Types of ATM NR.pptx

Download as PPTX, PDF0 likes652 views

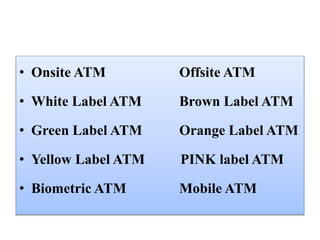

This slide explain different types of ATM machines available in India. like Mobile ATM, White Label and Brown Label ATM, Pink Lable ATM etc

1 of 9

Downloaded 14 times

Recommended

ELECTRONIC FUND TRANSFER

ELECTRONIC FUND TRANSFERANANDHU BALAN

Ěý

The document discusses electronic fund transfers (EFT) and various related topics. It defines EFT as the exchange of money from one account to another through computer. It describes different modes of EFT in India including NEFT, RTGS, and IMPS. NEFT allows customers to electronically transfer funds between bank accounts. RTGS facilitates real-time funds transfers between banks. IMPS enables instant mobile payments. The document also discusses the advantages of EFT like increased efficiency and the risks associated with security issues.Indian banking structure

Indian banking structureEldho J Valiyaveeden

Ěý

Banking in India originated in the late 18th century with the Bank of Hindustan and General Bank of India. The oldest and largest bank still in existence is the State Bank of India, which originated from the Bank of Bengal and later merged with the Bank of Bombay and Bank of Madras to form the Imperial Bank of India. In 1955 it became the State Bank of India. The government nationalized many banks in 1969 and they remain under government ownership as public sector undertakings. The modern Indian banking sector includes public sector banks, private sector banks, foreign banks, regional rural banks, urban cooperative banks and state cooperative banks.RBI : Payment & Settlement Systems

RBI : Payment & Settlement SystemsRahul Deka

Ěý

An overview of the Payment & Settlement Systems in India that undergoes as per the supervision & controlling of RBI.types of accounts in a bank

types of accounts in a bankBrijesh Sancheti

Ěý

The document discusses the four main types of bank accounts in India - current accounts, savings accounts, fixed deposits, and recurring deposits. It provides details on the features, pros and cons of each type of account. Current accounts are for businessmen and allow transactions without interest but with service charges. Savings accounts encourage personal savings and provide interest but have withdrawal limits. Fixed deposits require depositing money once for a set time at high interest rates but cannot withdraw funds early. Recurring deposits allow investing smaller amounts monthly over years at slightly lower interest.Electronic fund transfer system

Electronic fund transfer systemramandeepjrf

Ěý

Delivery Channels and Inter Bank Payment System, E-Payments, Types of Electronic Fund Transfer system, Real Time Gross Settlement,National Electronics Funds Transfer ,Immediate Payment Service, Credit Card, Automatic Teller Machine, Smart Card, E-Money, E- Wallet, E-Cheque Types of deposits

Types of depositsSunita Sukhija

Ěý

This document discusses the major types of bank deposits in India including savings accounts, recurring deposits, fixed deposits, and current accounts. It provides details on the key features of each type of account such as interest rates, minimum balance requirements, withdrawal limits, and purposes. Additionally, it mentions some newer deposit products introduced by banks that combine elements of different traditional accounts.E banking

E bankingJPEAGLES

Ěý

This document provides an overview of electronic banking, including its introduction, advantages, disadvantages and types. Electronic banking allows funds to be transferred electronically rather than through cash or checks. It was first conceptualized in the 1970s and introduced in some banks in 1985. Common types of electronic banking include automated teller machines (ATMs), internet banking, mobile banking, and electronic funds transfer. ATMs allow customers to access cash 24/7 using debit or credit cards. Internet and mobile banking provide banking services via websites and apps. Electronic funds transfer enables electronic money transfers between bank accounts in real-time.Current account

Current accountArvind Shrivastav

Ěý

The document provides information about current bank accounts in India. It discusses that current accounts are deposit accounts that allow for convenient withdrawing and depositing of funds and are commonly used by businesses. Key features of current accounts mentioned include no interest earned, ability to make instant fund transfers, use of debit cards, and access to services like RTGS and NEFT. The document also outlines eligibility requirements, required documents, available facilities like overdraft, and responsibilities and advantages of holding a current account.Banker & Cuctomer Relationship

Banker & Cuctomer RelationshipGurpreet Kaur

Ěý

This document defines key terms related to banking relationships. It states that while the Banking Regulations Act does not define "banker", it is generally considered to be someone who receives money and processes transactions for customers. A customer is defined as someone who has an account with a bank. The relationship between a banker and customer can be general, involving roles like creditor-debtor, or special, involving roles like trustee, bailee, agent, or custodian. Duties of bankers include maintaining secrecy, honoring transactions, and submitting statements. Rights of bankers include general lien, pledge, set-off, appropriation, and charging interest.New trends in indian banking system

New trends in indian banking systemRoy Thomas

Ěý

The document discusses new trends in the Indian banking system, including increased use of technology and digital services. It outlines how banks have adopted technologies like core banking solutions, customer relationship management, electronic payments, real-time gross settlement, electronic fund transfer, electronic clearing systems, ATMs, telebanking/mobile banking, point of sale terminals, and electronic data interchange to automate operations, improve efficiency, and enhance customer service. The trends have redefined banking operations and allowed customers to access services anytime from anywhere. Foreign direct investment is also said to ensure better risk management and capitalization in the Indian banking sector.Indian banking system and its emerging trends

Indian banking system and its emerging trendsRaveena Kaushal

Ěý

This document summarizes the history and development of the Indian banking system. It discusses the establishment of early banks in India such as the Bank of Calcutta in 1806. It also describes the functions of banks and various technological innovations that have eased banking like ATMs, credit cards, and electronic banking. The latest trends in Indian banking discussed include universal banking, globalization of banking, and use of technologies like satellite banking, phone banking, online banking, and real time gross settlement. Risk management and customer relationship management have also become increasingly important in Indian banks.Innovation of Products & Services in Banking

Innovation of Products & Services in BankingSaad Sair

Ěý

The document discusses the innovations in the Pakistani banking industry brought about by information technology. It outlines various digital banking services that have emerged, including automated teller machines (ATMs), point of sale (POS) terminals, mobile banking, smart cards, online and offline debit cards, and e-banking/internet banking. It also mentions several examples of Pakistani banks adopting new technologies or partnering with telecom companies to expand digital services.Role of Depositories and Depository Participants

Role of Depositories and Depository ParticipantsSai Surya Teja Maddikonda

Ěý

What are depositories? What have they got to do with the trading life cycle. Who are depository participants? Basic introduction of GST

Basic introduction of GSTDr. Khyati Vora

Ěý

This document provides an overview of the Goods and Services Tax (GST) that was implemented in India in July 2017. It defines GST as a comprehensive indirect tax on the supply of goods and services throughout India. The key highlights include:

- GST is a dual GST model with taxation powers shared between the central and state governments.

- It subsumes multiple taxes into a single tax to reduce the cascading effect of taxes and simplify compliance.

- Tax rates under GST range from 0-28% depending on the type of goods or services.

- Registration and returns involve a unified process with the central and state tax authorities for simplification.

- Implementation challenges include transitioningPresentation on financial services

Presentation on financial services9459334596

Ěý

The document discusses financial services and the Indian financial system. It defines financial services as those provided by financial institutions, such as banking services, foreign exchange services, investment services, and insurance services. It then describes the key components of the Indian financial system: financial services, financial markets, financial instruments, and financial institutions. It provides details on various financial concepts such as financial intermediaries, instruments, and markets. Finally, it briefly discusses types of financial services in India and international financial services.GST Model

GST ModelKajalVishwakarma7

Ěý

Goods and Services Tax (GST) is an indirect tax on the sale, consumption, and manufacturing of goods and services throughout India. It aims to eliminate multiple indirect taxes and create a single, unified Indian market. Unlike other countries, Indian GST consists of three taxes - Central GST, State GST, and Integrated GST. India follows a dual GST model where both central and state governments levy GST concurrently on the same base of goods and services. Merchant Banking in India

Merchant Banking in India Abhijeet Deshmukh

Ěý

This presentation covers Merchant Banking History; Categories; Services provided by them; Methods of placement; underwriting; Issue management & SEBI guidelines.Bank

Bankkhatwanisan

Ěý

Banks provide essential financial services and fall into several categories. Commercial banks accept deposits from customers and use those funds to issue loans to individuals and businesses. They can be public sector banks owned by the government, private sector banks operated by private entities, or foreign banks with branches in India. Cooperative banks provide lower-interest financing to farmers, small businesses, and salaried individuals. Specialized banks focus on unique services like foreign exchange, while investment banks help raise capital and provide financial advice. Central banks like India's Reserve Bank make monetary policy and ensure stability of the overall banking system.Ppt on atm machine

Ppt on atm machinePrabhat Singh

Ěý

The document provides information about ATM machines, including:

- It describes the basic functions of an ATM machine and how customers can access their bank accounts and perform transactions even when the bank is closed.

- It discusses the history and development of the first ATM machines in the late 1960s.

- It outlines the key components of an ATM machine, including the card reader, host processor, keypad/touchscreen, screen, receipt printer, cash dispenser, and their basic functions.

- It briefly explains how ATM machines connect to host processors and bank servers to authorize transactions and access customer account information.automated teller machines

automated teller machinestejinderubs

Ěý

An ATM allows customers to access financial services without a human bank teller. It uses a card with unique account information and a PIN for security. An ATM has components like a card reader, keypad, screen and cash dispenser to withdraw and deposit money, check balances, transfer funds and more. The first ATM was installed in 1967 in London. Now ATMs are widely used, come in various types, and occasionally experience fraud, but precautions can help users stay safe.Foreign banks in india

Foreign banks in india Mirali Madhuchhand

Ěý

This document discusses foreign banks operating in India. It notes that foreign banks are defined as banks headquartered in another country operating in India through branches. There are currently 45 foreign banks operating 286 branches in India. While foreign banks account for under 1% of branches, they control around 7% of banking sector assets and 11% of profits. The document outlines the advantages of foreign banks like increased competition and innovation, and the disadvantages like domestic banks facing greater competition.Various types of bank accounts

Various types of bank accountssakinapanvelwala

Ěý

its a very easy way of learning about typesof accounts. i made this myself and used it in a presentation. hope u guys find it informative.Non-Banking Financial Corporation (NBFC)

Non-Banking Financial Corporation (NBFC)jatinvermaiasacademy

Ěý

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 2013 or 1956 carrying on the business listed under Section 45 I (c ) of the RBI Act, 1934, i.e.Unit 2 co-operative banking in india

Unit 2 co-operative banking in indiaDr Isha Jaiswal

Ěý

Cooperative banks are owned and operated by their members. They are registered under cooperative laws and provide banking services like loans and deposits to their members. Cooperative banking in India has a 3-tier structure - at the bottom are Primary Credit Societies (PCS) in villages, then Central Cooperative Banks (DCCBs) at the district level, and State Cooperative Banks (SCBs) at the apex level in each state. PCS provide credit to local farmers and collect savings, DCCBs provide funds to PCS and oversee their functioning, and SCBs coordinate activities between DCCBs and act as a link between cooperative banks and money markets.Credit and debit

Credit and debitPeter vinosh

Ěý

A debit is an accounting entry that either increases an asset or expense account, or decreases a liability or equity account. It is positioned to the left in an accounting entry. A credit is an accounting entry that either increases a liability or equity account, or decreases an asset or expense account.Gst, introduction, definition, advantages, disadvantages

Gst, introduction, definition, advantages, disadvantagesDevadattaSai Cheedella

Ěý

This document discusses Goods and Services Tax (GST) in India. It provides an introduction to GST, defining it as an indirect tax on the supply of goods and services that replaced multiple taxes. The document outlines some key advantages of GST, including creating a single market, reducing corruption, and increasing GDP. It also notes some disadvantages such as dual control by central and state governments and potential loss of revenue for some states.Bank accounts

Bank accountsJubayer Alam Shoikat

Ěý

,

customer accounts in a bank

,

banking accounts in bangladesh

,

cons of current account

,

procedure to open an account

,

current account

,

pros of savings account

,

pros of fixed deposit

,

recurring deposit

,

fixed deposit

,

cons of fixed comparisondeposits

,

pros of recurring deposit accountRecent developments in banking

Recent developments in bankingVadivelM9

Ěý

Recent developments in banking include the growth of mobile, telephone, and online banking. Mobile banking allows customers to perform transactions through SMS or a WAP-enabled website. Telephone banking allows customers to get information or conduct transactions through an automated or live response system. Online services also continue to expand, with more banks offering internet banking, email, and fax services to customers. New technologies like real-time gross settlement, electronic funds transfer, automated clearing houses, and centralized banking solutions have also improved efficiency and connectivity within the banking system.ATM(AUTOMATIC TELLER MACHINE)-HISTORY,TYPES, WORKING, STRUCTURE

ATM(AUTOMATIC TELLER MACHINE)-HISTORY,TYPES, WORKING, STRUCTURERadhika Venkat

Ěý

An ATM allows customers to access financial services without a human clerk. It uses a card with magnetic stripe or chip to identify the customer and a PIN for security. The first ATM was introduced in 1967 in London. An ATM has components like a card reader, keypad, display, printer and cash dispenser. It communicates with a host processor to approve transactions, transferring funds between accounts. ATMs are commonly placed in locations where many people gather for convenience.Whitelabel atm

Whitelabel atmSunny Gandhi

Ěý

whitelabel atm, financial inclusion,tata indicash, rural area's atm, free transaction atm, brown label atm More Related Content

What's hot (20)

Banker & Cuctomer Relationship

Banker & Cuctomer RelationshipGurpreet Kaur

Ěý

This document defines key terms related to banking relationships. It states that while the Banking Regulations Act does not define "banker", it is generally considered to be someone who receives money and processes transactions for customers. A customer is defined as someone who has an account with a bank. The relationship between a banker and customer can be general, involving roles like creditor-debtor, or special, involving roles like trustee, bailee, agent, or custodian. Duties of bankers include maintaining secrecy, honoring transactions, and submitting statements. Rights of bankers include general lien, pledge, set-off, appropriation, and charging interest.New trends in indian banking system

New trends in indian banking systemRoy Thomas

Ěý

The document discusses new trends in the Indian banking system, including increased use of technology and digital services. It outlines how banks have adopted technologies like core banking solutions, customer relationship management, electronic payments, real-time gross settlement, electronic fund transfer, electronic clearing systems, ATMs, telebanking/mobile banking, point of sale terminals, and electronic data interchange to automate operations, improve efficiency, and enhance customer service. The trends have redefined banking operations and allowed customers to access services anytime from anywhere. Foreign direct investment is also said to ensure better risk management and capitalization in the Indian banking sector.Indian banking system and its emerging trends

Indian banking system and its emerging trendsRaveena Kaushal

Ěý

This document summarizes the history and development of the Indian banking system. It discusses the establishment of early banks in India such as the Bank of Calcutta in 1806. It also describes the functions of banks and various technological innovations that have eased banking like ATMs, credit cards, and electronic banking. The latest trends in Indian banking discussed include universal banking, globalization of banking, and use of technologies like satellite banking, phone banking, online banking, and real time gross settlement. Risk management and customer relationship management have also become increasingly important in Indian banks.Innovation of Products & Services in Banking

Innovation of Products & Services in BankingSaad Sair

Ěý

The document discusses the innovations in the Pakistani banking industry brought about by information technology. It outlines various digital banking services that have emerged, including automated teller machines (ATMs), point of sale (POS) terminals, mobile banking, smart cards, online and offline debit cards, and e-banking/internet banking. It also mentions several examples of Pakistani banks adopting new technologies or partnering with telecom companies to expand digital services.Role of Depositories and Depository Participants

Role of Depositories and Depository ParticipantsSai Surya Teja Maddikonda

Ěý

What are depositories? What have they got to do with the trading life cycle. Who are depository participants? Basic introduction of GST

Basic introduction of GSTDr. Khyati Vora

Ěý

This document provides an overview of the Goods and Services Tax (GST) that was implemented in India in July 2017. It defines GST as a comprehensive indirect tax on the supply of goods and services throughout India. The key highlights include:

- GST is a dual GST model with taxation powers shared between the central and state governments.

- It subsumes multiple taxes into a single tax to reduce the cascading effect of taxes and simplify compliance.

- Tax rates under GST range from 0-28% depending on the type of goods or services.

- Registration and returns involve a unified process with the central and state tax authorities for simplification.

- Implementation challenges include transitioningPresentation on financial services

Presentation on financial services9459334596

Ěý

The document discusses financial services and the Indian financial system. It defines financial services as those provided by financial institutions, such as banking services, foreign exchange services, investment services, and insurance services. It then describes the key components of the Indian financial system: financial services, financial markets, financial instruments, and financial institutions. It provides details on various financial concepts such as financial intermediaries, instruments, and markets. Finally, it briefly discusses types of financial services in India and international financial services.GST Model

GST ModelKajalVishwakarma7

Ěý

Goods and Services Tax (GST) is an indirect tax on the sale, consumption, and manufacturing of goods and services throughout India. It aims to eliminate multiple indirect taxes and create a single, unified Indian market. Unlike other countries, Indian GST consists of three taxes - Central GST, State GST, and Integrated GST. India follows a dual GST model where both central and state governments levy GST concurrently on the same base of goods and services. Merchant Banking in India

Merchant Banking in India Abhijeet Deshmukh

Ěý

This presentation covers Merchant Banking History; Categories; Services provided by them; Methods of placement; underwriting; Issue management & SEBI guidelines.Bank

Bankkhatwanisan

Ěý

Banks provide essential financial services and fall into several categories. Commercial banks accept deposits from customers and use those funds to issue loans to individuals and businesses. They can be public sector banks owned by the government, private sector banks operated by private entities, or foreign banks with branches in India. Cooperative banks provide lower-interest financing to farmers, small businesses, and salaried individuals. Specialized banks focus on unique services like foreign exchange, while investment banks help raise capital and provide financial advice. Central banks like India's Reserve Bank make monetary policy and ensure stability of the overall banking system.Ppt on atm machine

Ppt on atm machinePrabhat Singh

Ěý

The document provides information about ATM machines, including:

- It describes the basic functions of an ATM machine and how customers can access their bank accounts and perform transactions even when the bank is closed.

- It discusses the history and development of the first ATM machines in the late 1960s.

- It outlines the key components of an ATM machine, including the card reader, host processor, keypad/touchscreen, screen, receipt printer, cash dispenser, and their basic functions.

- It briefly explains how ATM machines connect to host processors and bank servers to authorize transactions and access customer account information.automated teller machines

automated teller machinestejinderubs

Ěý

An ATM allows customers to access financial services without a human bank teller. It uses a card with unique account information and a PIN for security. An ATM has components like a card reader, keypad, screen and cash dispenser to withdraw and deposit money, check balances, transfer funds and more. The first ATM was installed in 1967 in London. Now ATMs are widely used, come in various types, and occasionally experience fraud, but precautions can help users stay safe.Foreign banks in india

Foreign banks in india Mirali Madhuchhand

Ěý

This document discusses foreign banks operating in India. It notes that foreign banks are defined as banks headquartered in another country operating in India through branches. There are currently 45 foreign banks operating 286 branches in India. While foreign banks account for under 1% of branches, they control around 7% of banking sector assets and 11% of profits. The document outlines the advantages of foreign banks like increased competition and innovation, and the disadvantages like domestic banks facing greater competition.Various types of bank accounts

Various types of bank accountssakinapanvelwala

Ěý

its a very easy way of learning about typesof accounts. i made this myself and used it in a presentation. hope u guys find it informative.Non-Banking Financial Corporation (NBFC)

Non-Banking Financial Corporation (NBFC)jatinvermaiasacademy

Ěý

A Non-Banking Financial Company (NBFC) is a company registered under the Companies Act, 2013 or 1956 carrying on the business listed under Section 45 I (c ) of the RBI Act, 1934, i.e.Unit 2 co-operative banking in india

Unit 2 co-operative banking in indiaDr Isha Jaiswal

Ěý

Cooperative banks are owned and operated by their members. They are registered under cooperative laws and provide banking services like loans and deposits to their members. Cooperative banking in India has a 3-tier structure - at the bottom are Primary Credit Societies (PCS) in villages, then Central Cooperative Banks (DCCBs) at the district level, and State Cooperative Banks (SCBs) at the apex level in each state. PCS provide credit to local farmers and collect savings, DCCBs provide funds to PCS and oversee their functioning, and SCBs coordinate activities between DCCBs and act as a link between cooperative banks and money markets.Credit and debit

Credit and debitPeter vinosh

Ěý

A debit is an accounting entry that either increases an asset or expense account, or decreases a liability or equity account. It is positioned to the left in an accounting entry. A credit is an accounting entry that either increases a liability or equity account, or decreases an asset or expense account.Gst, introduction, definition, advantages, disadvantages

Gst, introduction, definition, advantages, disadvantagesDevadattaSai Cheedella

Ěý

This document discusses Goods and Services Tax (GST) in India. It provides an introduction to GST, defining it as an indirect tax on the supply of goods and services that replaced multiple taxes. The document outlines some key advantages of GST, including creating a single market, reducing corruption, and increasing GDP. It also notes some disadvantages such as dual control by central and state governments and potential loss of revenue for some states.Bank accounts

Bank accountsJubayer Alam Shoikat

Ěý

,

customer accounts in a bank

,

banking accounts in bangladesh

,

cons of current account

,

procedure to open an account

,

current account

,

pros of savings account

,

pros of fixed deposit

,

recurring deposit

,

fixed deposit

,

cons of fixed comparisondeposits

,

pros of recurring deposit accountRecent developments in banking

Recent developments in bankingVadivelM9

Ěý

Recent developments in banking include the growth of mobile, telephone, and online banking. Mobile banking allows customers to perform transactions through SMS or a WAP-enabled website. Telephone banking allows customers to get information or conduct transactions through an automated or live response system. Online services also continue to expand, with more banks offering internet banking, email, and fax services to customers. New technologies like real-time gross settlement, electronic funds transfer, automated clearing houses, and centralized banking solutions have also improved efficiency and connectivity within the banking system.Similar to Types of ATM NR.pptx (20)

ATM(AUTOMATIC TELLER MACHINE)-HISTORY,TYPES, WORKING, STRUCTURE

ATM(AUTOMATIC TELLER MACHINE)-HISTORY,TYPES, WORKING, STRUCTURERadhika Venkat

Ěý

An ATM allows customers to access financial services without a human clerk. It uses a card with magnetic stripe or chip to identify the customer and a PIN for security. The first ATM was introduced in 1967 in London. An ATM has components like a card reader, keypad, display, printer and cash dispenser. It communicates with a host processor to approve transactions, transferring funds between accounts. ATMs are commonly placed in locations where many people gather for convenience.Whitelabel atm

Whitelabel atmSunny Gandhi

Ěý

whitelabel atm, financial inclusion,tata indicash, rural area's atm, free transaction atm, brown label atm Inclusive Digital Payments Systems

Inclusive Digital Payments SystemsIoTForum | TiE Bangalore

Ěý

This presentation was given by Mr. Ravi Rajagopalan - CEO - Empays Payment Systems during IoTForum's AgriTech Day 2019 on February 9, 2019 at NIANP-ICAR, Bangaluruproject ppt.pdf

project ppt.pdfpriyanshusingh376646

Ěý

The document describes an automated teller machine (ATM) project created in Java. The project was developed by Mohammad Asif and Ridhima Sonkar using IntelliJ IDEA and includes a MySQL database. The ATM allows users to check balances, withdraw and deposit money, and print statements without assistance. While convenient, ATMs can charge fees and have withdrawal limits, creating issues for some users. However, ATMs provide 24/7 service with less human error compared to visiting a bank.Automated taller machine (atm)

Automated taller machine (atm)amanjit9306

Ěý

ATMs allow bank account holders to access their accounts and perform transactions without interacting with bank staff. An ATM uses a customer's plastic card with a magnetic strip containing their account information to identify them. The first ATM was installed in London in 1967. There are now over 1.8 million ATMs globally. ATMs provide convenience for customers as they offer 24/7 access to accounts and can be found in many public locations. However, they also pose security risks if cards are stolen and fees are sometimes charged. An ATM consists of components like a CPU, magnetic card reader, display, function keys and vault to control transactions securely.Types of ATMs in the world and their features

Types of ATMs in the world and their featuresRashmi Pandey

Ěý

This will give you a brief overview about types of ATMs present all around the world. Its a general knowledge thing and we should know that. 205 fmbounit 5b

205 fmbounit 5bASM's IBMR- Chinchwad

Ěý

Concepts in Banking and Accounting of transactions: Accounting in banks, Electronic Banking, RTGS, ATM, MICR,

OCR, OMR, and DATANET, Petty Cash, Electronic Clearing Service (ECS), National Electronic Funds Transfer (NEFT) System,

Real Time Gross Settlement (RTGS) System, IMPS.Final ppt of project

Final ppt of projectRuchi Gulati

Ěý

The document summarizes a presentation on e-banking services provided by HDFC Bank in India. It provides background on HDFC Bank's founding and operations, describes the different types of electronic banking available including internet banking, phone banking and mobile banking. It then outlines the objectives and findings of a study conducted on users of ATM and internet banking services, including that most users were satisfied with ATM services but some faced issues like cards getting stuck in machines. Suggestions to address problems include educating users, improving security, and making applications easy to use.E banking, internet banking and all services

E banking, internet banking and all servicesJomy Mathew

Ěý

Computers are widely used in banks to help staff operate more efficiently and effectively. They track transactions, process customer information, and allow banks to offer good customer service daily. Key computer applications used in banks include automated teller machines (ATMs), cash deposit machines, mobile banking, internet banking, and core banking systems. These applications provide customers with convenient access to their accounts and allow banks to save time and costs.Ppt final

Ppt finaldikshagupta111

Ěý

The document discusses the history and functions of automated teller machines (ATMs). It traces the development of ATMs from early prototypes in the 1930s to the first modern ATM introduced in the UK in 1972. It describes the basic components of an ATM and how they enable customers to perform transactions like withdrawing cash, checking balances, and transferring funds 24/7 without visiting a bank. Benefits include convenience and round-the-clock service for customers as well as reduced workload for bank staff. Potential disadvantages involve limited availability in remote areas and security issues if a card is stolen.Atm

AtmHimaja Amidala

Ěý

Automated Teller Machines (ATMs) allow users to access their bank accounts and perform financial transactions using a debit card any time of day. Currently, ATM cards with personal identification numbers (PINs) are required. The proposed system replaces ATM cards with mobile subscriber identification modules (SIM) cards, allowing users to perform ATM transactions using just their SIM. This would eliminate the need for multiple cards and PINs while providing increased security through SIM-based authentication. Some advantages include storing multiple applications on a single SIM and stronger security than magnetic stripe cards. A disadvantage is the SIM would need to be removed from the phone for each transaction.ATM_MRKTNGPLN

ATM_MRKTNGPLNHamed Alizadeh

Ěý

This document provides an analysis of ATM usage and customer behavior in Iran to help Bank Mellat optimize its ATM network performance. It includes statistics on ATM usage in Iran, Bank Mellat's market position, and analyses like a SWOT analysis, PESTLE analysis, Porter's Five Forces, BCG matrix, and customer buying behavior. The overall goal is to gather relevant data to help Bank Mellat outsource its ATM channel management to maximize performance and better serve customer needs.atmc-200505115106 (1).pdf

atmc-200505115106 (1).pdfMANISHKUMAR165449

Ěý

The document discusses the history and functions of automated teller machines (ATMs). It describes how the first ATM was introduced in 1967 in London to reduce customer time and bank costs. ATMs allow 24-hour access to cash withdrawals and other banking services using a card with a magnetic stripe or chip and personal identification number for security. Common ATM components include card readers, keypads, displays, cash dispensers and receipt printers. Location and security of ATMs are also addressed.ATM project presentation

ATM project presentationAbdul Rafay

Ěý

The document discusses the history and functions of automated teller machines (ATMs). It describes how the first ATM was introduced in 1967 in London to reduce customer time and bank costs. ATMs allow 24/7 access to cash withdrawals, balance checks, funds transfers and bill payments using plastic cards and PINs for security. The document outlines the common components of ATMs like card readers, keypads, displays and cash dispensers. It also reviews the programming elements like loops, if/else statements and switch cases used to develop ATM management systems.Cashless economy

Cashless economysiddharthapada

Ěý

From this project you know about various apps with benifits ehich facilitating cashless trasanction. thank you Towards cashless economy

Towards cashless economyJithin Parakka

Ěý

What is Cashless Economy ? Advantages, Disadvantages, Different Cashless payment methods, internet banking, plastic money, e-wallet, Point of sale, how to secure your cashless payment, future of cashless payment. ATM and E- Banking

ATM and E- BankingAniketPujari

Ěý

The document discusses the history and features of automatic teller machines (ATMs). It begins by explaining how ATMs provide convenient banking access for customers 24/7. It then describes the basic functions of an ATM and how customers can deposit, withdraw, and check balances without bank employees. The document outlines the origins of the first ATM in the 1960s and its growth. It also covers the types of ATMs, how to use an ATM, the advantages and disadvantages, and newer technologies like biometric authentication and real-time gross settlement systems.E – Banking.pptx

E – Banking.pptxVivekananda College, Tiruvedakam West, Madurai - 625234

Ěý

This document discusses e-banking and various electronic delivery channels for banking. It defines e-banking as conducting banking transactions electronically without visiting a physical branch. The main electronic delivery channels discussed are ATMs, smart cards, prepaid payment instruments, and telebanking. For each channel, the document provides details on what they are, how they work, their features and advantages. It also compares traditional banking to e-banking and highlights how e-banking provides benefits like convenience, accessibility and lower costs.Unit 5 emerging trends

Unit 5 emerging trendsDeepika S.R.

Ěý

The document discusses various emerging trends in financial services such as personalized banking options like ATMs, mobile banking, e-banking, credit/debit cards, and electronic fund transfer systems like NEFT, RTGS, and IMPS. It provides details on the ATM system including services available, free transaction limits, safety guidelines, and complaint procedures. It also explains the processes, eligibility criteria, and transaction charges for NEFT, RTGS, and mobile-based IMPS funds transfers. Additionally, it mentions that HSBC introduced the first ATM and SBI the first floating ATM in India, and covers the domestic Rupay card scheme.More from Rameshkumar Nagaraj (6)

CHARACTERISTICS OF AN ENTREPRENEUR.pptx

CHARACTERISTICS OF AN ENTREPRENEUR.pptxRameshkumar Nagaraj

Ěý

This slide explain characteristics of an entrepreneur. like Hard Work, Business Acumen and Sincerity ,Prudence,

Achievement Motivation,

Self-reliance and independence,

Highly Optimistic,

Planning and Organizing Ability,

Risk Taking,

Maintenance of Public Relations and Communication Skills

NR Debit Note in GST.pptx

NR Debit Note in GST.pptxRameshkumar Nagaraj

Ěý

This slide explain what is meant by debit note under GST.

It is helpful for beginners

Debit notes are usually issued to rectify erroneous values recorded in previous invoices

Different Types of Cheque

Different Types of ChequeRameshkumar Nagaraj

Ěý

There are several types of cheques:

Bearer cheques can be endorsed to anyone holding the cheque and no identification is required. Order cheques can only be cashed by the named payee. Crossed cheques can only be deposited, not cashed. Account payee cheques are deposited directly into the named payee's account. A cheque is considered stale if over 3 months old. Post dated and ante dated cheques are dated for the future or past respectively. Self cheques allow the drawer to withdraw for themselves. Traveler's cheques can be cashed while traveling abroad. Blank cheques only contain the drawer's signature.NR ATM Frauds.pptx

NR ATM Frauds.pptxRameshkumar Nagaraj

Ěý

This slide helpful to know the different types of ATM like skimming, transaction reversal fraud, card trapping etc.NR traditional banking vs e-banking.pptx

NR traditional banking vs e-banking.pptxRameshkumar Nagaraj

Ěý

This slide explain difference between Traditional banking and e-banking. Its presence, accessibility, customer service and time. This slide helps to the beginners who studying banking.atm safety precautions.jpg.pptx

atm safety precautions.jpg.pptxRameshkumar Nagaraj

Ěý

Dr. N. Rameshkumar provides safety precautions for using ATMs. Key precautions include: 1) Memorizing your PIN and not disclosing it to anyone; 2) Using well-lit ATMs located within banks or manned locations; 3) Checking for signs of tampering on card readers before using; and 4) Shielding your PIN entry and quickly putting away your receipt, card, and money after transactions.Recently uploaded (20)

N.C. DPI's 2023 Language Diversity Briefing

N.C. DPI's 2023 Language Diversity BriefingMebane Rash

Ěý

The number of languages spoken in NC public schools.The Battle of Belgrade Road: A WW1 Street Renaming Saga by Amir Dotan

The Battle of Belgrade Road: A WW1 Street Renaming Saga by Amir DotanHistory of Stoke Newington

Ěý

Presented at the 24th Stoke Newington History Talks event on 27th Feb 2025

https://stokenewingtonhistory.com/stoke-newington-history-talks/Lesson Plan M1 2024 Lesson Plan M1 2024 Lesson Plan M1 2024 Lesson Plan M1...

Lesson Plan M1 2024 Lesson Plan M1 2024 Lesson Plan M1 2024 Lesson Plan M1...pinkdvil200

Ěý

Lesson Plan M1 2024 Lesson Plan M1 2024 Lesson Plan M1 2024 Digital Tools with AI for e-Content Development.pptx

Digital Tools with AI for e-Content Development.pptxDr. Sarita Anand

Ěý

This ppt is useful for not only for B.Ed., M.Ed., M.A. (Education) or any other PG level students or Ph.D. scholars but also for the school, college and university teachers who are interested to prepare an e-content with AI for their students and others.FESTIVAL: SINULOG & THINGYAN-LESSON 4.pptx

FESTIVAL: SINULOG & THINGYAN-LESSON 4.pptxDanmarieMuli1

Ěý

Sinulog Festival of Cebu City, and Thingyan Festival of Myanmar.A PPT Presentation on The Princess and the God: A tale of ancient India by A...

A PPT Presentation on The Princess and the God: A tale of ancient India by A...Beena E S

Ěý

A PPT Presentation on The Princess and the God: A tale of ancient India by Aaron ShepardEssentials of a Good PMO, presented by Aalok Sonawala

Essentials of a Good PMO, presented by Aalok SonawalaAssociation for Project Management

Ěý

APM event hosted by the South Wales and West of England Network (SWWE Network)

Speaker: Aalok Sonawala

The SWWE Regional Network were very pleased to welcome Aalok Sonawala, Head of PMO, National Programmes, Rider Levett Bucknall on 26 February, to BAWA for our first face to face event of 2025. Aalok is a member of APM’s Thames Valley Regional Network and also speaks to members of APM’s PMO Interest Network, which aims to facilitate collaboration and learning, offer unbiased advice and guidance.

Tonight, Aalok planned to discuss the importance of a PMO within project-based organisations, the different types of PMO and their key elements, PMO governance and centres of excellence.

PMO’s within an organisation can be centralised, hub and spoke with a central PMO with satellite PMOs globally, or embedded within projects. The appropriate structure will be determined by the specific business needs of the organisation. The PMO sits above PM delivery and the supply chain delivery teams.

For further information about the event please click here.How to use Init Hooks in Odoo 18 - Odoo şÝşÝߣs

How to use Init Hooks in Odoo 18 - Odoo şÝşÝߣsCeline George

Ěý

In this slide, we’ll discuss on how to use Init Hooks in Odoo 18. In Odoo, Init Hooks are essential functions specified as strings in the __init__ file of a module.South Hornsey: The Lost Local Authority that Merged with Stoke Newington by T...

South Hornsey: The Lost Local Authority that Merged with Stoke Newington by T...History of Stoke Newington

Ěý

Presented at the 24th Stoke Newington History Talks event on 27th Feb 2025

https://stokenewingtonhistory.com/stoke-newington-history-talks/Computer Network Unit IV - Lecture Notes - Network Layer

Computer Network Unit IV - Lecture Notes - Network LayerMurugan146644

Ěý

Title:

Lecture Notes - Unit IV - The Network Layer

Description:

Welcome to the comprehensive guide on Computer Network concepts, tailored for final year B.Sc. Computer Science students affiliated with Alagappa University. This document covers fundamental principles and advanced topics in Computer Network. PDF content is prepared from the text book Computer Network by Andrew S. Tenanbaum

Key Topics Covered:

Main Topic : The Network Layer

Sub-Topic : Network Layer Design Issues (Store and forward packet switching , service provided to the transport layer, implementation of connection less service, implementation of connection oriented service, Comparision of virtual circuit and datagram subnet), Routing algorithms (Shortest path routing, Flooding , Distance Vector routing algorithm, Link state routing algorithm , hierarchical routing algorithm, broadcast routing, multicast routing algorithm)

Other Link :

1.Introduction to computer network - /slideshow/lecture-notes-introduction-to-computer-network/274183454

2. Physical Layer - /slideshow/lecture-notes-unit-ii-the-physical-layer/274747125

3. Data Link Layer Part 1 : /slideshow/lecture-notes-unit-iii-the-datalink-layer/275288798

Target Audience:

Final year B.Sc. Computer Science students at Alagappa University seeking a solid foundation in Computer Network principles for academic.

About the Author:

Dr. S. Murugan is Associate Professor at Alagappa Government Arts College, Karaikudi. With 23 years of teaching experience in the field of Computer Science, Dr. S. Murugan has a passion for simplifying complex concepts in Computer Network

Disclaimer:

This document is intended for educational purposes only. The content presented here reflects the author’s understanding in the field of Computer NetworkHow to Configure Flexible Working Schedule in Odoo 18 Employee

How to Configure Flexible Working Schedule in Odoo 18 EmployeeCeline George

Ěý

In this slide, we’ll discuss on how to configure flexible working schedule in Odoo 18 Employee module. In Odoo 18, the Employee module offers powerful tools to configure and manage flexible working schedules tailored to your organization's needs.CBSE Arabic Grammar - Class 10 ppt.pptx

CBSE Arabic Grammar - Class 10 ppt.pptxsuhail849886

Ěý

cbse arabic grammar

grade 10 cbse arabic grammar

cbse class 10 arabic grammar

arabic marathon cbse arabic 10

nominal sentences

Rass MELAI : an Internet MELA Quiz Prelims - El Dorado 2025

Rass MELAI : an Internet MELA Quiz Prelims - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ěý

Prelims of Rass MELAI : a Music, Entertainment, Literature, Arts and Internet Culture Quiz organized by Conquiztadors, the Quiz society of Sri Venkateswara College under their annual quizzing fest El Dorado 2025. Mate, a short story by Kate Grenville.pptx

Mate, a short story by Kate Grenville.pptxLiny Jenifer

Ěý

A powerpoint presentation on the short story Mate by Kate Greenville. This presentation provides information on Kate Greenville, a character list, plot summary and critical analysis of the short story.How to Manage Putaway Rule in Odoo 17 Inventory

How to Manage Putaway Rule in Odoo 17 InventoryCeline George

Ěý

Inventory management is a critical aspect of any business involved in manufacturing or selling products.

Odoo 17 offers a robust inventory management system that can handle complex operations and optimize warehouse efficiency. The Story Behind the Abney Park Restoration Project by Tom Walker

The Story Behind the Abney Park Restoration Project by Tom WalkerHistory of Stoke Newington

Ěý

Presented at the 24th Stoke Newington History Talks event on 27th Feb 2025

https://stokenewingtonhistory.com/stoke-newington-history-talks/South Hornsey: The Lost Local Authority that Merged with Stoke Newington by T...

South Hornsey: The Lost Local Authority that Merged with Stoke Newington by T...History of Stoke Newington

Ěý

Rass MELAI : an Internet MELA Quiz Prelims - El Dorado 2025

Rass MELAI : an Internet MELA Quiz Prelims - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ěý

Types of ATM NR.pptx

- 2. • Onsite ATM Offsite ATM • White Label ATM Brown Label ATM • Green Label ATM Orange Label ATM • Yellow Label ATM PINK label ATM • Biometric ATM Mobile ATM

- 3. • Onsite ATM • These ATMs are inside the bank compound and hence are known as Onsite ATMs. • Offsite ATMs • These ATMs are located in various places except inside the bank premises and thus named as Offsite ATMs.

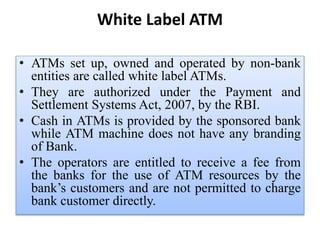

- 4. White Label ATM • ATMs set up, owned and operated by non-bank entities are called white label ATMs. • They are authorized under the Payment and Settlement Systems Act, 2007, by the RBI. • Cash in ATMs is provided by the sponsored bank while ATM machine does not have any branding of Bank. • The operators are entitled to receive a fee from the banks for the use of ATM resources by the bank’s customers and are not permitted to charge bank customer directly.

- 5. • Tata Communications Payment Solutions Limited (Indicash) is the first company authorized by RBI to open WLAs in the country. • RBI directly involved because these white label Companies have to separately get license/permission from RBI to run business.

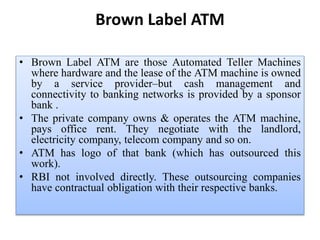

- 6. Brown Label ATM • Brown Label ATM are those Automated Teller Machines where hardware and the lease of the ATM machine is owned by a service provider–but cash management and connectivity to banking networks is provided by a sponsor bank . • The private company owns & operates the ATM machine, pays office rent. They negotiate with the landlord, electricity company, telecom company and so on. • ATM has logo of that bank (which has outsourced this work). • RBI not involved directly. These outsourcing companies have contractual obligation with their respective banks.

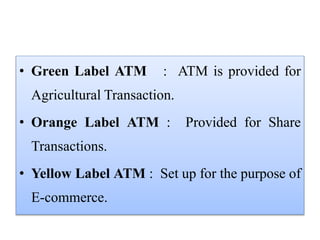

- 7. • Green Label ATM : ATM is provided for Agricultural Transaction. • Orange Label ATM : Provided for Share Transactions. • Yellow Label ATM : Set up for the purpose of E-commerce.

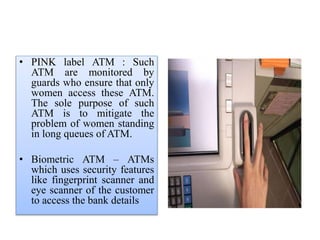

- 8. • PINK label ATM : Such ATM are monitored by guards who ensure that only women access these ATM. The sole purpose of such ATM is to mitigate the problem of women standing in long queues of ATM. • Biometric ATM – ATMs which uses security features like fingerprint scanner and eye scanner of the customer to access the bank details

- 9. Mobile ATM • Mobile ATM is a concept of ATM–on–wheels. These ATMs are available in areas that have a big footfall or have a good automobile traffic. • The main reason for the success of Mobile ATMs is the flexibility and convenience they provide to its customers.