Somesh Katre's Business Plan - Solved

Download as PPTX, PDF1 like813 views

The document compares approaches to equity valuation using free cash flow to the firm (FCFF) and free cash flow to equity (FCFE). FCFF considers cash flow available to all capital providers, while FCFE looks at cash flow to common equity holders. The document provides examples of discounting FCFF using the weighted average cost of capital (WACC) and FCFE using the required return on equity to determine equity value. It recommends using FCFF with WACC for valuation as the net present value is positive.

1 of 14

Download to read offline

Recommended

Sharing revenue recognition poc methodology

Sharing revenue recognition poc methodologyMarcus Bandeira

╠²

This document describes the percentage of completion (POC) methodology for revenue recognition on engineering, procurement, and construction (EPC) projects. It explains that revenue is recognized based on either incurred costs or physical progress. The POC methodology incentivizes on-budget and cost management practices, results in more predictable profit margins, and allows profits to be recognized in a manner that better matches fiscal years. Key concepts discussed include underbilling/overbilling, treatment of client acquisitions and subcontractor billing.Aggregate demand & aggregate supply

Aggregate demand & aggregate supplykvdibrugarh

╠²

This document defines and explains key macroeconomic concepts including aggregate demand, aggregate supply, autonomous consumption, and private final consumption expenditure. It provides schedules and diagrams to illustrate these concepts. Specifically, it defines aggregate demand as the total demand for goods and services in an economy, including consumption, investment, government spending, and net exports. Aggregate supply is defined as the total output of goods and services available for purchase. The equality of aggregate demand and aggregate supply indicates an economy is at full employment.Cost Segregation Studies

Cost Segregation StudiesKBKG, Inc.

╠²

Overview and example of cost segregation and how it can improve cash flow through income tax deferral.Project: BH SkyScan

Project: BH SkyScanLin BH

╠²

Use our 'live pricing' API to find return flights from Edinburgh to London, departing next Monday and returning the following day.

Use the returned data to display a page of results that matches the design provided.

studiobinghuan.blogspot.com/?view=flipcardManagerial budgets and project management

Managerial budgets and project management Jeremy Scholl

╠²

This Earned Value Analysis report summarizes the progress of painting furniture at a store in Palatine, Illinois through week 7. The scope includes priming and painting ceilings, offices, bathrooms, concrete floors, bollards, and doors per approved blueprints. As of week 7, the cumulative actual cost is $19,530 while the earned value is $18,330, resulting in a cost variance of $1,200 and a schedule variance of -$200. The cost performance index of 1.30 and schedule performance index of 1.03 indicate the project is under budget and slightly behind schedule.Cost & man chapter 2 solutions 2008

Cost & man chapter 2 solutions 2008Kwanda Matiwane

╠²

The document discusses different types of costs including variable costs, which change with activity levels, and fixed costs, which remain constant within a relevant range. It provides examples of how to calculate variable and fixed costs per unit using the high-low method and scatter graphs. The document also examines how total, variable, and fixed costs are affected when production volume changes.Depreciation Tax Shield | Finance

Depreciation Tax Shield | FinanceTransweb Global Inc

╠²

It is a technique under which depreciation of a company is managed as such there is tax saving due to this. This is called tax reduction technique. Under this technique, depreciation is deducted from the taxable income so that there is tax saving. Copy the link given below and paste it in new browser window to get more information on Depreciation Tax Shield:- http://www.transtutors.com/homework-help/finance/depreciation-tax-shield.aspxCost & management Accounting

Cost & management AccountingJisjissyChandran

╠²

The document discusses fund flow statements, including their meaning, objectives, and preparation. It provides examples of solutions to statements of changes in working capital and fund flow statements. Key points covered include:

- A fund flow statement explains the movement of funds and working capital during an accounting period.

- It shows how resources were obtained and used, the results of financial management, and how business expansion was financed.

- Preparing it involves scheduling changes in working capital accounts and determining the fund from operations using an adjusted income statement.

- The examples show statements of changes in working capital, working notes, and the completed fund flow statements for various periods.Construction cost reporting | Black & White List

Construction cost reporting | Black & White ListSteven Eady

╠²

Property assessment for new facility construction in Alberta is

based on actual construction costs which are to be reported

to the applicable assessing authority subsequent to facility

commissioning.Process flow for second hand machinery clearance

Process flow for second hand machinery clearanceGAJENDRANATH.T.M. .

╠²

The document outlines the process flow for importing used capital goods into India:

1. Importers must submit documents through the ICEGATE system and generate a bill of entry number.

2. Customs examines the cargo with a chartered engineer who prepares a report on the machine's details.

3. An assessment order is prepared to determine the assessable value based on the invoice, deduced, or appraised values. Cost & management Accounting

Cost & management AccountingJisjissyChandran

╠²

The document provides information about cash flow statements, including:

- Cash flow statements track the inflows and outflows of cash over a period of time for operating, investing, and financing activities.

- They focus on transactions that directly impact cash, explaining changes in a company's cash position between two balance sheet dates.

- The document also includes examples of completed cash flow statements using the direct method, showing calculations for net cash from operating, investing, and financing activities.Cf Capital Budgeting 6

Cf Capital Budgeting 6rajeevgupta

╠²

The document discusses capital budgeting and investment project evaluation. It states that when projects are undertaken that are expected to generate discounted cash flows exceeding the initial investment, it increases the economic value of the company and benefits shareholders through stock price appreciation. It also briefly describes several capital budgeting techniques used to evaluate projects, such as payback period, net present value, internal rate of return, and discounted payback period.Cf Capital Budgeting 6

Cf Capital Budgeting 6rajeevgupta

╠²

The document discusses capital budgeting and investment project evaluation. It states that when projects deliver discounted cash flows exceeding investment costs, shareholder value increases through stock price appreciation. Several capital budgeting techniques are described like net present value, internal rate of return, payback period. Risk analysis methods in capital budgeting like sensitivity analysis and scenario analysis are also covered.On site field inspections - property tax management

On site field inspections - property tax managementSteven Eady

╠²

When being assessed the best way to confirm that its correct is by putting feet on the ground. Ensure that you have someone with property assessment & taxation experience reviewing your properties.Netflix (NTLX) 20180813

Netflix (NTLX) 20180813 Invbots Limited

╠²

Netflix stock valuation commentary by Crystal Hsu dated 13/8/2018. The operating income and international streaming revenue for Netflix have not met consensus expectations. While revenue, operating profit, and net profit continue to grow, the sharp fall in stock price was due to overestimation. The commentary recommends holding Netflix stock and waiting another week for a potential buying opportunity, as the company still has a high growth rate and increasing paid membership.Cost-benefit analysis -2

Cost-benefit analysis -2Gashaw Abebe

╠²

A masonry dam was constructed in Mekdella Woreda, Ethiopia in 2015 using 1,019,703 ETB in capital funds. It can irrigate 48 hectares of farmland and benefit 189 households. In the first year of operation, it irrigated 11 hectares due to drought and generated 940,670 ETB in cash inflows. Financial analyses show the dam has a payback period of 1.2 years, a positive net present value of 4,695,791.87 ETB at a 12% discount rate, and an internal rate of return of 731%, indicating the dam is financially viable.Earned value 01

Earned value 01Ahmed Badr Eldin, EMBA, PMP, ITIL

╠²

show you how to use MS project to apply Earned Value method to track project performance from time to costAndreas Meier, TEKO

Andreas Meier, TEKOATMOsphere Conferences & Events

╠²

At the technology round table strategic presentations on Industrial Refrigeration will be presented by leading industry representatives, followed by a panel discussion. Oracle grants accounting 6

Oracle grants accounting 6Naveen Reddy

╠²

This document discusses expenditure implementation in Oracle Grants Accounting. It covers defining accounting periods, expenditure definitions, labor costing setup, and implementation listing reports. Key steps include setting up accounting periods, expenditure categories and types, labor costing rules and rate schedules, and running reports to document the implementation setup.Earned value analysis

Earned value analysisNikhil Raj

╠²

Earned value management (EVM) is a methodology that combines scope, schedule, and resource measurements to assess project performance and progress.

It is a commonly used method of performance measurement for projects.

It integrates the scope baseline with the cost baseline, along with the schedule baseline, to form the performance baseline, which helps the project management team assess and measure project performance and progress

By Er.Nikhil Raj, Senior Planning Enginner, Navig Solution Pvt LtdA Briefing Document on the ESFA Apprenticeship Non-Levy ITT

A Briefing Document on the ESFA Apprenticeship Non-Levy ITTThe Pathway Group

╠²

ESFA Apprenticeship Non-Levy ITT

Current Non-Levy ITT Maximum Contracting Values

Only open to organisations that are Main Providers as approved at the PQQ stage for the Provision of Non-Levy Apprenticeships

ITT Submission by the 4th September 2017

Awards and contracting to be in place by December 2017 - now released on 7th December 2017

Delivery running from January 18 for 15 months with possible extensions

Please ensure you read the ITT specification and fully understand the requirements and utilise the ESFA QAŌĆÖs within Bravo as this is our interpretation only and we have only created this to be helpful!Cost & management Accounting

Cost & management AccountingJisjissyChandran

╠²

The document discusses the classification, apportionment, and distribution of overheads. It defines overheads as business costs related to day-to-day operations that vary by industry. It outlines the steps to apportion overheads, including classification, collection, allocation, and absorption into production units. Various methods to reapportion service department overheads to production departments are also presented, including direct distribution and reciprocal methods. An example secondary distribution summary and calculation of department overhead rates based on direct wages is provided.HIGHER FINANCIAL ACCOUNTING

HIGHER FINANCIAL ACCOUNTINGJisjissyChandran

╠²

The document discusses the adjustment of capital accounts when admitting a new partner to a firm. It provides examples of adjusting capital accounts on the basis of the new partner's capital account or the existing partners' capital accounts. It also includes examples of journal entries for admitting a new partner when goodwill is involved and assets are revalued or reallocated between partners. The key information is how to account for changes to partners' capital accounts when admitting a new partner to the business in accordance with any terms of the new partnership agreement.Finance Group Assignment - Presentation

Finance Group Assignment - PresentationSmita Sinha

╠²

This case study analyzes two potential iron ore mining projects, Project A and Project B, for Fortescue Metals Group. It examines the key assumptions and financial projections of each project, including revenues, costs, capital expenditures, and tax rates. It then performs a net present value analysis and scenario analysis under different price projections. Based on the expected NPV and standard deviation of each project, it recommends that Project A has less risk and a higher expected return than Project B.Time value of money

Time value of moneyNileshParab18

╠²

The document discusses time value of money concepts like present value, future value, present value of annuity, and future value of annuity. It provides formulas to calculate these values and includes examples showing how to apply the formulas to calculate PV, FV, PVA and FVA given cash flows, interest rates, and time periods. Sample questions are included along with step-by-step solutions demonstrating the calculations.Swaminarayan Akshardham Temple Must Visit in Delhi One Day Trip

Swaminarayan Akshardham Temple Must Visit in Delhi One Day TripRajasthan Four Wheel Drive Pvt. Ltd.

╠²

Akshardham temple is based on Delhi and when you are looking into Delhi in near future, then be sure to go to it and we ensure that you will be going to take pleasure from it. Activate

ActivateSnehith Alapati

╠²

Internship Requirement. App idea. Prof. Sameer Mathur. Snehith Alapati. Activate. FA Acquisition with parallel valuation (AUC)

FA Acquisition with parallel valuation (AUC)Anatoly Ryabukha

╠²

This document discusses acquiring fixed assets with parallel valuation for accounting and tax purposes. It addresses settling the initial acquisition in the general ledger, performing a valuation for parallel cost of goods manufactured accounting, and calculating depreciation expenses under both the Russian Accounting Standards and International Financial Reporting Standards frameworks including any tax implications.Introducing financial analysis

Introducing financial analysisvenkataramanan Thiru

╠²

Any incorporated company at the end of the financial year is required to prepare financial statements showing the assets & liabilities, profit or loss for the period, a cash flow statement &get it audited. the audited statements along with the auditor's report & directors report with all schedules is to be submitted to the ROC, shareholders at the annual general meeting, banks, financial institutions, all stakeholders.etc

These statements form the basis of ANALYSIS, WHICH CAN BE (A) VERTICAL ANALYSIS ( B)HORIZONTAL ANALYSIS (C )COMPARITIVE STATEMENTS (D)COST ANALYSIS (E)CASH FLOW ANALYSIS AND SO ON 'The main feature of these analyses will be explained with illustrative examples Cf%20 Capital%20 Budgeting%206

Cf%20 Capital%20 Budgeting%206rajeevgupta

╠²

The document discusses capital budgeting and investment project evaluation. It states that when projects deliver discounted cash flows exceeding investment costs, shareholder value increases through stock price appreciation. Several capital budgeting techniques are described like net present value, internal rate of return, payback period. Risk analysis methods in capital budgeting are also covered like sensitivity analysis, scenario analysis and Monte Carlo simulation to incorporate risk.More Related Content

What's hot (20)

Construction cost reporting | Black & White List

Construction cost reporting | Black & White ListSteven Eady

╠²

Property assessment for new facility construction in Alberta is

based on actual construction costs which are to be reported

to the applicable assessing authority subsequent to facility

commissioning.Process flow for second hand machinery clearance

Process flow for second hand machinery clearanceGAJENDRANATH.T.M. .

╠²

The document outlines the process flow for importing used capital goods into India:

1. Importers must submit documents through the ICEGATE system and generate a bill of entry number.

2. Customs examines the cargo with a chartered engineer who prepares a report on the machine's details.

3. An assessment order is prepared to determine the assessable value based on the invoice, deduced, or appraised values. Cost & management Accounting

Cost & management AccountingJisjissyChandran

╠²

The document provides information about cash flow statements, including:

- Cash flow statements track the inflows and outflows of cash over a period of time for operating, investing, and financing activities.

- They focus on transactions that directly impact cash, explaining changes in a company's cash position between two balance sheet dates.

- The document also includes examples of completed cash flow statements using the direct method, showing calculations for net cash from operating, investing, and financing activities.Cf Capital Budgeting 6

Cf Capital Budgeting 6rajeevgupta

╠²

The document discusses capital budgeting and investment project evaluation. It states that when projects are undertaken that are expected to generate discounted cash flows exceeding the initial investment, it increases the economic value of the company and benefits shareholders through stock price appreciation. It also briefly describes several capital budgeting techniques used to evaluate projects, such as payback period, net present value, internal rate of return, and discounted payback period.Cf Capital Budgeting 6

Cf Capital Budgeting 6rajeevgupta

╠²

The document discusses capital budgeting and investment project evaluation. It states that when projects deliver discounted cash flows exceeding investment costs, shareholder value increases through stock price appreciation. Several capital budgeting techniques are described like net present value, internal rate of return, payback period. Risk analysis methods in capital budgeting like sensitivity analysis and scenario analysis are also covered.On site field inspections - property tax management

On site field inspections - property tax managementSteven Eady

╠²

When being assessed the best way to confirm that its correct is by putting feet on the ground. Ensure that you have someone with property assessment & taxation experience reviewing your properties.Netflix (NTLX) 20180813

Netflix (NTLX) 20180813 Invbots Limited

╠²

Netflix stock valuation commentary by Crystal Hsu dated 13/8/2018. The operating income and international streaming revenue for Netflix have not met consensus expectations. While revenue, operating profit, and net profit continue to grow, the sharp fall in stock price was due to overestimation. The commentary recommends holding Netflix stock and waiting another week for a potential buying opportunity, as the company still has a high growth rate and increasing paid membership.Cost-benefit analysis -2

Cost-benefit analysis -2Gashaw Abebe

╠²

A masonry dam was constructed in Mekdella Woreda, Ethiopia in 2015 using 1,019,703 ETB in capital funds. It can irrigate 48 hectares of farmland and benefit 189 households. In the first year of operation, it irrigated 11 hectares due to drought and generated 940,670 ETB in cash inflows. Financial analyses show the dam has a payback period of 1.2 years, a positive net present value of 4,695,791.87 ETB at a 12% discount rate, and an internal rate of return of 731%, indicating the dam is financially viable.Earned value 01

Earned value 01Ahmed Badr Eldin, EMBA, PMP, ITIL

╠²

show you how to use MS project to apply Earned Value method to track project performance from time to costAndreas Meier, TEKO

Andreas Meier, TEKOATMOsphere Conferences & Events

╠²

At the technology round table strategic presentations on Industrial Refrigeration will be presented by leading industry representatives, followed by a panel discussion. Oracle grants accounting 6

Oracle grants accounting 6Naveen Reddy

╠²

This document discusses expenditure implementation in Oracle Grants Accounting. It covers defining accounting periods, expenditure definitions, labor costing setup, and implementation listing reports. Key steps include setting up accounting periods, expenditure categories and types, labor costing rules and rate schedules, and running reports to document the implementation setup.Earned value analysis

Earned value analysisNikhil Raj

╠²

Earned value management (EVM) is a methodology that combines scope, schedule, and resource measurements to assess project performance and progress.

It is a commonly used method of performance measurement for projects.

It integrates the scope baseline with the cost baseline, along with the schedule baseline, to form the performance baseline, which helps the project management team assess and measure project performance and progress

By Er.Nikhil Raj, Senior Planning Enginner, Navig Solution Pvt LtdA Briefing Document on the ESFA Apprenticeship Non-Levy ITT

A Briefing Document on the ESFA Apprenticeship Non-Levy ITTThe Pathway Group

╠²

ESFA Apprenticeship Non-Levy ITT

Current Non-Levy ITT Maximum Contracting Values

Only open to organisations that are Main Providers as approved at the PQQ stage for the Provision of Non-Levy Apprenticeships

ITT Submission by the 4th September 2017

Awards and contracting to be in place by December 2017 - now released on 7th December 2017

Delivery running from January 18 for 15 months with possible extensions

Please ensure you read the ITT specification and fully understand the requirements and utilise the ESFA QAŌĆÖs within Bravo as this is our interpretation only and we have only created this to be helpful!Cost & management Accounting

Cost & management AccountingJisjissyChandran

╠²

The document discusses the classification, apportionment, and distribution of overheads. It defines overheads as business costs related to day-to-day operations that vary by industry. It outlines the steps to apportion overheads, including classification, collection, allocation, and absorption into production units. Various methods to reapportion service department overheads to production departments are also presented, including direct distribution and reciprocal methods. An example secondary distribution summary and calculation of department overhead rates based on direct wages is provided.HIGHER FINANCIAL ACCOUNTING

HIGHER FINANCIAL ACCOUNTINGJisjissyChandran

╠²

The document discusses the adjustment of capital accounts when admitting a new partner to a firm. It provides examples of adjusting capital accounts on the basis of the new partner's capital account or the existing partners' capital accounts. It also includes examples of journal entries for admitting a new partner when goodwill is involved and assets are revalued or reallocated between partners. The key information is how to account for changes to partners' capital accounts when admitting a new partner to the business in accordance with any terms of the new partnership agreement.Finance Group Assignment - Presentation

Finance Group Assignment - PresentationSmita Sinha

╠²

This case study analyzes two potential iron ore mining projects, Project A and Project B, for Fortescue Metals Group. It examines the key assumptions and financial projections of each project, including revenues, costs, capital expenditures, and tax rates. It then performs a net present value analysis and scenario analysis under different price projections. Based on the expected NPV and standard deviation of each project, it recommends that Project A has less risk and a higher expected return than Project B.Time value of money

Time value of moneyNileshParab18

╠²

The document discusses time value of money concepts like present value, future value, present value of annuity, and future value of annuity. It provides formulas to calculate these values and includes examples showing how to apply the formulas to calculate PV, FV, PVA and FVA given cash flows, interest rates, and time periods. Sample questions are included along with step-by-step solutions demonstrating the calculations.Swaminarayan Akshardham Temple Must Visit in Delhi One Day Trip

Swaminarayan Akshardham Temple Must Visit in Delhi One Day TripRajasthan Four Wheel Drive Pvt. Ltd.

╠²

Akshardham temple is based on Delhi and when you are looking into Delhi in near future, then be sure to go to it and we ensure that you will be going to take pleasure from it. Activate

ActivateSnehith Alapati

╠²

Internship Requirement. App idea. Prof. Sameer Mathur. Snehith Alapati. Activate. FA Acquisition with parallel valuation (AUC)

FA Acquisition with parallel valuation (AUC)Anatoly Ryabukha

╠²

This document discusses acquiring fixed assets with parallel valuation for accounting and tax purposes. It addresses settling the initial acquisition in the general ledger, performing a valuation for parallel cost of goods manufactured accounting, and calculating depreciation expenses under both the Russian Accounting Standards and International Financial Reporting Standards frameworks including any tax implications.Swaminarayan Akshardham Temple Must Visit in Delhi One Day Trip

Swaminarayan Akshardham Temple Must Visit in Delhi One Day TripRajasthan Four Wheel Drive Pvt. Ltd.

╠²

Similar to Somesh Katre's Business Plan - Solved (20)

Introducing financial analysis

Introducing financial analysisvenkataramanan Thiru

╠²

Any incorporated company at the end of the financial year is required to prepare financial statements showing the assets & liabilities, profit or loss for the period, a cash flow statement &get it audited. the audited statements along with the auditor's report & directors report with all schedules is to be submitted to the ROC, shareholders at the annual general meeting, banks, financial institutions, all stakeholders.etc

These statements form the basis of ANALYSIS, WHICH CAN BE (A) VERTICAL ANALYSIS ( B)HORIZONTAL ANALYSIS (C )COMPARITIVE STATEMENTS (D)COST ANALYSIS (E)CASH FLOW ANALYSIS AND SO ON 'The main feature of these analyses will be explained with illustrative examples Cf%20 Capital%20 Budgeting%206

Cf%20 Capital%20 Budgeting%206rajeevgupta

╠²

The document discusses capital budgeting and investment project evaluation. It states that when projects deliver discounted cash flows exceeding investment costs, shareholder value increases through stock price appreciation. Several capital budgeting techniques are described like net present value, internal rate of return, payback period. Risk analysis methods in capital budgeting are also covered like sensitivity analysis, scenario analysis and Monte Carlo simulation to incorporate risk.Capital Budgeting_Md. Mosharref Hossain.ppt

Capital Budgeting_Md. Mosharref Hossain.pptNurul Mostofa

╠²

Capital Budgeting: Different Techniques with Exercise

Capital Budgeting Final copy made vy Mr. Mosharref

Capital Budgeting Final copy made vy Mr. MosharrefNurul Mostofa

╠²

Capital Budgeting Final copy made vy Mr. MosharrefCapital budgeting cash flow estimation

Capital budgeting cash flow estimationPrafulla Tekriwal

╠²

This document provides an overview of capital budgeting and cash flow analysis for investment projects. It defines key terms like capital expenditures, sunk costs, opportunity costs, and discusses how to estimate cash flows, including operating, terminal, and tax cash flows. It emphasizes the importance of using relevant cash flows to evaluate whether projects increase shareholder wealth.Manajemen Keuangan Strat. Ch_10_Show.ppt

Manajemen Keuangan Strat. Ch_10_Show.pptdaniswaraashraf

╠²

Manajemen Keuangan Chapter 10 topik Corporate Valuation and Value-Based ManagementPPAM-AK PPT.pptx

PPAM-AK PPT.pptxShyam273559

╠²

This document outlines several special decision situations in capital budgeting, including:

1) Choosing between projects of unequal life by converting costs to a uniform annual equivalent

2) Determining optimal timing by examining net future value at alternative dates

3) Calculating economic life by minimizing total annual costs over an asset's life

It also discusses adjusting net present value for financing effects using the adjusted present value (APV) method and adjusting the cost of capital. Additional topics covered are inflation, international capital budgeting, and investing in organizational capabilities.Capital budgeting -2

Capital budgeting -2Augustin Bangalore

╠²

The document discusses various capital budgeting decision criteria for evaluating investment projects, including payback period, discounted payback period, net present value (NPV), profitability index (PI), and internal rate of return (IRR). It provides examples of how to calculate each metric and the decision rules for accepting or rejecting projects based on the criteria. For a sample problem, it calculates the project's IRR as 34.37%, NPV at a 15% discount rate as $510.52, and PI as 1.57 by taking the NPV and dividing it by the initial investment outlay.Capital Budgeting Er. S Sood

Capital Budgeting Er. S Soodshart sood

╠²

The document discusses various capital budgeting techniques used to evaluate long-term investment projects. It describes traditional methods like payback period and accounting rate of return, as well as discounted cash flow methods like net present value, internal rate of return, and profitability index. These time-adjusted methods account for the time value of money and required rate of return when analyzing projects. The document also discusses factors that introduce risk and uncertainty into capital budgeting decisions.Chapter13 specialdecisionsituations

Chapter13 specialdecisionsituationsAKSHAYA0000

╠²

This chapter discusses special capital budgeting situations including choosing between projects of unequal life, optimal timing decisions, determining economic life, adjusting the cost of capital for financing effects, considering inflation, international capital budgeting, and investing in organizational capabilities. It provides formulas and examples for calculating uniform annual equivalents, adjusted present value, weighted average cost of capital, and the impact of inflation and foreign exchange rates. Key organizational capabilities mentioned are external integration, internal integration, flexibility, and capacity to experiment.Investment Appraisal

Investment AppraisalGovernance Learning Network®

╠²

Investment appraisal is a means of assessing whether an investment project is worthwhile. It involves analyzing factors such as payback period, accounting rate of return, internal rate of return, profitability index, and net present value. Net present value discounts future cash flows to account for the time value of money and allows comparison of investments. Firms use these techniques to evaluate potential investments and determine which projects to pursue.Aminullah assagaf p6 manj keu 2 (2 april 2020)_versi 2

Aminullah assagaf p6 manj keu 2 (2 april 2020)_versi 2Aminullah Assagaf

╠²

The document summarizes key concepts from chapters 1, 6-7, 9-11, and 13 from the 13th edition of the textbook "Principles of Managerial Finance" by Gitman and Zutter. It outlines the topics covered in each chapter, including the role of finance, interest rates, stock valuation, capital budgeting techniques like payback period, net present value, internal rate of return, and cost of capital. It also provides examples of calculating various capital budgeting methods for projects A and B.Fin 2732 investment decisions

Fin 2732 investment decisionsYashGupta744

╠²

The document discusses various capital budgeting techniques for investment decision making including net present value (NPV), benefit-cost ratio (BCR), internal rate of return (IRR), payback period, and accounting rate of return (ARR). Examples are provided to illustrate how to use the techniques to evaluate potential projects. The key criteria are NPV (accept if greater than 0), BCR (accept if greater than 1), IRR (accept if greater than required rate of return), and payback period (accept if less than cutoff period).Topic 7

Topic 7Hanie Sayang

╠²

This document summarizes different types of financial statement analysis including percentage analysis, ratio analysis, and common ratios used. It discusses horizontal and vertical analysis for percentage analysis. For ratio analysis, it covers liquidity ratios like current and acid-test ratios, profitability ratios like profit margin and return on equity, efficiency ratios like inventory turnover, and solvency ratios like debt ratio. Examples are provided for calculations and analysis of each type of ratio.Capital-Budgeting_Grp1-v2.ppt

Capital-Budgeting_Grp1-v2.pptJacquelineChelseaChu1

╠²

This document discusses concepts related to capital budgeting. It defines capital budgeting as the process of analyzing projects and deciding which ones to include in the capital budget based on their projected expenditures and returns. It outlines several capital budgeting methods including payback period, discounted payback period, and net present value (NPV). NPV is described as the present value of all cash inflows from a project minus the initial cash outlay, and it helps evaluate whether a project will generate value above its cost. The document provides an example to illustrate how to calculate NPV for a project.capital budgeting In financial management

capital budgeting In financial managementssuserc3bdcc

╠²

The document discusses various capital budgeting techniques used to evaluate projects, including payback period, net present value, internal rate of return, and profitability index. It provides examples of how to calculate each measure and accept or reject projects based on established criteria. Potential issues that can arise with project rankings are also examined, such as conflicts from projects with different scales, cash flow patterns, or time horizons.Priyankabba

PriyankabbaPriyankaSachdeva35

╠²

This document discusses various capital budgeting techniques used to evaluate potential major projects or investments. It describes traditional non-discounted methods like payback period and accounting rate of return. It also explains discounted cash flow methods like net present value (NPV), profitability index, and internal rate of return (IRR). For each method, it provides examples to demonstrate how to calculate them and how they are used to evaluate projects. The key information is that capital budgeting evaluates the potential cash flows of projects to determine if returns meet benchmarks and whether projects should be accepted or rejected.Formats of Cost and Financial Control Reports

Formats of Cost and Financial Control Reportskashif khawja

╠²

The first document shows a cost to complete report comparing actual costs and quantities to forecasts to analyze project cost targets. It also notes that any negative variations will be further analyzed. The second document is a cash operating cycle report showing it takes 51 days to convert project investments into returns, so financing must be arranged for that time period. The third document shows project-wise returns on investments, noting returns can be increased by decreasing costs, reducing receivables or payables, or increasing profits. It will analyze projects with returns lower than desired.Recently uploaded (20)

HIRE A HACKER TO RECOVER SCAMMED CRYPTO// CRANIX ETHICAL SOLUTIONS HAVEN

HIRE A HACKER TO RECOVER SCAMMED CRYPTO// CRANIX ETHICAL SOLUTIONS HAVENduranolivia584

╠²

One night, deep within one of those YouTube rabbit holes-you know, the ones where you progress from video to video until you already can't remember what you were searching for-well, I found myself stuck in crypto horror stories. I have watched people share how they lost access to their Bitcoin wallets, be it through hacks, forgotten passwords, glitches in software, or mislaid seed phrases. Some of the stupid mistakes made me laugh; others were devastating losses. At no point did I think I would be the next story. Literally the next morning, I tried to get to my wallet like usual, but found myself shut out. First, I assumed it was some sort of minor typo, but after multiple attempts-anything I could possibly do with the password-I realized that something had gone very wrong. $400,000 in Bitcoin was inside that wallet. I tried not to panic. Instead, I went back over my steps, checked my saved credentials, even restarted my device. Nothing worked. The laughter from last night's videos felt like a cruel joke now. This wasn't funny anymore. It was then that I remembered: One of the videos on YouTube spoke about Cranix Ethical Solutions Haven. It was some dude who lost his crypto in pretty similar circumstances. He swore on their expertise; I was out of options and reached out to them. From the very moment I contacted them, their staff was professional, patient, and very knowledgeable indeed. I told them my case, and then they just went ahead and introduced me to the plan. They reassured me that they have dealt with cases similar to this-and that I wasn't doomed as I felt. Over the course of a few days, they worked on meticulously analyzing all security layers around my wallet, checking for probable failure points, and reconstructing lost credentials with accuracy and expertise. Then came the call that changed everything: ŌĆ£Your funds are safe. YouŌĆÖre back in.ŌĆØ I canŌĆÖt even put into words the relief I felt at that moment. Cranix Ethical Solutions Haven didnŌĆÖt just restore my walletŌĆöthey restored my sanity. I walked away from this experience with two important lessons:

1. Never, ever neglect a wallet backup.

2. If disaster strikes, Cranix Ethical Solutions Haven is the only name you need to remember.

If you're reading this and thinking, "That would never happen to me," I used to think the same thing.╠²Until╠²it╠²did.

EMAIL: cranixethicalsolutionshaven at post dot com

WHATSAPP: +44 (7460) (622730)

TELEGRAM: @ cranixethicalsolutionshavenFY 2024 Preliminary Results and Strategic Plan update

FY 2024 Preliminary Results and Strategic Plan updateGruppo TIM

╠²

FY 2024 Preliminary Results and Strategic Plan updateThe Economic History of the United States 13

The Economic History of the United States 13Gale Pooley

╠²

The Economic History of the United States 13The Economic History of the United States 15

The Economic History of the United States 15Gale Pooley

╠²

The Economic History of the United States 15HBS Study examines which freelance groups ChatGPT and AI is replacing on onli...

HBS Study examines which freelance groups ChatGPT and AI is replacing on onli...HostJane.com

╠²

Harvard Business School led 2024 study used Google Trends to prove freelance jobs based on manual-intensive skills (e.g., data entry and virtual office services, music and video services requiring human performers, and online tutoring services) were less affected by the proliferation of Generative AI and ChatGPT on online marketplaces like HostJane.com and Upwork over automation-prone jobs (e.g., writing, software development, iOS/Android app development, and WordPress web development).How to Perform a Cost-Benefit Analysis A Simple Step-by-Step Guide.pptx

How to Perform a Cost-Benefit Analysis A Simple Step-by-Step Guide.pptxTfin Career

╠²

A cost-benefit analysis (CBA) is essential for anyone making business decisions, managing projects, or creating policies. It helps you evaluate how much something will cost versus the benefits you expect to gain so you can make smarter, more informed choices.

This guide will show you how to quickly conduct a cost-benefit analysis, considering an investment, a new project, or a policy change.

What is a Cost-Benefit Analysis?

A cost-benefit analysis compares a decision's costs with its benefits to determine whether the benefits are worth the costs. This process is helpful when resources are limited, and you want to make sure you are making the best decision for the future.

Example: Imagine your company is thinking about buying new software. A cost-benefit analysis would compare the price of the software to the benefits, like more productivity, lower labor costs, or better customer service. If the benefits are higher than the costs, the investment makes sense.

Step 1: Identify and List All Costs

Sometime recently, you can calculate the benefits, you are required to list all the costs included. These are coordinated or backhanded, short-term or long-term. Begin by composing down each conceivable cost.

Direct Costs: These are easy to identify because they're directly tied to the project, such as buying equipment or paying for materials.

Indirect Costs: These are secondary expenses, like administrative costs or the time needed for training.

Recurring Costs: These are ongoing costs, like maintenance or subscription fees.

Opportunity Costs: Consider what you're missing out on by choosing this option instead of another.

Example: In the software case, direct costs include the price of the software and the cost of installation and training. Indirect costs could be employees' time learning how to use the new software.

Step 2: Identify and List All Benefits

Now that you've listed all the costs, you must consider the benefits. These can be tangible (easy to measure) or intangible (more challenging but still meaningful).

Tangible Benefits: These are measurable in financial terms, like increased revenue or cost savings.

Intangible Benefits: These might be improved employee morale or customer satisfaction.

Example: The computer program might bring significant benefits, like higher productivity or diminished labor costs. Intangible benefits include ways to improve group resolve or progress client advantage.

Step 3: Quantify Costs and Benefits

Once you've identified the costs and benefits, the next step is to assign a dollar amount to each one. Some benefits, especially intangibles, may be hard to quantify, but giving them a realistic value is essential. Base your estimates on reliable data, like industry standards or expert advice.

Example: If the software costs $10,000 to purchase and $1,000 per year for maintenance, and it's expected to save $15,000 annually in labor costs, the return on investment is easily visible.RECOVER YOUR SCAMMED FUNDS AND CRYPTOCURRENCY HIRE╠²iFORCE HACKER RECOVERY

RECOVER YOUR SCAMMED FUNDS AND CRYPTOCURRENCY HIRE╠²iFORCE HACKER RECOVERYlonniecort7

╠²

╠²iFORCE HACKER RECOVERY consists of professional hackers who specialize in securing compromised devices, accounts, and websites, as well as recovering stolen bitcoin and funds lost to scams. They operate efficiently and securely, ensuring a swift resolution without alerting external parties. From the very beginning, they have successfully delivered on their promises while maintaining complete discretion.╠² Few organizations take the extra step to investigate network security risks, provide critical information, or handle sensitive matters with such╠² ╠²professionalism. The iFORCE HACKER RECOVERY team helped me retrieve $364,000 that had been stolen from my corporate bitcoin wallet. I am incredibly grateful for their assistance and for providing me with additional insights into the unidentified individuals behind the theft.

╠² ╠²Webpage; www. iforcehackersrecovery. com

Email; contact@iforcehackersrecovery. com

whatsapp; +1 240. 803. 3. 706╠² ╠²╠²Yanis Varoufakis - Technofeudalism_ What Killed Capitalism - libgen.li.pdf

Yanis Varoufakis - Technofeudalism_ What Killed Capitalism - libgen.li.pdfMatiasMendoza46

╠²

Libro de Varoufakis sobre la evoluci├│n del sistema capitalista.APMC and E-NAM: Transforming Agricultural Markets in India

APMC and E-NAM: Transforming Agricultural Markets in IndiaSunita C

╠²

This presentation explores the Agricultural Produce Market Committees (APMCs) and the Electronic National Agriculture Market (e-NAM), highlighting their role in improving market efficiency, price discovery, farmer empowerment, and challenges in agricultural trade and supply chain management.Monthly Economic Monitoring of Ukraine No. 241

Monthly Economic Monitoring of Ukraine No. 241ąåąĮčüčéąĖčéčāčé ąĄą║ąŠąĮąŠą╝č¢čćąĮąĖčģ ą┤ąŠčüą╗č¢ą┤ąČąĄąĮčī čéą░ ą┐ąŠą╗č¢čéąĖčćąĮąĖčģ ą║ąŠąĮčüčāą╗čīčéą░čåč¢ą╣

╠²

Summary

ŌĆó The IER estimates real GDP growth at 3.5% in 2024. According to the current IER forecast, real

GDP will grow by 2.9% in 2025 and 3.2% in 2026.

ŌĆó According to the IER, real GDP grew by 2.0% yoy in January (by 1.6% yoy in December).

ŌĆó In early February, power outages began for industry and businesses during peak hours due to

russian attacks on energy infrastructure.

ŌĆó Naftogaz began importing gas due to a cold snap, the suspension of russian gas transit to the

EU, and shelling of gas infrastructure.

ŌĆó In January, Ukraine exported 6.6 m t of goods by sea and 14 m t by rail.

ŌĆó There was a seasonal decline in imports and a slowdown in exports in January.

ŌĆó In January, the government received EUR 3 bn from the EU under the ERA (Extraordinary

Revenue Acceleration) mechanism, which should be repaid from profits from russian assets

frozen in the EU.

ŌĆó In January, consumer inflation in annual terms further accelerated and reached 12.9% yoy.

ŌĆó The NBU raised the rate from 13.5% to 14.5% per annum due to further acceleration in inflation

and deterioration in inflation expectations.

ŌĆó The NBU's international reserves amounted to USD 43 bn at the end of January, which is slightly

less than USD 43.8 bn at the beginning of the year.Tran Quoc Bao: First Vietnamese Leader on the Advisory Panel of Asian Hospita...

Tran Quoc Bao: First Vietnamese Leader on the Advisory Panel of Asian Hospita...Ignite Capital

╠²

Tran Quoc Bao: Shaping VietnamŌĆÖs Healthcare Future with Visionary Leadership and Financial Expertise

Tran Quoc Bao, CEO of Prima Saigon, stands at the forefront of transforming healthcare in Vietnam and beyond. As the leader of Prima Saigon, the countryŌĆÖs premier international daycare and ambulatory hospital, Bao has set new benchmarks for medical excellence and innovation. His strategic vision has propelled Prima Saigon into becoming a beacon of quality healthcare, positioning the institution at the forefront of global healthcare trends.

Beyond his success in leading Prima Saigon, Bao serves as an Advisor Member for Asian Healthcare & Hospital Management, a prominent publication that shapes healthcare policy worldwide. His work is not limited to just local impact but extends to global healthcare trends, influencing policy and operational standards across the sector.

With nearly two decades of experience, Bao has carved out a unique space where healthcare administration meets investment strategy. His career spans key positions at some of VietnamŌĆÖs leading healthcare institutions, including City International Hospital, FV Hospital, TMMC Healthcare, and Cao Tang Hospital, along with international expertise at The Alfred Hospital in Australia. A pioneer in internationalizing VietnamŌĆÖs healthcare sector, Bao led the transformation of Cao Tang Hospital into the countryŌĆÖs first Joint Commission International (JCI)-accredited facility, marking a milestone for VietnamŌĆÖs healthcare system on the global stage.

BaoŌĆÖs expertise goes beyond healthcare management. Armed with prestigious credentialsŌĆöincluding CFA┬«, CMT┬«, CPWA┬«, and FMVA┬«ŌĆöhe has driven over $2 billion in healthcare mergers and acquisitions, reshaping VietnamŌĆÖs healthcare investment landscape. His ability to combine healthcare innovation with financial strategy has earned him recognition as a thought leader in the sector.

A prolific contributor to global discussions on healthcare investment, Bao has written for major publications like Bloomberg, Forbes, US News, and Voice of America, further cementing his status as a respected authority. His numerous accolades include Healthcare Executive of the Year by the Malaysia Health Tourism Council in 2021 and recognition as a ŌĆ£Doing Business 2022ŌĆØ leader by the World Bank Group.

Additionally, BaoŌĆÖs expertise is in demand by consulting powerhouses like BCG, Bain, and McKinsey, where he has advised on some of the most strategic healthcare investments and partnerships in Asia. With his unparalleled leadership and forward-thinking vision, Bao continues to shape the future of healthcare across the globe, ensuring that VietnamŌĆÖs healthcare system remains competitive and internationally recognized.Monthly Economic Monitoring of Ukraine No. 241

Monthly Economic Monitoring of Ukraine No. 241ąåąĮčüčéąĖčéčāčé ąĄą║ąŠąĮąŠą╝č¢čćąĮąĖčģ ą┤ąŠčüą╗č¢ą┤ąČąĄąĮčī čéą░ ą┐ąŠą╗č¢čéąĖčćąĮąĖčģ ą║ąŠąĮčüčāą╗čīčéą░čåč¢ą╣

╠²

Somesh Katre's Business Plan - Solved

- 1. Submitted By: Rajagiri Centre For Business Studies

- 2. Objective ’éŚ To arrive at best possible cash flow using Free Cash Flow to Firm, Free Cash Flow to Equity, and Capital Cash Flow ’éŚ Measurement of cost of capital. ’éŚ Valuation of a project.

- 3. FCFF vs. FCFE Approaches to Equity Valuation Equity Value FCFE Discounted at Required Equity Return FCFF Discounted at WACC ŌĆō Debt Value

- 4. FREE CASH FLOW TO FIRM (FCFF) Measure of financial performance that expresses the net amount of cash that is generated for the firm, consisting of expenses, taxes and changes in net working capital and investments. FCFF = Operating Cash Flow- Expenses- Taxes- Changes to NWC- Changes in Investments

- 5. VALUATION USING FCFF Year 0 1 2 3 4 5 FCFF 250.00 310.00 rwacc Value of Project 11.66% 11.68% 4639.53 4871.50 1700.00 1785.00 2939.53 3086.50 3458.09 Debt Value of Equity rw acc, year 5 E year 4 E year 4 D year 4 re, year 5 D year 4 D year 4 D year 4 rdebt 1 Tc

- 6. FREE CASH FLOW TO EQUITY(FCFE) Shows how much cash can be paid to the equity shareholders of the company after all expenses, reinvestment and debt repayment. FCFE= Net Income- Net Capital Expenditure- Change in Working Capital + New Debt- Debt Repayment

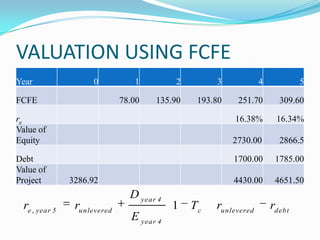

- 7. VALUATION USING FCFE Year 0 2 3 4 5 78.00 135.90 193.80 251.70 309.60 16.38% 16.34% 2730.00 2866.5 1700.00 FCFE 1 1785.00 4430.00 4651.50 re Value of Equity Debt Value of Project re , yea r 5 3286.92 ru n levered D yea r 4 E yea r 4 1 Tc ru n levered rd eb t

- 8. CAPITAL CASH FLOW (CCF) ’éŚ Movement of money for the purpose of investment, trade or business production. ’éŚ Occurs within corporations in the form of investment capital and capital spending on operations and research & development. ’éŚ Measure the cash flows accruing to both equity holders and bond holders. ’éŚ CCF = Free cash flow to equity + Cash Flow to Debt holders

- 9. VALUATION USING CCF Year 0 1 2 3 4 5 282.20 343.60 12.75% 12.76% 4430.00 4651.50 Debt 1700.00 1785.00 Value of Equity 2730.00 2866.50 CCF rccf Value of Project rccf 3286.92 E E D re D E D rdebt

- 10. FCFF Using E r D r WACC rwacc(modified) Year mv e Emv 0 FCFF 1 Dbv .ractual .T Dmv 2 3 4 5 70.00 130.00 190.00 250.00 310.00 rwacc, modified Value of Project mv debt 11.98% 12.00% 3286.92 4430.00 4651.50 Debt 1700.00 1785.00 Value of Equity 2730.00 2866.50

- 11. VALUATION USING FCFF - WACC ’éŚ NPV is showing positive value in FCFF using WACC. ’éŚ Firms in practice set their target capital structure in terms of book values. ’éŚ The book value information can be easily derived from the published sources. ’éŚ The book value debt-equity ratios are analyzed by investors to evaluate the risk of the firms in practice.

- 12. SUMMARY FCFF vs. FCFE ŌĆó FCFF = Cash flow available to all firm capital providers ŌĆó FCFE = Cash flow available to common equityholders ŌĆó FCFF is preferred when FCFE is negative or when capital structure is unstable Equity Valuation with FCFF & FCFE ŌĆó Discount FCFF with WACC ŌĆó Discount FCFE with required return on equity ŌĆó Equity value = PV(FCFF) ŌĆō Debt value or PV(FCFE)

- 13. RECOMMENDATION ’éŚ NPV is positive, so its better to select FCFF using WACC. ’éŚ Calculated using estimated forecasted value. ’éŚ We suggest FCFF using WACC method is appropriate for Somesh KatreŌĆÖs Business Plan.