Digital payments

Download as PPTX, PDF31 likes19,198 views

Digital payment companies in India are growing rapidly. Digital payments encompass various instruments like prepaid payment instruments, payment gateways, and Unified Payments Interface (UPI). Major players in the digital payment industry include banks and third party vendors. The Reserve Bank of India regulates payment systems and issues licenses to entities to operate prepaid payment instruments. Common modes of digital payment discussed include bank cards, USSD mobile banking, Aadhaar Enabled Payment System (AEPS), UPI, point of sale (POS) terminals, and virtual POS. Anti-money laundering procedures are also discussed, covering money laundering activities, stages of money laundering like placement, layering and integration.

1 of 35

Downloaded 740 times

![Digital Payment Companies

1.1 Introduction & Overview of Payment Systems

1.2 Prepaid Payment Instruments [PPI]

1.3 Who can Issue PPI?

1.4 Mode of Payment

1.5 Anti Money Laundering [AML]

1.6 Key Discussions

Session - I Road MapâĶ](https://image.slidesharecdn.com/digitalpaymentsi-161220105020/85/Digital-payments-3-320.jpg)

![1.2 Prepaid Payment Instruments [PPI]

Definition:

âPayment instruments that facilitate purchase of goods

and services, including funds transfer, against the

value stored on such instruments. â

---- RBI under Payment & Settlement Systems

Act 2007

Meaning & Definition:

âMode of cashless fund transfer or transaction

using cards or mobile phonesâ

-Umashanker Sahu](https://image.slidesharecdn.com/digitalpaymentsi-161220105020/85/Digital-payments-9-320.jpg)

![1.4 Mode of Payment

1.4.1 Bank Cards

1.4.2 USSD Mobile Banking

1.4.3 Aadhar enabled payment system [AEPS]

1.4.4 United Payments Interface [UPI]

1.4.5 Point of Sale (POS) & Cards

1.4.6 Mobile POS

1.4.7 V- POS

1.4.8 Best Practices](https://image.slidesharecdn.com/digitalpaymentsi-161220105020/85/Digital-payments-14-320.jpg)

![1.4.2 USSD â Mobile banking

Enables Customer to send money, check account balance,

mini statement and more without internet connectivity.

Non-internet Banking - USSD - *99#

Registrations

Get Mobile Money Identifier (MMID)

& Mobile Pin [MPIN]

Link mobile number with Bank Account

Account in a bank or

Any mobile phone on GSM network](https://image.slidesharecdn.com/digitalpaymentsi-161220105020/85/Digital-payments-17-320.jpg)

![1.4.3 Aadhar enabled payment system [AEPS]

AEPS allows bank-to-bank

transaction at PoS (MicroATM)

with the help of BC.

Only Aadhar needed

Aadhar enabled Services

ïžBalance Enquiry

ïžCash Withdrawal

ïžAadhaar to Aadhaar Funds Transfer](https://image.slidesharecdn.com/digitalpaymentsi-161220105020/85/Digital-payments-19-320.jpg)

![1.4.4 Unified Payment Interface [UPI]

A system that powers multiple bank

accounts into a single mobile application

like an email ID for your money.

Registration Requirements

Smartphone with internet facility

Bank Account details

(only for registration)

CUPI, UCO UPI, Union Bank UPI,

AVAILABLE APPS (28 BANK APPS)

like SBI app, PNB UPI, UPI Collect (ICICI) etc.](https://image.slidesharecdn.com/digitalpaymentsi-161220105020/85/Digital-payments-21-320.jpg)

![1.5 Anti Money Laundering [AML]

1.5.1 Meaning, Definition & Concepts

1.5.2 ML Activities

1.5.3 Stags of ML

1.5.4 AML Flow

1.5.5 Illustration Video](https://image.slidesharecdn.com/digitalpaymentsi-161220105020/85/Digital-payments-30-320.jpg)

Recommended

Digital payments

Digital paymentsVenkatesh Kumar Maale

Ėý

Digital payments in India are being transformed through multiple options like UPI, e-wallets, cards, Aadhaar payments and USSD. UPI allows money transfer between banks using a virtual address, while e-wallets like Paytm allow loading funds and using them for purchases and bills. The government is promoting digital payments through policies while barriers include lack of internet access in rural areas.Digital Payments

Digital PaymentsShivam Saxena

Ėý

The document discusses digital payments in India. It provides definitions of different types of digital payment instruments and outlines the history and evolution of digital payments in India from credit cards in 1981 to UPI in 2016. It describes key features of digital payments like convenience and security. Major reasons for increased adoption include demonetization in 2016 and expanding smartphone usage. Key digital payment methods discussed include cards, UPI, NEFT, RTGS, IMPS, internet banking, and mobile banking. The National Payments Corporation of India (NPCI) plays an important role in developing digital payment infrastructure.UPI Presentation.pptx

UPI Presentation.pptxRaushanKumar375157

Ėý

This document provides an overview of the Unified Payments Interface (UPI) system in India. UPI was launched by the National Payments Corporation of India (NPCI) to facilitate funds transfers between bank accounts. It allows for peer-to-peer transfers and supports merchant payments. UPI provides a simple, cost-effective, and mobile-based payment system using virtual payment addresses mapped to bank account and identity details. Transactions are routed and cleared through an NPCI central repository using a standardized process involving the payer and payee banks. UPI aims to support various payment types including direct payments, collect requests, and more to enable common digital payment solutions.Digital payments

Digital paymentsChinnaiah S Vivek

Ėý

Briefs the Transformation of Digital payments over a period of time especially in India. Also provides the Pros and cons of the Digital payments.Cash Less Society- Digital Payments

Cash Less Society- Digital Paymentsmahajanmanu

Ėý

The document discusses India's transition to a cashless society through digital payments. It outlines various digital payment methods like UPI, mobile wallets, debit/credit cards, and Aadhaar Enabled Payment System (AEPS). It provides details on how these digital payment methods work, their benefits in reducing cash usage and transactions costs, and promoting financial inclusion. Statistics on growth of digital transactions in India over the past few years are also presented.debit cards

debit cardsPreeti Agarwal

Ėý

The document provides information on various debit cards issued by State Bank of India (SBI). It discusses the features and uses of different SBI debit cards including the Classic, Silver International, Global International, Gold International, Platinum International, SBI INTOUCH Tap & Go, and Mumbai Metro Combo cards. The key details provided include cash withdrawal limits, accepted locations for use, available benefits like insurance and rewards points, and security precautions for safe debit card transactions.Cashless India

Cashless IndiaPooja.S Perumal

Ėý

The document discusses India's progress toward becoming a cashless economy. It defines a cashless economy as one where physical currency is minimal and transactions are done electronically. Some top cashless countries are cited as examples. India currently has less than 5% of transactions electronic. Challenges to India becoming cashless include internet availability, unoperational bank accounts, small retailers who don't accept digital payments, and consumers' perceptions. The government is taking steps like expanding banking access and mobile wallets to encourage digital payments.Mobile wallets

Mobile walletsKairavi Vyas

Ėý

Mobile wallets have made it easy to carry out online shopping payments, online utility bill payments, mobile recharge online, DTH recharge online, online bus / movie ticket booking.Ėý

In India there are options like Paytm, Mobikwik, Vodafone M-pesa, Chillr, Free-charge, Airtel Money, Oxigen etc.

Presentation on Electronic Fund Transfer

Presentation on Electronic Fund TransferPRINSHU SINGH

Ėý

Electronic funds transfer (EFT) involves the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, without direct intervention by bank staff. It is done through computer-based systems. Common types of EFT include National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), and Immediate Payment Service (IMPS). NEFT allows individuals and businesses to electronically transfer funds between bank accounts across India via electronic messages. RTGS facilitates real-time funds transfers between banks. IMPS offers an instant inter-bank electronic funds transfer service through mobile phones available 24/7.Upi, e wallets & other digital payments

Upi, e wallets & other digital paymentsArshit Agarwal

Ėý

This document provides information about Unified Payments Interface (UPI), e-wallets, Aadhaar Enabled Payment System (AEPS), and Bharat QR. UPI allows instant fund transfer between bank accounts on mobile. E-wallets store money online to make purchases. AEPS allows cash withdrawals and deposits using Aadhaar authentication at micro ATMs. Bharat QR is a common QR code standard for person to merchant mobile payments in India.Electronic payment system

Electronic payment systempankhadi

Ėý

Electronic payment systems allow customers to make online payments for purchases. There are various types of electronic payment methods, including e-wallets, e-cash, smart cards, and credit cards. E-cash works like real currency with unique serial numbers, while e-wallets store payment information like credit cards. Smart cards can be used for applications such as travel tickets and medical records. Credit cards involve repaying spent amounts later. Payment gateways protect sensitive credit card details during transactions between customers, merchants and payment processors. Electronic payment is growing in India due to technology changes, internet access, and encouragement by the Reserve Bank of India.Step by-step presentation on digital payments

Step by-step presentation on digital paymentsMahantesh Biradar

Ėý

Digital Payments, STEP BY STEP INSTRUCTIONS FOR VARIOUS MODES OF PAYMENT: Cards, USSD, AEPS, UPI, WalletsDigital wallet (e-wallet)

Digital wallet (e-wallet)Krishna Kumar

Ėý

A digital wallet allows users to store payment and loyalty card information electronically rather than physically. It authenticates users and facilitates contactless payment using technologies like near field communication (NFC). Digital wallets provide advantages over physical wallets like convenience, flexibility, and safety. While systems issues, security concerns, and user experience challenges remain, major companies are developing digital wallet applications that can be used to pay at retail locations and transfer funds between individuals.E payment

E paymentVishal Sancheti

Ėý

This document discusses various electronic payment systems for e-commerce. It begins by defining e-payment as any digital financial transaction involving currency transfer between parties. It then outlines several modes of e-payment including payment cards, electronic cash, check free, check share, electronic wallets, and smart cards. For each method, it provides a brief introduction and overview of advantages and disadvantages. The document primarily focuses on explaining how payment cards, electronic cash, check free, electronic wallets, and smart cards work as options for electronic payments.Unified Payment Interface (UPI)

Unified Payment Interface (UPI)Ravindra Dastikop

Ėý

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the âPeer to Peerâ collect request which can be scheduled and paid as per requirement and convenience.The Mobile Wallet

The Mobile Walletmidhun jose

Ėý

Mobile wallets started in Japan as a solution for small payments without change at gas stations and stores. They allow storing virtual money in a mobile account that can be used to pay for transactions with an SMS. In India, while some limited mobile wallet services exist, full implementation is awaiting RBI guidelines as current rules do not allow third party transfer of funds without a bank account. As mobile wallet usage grows, costs will decrease from current Indian rates of 0.8-1.5% per transaction. Widespread adoption faces challenges around customer acceptance of mobile payments and fraud prevention without direct bank involvement.Overview of digital payments in india

Overview of digital payments in india Mathew Chacko

Ėý

The digital payments landscape in India has evolved significantly in recent years due to improvements in technology and a push for cashless transactions. Notable developments include the introduction of the UPI system in 2016, which has grown enormously and now outpaces wallets. Various payment modes like UPI, wallets, cards and Bharat QR are regulated by entities like the RBI, NPCI and follow guidelines on KYC/AML. Digital payments are projected to reach $500B by 2020 and constitute 15% of India's GDP, indicating continued growth in online transactions.Presentation of digital payments

Presentation of digital paymentspro prosecl

Ėý

1) The document provides step-by-step instructions for various digital payment modes in India including Points of Sale (POS), Unstructured Supplementary Service Data (USSDS) based mobile banking, Unified Payments Interface (UPI), e-wallets, and Aadhaar Enabled Payment System (AEPS).

2) It explains the registration process and key steps to send and receive money for different payment methods like using a physical POS machine, mobile POS, virtual POS, USSD-based banking, UPI, and e-wallets.

3) The document also outlines the requirements and limits for using various payment modes like linking a bank account and mobile number for USSD, choosing aInternet banking

Internet bankingRanjeet Yadav

Ėý

Internet banking allows individuals to perform banking activities online via the internet. It provides automated delivery of traditional and new banking products and services directly to customers through electronic and interactive communication channels. Some banks offer both online and traditional banking, while others are online-only.

The concept of internet banking developed alongside the world wide web in the 1980s. The first online banking services launched in the United States in 1994 and India in 1997. The Reserve Bank of India categorized internet banking into three types - information only, electronic information transfer, and fully electronic transactional - based on access levels.

Internet banking provides benefits like convenience, lower costs, faster transactions, and increased competition for both customers and banks. However, security risks and theTowards cashless economy

Towards cashless economyJithin Parakka

Ėý

What is Cashless Economy ? Advantages, Disadvantages, Different Cashless payment methods, internet banking, plastic money, e-wallet, Point of sale, how to secure your cashless payment, future of cashless payment. Unified Payments Interface (UPI) - Introduction

Unified Payments Interface (UPI) - Introduction indiastack

Ėý

1) The Unified Payments Interface (UPI) allows for simple push and pull payments between banks using only a virtual address like a username.

2) Banks act as Payment Service Providers (PSPs) and provide a single app for all transactions via a single identifier like Aadhaar number with one-click two-factor authentication.

3) UPI provides benefits to end users like privacy by only sharing a virtual address, multiple uses for payments, remittances and bills, and availability 24/7 on personal devices with security.E wallet

E walletAyushi Shah

Ėý

Introduction of E-Wallets, its types, Advantages,Disadvantages, Examples of E-Wallet,Needs of E-Wallet, Top E-Wallets in World and in India, Description of Mobikwik, its Steps, Architecture of transfer between two wallets, About Paytm, How does Paytm Earn, Recharge on PayTm, Steps to use Paytm, Web Technologies of Paytm, Good at Paytm and Bad at it, Our own proposed system to overcome the disadvantage of existing systemPayment Gateway

Payment GatewayNyros Technologies

Ėý

A payment gateway is a service that allows online businesses to accept electronic payments for items purchased online. It securely transmits information between the customer's bank and the merchant's bank to facilitate processing payments. Common payment gateways include PayPal, Authorize.Net, and WorldPay. Payment gateways provide security for financial transactions online and allow merchants to accept credit card payments with fees for setup and transactions.Digital payment

Digital paymentRushikesh Maddalwar

Ėý

These presentation covers modes of digital payment, advantages and disadvantages of digital payment, role of digital payment in indian scnerio.Digital Payment-Revolution in India

Digital Payment-Revolution in IndiaBinod Sinha

Ėý

It is one of the best presentation by engineering students of RIT under the guidance of Dr. Binod SinhaPayment systems

Payment systemsAbhijeet Deshmukh

Ėý

The document discusses India's payment systems. It outlines the key regulatory bodies that oversee payment systems in India. It then describes various paper-based and electronic payment methods in India such as cheques, NEFT, RTGS, IMPS, and prepaid payment systems. It also discusses the settlement system operator Clearing Corporation of India and features of the Cheque Truncation System. The document provides details on processing times, charges and limits for different payment methods in India. It concludes by noting some limitations of India's payment systems including the lack of standardized account numbering across banks.Mobile banking

Mobile bankingManoj Karangoda

Ėý

out line of this Presentation.

Elaboration of Mobile banking.

What is the Mobile banking.

How to connect with Mobile banking.

Features & Benefits of Mobile banking.

Advantages & Disadvantages of M-banking

Mobile banking in world.

Mobile banking in sri lanka.

UPI Technology

UPI Technologyindiastack

Ėý

The Unified Payments Interface (UPI) provides a single interface for online payments across all NPCI systems using standard APIs. It aims to simplify payments and improve customer experience through interoperability. UPI allows for instant payments through a single click using two-factor authentication on mobile. It also enables use of virtual payment addresses instead of sharing sensitive bank details. UPI transactions use a central repository to route payments between participating banks in real-time, with strong security features like encryption and digital signatures.E commerce cashless payment system

E commerce cashless payment systemMeet Shah

Ėý

This Presentation will let you know about the main Digital/Cashleaa payment Systems in India, This Presentation will Also Guide you towards new Payment Systems Launched Like UPI, USSD, AEPS etc. many Other Payment Systems. Digital payments Presentations

Digital payments PresentationsTRIPLE S PORTFOLIO

Ėý

UPI is a single window mobile payment system launched by NPCI that allows users to instantly transfer money between bank accounts using only a virtual payment address. It eliminates the need for users to enter sensitive bank details with each transaction. To use UPI, a user simply downloads a participating bank's app, registers with their bank account details and virtual ID, then can make or receive payments by providing only this virtual ID to the payee. This simplifies payments and promotes a cashless economy.More Related Content

What's hot (20)

Presentation on Electronic Fund Transfer

Presentation on Electronic Fund TransferPRINSHU SINGH

Ėý

Electronic funds transfer (EFT) involves the electronic transfer of money from one bank account to another, either within a single financial institution or across multiple institutions, without direct intervention by bank staff. It is done through computer-based systems. Common types of EFT include National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), and Immediate Payment Service (IMPS). NEFT allows individuals and businesses to electronically transfer funds between bank accounts across India via electronic messages. RTGS facilitates real-time funds transfers between banks. IMPS offers an instant inter-bank electronic funds transfer service through mobile phones available 24/7.Upi, e wallets & other digital payments

Upi, e wallets & other digital paymentsArshit Agarwal

Ėý

This document provides information about Unified Payments Interface (UPI), e-wallets, Aadhaar Enabled Payment System (AEPS), and Bharat QR. UPI allows instant fund transfer between bank accounts on mobile. E-wallets store money online to make purchases. AEPS allows cash withdrawals and deposits using Aadhaar authentication at micro ATMs. Bharat QR is a common QR code standard for person to merchant mobile payments in India.Electronic payment system

Electronic payment systempankhadi

Ėý

Electronic payment systems allow customers to make online payments for purchases. There are various types of electronic payment methods, including e-wallets, e-cash, smart cards, and credit cards. E-cash works like real currency with unique serial numbers, while e-wallets store payment information like credit cards. Smart cards can be used for applications such as travel tickets and medical records. Credit cards involve repaying spent amounts later. Payment gateways protect sensitive credit card details during transactions between customers, merchants and payment processors. Electronic payment is growing in India due to technology changes, internet access, and encouragement by the Reserve Bank of India.Step by-step presentation on digital payments

Step by-step presentation on digital paymentsMahantesh Biradar

Ėý

Digital Payments, STEP BY STEP INSTRUCTIONS FOR VARIOUS MODES OF PAYMENT: Cards, USSD, AEPS, UPI, WalletsDigital wallet (e-wallet)

Digital wallet (e-wallet)Krishna Kumar

Ėý

A digital wallet allows users to store payment and loyalty card information electronically rather than physically. It authenticates users and facilitates contactless payment using technologies like near field communication (NFC). Digital wallets provide advantages over physical wallets like convenience, flexibility, and safety. While systems issues, security concerns, and user experience challenges remain, major companies are developing digital wallet applications that can be used to pay at retail locations and transfer funds between individuals.E payment

E paymentVishal Sancheti

Ėý

This document discusses various electronic payment systems for e-commerce. It begins by defining e-payment as any digital financial transaction involving currency transfer between parties. It then outlines several modes of e-payment including payment cards, electronic cash, check free, check share, electronic wallets, and smart cards. For each method, it provides a brief introduction and overview of advantages and disadvantages. The document primarily focuses on explaining how payment cards, electronic cash, check free, electronic wallets, and smart cards work as options for electronic payments.Unified Payment Interface (UPI)

Unified Payment Interface (UPI)Ravindra Dastikop

Ėý

Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood. It also caters to the âPeer to Peerâ collect request which can be scheduled and paid as per requirement and convenience.The Mobile Wallet

The Mobile Walletmidhun jose

Ėý

Mobile wallets started in Japan as a solution for small payments without change at gas stations and stores. They allow storing virtual money in a mobile account that can be used to pay for transactions with an SMS. In India, while some limited mobile wallet services exist, full implementation is awaiting RBI guidelines as current rules do not allow third party transfer of funds without a bank account. As mobile wallet usage grows, costs will decrease from current Indian rates of 0.8-1.5% per transaction. Widespread adoption faces challenges around customer acceptance of mobile payments and fraud prevention without direct bank involvement.Overview of digital payments in india

Overview of digital payments in india Mathew Chacko

Ėý

The digital payments landscape in India has evolved significantly in recent years due to improvements in technology and a push for cashless transactions. Notable developments include the introduction of the UPI system in 2016, which has grown enormously and now outpaces wallets. Various payment modes like UPI, wallets, cards and Bharat QR are regulated by entities like the RBI, NPCI and follow guidelines on KYC/AML. Digital payments are projected to reach $500B by 2020 and constitute 15% of India's GDP, indicating continued growth in online transactions.Presentation of digital payments

Presentation of digital paymentspro prosecl

Ėý

1) The document provides step-by-step instructions for various digital payment modes in India including Points of Sale (POS), Unstructured Supplementary Service Data (USSDS) based mobile banking, Unified Payments Interface (UPI), e-wallets, and Aadhaar Enabled Payment System (AEPS).

2) It explains the registration process and key steps to send and receive money for different payment methods like using a physical POS machine, mobile POS, virtual POS, USSD-based banking, UPI, and e-wallets.

3) The document also outlines the requirements and limits for using various payment modes like linking a bank account and mobile number for USSD, choosing aInternet banking

Internet bankingRanjeet Yadav

Ėý

Internet banking allows individuals to perform banking activities online via the internet. It provides automated delivery of traditional and new banking products and services directly to customers through electronic and interactive communication channels. Some banks offer both online and traditional banking, while others are online-only.

The concept of internet banking developed alongside the world wide web in the 1980s. The first online banking services launched in the United States in 1994 and India in 1997. The Reserve Bank of India categorized internet banking into three types - information only, electronic information transfer, and fully electronic transactional - based on access levels.

Internet banking provides benefits like convenience, lower costs, faster transactions, and increased competition for both customers and banks. However, security risks and theTowards cashless economy

Towards cashless economyJithin Parakka

Ėý

What is Cashless Economy ? Advantages, Disadvantages, Different Cashless payment methods, internet banking, plastic money, e-wallet, Point of sale, how to secure your cashless payment, future of cashless payment. Unified Payments Interface (UPI) - Introduction

Unified Payments Interface (UPI) - Introduction indiastack

Ėý

1) The Unified Payments Interface (UPI) allows for simple push and pull payments between banks using only a virtual address like a username.

2) Banks act as Payment Service Providers (PSPs) and provide a single app for all transactions via a single identifier like Aadhaar number with one-click two-factor authentication.

3) UPI provides benefits to end users like privacy by only sharing a virtual address, multiple uses for payments, remittances and bills, and availability 24/7 on personal devices with security.E wallet

E walletAyushi Shah

Ėý

Introduction of E-Wallets, its types, Advantages,Disadvantages, Examples of E-Wallet,Needs of E-Wallet, Top E-Wallets in World and in India, Description of Mobikwik, its Steps, Architecture of transfer between two wallets, About Paytm, How does Paytm Earn, Recharge on PayTm, Steps to use Paytm, Web Technologies of Paytm, Good at Paytm and Bad at it, Our own proposed system to overcome the disadvantage of existing systemPayment Gateway

Payment GatewayNyros Technologies

Ėý

A payment gateway is a service that allows online businesses to accept electronic payments for items purchased online. It securely transmits information between the customer's bank and the merchant's bank to facilitate processing payments. Common payment gateways include PayPal, Authorize.Net, and WorldPay. Payment gateways provide security for financial transactions online and allow merchants to accept credit card payments with fees for setup and transactions.Digital payment

Digital paymentRushikesh Maddalwar

Ėý

These presentation covers modes of digital payment, advantages and disadvantages of digital payment, role of digital payment in indian scnerio.Digital Payment-Revolution in India

Digital Payment-Revolution in IndiaBinod Sinha

Ėý

It is one of the best presentation by engineering students of RIT under the guidance of Dr. Binod SinhaPayment systems

Payment systemsAbhijeet Deshmukh

Ėý

The document discusses India's payment systems. It outlines the key regulatory bodies that oversee payment systems in India. It then describes various paper-based and electronic payment methods in India such as cheques, NEFT, RTGS, IMPS, and prepaid payment systems. It also discusses the settlement system operator Clearing Corporation of India and features of the Cheque Truncation System. The document provides details on processing times, charges and limits for different payment methods in India. It concludes by noting some limitations of India's payment systems including the lack of standardized account numbering across banks.Mobile banking

Mobile bankingManoj Karangoda

Ėý

out line of this Presentation.

Elaboration of Mobile banking.

What is the Mobile banking.

How to connect with Mobile banking.

Features & Benefits of Mobile banking.

Advantages & Disadvantages of M-banking

Mobile banking in world.

Mobile banking in sri lanka.

UPI Technology

UPI Technologyindiastack

Ėý

The Unified Payments Interface (UPI) provides a single interface for online payments across all NPCI systems using standard APIs. It aims to simplify payments and improve customer experience through interoperability. UPI allows for instant payments through a single click using two-factor authentication on mobile. It also enables use of virtual payment addresses instead of sharing sensitive bank details. UPI transactions use a central repository to route payments between participating banks in real-time, with strong security features like encryption and digital signatures.Similar to Digital payments (20)

E commerce cashless payment system

E commerce cashless payment systemMeet Shah

Ėý

This Presentation will let you know about the main Digital/Cashleaa payment Systems in India, This Presentation will Also Guide you towards new Payment Systems Launched Like UPI, USSD, AEPS etc. many Other Payment Systems. Digital payments Presentations

Digital payments PresentationsTRIPLE S PORTFOLIO

Ėý

UPI is a single window mobile payment system launched by NPCI that allows users to instantly transfer money between bank accounts using only a virtual payment address. It eliminates the need for users to enter sensitive bank details with each transaction. To use UPI, a user simply downloads a participating bank's app, registers with their bank account details and virtual ID, then can make or receive payments by providing only this virtual ID to the payee. This simplifies payments and promotes a cashless economy.digitalpayments-170714070455.pptx

digitalpayments-170714070455.pptxManoj614681

Ėý

UPI is a single-window mobile payment system launched by NPCI that allows users to instantly transfer money between bank accounts using only a virtual payment address. It eliminates the need for users to enter sensitive bank details with each transaction. To use UPI, a user simply downloads a participating bank's app, registers with their virtual ID like phone number, and can then send and receive money instantly. For online purchases, a user only needs to provide their virtual ID to the merchant and authenticate the transaction via their bank app. UPI aims to facilitate a digital and cashless society in India by making payments simple, secure and convenient through a single mobile interface.Digital Payments

Digital Paymentsrohancool

Ėý

Cashless transactions are becoming more popular due to technological advancements in banking. Cashless transactions require support from banks and involve the government and RBI, making tax evasion difficult. Popular cashless methods include debit/credit cards, digital wallets, NEFT and RTGS. In contrast, cash transactions do not involve banks or the government, making tax evasion easier. The government is promoting cashless transactions to reduce black money. New digital payment methods like UPI aim to make transactions more convenient and secure.Digital Payments Growth Strategy - Citi Challenge

Digital Payments Growth Strategy - Citi ChallengeKaran Chhabra

Ėý

Innovative solutions to promote digital payments in India. How we can leverage aadhar and use Fintech to increase financial literacy.Electronic payment system

Electronic payment systemMandar Thakur

Ėý

The document discusses various electronic payment systems in India such as internet banking, NEFT, RTGS, ECS, IMPS, banking cards, USSD and AEPS. It provides details on how to activate and use these payment methods, transaction costs and limits, and services offered. Key points covered are that NEFT and RTGS facilitate funds transfer between bank accounts, while ECS, IMPS and USSD allow for utility payments, instant bank transfers using mobile phones, and basic mobile banking respectively.Cashless economy

Cashless economysiddharthapada

Ėý

From this project you know about various apps with benifits ehich facilitating cashless trasanction. thank you cashlesseconomyppt-171212063021 (1).pdf

cashlesseconomyppt-171212063021 (1).pdfDarshanAgrawal18

Ėý

This document outlines India's objectives for promoting a cashless economy through digital payments. It discusses establishing digital payment frameworks, educating citizens and merchants, and the short and long term benefits. The roadmap involves awareness campaigns using common service centers, issuing cards and machines, discounts for digital payments, and reducing transaction fees. Implementation will be led by NIC teams promoting adoption among IT professionals. The document also provides information on various digital payment options like cards, UPI, USSD, Aadhaar Pay, wallets and IMPS.Cashless economy - Presentation of Cashless economy methods to follow

Cashless economy - Presentation of Cashless economy methods to followAbhinav Reddy Lattu

Ėý

This is a presentation for cashless economy , as we know it is the most discusses topic of the present world.Digital Payment Terms Simplified

Digital Payment Terms SimplifiedAGS Transact Technologies

Ėý

From commonly used cards to newly launched UPI, digital payment options are aplenty. We have compared them side-by-side listing features and USPs of each, to help you select the most suitable mode of payment available today in India.Modes of Cashless Transactions - Cash-less Indian Economy

Modes of Cashless Transactions - Cash-less Indian EconomyRajan Chhangani

Ėý

This presentations is all about the different modes of cashless transactions and a small step to promote digital India and digitization in India.

Sources:- NPCI

Axis Bank

SBI

RBIElectronic Payment system Ecommerce for college student

Electronic Payment system Ecommerce for college studentAmuanpuia1

Ėý

An electronic payment (e-payment) system is a digital infrastructure that allows people and businesses to electronically transfer funds, instead of using cash or checks. E-payment systems can be convenient, fast, and secure.Juno pay ipos_pickup_v1

Juno pay ipos_pickup_v1Rashi Vaidya

Ėý

Product Presentation for Juno's integrated POS

Empowering business to accept payments anytime anywhere, with or without internet

10 online transactions

10 online transactionsNishant Pahad

Ėý

This document discusses 10 different online payment and wallet apps in India. It provides details on each app such as Paytm, Momoe, PayUMoney, Mobikwik, Citrus, State Bank Buddy, ICICI Pockets, HDFC Chillr, HDFC Chillr and LIME. For 3 of the apps (Paytm, PayUMoney and SBI Buddy), it describes the process for common transactions like sending money or making a payment. Finally, it discusses why online transactions are important by providing benefits like reduced costs, reliability, security and variety of choice. Mobile wallets Analysis - Evolution, Scope & Future in India

Mobile wallets Analysis - Evolution, Scope & Future in IndiaRohit Namboodiri

Ėý

Mobile wallets are digital forms of traditional wallets that store payment and identity information on a mobile device. In India, mobile wallets grew rapidly after demonetization but now face threats from the Unified Payments Interface (UPI) and new Payment Banks licensed by the RBI. To remain competitive, mobile wallets will need to enhance their apps to be as easy to use as UPI and offer more discounts, offers, and loyalty programs to attract and retain customers.electronic commerce payment systems

electronic commerce payment systemstumetr1

Ėý

This document discusses various electronic payment systems used in e-commerce. It covers using payment cards online, including credit, debit and charge cards. Smart cards and stored-value cards are described as well as e-micropayments, e-checking, mobile payments and B2B electronic payments. Key aspects like authorization, settlement, payment processors, fraud prevention, and mobile payment processes are summarized. The document provides an overview of major electronic payment methods for different e-commerce contexts.World of mobile payments by Muthu

World of mobile payments by MuthuMuthu Siva

Ėý

Great opportunity exist for businesses to develop their capability in this industry. Mobile payments are growing in alignment with the mobile growth.Digital banking

Digital bankingnoT yeT woRkiNg !! iM stiLl stUdYinG !!

Ėý

This document discusses various electronic payment systems used in banking. It begins by defining banking and describing how banking services have expanded over time to include debit/credit cards, ATM services, online fund transfers. It then discusses core banking functions like accessing accounts from any location. Other sections cover virtual banking without physical branches, various payment systems like ATM cards, credit cards, debit cards and electronic fund transfers. Mobile banking and online shopping are also summarized. The document concludes by describing internet banking and its history and procedures.Digital Payment Campaign

Digital Payment Campaignpankajkumar3274

Ėý

The document outlines a digital payment awareness campaign with the objectives of enrolling 25 lakh merchants and 1 crore citizens across India's 250,000 panchayats. It discusses promoting digital payments through common service centers and various stakeholders. The benefits of a cashless economy are described, along with an implementation roadmap including training programs and support cells. Various digital payment methods like UPI, IMPS, wallets, and Aadhaar payments are explained in detail.Electronic fund transfer system

Electronic fund transfer systemramandeepjrf

Ėý

Delivery Channels and Inter Bank Payment System, E-Payments, Types of Electronic Fund Transfer system, Real Time Gross Settlement,National Electronics Funds Transfer ,Immediate Payment Service, Credit Card, Automatic Teller Machine, Smart Card, E-Money, E- Wallet, E-Cheque Recently uploaded (20)

HIRE THE TOP CRYPTO RECOVERY EXPERT, HIRE iFORCE HACKER RECOVERY

HIRE THE TOP CRYPTO RECOVERY EXPERT, HIRE iFORCE HACKER RECOVERYraclawwysocki2

Ėý

ĖýĖýMy name is Raclaw Wysocki, a real estate investor from Warszawa, Poland. Last year, I invested in cryptocurrency, hoping to double my investment by the start of the new year. However, I soon discovered that I had fallen victim to a scam. It was a devastating experience for me and my family, and without iFORCE HACKER RECOVERY, I wouldnât have been able to recover my funds.ĖýiFORCE HACKER RECOVERY is a leading cryptocurrency and data recovery company specializing in retrieving lost crypto assets from hackers and fraudulent investment brokers. Thanks to their expertise, I successfully recovered $950,000 worth of crypto. I highly recommend their services. They are trustworthy, reliable, and have a proven 100% success rate.

Website; www. iforcehackersrecovery. com

Email; contact@iforcehackersrecovery. comĖý

Call/whatsapp +1 240 (80) (33) 706Ėý Ėý Ėý

Pearson's Chi-square Test for Research Analysis

Pearson's Chi-square Test for Research AnalysisYuli Paul

Ėý

The Chi-Square test is a powerful statistical tool used to analyze categorical data by comparing observed and expected frequencies. It helps determine whether a dataset follows an expected distribution (Goodness-of-Fit Test) or whether two categorical variables are related (Test for Independence). Being a non-parametric test, it is widely applicable but requires large sample sizes and independent observations for reliable results. While it identifies associations between variables, it does not measure causation or the strength of relationships. Despite its limitations, the Chi-Square test remains a fundamental method in statistics for hypothesis testing in various fields.THSYU Launches Innovative Cryptocurrency Platform: A New Era of Secure and Ef...

THSYU Launches Innovative Cryptocurrency Platform: A New Era of Secure and Ef...Google

Ėý

THSYU, a trailblazer in the global cryptocurrency trading landscape, is thrilled to announce the launch of its cutting-edge trading platform. This innovative platform is meticulously designed to provide secure, efficient, and user-friendly trading solutions. With this development, THSYU solidifies its position in the competitive cryptocurrency market while demonstrating its commitment to leveraging advanced technology for the protection of user assets.SSON Report Webinar Recap - Auxis Webinar

SSON Report Webinar Recap - Auxis WebinarAuxis Consulting & Outsourcing

Ėý

SSON Report Webinar Recap.pdfRECOVER YOUR SCAMMED FUNDS AND CRYPTOCURRENCY HIREĖýiFORCE HACKER RECOVERY

RECOVER YOUR SCAMMED FUNDS AND CRYPTOCURRENCY HIREĖýiFORCE HACKER RECOVERYlonniecort7

Ėý

ĖýiFORCE HACKER RECOVERY consists of professional hackers who specialize in securing compromised devices, accounts, and websites, as well as recovering stolen bitcoin and funds lost to scams. They operate efficiently and securely, ensuring a swift resolution without alerting external parties. From the very beginning, they have successfully delivered on their promises while maintaining complete discretion.Ėý Few organizations take the extra step to investigate network security risks, provide critical information, or handle sensitive matters with suchĖý Ėýprofessionalism. The iFORCE HACKER RECOVERY team helped me retrieve $364,000 that had been stolen from my corporate bitcoin wallet. I am incredibly grateful for their assistance and for providing me with additional insights into the unidentified individuals behind the theft.

Ėý ĖýWebpage; www. iforcehackersrecovery. com

Email; contact@iforcehackersrecovery. com

whatsapp; +1 240. 803. 3. 706Ėý ĖýĖýBilling for Non-Credentialed Providers A Guide (1).pdf

Billing for Non-Credentialed Providers A Guide (1).pdfmedlifemedicalbillin

Ėý

Billing for non-credentialed providers can be complex, but understanding the right strategies ensures compliance and prevents revenue loss. Whether using incident-to billing, locum tenens, or group NPI billing, following payer-specific guidelines is essential.HIRE THE TOP CRYPTO RECOVERY EXPERT, CONTACT iFORCE HACKER RECOVERY

HIRE THE TOP CRYPTO RECOVERY EXPERT, CONTACT iFORCE HACKER RECOVERYdeanbaird9573

Ėý

After investing nearly everything I had worked for, my cryptocurrency journey took a devastating turn, completely changing my life. I lost $4.7 million in a Bitcoin investment, leaving me in a desperate and hopeless situation. I was overwhelmed with despair until I came across iFORCE HACKER RECOVERY while researching solutions.Ėý After explaining my predicament to them, they assured me that they could help recover my lost funds. I decided to give them a chance, and to my amazement, they did an outstanding jobâwithin days, all my money was restored to my wallet. I am beyond relieved to have my crypto back, and I can confidently say that iFORCE HACKER RECOVERY provides truly reliable and trustworthy services.

ĖýWebsite; www. iforcehackersrecovery. com

Email; contact@iforcehackersrecovery. comĖý

Call/whatsapp +1 240 (80) (33) 706Ėý Ėý ĖýSilver One March 2025 Corporate Presentation

Silver One March 2025 Corporate PresentationAdnet Communications

Ėý

Silver One March 2025 Corporate PresentationFinancial Leadership Redefined: Nadia Dawedâs Success Story

Financial Leadership Redefined: Nadia Dawedâs Success StoryNadia Dawed

Ėý

Nadia Dawedâs remarkable journey in financial management reflects her commitment to delivering measurable results. With extensive experience in supply chain financial analysis and compliance, she ensures businesses operate efficiently and profitably. Her ability to collaborate with cross-functional teams and implement strategic solutions makes her an invaluable leader in financial operations.Compliance First, Security Guaranteed: Unveiling the Five Core Advantages of ...

Compliance First, Security Guaranteed: Unveiling the Five Core Advantages of ...MLPRU

Ėý

MLPRU believes that the future competition among exchanges will no longer be a simple battle over transaction fees but a comprehensive contest of âsecurity + compliance + technology + liquidity + ecosystem layoutâ. Among numerous trading platforms, MLPRU stands out as the top choice for many investors due to its global compliance operations, top-tier security system, robust liquidity, intelligent trading tools, and innovative ecosystem layout.Strategic Resources March 2025 Corporate Presentation

Strategic Resources March 2025 Corporate PresentationAdnet Communications

Ėý

Strategic Resources March 2025 Corporate Presentation_Offshore Banking and Compliance Requirements.pptx

_Offshore Banking and Compliance Requirements.pptxLDM Global

Ėý

Offshore banking allows individuals and businesses to hold accounts in foreign jurisdictions, offering benefits like privacy, asset protection, and potential tax advantages. However, strict compliance regulations govern these banks to prevent financial crimes. Key requirements include Know Your Customer (KYC) and Anti-Money Laundering (AML) laws, along with international regulations like FATCA (for U.S. taxpayers) and CRS (for global tax transparency).HIRE THE TOP CRYPTO RECOVERY EXPERT, HIRE iFORCE HACKER RECOVERY

HIRE THE TOP CRYPTO RECOVERY EXPERT, HIRE iFORCE HACKER RECOVERYraclawwysocki2

Ėý

ĖýĖýMy name is Raclaw Wysocki, a real estate investor from Warszawa, Poland. Last year, I invested in cryptocurrency, hoping to double my investment by the start of the new year. However, I soon discovered that I had fallen victim to a scam. It was a devastating experience for me and my family, and without iFORCE HACKER RECOVERY, I wouldnât have been able to recover my funds.ĖýiFORCE HACKER RECOVERY is a leading cryptocurrency and data recovery company specializing in retrieving lost crypto assets from hackers and fraudulent investment brokers. Thanks to their expertise, I successfully recovered $950,000 worth of crypto. I highly recommend their services. They are trustworthy, reliable, and have a proven 100% success rate.

Website; www. iforcehackersrecovery. com

Email; contact@iforcehackersrecovery. comĖý

Call/whatsapp +1 240 (80) (33) 706Ėý Ėý Ėý

crisil report 2 that analyses the current situation

crisil report 2 that analyses the current situationKalashJainfiitjee

Ėý

crisil report 2 that analyses the current situationTAX PLANNING TAX AVOIDANCE TAX EVASION MEASURES TO CHECK TAX AVOIDANCE AND EV...

TAX PLANNING TAX AVOIDANCE TAX EVASION MEASURES TO CHECK TAX AVOIDANCE AND EV...Aman Thakur

Ėý

TAX PLANNING

TAX AVOIDANCE

TAX EVASION

MEASURES TO CHECK TAX AVOIDANCE AND EVASION

MINIMUM ALTERNATE TAX

Digital payments

- 2. Digital Payment Companies In India 1.1.1 Concept â Meaning & Definition 1.1.2 Overview of Payment Systems 1.1.3 Digital Payment Forecasting 1.1.4 Payment Gateways

- 3. Digital Payment Companies 1.1 Introduction & Overview of Payment Systems 1.2 Prepaid Payment Instruments [PPI] 1.3 Who can Issue PPI? 1.4 Mode of Payment 1.5 Anti Money Laundering [AML] 1.6 Key Discussions Session - I Road MapâĶ

- 4. 1.1.1 Concept âDigital payments are not one instrument but rather an umbrella term applied to a range of different instruments used in different ways.â Meaning & Definition: âI love you not for what you are but for what I am when I am with youâ -- Umashanker Sahu

- 5. 1.1.2 Overview of Payment System ïĻ Countryâs Cashless Journey ïž 2006-2011- Shift of Non Cash Payments ïž 2013 â Master Card launched ïž 2014 â Online payments rapid Growth ïž 2014 â Adaption of Mobile payment ïž 2015 â 200% increase in Mobile Payment from 2011 ïĻ E- Commerce ïž Consumer to Business (C2B) ïž Business to Consumer(B2C) Manufacturer Wholesaler

- 6. 1.1.3 Forecasting 'Indian digital payments market to reach $500 bn by 2020'

- 7. 1.1.4 Payment gateway market HOW PAYMENT GATEWAYS WORK Software and servers that transmit Transaction information to Acquiring Banks and responses from Issuing Banks (such as whether a transaction is approved or declined).

- 8. 1.1.4 Payment gateway market Payment Gateway Players Financial Institutions/Banks âĒ ICICI âĒ CITI âĒ HDFC âĒ AXIS etc. Third Party Vendors âĒ CC Avenue âĒ Bill Desk âĒ PayU âĒ PayPal etc.

- 9. 1.2 Prepaid Payment Instruments [PPI] Definition: âPayment instruments that facilitate purchase of goods and services, including funds transfer, against the value stored on such instruments. â ---- RBI under Payment & Settlement Systems Act 2007 Meaning & Definition: âMode of cashless fund transfer or transaction using cards or mobile phonesâ -Umashanker Sahu

- 10. 1.2 PPI Exists??

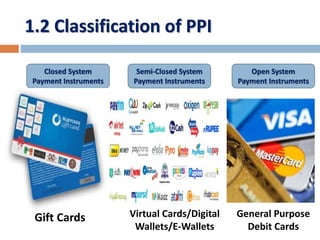

- 11. 1.2 Classification of PPI ClosedSystemPaymentInstruments âĒ Issued by an entity for facilitating the purchase of goods and services âĒ Do not permit cash withdrawal âĒ Usage - Web portals for online purchases /shopping - Make my Trip, Flipkart, Jabong etc. Semi-ClosedPaymentInstruments âĒ Facilitates the purchase of goods and services at identified merchant locations âĒ Do not permit cash withdrawal âĒ Limit â Rs. 20,000 with minimum details âĒ E.g. E Wallets/Digital Wallets OpenSystemPayment Instruments âĒ Facilitates the purchase of goods and services at POS terminal. âĒ Permit Cash withdrawal upto Rs.1000 at any point of time. âĒ Eg. Web portals for online purchases /shopping - Closed System Payment Instruments Semi-Closed System Payment Instruments Open System Payment Instruments

- 12. 1.2 Classification of PPI Closed System Payment Instruments Semi-Closed System Payment Instruments Open System Payment Instruments Virtual Cards/Digital Wallets/E-Wallets General Purpose Debit Cards Gift Cards

- 13. 1.3 Who can issue PPI in India? ïĻ Companies minimum paid up capital of Rs. 5 crore and +ve Net worth of Rs. 1 crore ïĻ Mobile based pre-paid payment instruments (mobile wallets & mobile accounts) ïĻ NBFC - closed and semi-closed system payment instruments, including mobile phone based pre-paid payment instruments ïĻ Certificates of Authorization issued by Reserve Bank of India under the Payment and Settlement Systems Act, 2007 for Setting up and Operating Payment System in India

- 14. 1.4 Mode of Payment 1.4.1 Bank Cards 1.4.2 USSD Mobile Banking 1.4.3 Aadhar enabled payment system [AEPS] 1.4.4 United Payments Interface [UPI] 1.4.5 Point of Sale (POS) & Cards 1.4.6 Mobile POS 1.4.7 V- POS 1.4.8 Best Practices

- 15. 1.4.1 Bank Cards ïĻ How to issue ïž Approach nearest bank branch ïž Multiple cards from one account ïž PIN issued by bank separately ïĻ Activate your Card ïž At your Bankâs ATM by even balance checking ïž At your bank branch by any transaction

- 16. 1.4.1 Bank Cards â Types & Usage ïĻ PREPAID CARDS ïž Pre-loaded from your bank account ïž Safe to use, limited amount of transaction ïž Can be recharged like mobile recharge like Gift Card ïĻ DEBIT CARDS ïž Linked to your bank account ïž Used to pay at shops, ATMs, wallets, Micro ATMs, online shopping Etc.

- 17. 1.4.2 USSD â Mobile banking Enables Customer to send money, check account balance, mini statement and more without internet connectivity. Non-internet Banking - USSD - *99# Registrations Get Mobile Money Identifier (MMID) & Mobile Pin [MPIN] Link mobile number with Bank Account Account in a bank or Any mobile phone on GSM network

- 18. 1.4.2 Transaction Flow Transfer Funds to another Bank Account Dial 99# from your phone

- 19. 1.4.3 Aadhar enabled payment system [AEPS] AEPS allows bank-to-bank transaction at PoS (MicroATM) with the help of BC. Only Aadhar needed Aadhar enabled Services ïžBalance Enquiry ïžCash Withdrawal ïžAadhaar to Aadhaar Funds Transfer

- 20. 1.4.3 Transaction Flow GO TO A MICROATM OR BANKING CORRESPONDENT PROVIDE YOUR BANK NAME AND AADHAAR CHOOSE WHICH TRANSACTION TO DO PROVIDE FINGER PRINT ON SCANNER ON SUCCESSFUL TRANSACTION TAKE THE PRINT SLIP PROCESS COMPLETED

- 21. 1.4.4 Unified Payment Interface [UPI] A system that powers multiple bank accounts into a single mobile application like an email ID for your money. Registration Requirements Smartphone with internet facility Bank Account details (only for registration) CUPI, UCO UPI, Union Bank UPI, AVAILABLE APPS (28 BANK APPS) like SBI app, PNB UPI, UPI Collect (ICICI) etc.

- 22. 1.4.4 Registration Process DOWNLOAD ANY BANKâS APP CHOOSE YOUR UNIQUE ID AS VIRTUAL PAYMENT ADDRESS (VPA) SELECT YOUR BANK GIVE ACCOUNT DETAILS FOR FIRST TIME SET M-PIN FOR VALIDATING TRANSACTIONS REGISTRATIO N COMPLETED

- 23. 1.4.4 Registering on UPI

- 24. 1.4.4 Sending Money on UPI

- 25. 1.4.5 Point of Sale (POS) & Types An electronic device used to process card payments at retail locations. PHYSICAL POS MOBILE POS VIRTUAL POS

- 26. 1.4.5 Physical POS The physical location at which goods are sold to customers. 1. Swipe a Debit/Credit Card on the POS Machine. 2. Enter Amount to be Paid and PIN 3. Generate Receipt

- 27. 1.4.6 Mobile POS A Smartphone, tablet or dedicated wireless device or electronic point of sale terminal.

- 28. 1.4.7 Virtual- POS A web or windows application that can be used by card-accepting merchants to manually authorize card transactions. ïž No POS machine required ïž QR code used for payment to bank account of merchant ïž Complete privacy of merchant bank account

- 29. 1.4.8 Best Practices ïĻ Register your mobile number at bank for regular information by SMS for every transaction ïĻ Never share your PIN to anyone ïĻ Transact at only trusted merchants ïĻ While at ATM, ensure no one is looking over your shoulders

- 30. 1.5 Anti Money Laundering [AML] 1.5.1 Meaning, Definition & Concepts 1.5.2 ML Activities 1.5.3 Stags of ML 1.5.4 AML Flow 1.5.5 Illustration Video

- 31. 1.5.1 Meaning, Definition & Concepts Section 3 of PMLA 2005, describes the offence of ML. Section 3 reads as under: âWhosoever directly or indirectly attempts to indulge or knowingly assists or knowingly is a party or is actually involved in any process or activity connected with the proceeds of crime and projecting it as untainted property shall be guilty of offence of money-laundering.â Money Laundering (ML) is the processing of criminal proceeds in order to disguise their illegal origin.

- 32. 1.5.2 Money Laundering Activities ïĻ Account activities not consistent with the customerâs business or normal transaction profile of the customer. ïĻ Transactions which attempts to avoid reporting/record-keeping requirements. ïĻ Unusual activities. ïĻ Transaction or account activities pertaining to customer who provides insufficient or suspicious information or is reluctant to provide requisite information. ïĻ Suspicious fund transfer activities.

- 33. 1.5.3 Stages of ML âĒ Physical Movement of cash through banking channel.PLACEMENT STAGE âĒ Conducting Multiple complex financial Transactions to eliminates the audit trail.LAYERING STAGE âĒ Integrate the illicit funds into the Economy âĒ E.g. Purchase of real estate, Jewellery etc. INTEGRATION STAGE

- 34. 1.5.4 Money Laundering Flow