Wealth building

0 likes134 views

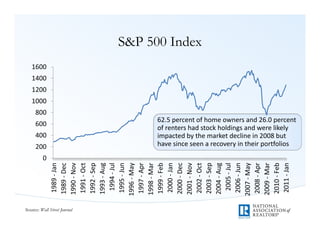

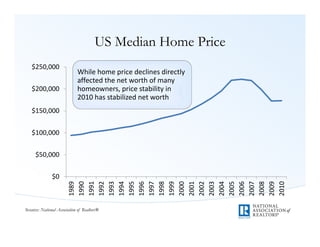

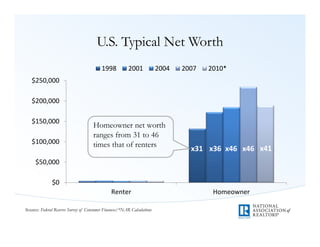

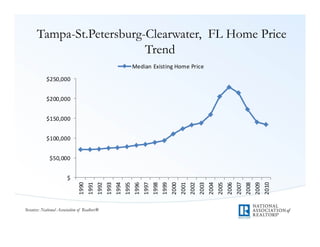

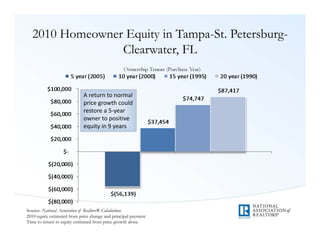

Housing equity and net worth are impacted by home prices and stock market performance. In the US, the housing crash and stock market decline in 2008 significantly reduced homeowner and renter net worth, though it has since recovered. Homeowners typically have much higher net worth than renters, ranging from 31 to 46 times higher. In the Tampa Bay area, the median home price declined after the housing bubble but has stabilized in recent years. A return to typical price growth could restore positive equity for homeowners who purchased during the housing crash within around 9 years.

1 of 7

Download to read offline

Ad

Recommended

Local Food as Economic Recovery

Local Food as Economic RecoveryCommunity Food Security Coalition

╠²

The document discusses the economic potential of local food systems, specifically highlighting Marshall County, Iowa, where local farmers face significant financial losses due to reliance on external food purchasing. It emphasizes the importance of community-based food systems in promoting health, wealth, and sustainability, suggesting that local purchasing can generate new farm income and jobs. Various case studies from different regions illustrate the positive impact of local food initiatives on economic recovery and community cohesion.Austin Real Estate Update January '08

Austin Real Estate Update January '08Dee Patience

╠²

The document provides annual real estate statistics for the Greater Austin, Texas area in 2007. Some key points:

- The population of Greater Austin was 1.25 million in 2007 and is projected to grow by 1 million people in the next 10 years.

- In 2007, the average home sales price in Austin was $249,543, up from $234,601 in 2006. The median sales price was $184,040, an increase of $10,000 from 2006.

- In December 2007, the average number of days homes spent on the market before being sold was 78 days. The average for all of 2007 was 64 days.Local Foods Strengthen Your Local Economy

Local Foods Strengthen Your Local EconomyFarm to Cafeteria Conference

╠²

This document discusses how strengthening local food economies can help communities economically. It provides data showing that when food is produced and consumed locally, more money stays in the community and creates jobs, rather than leaving the community. However, current industrialized food systems cause wealth to leave communities. The document advocates for policies and programs that support relocalizing food systems through measures like farm to school programs, food hubs, and prioritizing local food procurement. This can boost local economies and reduce health care and infrastructure costs.Heesen san diego venture group - 2012-01-24

Heesen san diego venture group - 2012-01-24San Diego Venture Group

╠²

The number of active US venture capital firms peaked in 2000 at over 1,000 firms but has since declined to around 450 firms in 2010. Venture capital fundraising has slowed with new commitments below levels of company investment. The vast majority of capital is raised through existing venture capital managers raising follow-on funds, rather than first-time managers. Despite economic turbulence, over 1,100 companies received venture capital funding in 2011, consistent with typical annual levels of 1,000-1,300 companies. Venture capital investing in Southern California generally tracked national trends, with some decline from peak levels in the late 1990s/early 2000s.Erwin Rode on Prospects for Property

Erwin Rode on Prospects for Propertymoneyweb

╠²

1. The document discusses Erwin Rode's presentation on economic prospects for South Africa and the world.

2. Rode predicts that world and European growth will remain poor for many years, around 10 years, due to the ongoing financial crisis.

3. For South Africa, Rode forecasts lower growth in the coming years as a result of weak global growth and infrastructure constraints domestically, although China may provide some support. Taxes and tariffs are also expected to rise.October 2012 Vreb Statistics

October 2012 Vreb StatisticsTara Lynn

╠²

The Victoria real estate market is experiencing a standoff as prices remain steady but sales numbers decline slightly. Total residential sales in September 2012 were 400, down from 435 the previous September. The average price of single family homes was $589,361, a small decrease from 2011. The market is in a wait-and-see attitude as buyers wait for lower prices but sellers are pricing reasonably given current conditions. Condominium and manufactured home sales were unchanged while townhome sales declined 10% compared to September 2011.Boulder County Real Estate Statistics February 2013

Boulder County Real Estate Statistics February 2013Neil Kearney

╠²

Boulder County's real estate market experienced a 7% increase in sales for both single-family homes and condos compared to last February, with inventory levels decreasing. Over 30% of active listings are currently under contract, indicating high demand amid a supply shortage. The market is competitive, and potential sellers are advised to list their homes early in 2013 due to low supply and rising interest rates.Lake Elsinore EWDC 2-21-13

Lake Elsinore EWDC 2-21-13Southwest Riverside County Association of Realtors

╠²

The document provides an overview of key economic and political factors that may impact the housing market in 2013, including the fiscal cliff, debt ceiling, Eurozone debt crisis, and state/federal policies. It summarizes housing market trends in Southwest California in 2012, with median home prices rising 9-30% year-over-year in areas like Lake Elsinore and Temecula. Demand remained strong with over 250 homes sold in January 2013 across the region.Pilar Ramirez, Microcredit and Job Creation

Pilar Ramirez, Microcredit and Job CreationMicrocredit Summit Campaign

╠²

The document summarizes Bolivia's experience with microcredit and job creation over 25 years. It shows graphs of growing microfinance institutions, loan portfolios, number of offices and employees, indicating microcredit has contributed to financial inclusion. While no major studies have assessed job creation directly, the presence of microcredit clients in many economic sectors implies increased incomes and opportunities likely led to jobs within families and elsewhere. The vibrant microcredit sector, along with recent social changes, have enabled social and economic participation for those previously excluded.Housing Market Outlook and Affordable Housing in the Twin Cities Metro

Housing Market Outlook and Affordable Housing in the Twin Cities Metrosotatodd

╠²

The document summarizes the Twin Cities housing market outlook and recent affordable housing production. It found that since the 2007 housing collapse, the region has seen a slow recovery in homebuilding and shifting locations toward urban cores. The metro is projected to gain over 800,000 new residents by 2040, with most new households consisting of single adults and seniors. Assessing future affordable housing needs will require balancing policy goals with market realities to ensure adequate affordable options near jobs and transit.South Windsor Conditions and Trends

South Windsor Conditions and TrendsPlanimetrics, Inc.

╠²

The document provides an analysis of demographics, housing, and economic conditions in South Windsor, highlighting trends such as moderated population growth, changes in household types, and the community's reliance on property taxes. It notes that while South Windsor residents earn higher incomes compared to surrounding communities, the town faces challenges with affordable housing and job wages. The report also examines the distribution of housing units, workforce demographics, and zoning regulations affecting future development.Australian Residential Property Presentation14 04 2009

Australian Residential Property Presentation14 04 2009Ivan Kaye

╠²

The document summarizes property investment opportunities on the eastern coast of Australia. It discusses demographic and economic factors that influence the real estate market such as population growth, infrastructure development, employment levels, and supply and demand of housing units. Charts show historical housing price trends and vacancy rates in Australian cities. The document concludes with examples of successful property investments in Sydney, Melbourne, Perth and Darwin that achieved high annualized returns.Energy Statistic : Global and Thailand Outlook

Energy Statistic : Global and Thailand OutlookDenpong Soodphakdee

╠²

This document discusses the importance of saving energy. It shows that between 1986 and 2007, both Thailand's population and energy consumption increased substantially. Specifically, the population grew from around 50,000 to over 60,000 and energy usage rose from about 300,000 to nearly 900,000 tonnes of oil equivalent. This rapid growth in energy consumption could create problems if not managed properly.Sarasota Market Stats feb2012

Sarasota Market Stats feb2012Sarasota Real Estate

╠²

This document summarizes real estate statistics for Sarasota County for February 2012. It shows that in February:

- 414 single family homes and 177 condos were sold, with average days on market of 171 and 212 respectively.

- Median sale prices for single family homes and condos were $167,500 and $150,000, with sale to list price ratios of 94.2% and 93.5%.

- Total active listings declined from the previous month while pending sales also decreased for both single family homes and condos.Current Homedex Ncounty.2010

Current Homedex Ncounty.2010triciaobrien

╠²

The median price for single-family detached homes in North San Diego County rose 1.74% from December 2010 to January 2011. While listings increased 8.08% from the prior month, home sales declined 32.87%. The monthly payment for the median-priced home increased slightly to $2,321. Housing affordability remained at 30% in North County and increased to 43% in other parts of San Diego County.Prt ir update may 2012

Prt ir update may 2012Company Spotlight

╠²

- PRT Growing Services Ltd. is the largest producer of container grown forest seedlings in North America, with 13 nursery sites and over 425 employees.

- The presentation discusses PRT's competitive position, contracted revenue stream, forest seedling market drivers including the housing market and export markets, and the impact of the US housing market downturn on PRT's financial performance between 2008-2011.

- Looking ahead, PRT's growth strategies include leveraging an expected housing market recovery, expanding into regional forestry markets, diversifying into non-forestry starter plants and hardwood seedlings.Boulder County Real Estate Statistics October 2012

Boulder County Real Estate Statistics October 2012Neil Kearney

╠²

The real estate market in Boulder County has been strong in 2012, with home sales up 21% in October and 25% for single family homes compared to the previous year. Housing inventory is down 18% from 2011, resulting in only 40% of active listings remaining on the market. While the market peaked earlier in the year, housing activity remains robust with year-to-date sales increased approximately 23% over 2010.From Oecd To SNR

From Oecd To SNR30088

╠²

The document discusses challenges facing efforts to reduce economic disparities between regions in England. It notes that while the goal is to narrow gaps in growth rates, economic performance has always varied between cities and little progress has been made. Barriers include a lack of consensus around the role of core cities, artificial administrative boundaries, and departments prioritizing different approaches. Resolving tensions between priorities of growth places versus places in need remains difficult politically.Australia's water story

Australia's water storyHarsh Shrivastava

╠²

The document provides a comprehensive overview of Victoria's water industry, highlighting historical context, policy reforms, and current challenges related to climate change and water allocation. It details the transition from localized management to a structured regulatory framework and the establishment of water markets aimed at improving efficiency and sustainability. Additionally, it outlines various conservation efforts and infrastructure investments made in response to water crises, emphasizing the importance of integrated water management for future security.Bruce yandle-chc-january

Bruce yandle-chc-januaryMercatus Center

╠²

This document provides an economic outlook and update from Bruce Yandle. It includes GDP growth forecasts for 2013-2014 from various forecasters ranging from 0.5-2.4%. Charts show historical data on retail sales, housing starts, auto sales, employment and other economic indicators. The document discusses regulatory costs and how incentives change when regulation becomes endogenous, with entrepreneurs focusing more on lobbying than innovation.9 City Rept Murrieta

9 City Rept MurrietaSouthwest Riverside County Association of Realtors

╠²

The document discusses a forecast for the economic recovery of the Inland Empire region of California presented by Dr. John Husing. Some key points:

1) Housing affordability in the region is at an all-time high due to declining home prices, though this is largely the result of economic struggles rather than new high-paying jobs.

2) Unemployment in the Inland Empire remains high at 15.1%, second only to Detroit, though recent housing sales data shows demand remains healthy with multiple bids on well-priced homes.

3) A potential "shadow inventory" of foreclosed homes could further pressure home prices if banks release properties all at once, though the author believes demandAug2012 stats 3_8

Aug2012 stats 3_8Sarasota Real Estate

╠²

- The document provides statistics on the real estate market in Sarasota, Florida for August 2012, including data on single family homes and condominiums.

- It shows that in August 2012, 587 single family homes and 232 condos were sold, with median sale prices of $169,945 for single family homes and $149,000 for condos.

- The statistics also show that months of inventory decreased for both single family homes and condos compared to the previous year.Discussion of ŌĆ£Do Global Banks Spread Global Imbalances?ŌĆØ

Discussion of ŌĆ£Do Global Banks Spread Global Imbalances?ŌĆØcatelong

╠²

The document discusses the role of global banks in creating financial imbalances through the use of asset-backed commercial paper (ABCP) conduits, which peaked at $1.2 trillion in June 2007. It highlights the negative impact of these conduits on equity returns of banks, particularly during the financial turmoil of August 2007, and analyzes the structure and liabilities of shadow banks that contributed to the financial crisis. The document also presents data regarding ABS demand and issuance, revealing significant fluctuations and underlying vulnerabilities in the market.Sarasota Market Statistics - October

Sarasota Market Statistics - OctoberSarasota Real Estate

╠²

The document contains statistics on the real estate market in Sarasota, Florida for October 2012. It shows that single family home sales decreased compared to the previous year while condo sales increased. Median home prices rose slightly for both single family homes and condos compared to the previous year. The number of homes and condos on the market decreased from the previous year.home depot PDF Frank Blake Presentation

home depot PDF Frank Blake Presentation finance2

╠²

The document discusses a decline in private residential investment and subprime/Alt-A mortgages over the past few years which has negatively impacted the housing market. It then outlines Home Depot's strategic focus on increasing returns through disciplined capital allocation, investing in existing assets like employee training and supply chain improvements, and building sustained competitive advantages. Home Depot expects another difficult year in 2008 but believes these strategic initiatives position it for stronger future growth once market conditions normalize.newmont mining Final_West_Coast_Presentation

newmont mining Final_West_Coast_Presentationfinance37

╠²

This presentation discusses capitalizing on the gold bull market. It provides an overview of Newmont Mining Corporation, including that it is a world leading gold company and the only major US gold company. It also provides financial and operating highlights for 2006, including equity gold sales and costs applicable to sales. Projections and opportunities for 2007 are discussed for various regions and mines, with costs applicable to sales expected to increase approximately 25% compared to 2006 due to rising input costs.2001* Embraer Proje├¦├ŻO Da Demanda

2001* Embraer Proje├¦├ŻO Da DemandaEmbraer RI

╠²

Embraer forecasts strong growth in the regional airline market over the next decade. Regional jets are becoming more widely used in the US and Europe, with passengers increasing by 5-7% annually and aircraft growing larger and flying longer routes on average. Regional jets are opening new route opportunities for airlines and replacing aging turboprops and jets. Embraer expects around 8,000 new regional aircraft deliveries over the next 10 years.Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

Property values in southwest Florida, particularly in cities like Fort Myers and Cape Coral, initially dropped sharply after the housing crisis but have since stabilized and begun increasing again as demand has caught up with supply. Several Florida cities saw some of the largest year-over-year percentage increases in median home prices from 2010 to 2011, led by Fort Myers with a 34.46% rise. Zadooland.com promotes land investment opportunities in Florida, noting that land prices dropped 95% from 2006 peaks but are believed to recover to 25% of prior values in coming years.Dr. Lawrence Yun Economic Forecast Presentation

Dr. Lawrence Yun Economic Forecast PresentationSt. Charles County Association of REALTORS

╠²

The economic and housing market outlook discusses the stagnation in home sales despite favorable affordability conditions, with national home prices stabilizing after a previous decline. Key factors include low inventory of newly constructed homes, high levels of bank reserves not entering the economy, and ongoing challenges with consumer confidence and lending practices. The presentation highlights the complex landscape of the housing market, with regional variations in pricing and sales activity.MyTownCryer Mid Year 2010 Analysis

MyTownCryer Mid Year 2010 AnalysisTom Cryer

╠²

1. Foreclosures have declined for almost three years after peaking in 2008. However, short sales continue to be common as lenders work with borrowers. The short sale cycle may continue for 2-5 more years before a normal market trend returns.

2. The ratio of home listings to sales indicates the market may drift into oversupply in the second half of 2010 if current trends continue, potentially leading to more foreclosures and short sales.

3. While average home prices have increased in the first half of 2010, particularly for higher-end homes, prices have actually declined in many individual areas. Average prices should only be used as a general guide, not to assess specific markets or properties.More Related Content

What's hot (19)

Pilar Ramirez, Microcredit and Job Creation

Pilar Ramirez, Microcredit and Job CreationMicrocredit Summit Campaign

╠²

The document summarizes Bolivia's experience with microcredit and job creation over 25 years. It shows graphs of growing microfinance institutions, loan portfolios, number of offices and employees, indicating microcredit has contributed to financial inclusion. While no major studies have assessed job creation directly, the presence of microcredit clients in many economic sectors implies increased incomes and opportunities likely led to jobs within families and elsewhere. The vibrant microcredit sector, along with recent social changes, have enabled social and economic participation for those previously excluded.Housing Market Outlook and Affordable Housing in the Twin Cities Metro

Housing Market Outlook and Affordable Housing in the Twin Cities Metrosotatodd

╠²

The document summarizes the Twin Cities housing market outlook and recent affordable housing production. It found that since the 2007 housing collapse, the region has seen a slow recovery in homebuilding and shifting locations toward urban cores. The metro is projected to gain over 800,000 new residents by 2040, with most new households consisting of single adults and seniors. Assessing future affordable housing needs will require balancing policy goals with market realities to ensure adequate affordable options near jobs and transit.South Windsor Conditions and Trends

South Windsor Conditions and TrendsPlanimetrics, Inc.

╠²

The document provides an analysis of demographics, housing, and economic conditions in South Windsor, highlighting trends such as moderated population growth, changes in household types, and the community's reliance on property taxes. It notes that while South Windsor residents earn higher incomes compared to surrounding communities, the town faces challenges with affordable housing and job wages. The report also examines the distribution of housing units, workforce demographics, and zoning regulations affecting future development.Australian Residential Property Presentation14 04 2009

Australian Residential Property Presentation14 04 2009Ivan Kaye

╠²

The document summarizes property investment opportunities on the eastern coast of Australia. It discusses demographic and economic factors that influence the real estate market such as population growth, infrastructure development, employment levels, and supply and demand of housing units. Charts show historical housing price trends and vacancy rates in Australian cities. The document concludes with examples of successful property investments in Sydney, Melbourne, Perth and Darwin that achieved high annualized returns.Energy Statistic : Global and Thailand Outlook

Energy Statistic : Global and Thailand OutlookDenpong Soodphakdee

╠²

This document discusses the importance of saving energy. It shows that between 1986 and 2007, both Thailand's population and energy consumption increased substantially. Specifically, the population grew from around 50,000 to over 60,000 and energy usage rose from about 300,000 to nearly 900,000 tonnes of oil equivalent. This rapid growth in energy consumption could create problems if not managed properly.Sarasota Market Stats feb2012

Sarasota Market Stats feb2012Sarasota Real Estate

╠²

This document summarizes real estate statistics for Sarasota County for February 2012. It shows that in February:

- 414 single family homes and 177 condos were sold, with average days on market of 171 and 212 respectively.

- Median sale prices for single family homes and condos were $167,500 and $150,000, with sale to list price ratios of 94.2% and 93.5%.

- Total active listings declined from the previous month while pending sales also decreased for both single family homes and condos.Current Homedex Ncounty.2010

Current Homedex Ncounty.2010triciaobrien

╠²

The median price for single-family detached homes in North San Diego County rose 1.74% from December 2010 to January 2011. While listings increased 8.08% from the prior month, home sales declined 32.87%. The monthly payment for the median-priced home increased slightly to $2,321. Housing affordability remained at 30% in North County and increased to 43% in other parts of San Diego County.Prt ir update may 2012

Prt ir update may 2012Company Spotlight

╠²

- PRT Growing Services Ltd. is the largest producer of container grown forest seedlings in North America, with 13 nursery sites and over 425 employees.

- The presentation discusses PRT's competitive position, contracted revenue stream, forest seedling market drivers including the housing market and export markets, and the impact of the US housing market downturn on PRT's financial performance between 2008-2011.

- Looking ahead, PRT's growth strategies include leveraging an expected housing market recovery, expanding into regional forestry markets, diversifying into non-forestry starter plants and hardwood seedlings.Boulder County Real Estate Statistics October 2012

Boulder County Real Estate Statistics October 2012Neil Kearney

╠²

The real estate market in Boulder County has been strong in 2012, with home sales up 21% in October and 25% for single family homes compared to the previous year. Housing inventory is down 18% from 2011, resulting in only 40% of active listings remaining on the market. While the market peaked earlier in the year, housing activity remains robust with year-to-date sales increased approximately 23% over 2010.From Oecd To SNR

From Oecd To SNR30088

╠²

The document discusses challenges facing efforts to reduce economic disparities between regions in England. It notes that while the goal is to narrow gaps in growth rates, economic performance has always varied between cities and little progress has been made. Barriers include a lack of consensus around the role of core cities, artificial administrative boundaries, and departments prioritizing different approaches. Resolving tensions between priorities of growth places versus places in need remains difficult politically.Australia's water story

Australia's water storyHarsh Shrivastava

╠²

The document provides a comprehensive overview of Victoria's water industry, highlighting historical context, policy reforms, and current challenges related to climate change and water allocation. It details the transition from localized management to a structured regulatory framework and the establishment of water markets aimed at improving efficiency and sustainability. Additionally, it outlines various conservation efforts and infrastructure investments made in response to water crises, emphasizing the importance of integrated water management for future security.Bruce yandle-chc-january

Bruce yandle-chc-januaryMercatus Center

╠²

This document provides an economic outlook and update from Bruce Yandle. It includes GDP growth forecasts for 2013-2014 from various forecasters ranging from 0.5-2.4%. Charts show historical data on retail sales, housing starts, auto sales, employment and other economic indicators. The document discusses regulatory costs and how incentives change when regulation becomes endogenous, with entrepreneurs focusing more on lobbying than innovation.9 City Rept Murrieta

9 City Rept MurrietaSouthwest Riverside County Association of Realtors

╠²

The document discusses a forecast for the economic recovery of the Inland Empire region of California presented by Dr. John Husing. Some key points:

1) Housing affordability in the region is at an all-time high due to declining home prices, though this is largely the result of economic struggles rather than new high-paying jobs.

2) Unemployment in the Inland Empire remains high at 15.1%, second only to Detroit, though recent housing sales data shows demand remains healthy with multiple bids on well-priced homes.

3) A potential "shadow inventory" of foreclosed homes could further pressure home prices if banks release properties all at once, though the author believes demandAug2012 stats 3_8

Aug2012 stats 3_8Sarasota Real Estate

╠²

- The document provides statistics on the real estate market in Sarasota, Florida for August 2012, including data on single family homes and condominiums.

- It shows that in August 2012, 587 single family homes and 232 condos were sold, with median sale prices of $169,945 for single family homes and $149,000 for condos.

- The statistics also show that months of inventory decreased for both single family homes and condos compared to the previous year.Discussion of ŌĆ£Do Global Banks Spread Global Imbalances?ŌĆØ

Discussion of ŌĆ£Do Global Banks Spread Global Imbalances?ŌĆØcatelong

╠²

The document discusses the role of global banks in creating financial imbalances through the use of asset-backed commercial paper (ABCP) conduits, which peaked at $1.2 trillion in June 2007. It highlights the negative impact of these conduits on equity returns of banks, particularly during the financial turmoil of August 2007, and analyzes the structure and liabilities of shadow banks that contributed to the financial crisis. The document also presents data regarding ABS demand and issuance, revealing significant fluctuations and underlying vulnerabilities in the market.Sarasota Market Statistics - October

Sarasota Market Statistics - OctoberSarasota Real Estate

╠²

The document contains statistics on the real estate market in Sarasota, Florida for October 2012. It shows that single family home sales decreased compared to the previous year while condo sales increased. Median home prices rose slightly for both single family homes and condos compared to the previous year. The number of homes and condos on the market decreased from the previous year.home depot PDF Frank Blake Presentation

home depot PDF Frank Blake Presentation finance2

╠²

The document discusses a decline in private residential investment and subprime/Alt-A mortgages over the past few years which has negatively impacted the housing market. It then outlines Home Depot's strategic focus on increasing returns through disciplined capital allocation, investing in existing assets like employee training and supply chain improvements, and building sustained competitive advantages. Home Depot expects another difficult year in 2008 but believes these strategic initiatives position it for stronger future growth once market conditions normalize.newmont mining Final_West_Coast_Presentation

newmont mining Final_West_Coast_Presentationfinance37

╠²

This presentation discusses capitalizing on the gold bull market. It provides an overview of Newmont Mining Corporation, including that it is a world leading gold company and the only major US gold company. It also provides financial and operating highlights for 2006, including equity gold sales and costs applicable to sales. Projections and opportunities for 2007 are discussed for various regions and mines, with costs applicable to sales expected to increase approximately 25% compared to 2006 due to rising input costs.2001* Embraer Proje├¦├ŻO Da Demanda

2001* Embraer Proje├¦├ŻO Da DemandaEmbraer RI

╠²

Embraer forecasts strong growth in the regional airline market over the next decade. Regional jets are becoming more widely used in the US and Europe, with passengers increasing by 5-7% annually and aircraft growing larger and flying longer routes on average. Regional jets are opening new route opportunities for airlines and replacing aging turboprops and jets. Embraer expects around 8,000 new regional aircraft deliveries over the next 10 years.Similar to Wealth building (20)

Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

Property values in southwest Florida, particularly in cities like Fort Myers and Cape Coral, initially dropped sharply after the housing crisis but have since stabilized and begun increasing again as demand has caught up with supply. Several Florida cities saw some of the largest year-over-year percentage increases in median home prices from 2010 to 2011, led by Fort Myers with a 34.46% rise. Zadooland.com promotes land investment opportunities in Florida, noting that land prices dropped 95% from 2006 peaks but are believed to recover to 25% of prior values in coming years.Dr. Lawrence Yun Economic Forecast Presentation

Dr. Lawrence Yun Economic Forecast PresentationSt. Charles County Association of REALTORS

╠²

The economic and housing market outlook discusses the stagnation in home sales despite favorable affordability conditions, with national home prices stabilizing after a previous decline. Key factors include low inventory of newly constructed homes, high levels of bank reserves not entering the economy, and ongoing challenges with consumer confidence and lending practices. The presentation highlights the complex landscape of the housing market, with regional variations in pricing and sales activity.MyTownCryer Mid Year 2010 Analysis

MyTownCryer Mid Year 2010 AnalysisTom Cryer

╠²

1. Foreclosures have declined for almost three years after peaking in 2008. However, short sales continue to be common as lenders work with borrowers. The short sale cycle may continue for 2-5 more years before a normal market trend returns.

2. The ratio of home listings to sales indicates the market may drift into oversupply in the second half of 2010 if current trends continue, potentially leading to more foreclosures and short sales.

3. While average home prices have increased in the first half of 2010, particularly for higher-end homes, prices have actually declined in many individual areas. Average prices should only be used as a general guide, not to assess specific markets or properties.PCT Patents in Costa Rica - AIPLA New York 2010

PCT Patents in Costa Rica - AIPLA New York 2010Luis Diego Castro

╠²

The document appears to track the patent applications filed by Luis D. Castro over multiple years, spanning from 1990 to 2009. It includes charts or data representations showing the number of applications submitted annually. The information indicates a historical overview of intellectual property activities associated with Castro.Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

This article discusses investment opportunities in Southwest Florida real estate. It notes that the housing market has stabilized after prices dramatically fell, and demand has now caught up with supply. Home prices are increasing and the market is appreciating. Several Florida cities saw large percentage increases in median list prices from 2010 to 2011, including Fort Myers-Cape Coral at 34.46%. Cape Coral specifically is highlighted as a boater's paradise known for its extensive canal system and as a popular retirement destination with amenities and lower costs of living. Foreign purchases have helped boost the otherwise weak Florida real estate market in recent years.Presentation: Dr Yun - Charlotte

Presentation: Dr Yun - Charlottehelenadamsadmin

╠²

This document summarizes a presentation by Lawrence Yun, Chief Economist of the National Association of Realtors, on the housing market and economic outlook. It includes charts and data on existing home sales, mortgage rates, housing starts, home prices, jobs, unemployment and other economic indicators. The presentation analyzes improving and worsening factors for the housing market and concludes that while the economic recovery is continuing, growth is slower than desired.Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

The document discusses real estate investments in Florida, specifically Cape Coral. It notes that property values in Florida fell dramatically after the housing crash but have since stabilized and begun increasing again. It highlights Cape Coral as a unique market with a large canal system and boating culture that has seen home prices rise 34.46% in the last year according to the National Association of Realtors. The document promotes land investment in Florida through Zadooland.com, citing the company's experience and ability to provide international clients with secure investment opportunities.Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

The document discusses real estate investments in Florida, specifically Cape Coral. It notes that property values in Florida fell dramatically after the housing crash but have since stabilized and begun increasing again. Cape Coral in particular is highlighted as having low housing costs, a boating paradise environment with many canals, and being a top retirement destination. The document promotes land investments in Florida through Zadooland.com, citing the company's experience and ability to provide international clients secure investment opportunities.Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

This document discusses real estate investment opportunities in Southwest Florida, specifically Cape Coral. It notes that the housing market in Southwest Florida has stabilized with demand outpacing supply and home prices increasing. Cape Coral offers affordable housing and was named a top place to retire by CNN Money in 2012 and 2009. The document also provides statistics showing large percentage increases in median home prices from 2010 to 2011 in several Florida cities including Fort Myers-Cape Coral at 34.46% growth. Cape Coral is highlighted for its extensive canal system and amenities that appeal to retirees looking for a low tax, affordable place to live near beaches and amenities.Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

1. Southwest Florida, particularly the cities of Port Charlotte and Cape Coral, is experiencing a recovery in the real estate market with home prices increasing from recent lows.

2. Cape Coral specifically offers affordable housing and a pleasant climate for retirees, along with amenities like waterfront canals and golf courses.

3. Data shows several Florida cities, including Fort Myers-Cape Coral, Miami, and Naples, have seen some of the largest year-over-year percentage increases in median home list prices nationally.Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

1. Southwest Florida, particularly the cities of Port Charlotte and Cape Coral, is experiencing a recovery in the real estate market with home prices increasing from recent lows.

2. Cape Coral specifically offers affordable housing and a low cost of living for retirees, along with amenities like miles of canals and waterways.

3. Several cities in Florida saw among the largest year-over-year increases in median home list prices between September 2010 and 2011 according to the National Association of Realtors, with Fort Myers-Cape Coral topping the list at a 34.46% increase.Housing and Economic Outlook: Residential Forum, NAR Midyear Meeting

Housing and Economic Outlook: Residential Forum, NAR Midyear MeetingNar Res

╠²

The document summarizes Lawrence Yun's presentation on the housing and economic outlook at a midyear meeting on May 17, 2012. It includes the following key points:

1. Existing home sales have been flat for the past 4 years between 4-5 million units annually. Second home and investment property sales have recovered while owner-occupied sales are falling.

2. Pending home sales contracts point to the strongest second quarter for home sales in 5 years, driven by high affordability, job growth, and rising stock and rental markets satisfying pent-up household formation.

3. Improving factors for higher home sales in 2012 include high affordability levels, stock market recovery, rising rents, and demand from young adultsJgct presentation

Jgct presentationRoger March PhD

╠²

The document discusses trends in Japanese outbound tourism from 1985-2009. Some key points:

- Japanese outbound tourism grew 323% from 1986-2000 but has fallen 13% from 2001-2010.

- Australia's market share of Japanese tourists peaked at 5.6% in 1993 but had fallen to 2.1% by 2009, lower than 1985 levels.

- From 2006-2009 the overall Japanese outbound market fell 12% while Australia's market halved.

- China and Korea have increased their share of the Japanese outbound market from 26% in 2000 to 41% in 2009, taking customers from other destinations like Australia.LDI Research Seminar with Art Kellermann, MD, MPH 11_28_12

LDI Research Seminar with Art Kellermann, MD, MPH 11_28_12Leonard Davis Institute of Health Economics

╠²

This document summarizes key findings from RAND research on health care spending in the United States. It finds that between 1999-2009, health care costs grew substantially for a median-income American family, consuming money that could have otherwise been used to pay down debt, save for retirement, or pay for education. While Americans received more medical services, the quality of care was still suboptimal, with recommended care received only about 55% of the time. The document also examines different approaches to reducing health care costs, finding that high-deductible health plans with deductibles over $1,000 were effective in reducing spending.Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

The document discusses real estate investments in Florida. It notes that property values in Florida were among the first to rise and fall during the housing boom and bust. Now, the Southwest Florida market is recovering, with home prices and demand increasing. Cape Coral specifically is highlighted as a top retirement destination known for its extensive canal system and waterfront properties. The document promotes land investment opportunities through Zadooland.com, citing the company's experience and ability to provide international clients with secure real estate investments in Florida.Mariecris slide presentation

Mariecris slide presentationMariecris Bergavera

╠²

The document discusses real estate investments in Florida. It notes that property values in Florida were among the first to rise and fall during the housing boom and bust. Now, the Southwest Florida market is recovering, with home prices and demand increasing. Cape Coral specifically is highlighted as a top retirement destination known for its extensive canal system and waterfront properties. The document then lists Cape Coral and other Florida cities as having seen some of the largest year-over-year increases in median home list prices according to the National Association of Realtors.03 05-13 ucan @ piedmont economics club

03 05-13 ucan @ piedmont economics clubMatt Dunbar

╠²

This document discusses entrepreneurship and early stage capital challenges. It notes that while about half a million startups are formed in the US each year, creating all net new jobs, most struggle to survive the "valley of death" between seed funding and later stage capital. Venture capital funds are now too large for most startups, so angels have become important early investors, though South Carolina lags in VC and angel funding per capita. The Upstate Capital Angel Network (UCAN) aims to help fill this gap by investing in scalable Southeast startups, though barriers around talent, technology costs, and regulations still exist. The presentation closes by praising entrepreneurs for the risks and sacrifices they take to drive economic growth.Agcapita January 2010 Agriculture Briefing

Agcapita January 2010 Agriculture BriefingVeripath Partners

╠²

The demand for Western Canadian farmland is increasing, driven by its appeal as an inflation hedge, diversification tool, and low-risk investment correlated with growth in China's economy. Farmland values in Saskatchewan have shown substantial appreciation, with projections indicating continued growth amidst rising international food prices. Demographic shifts suggest the 21st century may favor China, while Western economies grapple with debt and aging populations, emphasizing the importance of investing in politically stable, resource-rich regions.Is there an ideal farming system to maximise stored soil water in the Eastern...

Is there an ideal farming system to maximise stored soil water in the Eastern...Joanna Hicks

╠²

This document discusses using crop simulation models like APSIM to identify optimal farming systems for semi-arid subtropical regions of eastern Australia characterized by Vertosol soils. It notes that complex systems can be reduced to simple messages and that models can help determine if current farming practices match the local environment given factors like rainfall amounts, timing, and variability. The document explores using APSIM to analyze these factors for a particular farm site in Australia.Austin Market Update January 2008

Austin Market Update January 2008Dee Patience

╠²

The Greater Austin real estate market is experiencing consistent growth and is projected to reach a population of 2.25 million in the next decade. The market is currently stable, with average home prices ranging around $250,000 and properties in desirable areas selling quickly, yet there has been a decrease in overall home sales and pending listings. Key insights include a significant increase in inventory, particularly for homes priced below $500,000, while areas in north and south Austin remain highly sought after.LDI Research Seminar with Art Kellermann, MD, MPH 11_28_12

LDI Research Seminar with Art Kellermann, MD, MPH 11_28_12Leonard Davis Institute of Health Economics

╠²

Ad

Wealth building

- 1. Housing Equity and Net Worth, US and Tampa-St.Petersburg-Clearwater, FL Research Division 2011 Report

- 2. Net Worth in the US ŌĆó What is it? o Wealth measured as total assets (incl. homes, bank accounts, etc.) minus total liabilities (incl. mortgages, car loans, credit cards, other debt) ŌĆó What changes it? o Investment o Ownership of Assets o Valuation o Acquiring or paying down debt ŌĆó Why do we care? o Wealth impacts consumer decisions regarding consumption & saving and work & leisure

- 3. 200 400 600 800 1000 1200 1400 1600 0 1989╠²ŌĆÉ╠²Jan 1989╠²ŌĆÉ╠²Dec Source: Wall Street Journal 1990╠²ŌĆÉ╠²Nov 1991╠²ŌĆÉ╠²Oct 1992╠²ŌĆÉ╠²Sep 1993╠²ŌĆÉ╠²Aug 1994╠²ŌĆÉ╠²Jul 1995╠²ŌĆÉ╠²Jun 1996╠²ŌĆÉ╠²May 1997╠²ŌĆÉ╠²Apr 1998╠²ŌĆÉ╠²Mar 1999╠²ŌĆÉ╠²Feb 2000╠²ŌĆÉ╠²Jan 2000╠²ŌĆÉ╠²Dec 2001╠²ŌĆÉ╠²Nov S&P 500 Index 2002╠²ŌĆÉ╠²Oct 2003╠²ŌĆÉ╠²Sep 2004╠²ŌĆÉ╠²Aug 2005╠²ŌĆÉ╠²Jul 2006╠²ŌĆÉ╠²Jun 2007╠²ŌĆÉ╠²May 2008╠²ŌĆÉ╠²Apr 2009╠²ŌĆÉ╠²Mar 2010╠²ŌĆÉ╠²Feb impacted╠²by╠²the╠²market╠²decline╠²in╠²2008╠²but╠² have╠²since╠²seen╠²a╠²recovery╠²in╠²their╠²portfolios of╠²renters╠²had╠²stock╠²holdings╠²and╠²were╠²likely╠² 2011╠²ŌĆÉ╠²Jan 62.5╠²percent╠²of╠²home╠²owners╠²and╠²26.0╠²percent╠²

- 4. US Median Home Price $250,000 While╠²home╠²price╠²declines╠²directly╠² affected╠²the╠²net╠²worth╠²of╠²many╠²╠² $200,000 homeowners,╠²price╠²stability╠²in╠² 2010╠²has╠²stabilized╠²net╠²worth $150,000 $100,000 $50,000 $0 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Source: National Association of Realtors┬«

- 5. U.S. Typical Net Worth 1998 2001 2004 2007 2010* $250,000 $200,000 $150,000 Homeowner net worth ranges from 31 to 46 $100,000 times that of renters x31 x36 x46 x46 x41 $50,000 $0 Renter Homeowner Source: Federal Reserve Survey of Consumer Finances/*NAR Calculations

- 6. Tampa-St.Petersburg-Clearwater, FL Home Price Trend Median╠²Existing╠²Home╠²Price $250,000 $200,000 $150,000 $100,000 $50,000 $ 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Source: National Association of Realtors┬«

- 7. 2010 Homeowner Equity in Tampa-St. Petersburg- Clearwater, FL Ownership Tenure (Purchase Year) A╠²return╠²to╠²normal╠² price╠²growth╠²could╠² restore╠²a╠²5ŌĆÉyear╠² owner╠²to╠²positive╠² equity╠²in╠²9╠²years Source: National Association of Realtors┬« Calculations 2010 equity estimated from price change and principal payment Time to return to equity estimated from price growth alone