Segundo bimestre2009

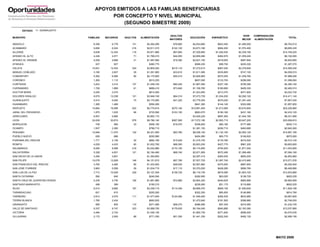

- 1. APOYOS EMITIDOS A LAS FAMILIAS BENEFICIARIAS POR CONCEPTO Y NIVEL MUNICIPAL (SEGUNDO BIMESTRE 2009) ESTADO: 11 GUANAJUATO ADULTOS VIVIR COMPENSACI?N MUNICIPIO FAMILIAS BECARIOS ADULTOS ALIMENTACI?N EDUCACI?N ENERG?TICO TOTAL MAYORES MEJOR ALIMENTACI?N ABASOLO 6,356 6,778 131 $2,494,290 $76,660 $4,053,660 $653,400 $1,485,000 $8,763,010 ACAMBARO 6,690 6,024 216 $2,611,515 $122,130 $3,673,190 $684,200 $1,574,400 $8,665,435 ALLENDE 9,838 12,434 119 $3,971,880 $67,850 $7,329,800 $1,040,535 $2,339,160 $14,749,225 APASEO EL ALTO 4,436 4,571 71 $1,766,415 $44,050 $2,859,490 $462,870 $1,059,240 $6,192,065 APASEO EL GRANDE 4,059 4,666 31 $1,597,680 $19,390 $2,827,100 $418,655 $957,840 $5,820,665 ATARJEA 937 927 $380,775 $586,225 $99,750 $220,320 $1,287,070 CELAYA 10,001 12,434 324 $3,805,020 $215,110 $7,272,615 $997,045 $2,279,640 $14,569,430 MANUEL DOBLADO 3,180 2,827 29 $1,281,900 $33,610 $1,611,085 $335,800 $747,120 $4,009,515 COMONFORT 5,362 6,566 80 $2,175,905 $55,410 $3,826,965 $570,255 $1,259,760 $7,888,295 CORONEO 1,260 1,112 $510,225 $657,050 $133,705 $298,080 $1,599,060 CORTAZAR 3,203 3,310 137 $1,248,720 $80,240 $1,967,590 $327,190 $756,360 $4,380,100 CUERAMARO 1,726 1,869 61 $689,410 $73,840 $1,108,760 $180,680 $409,320 $2,462,010 DOCTOR MORA 2,000 2,570 $814,260 $1,523,500 $213,370 $471,600 $3,022,730 DOLORES HIDALGO 9,570 12,238 121 $3,946,745 $64,310 $7,073,735 $1,034,230 $2,292,120 $14,411,140 GUANAJUATO 5,514 6,550 75 $2,175,060 $41,220 $3,779,305 $570,020 $1,291,440 $7,857,045 HUANIMARO 1,385 1,468 $550,260 $841,365 $144,145 $322,080 $1,857,850 IRAPUATO 15,664 18,589 522 $5,775,815 $270,140 $10,991,505 $1,513,560 $3,675,840 $22,226,860 JARAL DEL PROGRESO 1,875 1,635 96 $725,580 $103,150 $983,070 $190,160 $431,160 $2,433,120 JERECUARO 6,507 5,885 $2,662,110 $3,428,220 $697,400 $1,544,160 $8,331,890 LEON 24,639 30,674 978 $9,786,140 $587,560 $17,072,195 $2,565,715 $5,647,200 $35,658,810 MOROLEON 749 584 33 $306,150 $19,470 $348,820 $80,190 $177,480 $932,110 OCAMPO 1,937 2,382 $788,715 $1,381,155 $206,710 $463,680 $2,840,260 PENJAMO 10,946 11,070 142 $4,321,065 $83,780 $6,538,120 $1,132,100 $2,592,120 $14,667,185 PUEBLO NUEVO 626 686 $250,980 $404,590 $65,770 $148,920 $870,260 PURISIMA DEL RINCON 1,771 2,136 30 $682,185 $15,930 $1,216,725 $178,780 $416,520 $2,510,140 ROMITA 4,029 4,433 60 $1,632,795 $68,300 $2,603,530 $427,775 $961,200 $5,693,600 SALAMANCA 8,090 8,588 219 $3,032,880 $170,100 $5,174,850 $794,930 $1,871,040 $11,043,800 SALVATIERRA 5,328 4,831 121 $2,184,490 $68,740 $2,971,955 $572,495 $1,266,480 $7,064,160 SAN DIEGO DE LA UNION 3,394 3,851 $1,394,800 $2,287,415 $365,545 $805,200 $4,852,960 SAN FELIPE 10,078 12,828 148 $4,151,815 $87,790 $7,527,725 $1,087,745 $2,415,960 $15,271,035 SAN FRANCISCO DEL RINCON 3,760 4,482 90 $1,433,000 $48,930 $2,567,860 $375,550 $867,600 $5,292,940 SAN JOSE ITURBIDE 3,983 5,558 29 $1,634,715 $17,110 $3,370,020 $428,285 $956,760 $6,406,890 SAN LUIS DE LA PAZ 7,712 10,529 229 $3,127,305 $136,720 $6,116,735 $819,380 $1,803,720 $12,003,860 SANTA CATARINA 582 640 $240,540 $382,950 $63,025 $138,720 $825,235 SANTA CRUZ DE JUVENTINO ROSAS 4,235 4,730 126 $1,681,860 $72,880 $2,804,320 $440,625 $983,880 $5,983,565 SANTIAGO MARAVATIO 498 399 $195,210 $239,260 $51,175 $116,880 $602,525 SILAO 8,214 9,682 197 $3,236,715 $114,340 $5,689,370 $848,130 $1,940,640 $11,829,195 TARANDACUAO 621 610 $250,050 $352,355 $65,505 $146,880 $814,790 TARIMORO 2,812 2,570 111 $1,077,645 $124,260 $1,549,400 $282,535 $633,960 $3,667,800 TIERRA BLANCA 1,785 2,434 $692,835 $1,472,840 $181,500 $398,880 $2,746,055 URIANGATO 956 835 110 $371,580 $58,370 $486,090 $97,345 $219,360 $1,232,745 VALLE DE SANTIAGO 9,337 8,747 323 $3,589,755 $179,830 $5,164,040 $940,880 $2,163,360 $12,037,865 VICTORIA 2,494 2,743 $1,036,145 $1,665,730 $271,640 $596,520 $3,570,035 VILLAGRAN 2,172 2,505 88 $771,250 $51,250 $1,441,330 $202,245 $492,120 $2,958,195 MAYO 2009

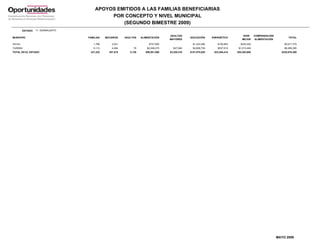

- 2. APOYOS EMITIDOS A LAS FAMILIAS BENEFICIARIAS POR CONCEPTO Y NIVEL MUNICIPAL (SEGUNDO BIMESTRE 2009) ESTADO: 11 GUANAJUATO ADULTOS VIVIR COMPENSACI?N MUNICIPIO FAMILIAS BECARIOS ADULTOS ALIMENTACI?N EDUCACI?N ENERG?TICO TOTAL MAYORES MEJOR ALIMENTACI?N XICHU 1,798 2,041 $747,600 $1,243,480 $195,855 $430,440 $2,617,375 YURIRIA 5,113 4,494 79 $2,049,275 $47,940 $2,608,730 $537,010 $1,213,440 $6,456,395 TOTAL EN EL ESTADO 227,222 257,515 5,126 $89,851,060 $3,220,410 $151,075,820 $23,545,410 $53,283,600 $320,976,300 MAYO 2009