About FCTC July 2011

0 likes284 views

An introduction to the service provided by Francis Clark Tax Consultancy and the people who make it happen

1 of 19

Recommended

About True Partners Consulting Generic

About True Partners Consulting GenericAgronenthal

Ã˝

True Partners Consulting is an independent tax consulting firm founded in 2005 by former partners of the Big 5 accounting firms. It has grown rapidly to over 200 employees across 6 US offices and a growing international network. The firm provides tax advisory, compliance, and consulting services to Fortune 1000 and emerging companies, leveraging its experts' experience from the Big 4 firms and corporations.BLACK ECONOMIC EMPOWERMENT

BLACK ECONOMIC EMPOWERMENT DrLendySpires

Ã˝

The document provides information about Cliffe Dekker Hofmeyr, a South African law firm with extensive expertise in advising on Black Economic Empowerment (BEE) compliance. They assist businesses in implementing BEE ownership and management structures to comply with South African laws promoting broad-based black empowerment. The firm helps clients develop BEE strategies, conducts due diligence, and advises on crafting deals and transactions in accordance with BEE requirements. Cliffe Dekker Hofmeyr has been recognized as a top law firm for its work in BEE and is considered very knowledgeable on the related regulatory framework in South Africa.Market Analysis of Big 4 Auditing Firms

Market Analysis of Big 4 Auditing FirmsHAYAGREEVAN GP

Ã˝

This presentation helps to identify the market interpretation of BIG 4 Auditing Giants. Everything is detailly well explained. It includes Market share capital, Labour, Turnover, Internship details etc! It will be much useful for MBA finance students.Amazing Facts about big 4 accounting firms

Amazing Facts about big 4 accounting firmsYogesh Goel

Ã˝

The Big Bang Theory - Amazing Facts about big 4 accounting firms.

http://yogeshgoel.blogspot.com

http://123net.blogspot.comCompany registration in romania

Company registration in romaniaFreddy Jacobs

Ã˝

Registering a company in Romania provides benefits such as reduced bureaucracy, tax advantages, and asset protection. There are three main ways to open an overseas operation: establishing a local office, registering a subsidiary company, or entering a joint venture with a local partner. The company registration process can be completed remotely with assistance from professionals to guide the process efficiently and cost-effectively.International Auditing Organizations – Big Four

International Auditing Organizations – Big FourYura Stakh

Ã˝

A brief review of world's largest auditing organizations Deloitte Touche Tohmatsu, PwC, Ernst & Young and KPMG.B&M_Bangkok_Tax

B&M_Bangkok_TaxJonathan LH Blaine (Chartered MCSI, JD, CPA, MAICD)

Ã˝

The Bangkok Tax Group at Baker & McKenzie has over 10 lawyers and consultants specializing in Thai, ASEAN, and international tax law. They provide tax advice to businesses and individuals on issues related to financial services, mergers and acquisitions, restructuring, transfer pricing, real estate, VAT, tax litigation, and international structures. As the largest global law firm, Baker & McKenzie can also draw on its network of over 650 tax lawyers worldwide to advise clients on cross-border tax matters. The Bangkok office is highly ranked and has expertise in tax litigation, customs disputes, corporate restructuring, and international mergers and acquisitions.Fta consulting@2019 tax_m&a_international_business

Fta consulting@2019 tax_m&a_international_businessMarcelo Couceiro

Ã˝

Tax Advisory, International Tax, Merger & Acquisition - M&A, Transactions Advisory Services, International Business, Corporate Consulting.BIG FOUR ACCOUNTING FIRMS

BIG FOUR ACCOUNTING FIRMSICFAI Business School

Ã˝

The Big Four accounting firms are EY, Deloitte, PwC, and KPMG. They offer audit, assurance, tax, consulting, and advisory services. Through a series of mergers and dissolutions in the late 1980s and early 1990s, the Big Eight accounting firms consolidated to form the Big Four that exist today. Each firm has a global presence with offices around the world and brings in billions in annual revenue.Corr & Corr Corporate Brochure

Corr & Corr Corporate BrochureCorrand Corr

Ã˝

Just Released, please find our new Corporate Brochure - Contact our Coalisland or Cookstown Office to discuss any area of Accounts/Audit, Tax Planning or Business Consultancy Who we are?

Who we are?Ger Foley

Ã˝

Ger Foley has over 13 years of experience working in audit and accountancy for Ernst & Young as a Senior Manager. He is a member of the Institute of Chartered Accountants in Ireland. His experience includes working with both large multinational companies in Ireland, UK, and Europe as well as local businesses ranging from sole traders to large corporates.

Colin Comerford has over 13 years of experience in taxation and financial services. He worked in a "Big 4" tax department for 8 years before becoming a self-employed tax consultant and financial advisor in 2006. His clients include sole traders, partnerships, small companies, and he provides tax work for large multinationals and private clients. He also advTHE BIG FOUR

THE BIG FOURICFAI Business School

Ã˝

The document discusses the Big Four accounting firms - PwC, Deloitte, EY, and KPMG. It provides details on their evolution over time from the Big Eight firms in the 20th century, mergers that resulted in the Big Six and Big Five, and eventually the Big Four today. Key information on each firm is given, including revenues, number of employees, services offered, and brief histories. The Big Four audit most major global companies and provide a variety of assurance, tax, consulting and advisory services worldwide.Acr st johns_apr0313_normwilliamsthetelegram (2)

Acr st johns_apr0313_normwilliamsthetelegram (2)Phil Sceviour, MBA, CMA

Ã˝

BDO's tax group in Newfoundland and Labrador has welcomed Norm Williams as the newest member of their tax team in the St. John's office. Norm has over 28 years of experience providing tax services to businesses and companies across Eastern Canada. BDO looks forward to Norm utilizing his expertise and experience to further contribute to the success of their tax team and their local community.Grant Thornton Isle of Man business services brochure

Grant Thornton Isle of Man business services brochureLee Penrose

Ã˝

Grant Thornton Isle of Man provides a wide range of professional business services including audit and assurance, accounting, taxation, internal audit, and international corporate services. They work in partnership with local businesses to help them achieve their goals through high quality expertise. Grant Thornton combines technical skills with industry experience and understanding of clients to provide strategic advice and support to help businesses unlock their growth potential. They take a personalized, hands-on approach to client services.Lga test

Lga testNatalia Wiegelman

Ã˝

LitmanGerson Associates, LLP (LGA) is an accounting and financial consulting firm located in Woburn, MA that has served owner-managed companies in New England for over 30 years. LGA seeks clients looking for more than just traditional compliance services and works with both mature businesses valuing holistic client services and ambitious startups needing trusted advisors. LGA provides tax, accounting, auditing, and business consulting services to companies with revenues between $2 million to $50 million, focusing on industries like manufacturing, real estate, professional services, and life sciences.Business_Services_Brochure

Business_Services_BrochureMike Ayres

Ã˝

Menzies is a top 20 firm of accountants, finance and business advisors operating out of multiple offices across Surrey, Hampshire and London. They provide accounting, financial, and strategic consulting services to clients, many of which are expanding internationally. Their key strengths are their focus on deep industry expertise to provide valuable insights to clients, and developing close relationships to understand each client's business through consultative services and diagnostic tools.Citrin Cooperman's International Tax Services

Citrin Cooperman's International Tax ServicesCitrin Cooperman

Ã˝

Explore how Citrin Cooperman can help your personal and business interests stateside and across the globe.Efficient Multidisiplinary Approach Valued by Freeman Tax Law Clients

Efficient Multidisiplinary Approach Valued by Freeman Tax Law ClientsJeffrey S. Freeman

Ã˝

Freeman Tax Law is a boutique law firm that helps clients to navigate the ever-changing landscape of tax law in the United States. One of the most significant changes in the past few years is the implementation of the Foreign Accounts Tax Compliance Act. This law requires overseas financial institutions to provide more transparent records regarding accounts and account holders with U.S. ties. Penalties for non-compliance can result in steep fines for individuals and a 30% sanction on foreign banking institutions for all funds transfers originating from the United States. Because of these new laws, many U.S. citizens who live or bank overseas are searching for a reliable law firm to assist them in complying with all the new FATCA disclosure and reporting requirements.Argentina Clarifies Income Tax Provisions

Argentina Clarifies Income Tax ProvisionsNair and Co.

Ã˝

Argentina has amended its income tax provisions relating to securities transactions and dividend distributions. Key changes include a 15% tax on gains from selling securities, a 13.5% tax on foreign shareholders' security sales, and a 10% withholding tax on dividends paid to local and foreign shareholders. Clarifications have provided some exemptions to the capital gains tax and guidance on calculating dividend withholding taxes. These amendments and clarifications apply retroactively to transactions since September 2013.Eurofast - The company's profile

Eurofast - The company's profileEurofast

Ã˝

Where we came from

Numbers…and why we don’t care about them!

What we are good at…and why!

Our passion about tax

What others think about us

Who do we work with

Our focus on knowledge20161116 RP Firm Introduction (MR)-2

20161116 RP Firm Introduction (MR)-2Michael Wilder

Ã˝

R&P China Lawyers is a law firm with offices in Shanghai and Beijing that provides legal services throughout mainland China. The firm was established by a Dutch founder and has a mix of European and Chinese management. It has over 40 professionals, including Chinese lawyers admitted to the Chinese bar. The firm handles complex legal issues in-house for foreign and foreign-invested companies. It offers services in various practice areas including corporate law, intellectual property, employment law, and dispute resolution. The firm aims to build long-term relationships with clients and provide tailored solutions through a combination of local expertise and international experience.BDO Tax Services

BDO Tax Servicessamgrewal

Ã˝

BDO provides scalable tax solutions to help businesses of all sizes minimize their taxes and maximize profits. Their team of tax advisors and specialists work year-round to develop comprehensive tax strategies using their expertise in corporate income tax, commodity tax, international tax, transfer pricing, and research and development tax credits. In addition to direct services, BDO helps clients and businesses stay informed of changing tax laws through publications, alerts, and their website. Whether clients need help with corporate, personal, or international taxation, BDO understands how these areas can overlap and aims to provide effective strategies to reduce clients' overall tax burdens.DFSCo Initial Public Offerings Considerations for Business Owners 20170112.PDF

DFSCo Initial Public Offerings Considerations for Business Owners 20170112.PDFLee Anne Sexton

Ã˝

This document provides an overview of the initial public offering (IPO) process for business owners and executives. It discusses the principal phases of an IPO, which typically includes 6-24 months of preparation prior to engaging underwriters, followed by the registration statement submission period, SEC review period, and final marketing and pricing phase. Key topics covered include financial statement requirements, costs of going public, selecting underwriters, accounting firm considerations, NYSE vs Nasdaq listing choices, and planning for life as a public company.Taxation Consultancy Services

Taxation Consultancy ServicesSidra Salman & Co. Chartered Accountants LLC

Ã˝

Need guidance with constantly evolving tax consultancy services in Sharjah, UAE? At SS&Co, we provide comprehensive accounting, advisory, consulting, and tax services to its firm’s clients. Contact us today and we serve you better. Visit: https://ssconsultancyme.com/tax-consultancy/

G&C Financials Folio

G&C Financials FolioGood Light Massage Center

Ã˝

G&C Financials is an accounting and business consulting firm founded by finance professionals to provide outsourced services. The firm has over 50 years of combined experience from major accounting firms and industries. It offers a full range of accounting, auditing, tax, legal, and consulting services. G&C Financials aims to help clients meet deadlines efficiently while reducing costs through leveraging technology and cross-domain expertise.CTL Strategies Profile.compressed

CTL Strategies Profile.compressedCTL Strategies

Ã˝

CTL Strategies LLP is a tax and legal advisory firm in the Maldives specializing in tax planning and dispute resolution. It offers services related to tax compliance, international taxation, tax advisory, planning, and representing clients in tax audits and appeals. The firm aims to achieve client satisfaction through integrity, competence, and reliability. It employs tax professionals with experience working for the Maldives tax authority who provide strategic advice and advocacy for businesses.Tax Services Jamaica

Tax Services JamaicaDawgen Global

Ã˝

Crowe Horwath Jamaica provides tax compliance and advisory services to corporations, individuals, and expatriates. Their services include corporate and individual tax return preparation and planning, transfer pricing reviews, tax due diligence for transactions, and advice on goods and services tax (GCT) compliance. Their goal is to help clients meet their tax obligations while maximizing tax efficiencies.International Tax For SMEs September 2011 Abbreviated

International Tax For SMEs September 2011 Abbreviatedsarogers99

Ã˝

These slides were used in a presentation given to attendees at a recent UKTI / Natwest / Francis Clark LLP seminar in Salisbury - How to Open Up New Markets Overseas.Ryan Capabilites

Ryan CapabilitesDiane Jarbawi

Ã˝

Ryan is a leading global tax services firm focused on delivering the best results for clients. They guarantee client satisfaction and won't quit until the client is satisfied. While known for tax recovery expertise, Ryan also provides prospective tax improvement and knowledge transfer to help clients achieve greater overall tax performance. The firm has extensive international experience and local expertise in 40 countries, and delivers a wide range of innovative tax advisory services to many Global 5000 clients.The UK’s Persons with Significant Control (PSC) Register – The Webinar!

The UK’s Persons with Significant Control (PSC) Register – The Webinar!Taxlinked net

Ã˝

Curious about the UK's Persons with Significant Control (PSC) Register? Our July 21st webinar will answer your questions. For details, click here!More Related Content

What's hot (19)

BIG FOUR ACCOUNTING FIRMS

BIG FOUR ACCOUNTING FIRMSICFAI Business School

Ã˝

The Big Four accounting firms are EY, Deloitte, PwC, and KPMG. They offer audit, assurance, tax, consulting, and advisory services. Through a series of mergers and dissolutions in the late 1980s and early 1990s, the Big Eight accounting firms consolidated to form the Big Four that exist today. Each firm has a global presence with offices around the world and brings in billions in annual revenue.Corr & Corr Corporate Brochure

Corr & Corr Corporate BrochureCorrand Corr

Ã˝

Just Released, please find our new Corporate Brochure - Contact our Coalisland or Cookstown Office to discuss any area of Accounts/Audit, Tax Planning or Business Consultancy Who we are?

Who we are?Ger Foley

Ã˝

Ger Foley has over 13 years of experience working in audit and accountancy for Ernst & Young as a Senior Manager. He is a member of the Institute of Chartered Accountants in Ireland. His experience includes working with both large multinational companies in Ireland, UK, and Europe as well as local businesses ranging from sole traders to large corporates.

Colin Comerford has over 13 years of experience in taxation and financial services. He worked in a "Big 4" tax department for 8 years before becoming a self-employed tax consultant and financial advisor in 2006. His clients include sole traders, partnerships, small companies, and he provides tax work for large multinationals and private clients. He also advTHE BIG FOUR

THE BIG FOURICFAI Business School

Ã˝

The document discusses the Big Four accounting firms - PwC, Deloitte, EY, and KPMG. It provides details on their evolution over time from the Big Eight firms in the 20th century, mergers that resulted in the Big Six and Big Five, and eventually the Big Four today. Key information on each firm is given, including revenues, number of employees, services offered, and brief histories. The Big Four audit most major global companies and provide a variety of assurance, tax, consulting and advisory services worldwide.Acr st johns_apr0313_normwilliamsthetelegram (2)

Acr st johns_apr0313_normwilliamsthetelegram (2)Phil Sceviour, MBA, CMA

Ã˝

BDO's tax group in Newfoundland and Labrador has welcomed Norm Williams as the newest member of their tax team in the St. John's office. Norm has over 28 years of experience providing tax services to businesses and companies across Eastern Canada. BDO looks forward to Norm utilizing his expertise and experience to further contribute to the success of their tax team and their local community.Grant Thornton Isle of Man business services brochure

Grant Thornton Isle of Man business services brochureLee Penrose

Ã˝

Grant Thornton Isle of Man provides a wide range of professional business services including audit and assurance, accounting, taxation, internal audit, and international corporate services. They work in partnership with local businesses to help them achieve their goals through high quality expertise. Grant Thornton combines technical skills with industry experience and understanding of clients to provide strategic advice and support to help businesses unlock their growth potential. They take a personalized, hands-on approach to client services.Lga test

Lga testNatalia Wiegelman

Ã˝

LitmanGerson Associates, LLP (LGA) is an accounting and financial consulting firm located in Woburn, MA that has served owner-managed companies in New England for over 30 years. LGA seeks clients looking for more than just traditional compliance services and works with both mature businesses valuing holistic client services and ambitious startups needing trusted advisors. LGA provides tax, accounting, auditing, and business consulting services to companies with revenues between $2 million to $50 million, focusing on industries like manufacturing, real estate, professional services, and life sciences.Business_Services_Brochure

Business_Services_BrochureMike Ayres

Ã˝

Menzies is a top 20 firm of accountants, finance and business advisors operating out of multiple offices across Surrey, Hampshire and London. They provide accounting, financial, and strategic consulting services to clients, many of which are expanding internationally. Their key strengths are their focus on deep industry expertise to provide valuable insights to clients, and developing close relationships to understand each client's business through consultative services and diagnostic tools.Citrin Cooperman's International Tax Services

Citrin Cooperman's International Tax ServicesCitrin Cooperman

Ã˝

Explore how Citrin Cooperman can help your personal and business interests stateside and across the globe.Efficient Multidisiplinary Approach Valued by Freeman Tax Law Clients

Efficient Multidisiplinary Approach Valued by Freeman Tax Law ClientsJeffrey S. Freeman

Ã˝

Freeman Tax Law is a boutique law firm that helps clients to navigate the ever-changing landscape of tax law in the United States. One of the most significant changes in the past few years is the implementation of the Foreign Accounts Tax Compliance Act. This law requires overseas financial institutions to provide more transparent records regarding accounts and account holders with U.S. ties. Penalties for non-compliance can result in steep fines for individuals and a 30% sanction on foreign banking institutions for all funds transfers originating from the United States. Because of these new laws, many U.S. citizens who live or bank overseas are searching for a reliable law firm to assist them in complying with all the new FATCA disclosure and reporting requirements.Argentina Clarifies Income Tax Provisions

Argentina Clarifies Income Tax ProvisionsNair and Co.

Ã˝

Argentina has amended its income tax provisions relating to securities transactions and dividend distributions. Key changes include a 15% tax on gains from selling securities, a 13.5% tax on foreign shareholders' security sales, and a 10% withholding tax on dividends paid to local and foreign shareholders. Clarifications have provided some exemptions to the capital gains tax and guidance on calculating dividend withholding taxes. These amendments and clarifications apply retroactively to transactions since September 2013.Eurofast - The company's profile

Eurofast - The company's profileEurofast

Ã˝

Where we came from

Numbers…and why we don’t care about them!

What we are good at…and why!

Our passion about tax

What others think about us

Who do we work with

Our focus on knowledge20161116 RP Firm Introduction (MR)-2

20161116 RP Firm Introduction (MR)-2Michael Wilder

Ã˝

R&P China Lawyers is a law firm with offices in Shanghai and Beijing that provides legal services throughout mainland China. The firm was established by a Dutch founder and has a mix of European and Chinese management. It has over 40 professionals, including Chinese lawyers admitted to the Chinese bar. The firm handles complex legal issues in-house for foreign and foreign-invested companies. It offers services in various practice areas including corporate law, intellectual property, employment law, and dispute resolution. The firm aims to build long-term relationships with clients and provide tailored solutions through a combination of local expertise and international experience.BDO Tax Services

BDO Tax Servicessamgrewal

Ã˝

BDO provides scalable tax solutions to help businesses of all sizes minimize their taxes and maximize profits. Their team of tax advisors and specialists work year-round to develop comprehensive tax strategies using their expertise in corporate income tax, commodity tax, international tax, transfer pricing, and research and development tax credits. In addition to direct services, BDO helps clients and businesses stay informed of changing tax laws through publications, alerts, and their website. Whether clients need help with corporate, personal, or international taxation, BDO understands how these areas can overlap and aims to provide effective strategies to reduce clients' overall tax burdens.DFSCo Initial Public Offerings Considerations for Business Owners 20170112.PDF

DFSCo Initial Public Offerings Considerations for Business Owners 20170112.PDFLee Anne Sexton

Ã˝

This document provides an overview of the initial public offering (IPO) process for business owners and executives. It discusses the principal phases of an IPO, which typically includes 6-24 months of preparation prior to engaging underwriters, followed by the registration statement submission period, SEC review period, and final marketing and pricing phase. Key topics covered include financial statement requirements, costs of going public, selecting underwriters, accounting firm considerations, NYSE vs Nasdaq listing choices, and planning for life as a public company.Taxation Consultancy Services

Taxation Consultancy ServicesSidra Salman & Co. Chartered Accountants LLC

Ã˝

Need guidance with constantly evolving tax consultancy services in Sharjah, UAE? At SS&Co, we provide comprehensive accounting, advisory, consulting, and tax services to its firm’s clients. Contact us today and we serve you better. Visit: https://ssconsultancyme.com/tax-consultancy/

G&C Financials Folio

G&C Financials FolioGood Light Massage Center

Ã˝

G&C Financials is an accounting and business consulting firm founded by finance professionals to provide outsourced services. The firm has over 50 years of combined experience from major accounting firms and industries. It offers a full range of accounting, auditing, tax, legal, and consulting services. G&C Financials aims to help clients meet deadlines efficiently while reducing costs through leveraging technology and cross-domain expertise.CTL Strategies Profile.compressed

CTL Strategies Profile.compressedCTL Strategies

Ã˝

CTL Strategies LLP is a tax and legal advisory firm in the Maldives specializing in tax planning and dispute resolution. It offers services related to tax compliance, international taxation, tax advisory, planning, and representing clients in tax audits and appeals. The firm aims to achieve client satisfaction through integrity, competence, and reliability. It employs tax professionals with experience working for the Maldives tax authority who provide strategic advice and advocacy for businesses.Tax Services Jamaica

Tax Services JamaicaDawgen Global

Ã˝

Crowe Horwath Jamaica provides tax compliance and advisory services to corporations, individuals, and expatriates. Their services include corporate and individual tax return preparation and planning, transfer pricing reviews, tax due diligence for transactions, and advice on goods and services tax (GCT) compliance. Their goal is to help clients meet their tax obligations while maximizing tax efficiencies.Similar to About FCTC July 2011 (20)

International Tax For SMEs September 2011 Abbreviated

International Tax For SMEs September 2011 Abbreviatedsarogers99

Ã˝

These slides were used in a presentation given to attendees at a recent UKTI / Natwest / Francis Clark LLP seminar in Salisbury - How to Open Up New Markets Overseas.Ryan Capabilites

Ryan CapabilitesDiane Jarbawi

Ã˝

Ryan is a leading global tax services firm focused on delivering the best results for clients. They guarantee client satisfaction and won't quit until the client is satisfied. While known for tax recovery expertise, Ryan also provides prospective tax improvement and knowledge transfer to help clients achieve greater overall tax performance. The firm has extensive international experience and local expertise in 40 countries, and delivers a wide range of innovative tax advisory services to many Global 5000 clients.The UK’s Persons with Significant Control (PSC) Register – The Webinar!

The UK’s Persons with Significant Control (PSC) Register – The Webinar!Taxlinked net

Ã˝

Curious about the UK's Persons with Significant Control (PSC) Register? Our July 21st webinar will answer your questions. For details, click here!accounting london.pdf

accounting london.pdfAccountancy Enterprise Ltd

Ã˝

Accountancy Enterprise is the expert in small business accounting services London, We offer all types of Accounting and Tax related services for your business.

At Accountancy Enterprise Ltd (AEL), we are committed to our clients and the profession’s success. We can adapt and respond quickly to client requirements and changes in the work. We build relationships based on confidence and trust. We act with integrity, openness, and accountability to stay true to our purpose and behave in a way that is consistent with our values.Tax in Finance.PDF

Tax in Finance.PDFTahira Raja

Ã˝

This document discusses recent increased scrutiny of multinational corporations' tax planning policies from media and governments. It summarizes that companies have used increasingly complex tax avoidance strategies to shift profits to low tax jurisdictions, though these strategies may be legal. The OECD and UK government are now seeking changes to international tax rules in response to issues like base erosion and profit shifting. Large companies and their advisors await how these tax issues will be addressed going forward.International Tax Risk.May2011

International Tax Risk.May2011sarogers99

Ã˝

This document provides an overview of international tax risks facing multinational companies, including transfer pricing and permanent establishment issues. It notes increased scrutiny from tax authorities around the world on cross-border transactions following the global recession. Examples are given of large tax disputes between countries over transfer pricing arrangements. The document outlines strategies for managing transfer pricing risks, such as having contemporaneous documentation and advance pricing agreements negotiated with tax authorities. It also provides a checklist of key international tax compliance matters for companies to consider.Everything you Need to Know about April 2016 in 20 minutes

Everything you Need to Know about April 2016 in 20 minutesTALiNT Partners

Ã˝

What is changing and who is liable for potential wrongful operation of tax relief

What to do next as a Recruiter and other models you may see

Free document to enable you to vet your supply chainNational Tax Investigations flyer CHSS

National Tax Investigations flyer CHSSJohn Brassey

Ã˝

The document discusses UK tax risk in the current climate of increased information sharing between countries. It summarizes Grant Thornton's expertise in dealing with HM Revenue and Customs (HMRC) inquiries across various tax areas. Their specialists are skilled at negotiating settlements with HMRC. Countries increasingly share financial information, making wealthy individuals more vulnerable to HMRC activity and uncertainty regarding managing personal and business affairs. Grant Thornton can help navigate this challenging environment and identify and manage tax risks.Global Tax Optimisation for Shipping 2015

Global Tax Optimisation for Shipping 2015Ruoh Yi Tham

Ã˝

This document provides information about the "Global Tax Optimisation for Shipping" conference taking place on June 15-16, 2015 in Singapore. The two-day conference will address complex tax issues facing the shipping industry through presentations from tax law and consulting experts. Topics will include strategies for optimizing tax obligations, navigating international tax treaties, and managing tax compliance risks. Attendees will gain practical tips and insights from case studies. Speakers are from firms like Deloitte, PwC, and Rajah & Tann. Registering early provides discounts of up to $400.DCC Corporate Presentation

DCC Corporate PresentationJPC1974

Ã˝

DC Consulting is a corporate finance, taxation and advisory firm established in 2001 in Dundee, Scotland. The firm specializes in deals between £0.5 million to £25 million, structuring transactions, arranging financing, and management buyouts. They have raised over £137 million for clients to date. DC Consulting provides services such as corporate fundraising, strategic planning, due diligence, tax advice, and valuation work through a team of experienced directors.About us PDF

About us PDFDalton Gooding

Ã˝

Gooding Partners is a leading accounting, taxation and business advisory firm established in 1998 in Perth, Western Australia. They provide high quality, personalized services to clients across Australia and internationally. Gooding Partners differentiates itself by closely aligning its interests with clients and devising tailored solutions to meet individual needs. They are also a member of DFK International, a top 10 international association of accounting firms, which provides clients access to a global network of professionals. Gooding Partners prides itself on providing a complete package of services beyond just accounting to help clients grow their businesses and find success.About us PDF

About us PDFDalton Gooding

Ã˝

Gooding Partners is a leading accounting, taxation and business advisory firm established in 1998 in Perth, Western Australia. They provide high quality, personalized services to clients across Australia and internationally. Gooding Partners differentiates itself by closely aligning its interests with clients and developing tailored solutions to meet individual needs. The firm is a member of DFK International, a top 10 international association of accounting firms, which provides clients with access to a global network of professionals and expertise. Gooding Partners prides itself on offering a complete package of services beyond just accounting to help clients grow their businesses and find success.Tax Services - Edwin Coe

Tax Services - Edwin CoeKieron Clement-Smith

Ã˝

This document provides information about Edwin Coe LLP's tax services. It discusses their expertise in advising clients on UK and international tax matters. They assist clients who are under tax investigation or seeking to disclose offshore matters through UK tax amnesty programs. They also provide tax compliance services and advisory services on various tax issues such as inheritance tax, property taxes, and tax planning for non-domiciled individuals and families with global wealth.Taxatelier_Brochure_v4_web

Taxatelier_Brochure_v4_webChristos Theophilou

Ã˝

This document provides information about the international tax advisory firm Taxatelier Ltd. It is based in Nicosia, Cyprus and offers services including international tax advice, tax compliance, and indirect tax. The firm was founded in 2014 by experienced tax professionals and is led by Managing Director Neofytos Neofytou, who has almost 40 years of tax experience. Taxatelier provides tailored tax advice and solutions to multinational corporations and high net worth individuals.Building the Successful Accounting Practice

Building the Successful Accounting PracticeDennis Taylor

Ã˝

Begbies Traynor - Leading experts who work extensively with accountancy practices update you on areas such as retaining and winning clients, practical strategies for minimising cyber risk, as well as how to minimise PI claims.What is tax and how do I pay it?

What is tax and how do I pay it?Dean Renshaw

Ã˝

This document provides a summary of taxes in the UK, including income tax, corporation tax, VAT, and how to spread the costs of taxes through financing options from White Oak UK. It defines each major tax, how often payments are due, and tips for tax filing and claiming deductions. White Oak UK offers short-term loans to help businesses pay tax bills in installments rather than a lump sum. The loans can be arranged quickly online and provide cash flow benefits over using cash reserves.Commodity trade, Tax and Transfer Pricing 2015

Commodity trade, Tax and Transfer Pricing 2015 Ruoh Yi Tham

Ã˝

Given the complex value chains and the scope of trading activities, commodity companies must constantly navigate through a myriad of international trade, tax and transfer pricing rules. Further, with changing Government positions on Tax liability, and ongoing developments in international tax reforms, Commodity companies nowadays face extensive risk.

This high level Expert briefing will provide tax planning, structuring and transactional advice to companies in any commodity trade business. Real life examples and case law analysis will be used to communicate tax law interpretation, transfer pricing approaches and how to manage investigations. More at Commodity Trade, Tax and Transfer Pricing, 2-3 September 2015, Singapore, www.commoditiestax.comMature Accountants Credentials

Mature Accountants CredentialsMARKWSCOTT

Ã˝

This document summarizes the credentials and experience of the team members at the accounting firm Mature Accountants. The firm was formed in 2005 to fill a gap in the market for experienced accountants over 50. It has over 7,000 registered candidates, has advertised over 635 jobs on its site, and has placed over 250 candidates in the UK and overseas. The firm is run by experienced accountants rather than just recruiters, and focuses on experience over age. Fees are contingent on placements, and they aim to get placements right on the first try without needing rebates.Getting the Deal Through: Tax Controversy 2017

Getting the Deal Through: Tax Controversy 2017Matheson Law Firm

Ã˝

The Revenue Commissioners are responsible for tax administration in Ireland. They verify compliance by reviewing tax returns, which typically takes less than four years from the filing date. Revenue can request information from taxpayers and interview employees. If taxpayers do not comply, Revenue can take enforcement actions like assessments, penalties and criminal prosecution. Taxpayers can protect privileged commercial information like legal advice. The standard limitation period for Revenue to review returns is four years.About FCTC July 2011

- 1. Francis ClarkTax Consultancy ServicesJuly 2011

- 2. ContentsAbout Francis Clark LLP

- 3. Awards

- 4. Francis Clark Tax Consultancy – A Quick Guide

- 5. Global Reach

- 6. The FCTC Who’s Who2

- 7. About Francis Clark - Fast FactsLargest independent firm in the South WestLargest range of specialists located in the South WestLargest corporate department in the South WestPartner-led serviceCorporate member of ICAEW Financial Reporting Faculty38 partners and over 250 staff (pre Winter Rule)45 partners and over 350 staff (post Winter Rule)

- 8. About Francis Clark ‚Äì Fast Facts13 Corporate Partners6Ã˝regional offices ‚Äì Torquay HQAwarded ‚ÄòAuditor of the Year ‚Äì Mid Tier‚Äô at the national Financial Directors' Excellence Awards 2011Awarded ‚ÄòBest General Tax Practice‚Äô in UK LexisNexis Taxation Awards 2009

- 9. Awards – Audit 2011

- 10. Awards – Audit 2011ICAEW awardsVoted for by over 1,000 finance professionalsBest Mid Tier FirmMarks of 9/10 for client serviceOthers shortlisted : Crowe Clark WhitehillRSM TenonPKFBaker Tilly

- 11. Awards – Taxation 2009

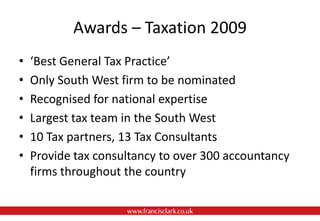

- 12. Awards – Taxation 2009‘Best General Tax Practice’Only South West firm to be nominated Recognised for national expertise Largest tax team in the South West 10 Tax partners, 13 Tax ConsultantsProvide tax consultancy to over 300 accountancy firms throughout the country

- 13. Tax Consultancy Services300 plus independent accountancy services use usMany in London, also Devon, Bristol & the South13 Tax Consultants Regularly in London and M25 areaHighly mobile ‘Ask The Expert’ Service for 15 minute bitesNon compete agreement provided

- 16. Global Reach – Leading Edge Alliance2nd largest independent accounting associationFrancis Clark LLP one of only 4 UK membersAnnual revenue of over $2.4 Billion Consistently ranked as one of the largest associations worldwide Average firm turnover $29 Million One of the fastest growing accounting associations in the world

- 17. Global Reach – Leading Edge AllianceOver 100 Countries, 450 offices & 170 firms 1,615 Partners 15,200 professional staff & 19,800 total staffFull service accountancy practices Aggressive campaign to expand into new global markets to ensure full coverage for clients

- 18. Who’s Who ?

- 19. 15A local team with the right mix of experience Tax Investigations

- 20. Construction Industry / IR35

- 22. Profit Extraction Dave WilliamsTax Partner"Tax investigations are due to increase considerably over the next few years with Inspectors of Taxes coming under increasing pressure to get results. In advising other accountants on how best to defend their clients I see far too many cases of weak defence resulting in an aggressive Inspector charging a taxpayer excessive amounts of tax. With my background and experience I am in a position to ensure that only the minimum tax is payable.“Dave specialises in tax investigations and contentious issues of all types with HM Revenue & Customs and capital allowances planning. He is a status specialist, and a specialist in the preparation of IR35/self employed contracts and defending clients against Revenue attack, preparation of reports for Special Compliance Office and Sec.660A problems.Dave worked in the Inland Revenue for 14 years, and after specialising in investigating medium sized businesses and companies joined a firm of accountants in Central London as corporation tax manager and investigations specialist. After 2 years he moved to the West Country and spent 7 years as a tax manager with a local firm before joining Francis Clark.T 01803 320100E daw@francisclark.co.uk

- 23. 16A local team with the right mix of experience Group Reorganisations

- 24. Corporate Sales & Acquisitions

- 25. R&D claims

- 26. Capital Allowances Damian LannonCorporate Tax PartnerDamian specialises in corporate and business tax consultancy and compliance. He deals with and provides advice on HM Revenue & Customs enquiry, corporate restructuring, sales and acquisitions and reviews for capital allowances and research and development claims.Damian has 15 years experience in accountancy and taxation, training with a big four firm in the South East before moving to Devon in 2001.T 01803 320100E del@francisclark.co.uk

- 27. 17A local team with the right mix of experience Profit Extraction

- 29. Employment Related Securities Andy SquiresTax PartnerAndrew advises entrepreneurs and owner managed businesses concerning taxation issues.Ã˝Areas of skill include share option schemes, the restricted securities regime and remuneration planning. He is also involved with CGT and IHT issues and general succession planning.Andrew started his career with Francis Clark in 1990 before spending eleven years in London with the private client group at Deloitte (1996 to 1998) and BDO Stoy Hayward (1998 to 2007). He re-joined Francis Clark as a Tax Consultant in June 2007, and became a Partner in 2011.Andrew is a Chartered Tax Adviser and a member of the Association of Taxation Technicians.T 01823 275925E axs@francisclark.co.uk

- 30. 18A local team with the right mix of experienceInternational Tax Matters

- 32. Complex Corporate Tax Matters

- 33. Equity Incentive Structures Stuart Rogers Corporate Tax consultantA Chartered Tax Adviser and a commerce graduate from The University of Birmingham, Stuart is a tax consultant who specialises in international tax matters and advising complex corporate entities.Stuart trained with KPMG in London and Bristol, passing the ATT and CTA examinations and gaining invaluable experience with large foreign owned subsidiaries and listed businesses. In 2002 he joined Target Consulting, a specialist tax firm in Bath as a corporate tax consultant. Target subsequently grew to 200 people, and in that time Stuart developed a senior advisory role across the South of England, latterly based in the firm‚Äôs London offices. He was involved in a wide spectrum of work, ranging from advising start ups and niche businesses, through to leading complex projects for clients such as Mulberry Group Plc and Crabtree & Evelyn Group.In May 2011 Stuart joined FC as a tax consultant specialising in corporate and international tax matters, based in Salisbury but with a cross-group brief.Ã˝ He also has experience in complex leasing tax matters, share schemes and employment related securities, due diligence and vendor tax planning, de-mergers and corporate reconstructions, capital allowances, R&D tax claims, VAT and other general owner managed business issuesT 0044 7330 220138E sar@francisclark.co.uk

- 34. Francis ClarkTax Consultancy ServicesJuly 2011