment and the approver takes responsibility for compensation. Page 4 of 8

- 5. 4.2. This regulation will be applied from July 01 st , 2011. The issued documents about working regime which have the dissimilar content will be invalid. V. ANNEX/FORMS. 1. Request form BM: 02/HC-05 2. Business trip form BM: 03/HC-05 Page 5 of 8

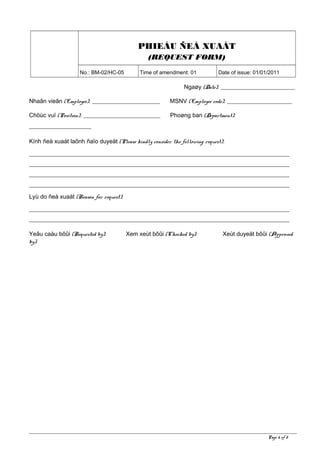

- 6. PHIE├üU ├æE├Ć XUA├üT (REQUEST FORM) No.: BM-02/HC-05 Time of amendment: 01 Date of issue: 01/01/2011 Nga├Ėy (Date): _________________________ Nha├ón vie├ón (Employee): _______________________ MSNV (Employee code): ______________________ Ch├Č├╣c vu├» (Position): __________________________ Pho├Ėng ban (Department): _____________________ K├Łnh ├▒e├Ā xua├Īt la├Ąnh ├▒a├»o duye├żt (Please kindly consider the following request): ________________________________________________________________________________________ ________________________________________________________________________________________ ________________________________________________________________________________________ ________________________________________________________________________________________ Ly├╣ do ├▒e├Ā xua├Īt (Reason for request): ________________________________________________________________________________________ ________________________________________________________________________________________ Ye├óu ca├Āu b├┤├╗i (Requested by): Xem xe├╣t b├┤├╗i (Checked by): Xe├╣t duye├żt b├┤├╗i (Approved by): Page 6 of 8

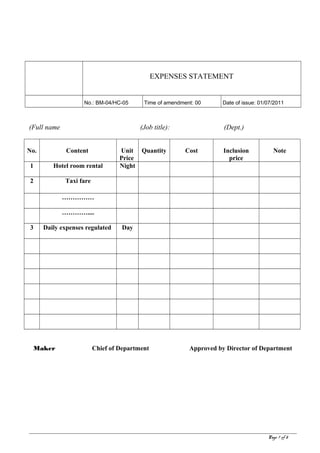

- 7. EXPENSES STATEMENT No.: BM-04/HC-05 Time of amendment: 00 Date of issue: 01/07/2011 (Full name (Job title): (Dept.) No. Content Unit Price Quantity Cost Inclusion price Note 1 Hotel room rental Night 2 Taxi fare ŌĆ”ŌĆ”ŌĆ”ŌĆ”ŌĆ” ŌĆ”ŌĆ”ŌĆ”ŌĆ”.... 3 Daily expenses regulated Day Maker Chief of Department Approved by Director of Department Page 7 of 8

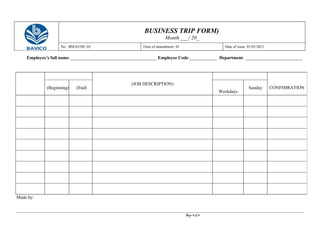

- 8. BUSINESS TRIP FORM) Month ___/ 20_ No.: BM-03/HC-05 Time of amendment: 01 Date of issue: 01/01/2011 EmployeeŌĆÖs full name:______________________________________ Employee Code:____________ Department: _________________________ Made by: Page 8 of 8 (JOB DESCRIPTION) CONFIMRATION(Beginning) (End) Weekdays Sunday