Accounting Systems.pptx

- 2. WHAT IS ACCOUNTING? Accounting is a systematic process of recording, analyzing and summarizing transactions of an entity. * The transactions are recorded in the books of original entry * The transactions are then analyzed and posted in the Ledgers • Finally, the transactions are summarized in the Financial Statements The Objective of Financial Statements The Objective of Financial Statements is to provide information about the reporting entity’s financial position and financial performance that is useful to a wide range of users in making economic decisions.

- 3. Users of Financial Statements 1) Present and potential investors 2) Employees 3) Lenders 4) Suppliers and other trade creditors 5) Customers 6) Governments and their agencies 7) The Public

- 4. Accounting Concept Going Concern Accrual concept Materiality concept Consistency concept Accounting Concept: Accounting concepts is basically the accounting rules that should be followed while preparing the financial statements. Some Accounting concepts on which financial statements are prepared:

- 5. Every transaction must have two parts. One is Debit and another is Credit. Assets and Liabilities are always will be equal. Liabilities Owner’s Equity Assets Luca Pacioli, an Italian Mathematician, Father of Modern Accounting was invented the equation.

- 6. COMPONENT OF FINANCIAL STATEMENTS A complete set of financial statements comprises: Balance Sheet Income Statement Statement of Changes in Equity Cash Flow Statement; and Notes to the Financial Statements

- 7. The elements of Financial Statements In the Balance Sheet a) Assets b) Liabilities c) Equity In the Income Statements a) Income b) Expenses

- 8. Definitions of Elements Asset: A resource controlled by an entity as a result of past events and from which future economic benefits are expected to flow to the entity. Liability: A present obligation of the entity arising from the past events, the settlement of which is expected to led to the outflow from the entity of resources embodying economic benefits. Equity: The residual amount found by deducting all of the entity’s liabilities from all of the entity’s assets. Income: Increase in economic benefits in the form of asset increases/liability decreases not resulting from contributions from equity participants. Expenses: Decreases in economic benefits in the form of asset decreases/liability increases not resulting from distributions to equity participants.

- 9. PREPARATION OF FINANCIAL STATEMENTS The Financial Statements are prepared in accordance with: The guidelines of Islamic Banking issued by Bangladesh Bank through BRPD Circular # 15 dated 09.11. 2009 The Company Act 1994 The Bank Company Act 1991 (Amendment up to 2018) The Securities and Exchange Rules ,1987 Bangladesh Financial Reporting Standards (BFRS) International Accounting Standard (IAS) as adopted by the ICAB The Financial Reporting Act 2015 Listing Regulation of Dhaka Stock Exchange & Chittagong Stock Exchange, and Other applicable laws and regulations.

- 10. An accounting information system (AIS) is a system of collecting, storing and processing financial and accounting data that are used by decision makers. An accounting information system is generally a computer-based method for tracking accounting activity in conjunction with information technology resources. AIS is a structure that a business uses to collect, store, manage, process, retrieve and report its financial data so that it can be used by accountants, consultants, business analysts, managers, chief financial officers (CFOs), auditors, regulators and tax agencies.

- 11. The elements work together to provide reliable information effectively and efficiently. Fig: Elements of AIS

- 12. Chart of accounts is simply a list of account names that a company uses in its general ledger for recording various business transactions. It provides guidance to accountants or other relevant persons in using specific account names while entering transactions in journal and posting them to ledger There is no common structure or template of chart of accounts available for the use of all types of businesses. Each company prepares its own chart of accounts depending on its individual requirements. The structure of a chart of accounts is normally as complex as the business structure of the company. For example, the type and number of accounts needed by a large corporation would significantly differ from those needed by a small retailer. Similarly many accounts that are essential in banking companies are not used by manufacturing companies.

- 13. Balance Sheet Assets Liabilities & Owner’s Equity Income Statement Operating Revenue Non- Operating Revenue Operating Expenses Non- Operating Expenses

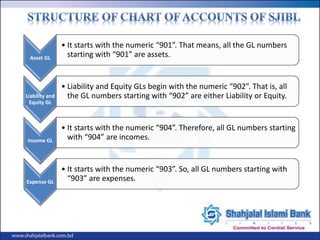

- 14. Asset GL • It starts with the numeric “901”. That means, all the GL numbers starting with “901” are assets. Liability and Equity GL • Liability and Equity GLs begin with the numeric “902”. That is, all the GL numbers starting with “902” are either Liability or Equity. Income GL • It starts with the numeric “904”. Therefore, all GL numbers starting with “904” are incomes. Expense GL • It starts with the numeric “903”. So, all GL numbers starting with “903” are expenses.

- 15. GL is an account or record used to sort, store and summarize a bank's transactions. These accounts are arranged in the chart of accounts with the balance sheet accounts appearing first followed by the income statement account. GL Balance Sheet Assets Liabilities & Owners’ Equity Income Statement Income Expense

- 16. Reconciliation of inter-branch transactions: Books of Account in regard to inter-Bank are reconciled and un-reconciled entries in case of inter- branch transactions on the reporting date are not mentionable, which are, due to the time-gap before finalizing the same. Example of inter-branch transactions: Cash Deposit in other Branch’s Account (i.e. Online Cash Deposit), the following entries will be passed: a) At Originating Branch [Through Cash Mode] : GLAccount No. GL Name Debit/Credit 9010101010200 Cash in Hand Debit 9010901000000 SJIBL General Account Credit b) At Home/ Responding Branch [Through Transfer Mode]: GLAccount No. GL Name Debit/Credit 9010901000000 SJIBL General Account Debit Respective Customer Account Credit

- 17. Compliance with Financial Reporting Standards as applicable in Bangladesh Sl. No. BAS No. BAS Title Compliance Status 1 1 Presentation of Financial Statements Complied * 2 2 Inventories Not Applicable 3 7 Statement of Cash Flows Complied * 4 8 Accounting Policies, Changes in Accounting Estimates and Errors Complied 5 10 Events after Reporting Period Complied 6 11 Construction Contracts Not Applicable 7 12 Income Taxes Complied 8 16 Property, Plant & Equipment Complied 9 17 Leases Complied 10 18 Revenue Complied 11 19 Employee Benefits Complied 12 20 Accounting for Government Grants and Discloser of Government Assistance Not Applicable 13 21 The Effects of Changes in Foreign Exchanges Rates Complied 14 23 Borrowing Costs Not Applicable

- 18. Compliance with Financial Reporting Standards as applicable in Bangladesh Sl. No. BAS No. BAS Title Compliance Status 15 24 Related Party Disclosures Complied 16 26 Accounting and Reporting by Retirement Benefit Plans Not Applicable 17 27 Consolidated and Separate Financial Statements Complied 18 28 Investment in Associates Not Applicable 19 31 Interest in Joint Venture Not Applicable 20 32 Financial Instruments: Presentation Complied * 21 33 Earnings per Share Complied 22 34 Interim Financial Reporting Complied 23 36 Impairment of Assets Complied 24 37 Provisions, Contingent liabilities and Contingent Assets Complied * 25 38 Intangible Assets Complied 26 39 Financial Instruments: Recognition and Measurement Complied * 27 40 Investment Property Not Applicable 28 41 Agriculture Not Applicable

- 19. Compliance with Financial Reporting Standards as applicable in Bangladesh Sl. No. BFRS No. BFRS Title Compliance Status 1 1 First-time Adoption of Bangladesh Financial Reporting Standards Not Applicable 2 2 Share-based Payment Not Applicable 3 3 Business Combinations Not Applicable 4 4 Insurance contracts Not Applicable 5 5 Non-Current Assets Held for Sale and Discontinued Operations Not Applicable 6 6 Exploration for and Evaluation of Mineral Not Applicable 7 7 Financial Instruments: Disclosures Complied * 8 8 Operating Segments Complied 9 10 Consolidated Financial Statements Complied 10 11 Joint Arrangements Not Applicable 11 12 Disclosure of Interest in other Entities Not Applicable 12 13 Fair Value Measurement Complied 13 14 Regulatory Deferral Accounts Not Applicable

- 20. Misreporting Branch [GB, Investment, Foreign Exchange] Financial Administration Division Treasury Division Alternative Delivery Channel (ADC) – Card Division International Division Central Processing Center (CPC) Bangladesh Automated Clearing House (BACH)

- 21. Typing errors Human errors due to discrepancies in the account number Record keeping – capital expenditure to revenue expenditure or revenue expenditure to capital expenditure Posting in wrong GL account Wrong posting Consequences: The overstatement/ understatement of Assets The overstatement/ understatement of Liabilities The overstatement/ understatement of Income The overstatement/ understatement of Expenses

- 22. Example: Total Income of X Bank Ltd. is Tk. 5,00,00,000 and Operating Expenses is Tk. 4,00,00 000 for the year 2018. The Bank purchased an office equipment for Tk. 10,00,000/= during this year. Estimated useful life of the equipment is 5 years. Use straight line method for depreciation. Calculate the Net Profit of the Bank for the year 2018. Rate of Depreciation is 20%. 1. If the cost of equipment is charged as revenue expenses, the result will be: Particulars Taka Remarks Operating Income 5,00,00,000 Less: Operating Expenses 4,00,00,000 Operating Profit 1,00,00,000 Less: Depreciation 2,00,000 Net Profit before tax 98,00,000 Income Tax @ 37.5% 36,75,000 Net Profit after Tax 61,25,000 2. If the cost of equipment is charged as capital expenditure, the result will be: Particulars Taka Remarks Operating Income 5,00,00,000 Less: Operating Expenses * 4,10,00,000 Operating Profit 90,00,000 Less: Depreciation ---- Net Profit before tax 90,00,000 Income Tax @ 37.5% 33,75,000 Net Profit after Tax 56,25,000 [ * Taka 4,00,00,000+10,00,000 = 4,10,00,000]

- 23. Using the same data mentioned as above. For 1st year the depreciation amount will be the same but for the subsequent year, the amount of depreciation will be different. Details are as under: Particulars For 2nd year Remarks Straight Line method Declining method Operating Income 5,00,00,000 5,00,00,000 Less: Operating Expenses 4,00,00,000 4,00,00,000 Operating Profit 1,00,00,000 1,00,00,000 Less: Depreciation 2,00,000 1,60,000 Net Profit before tax 98,00,000 98,40,000 Income Tax @ 37.5% 36,75,000 36,90,000 Net Profit after Tax 61,25,000 61,50,000

- 24. Transfer Pricing of SJIBL General Account Transfer pricing means the determination of profit rate of SJIBL General Account. We have some Branches who have surplus deposit but do not have optimum investment opportunities, on the other hand some branches have optimum investment opportunities but do not have enough deposit balance to invest. In this cases head office take deposits from surplus units and provide them to the deficit units through general account. The rates offered by head office for lending to head office and borrowing from head office general account is called “Profit Rate on SJIBL General Account”. The rate is decided by the Management of the Bank in its ALCO meeting.

- 25. The effective rate of profit on SJIBL General Account with effect from 01 July 2019: 1. Profit should be calculated on daily product basis on the balance of SJIBL General Account on daily product basis. 2. The rate of profit would be: a) 10% p.a, if branches borrow funds from Head Office (i.e credit balance of SJIBL General Account) b) 10% p.a, if branches lend funds to Head Office (i.e debit balance of SJIBL General Account) c) Branches will get reimbursement of excess amount of profit paid against Deposits in excess of the rate above 10%. d) The enhance rate which was allowed for rural branches will be discontinued.

- 26. Budget Definition: A budget is a formal statement of estimated income, expenses, operating profit, assets, liabilities and other business issues based on future plans and objectives. In other words, a budget is a document that management makes to estimate the revenues and expenses for an upcoming period based on their goals for the business. Features of Budget 1. It is an estimate of the economic activities of an entity which related to a specified future period. 2. It must be written and approved by the appropriate authority. 3. It should be modified or corrected, whenever, there is a change in circumstances.

- 27. Features of Budget 4. It plays the role of a business barometer that helps in measuring the performance of the business by comparing actual and budgeted results. 5. It is prepared on the basis of past experiences and trends in the business. 6. It is a business practice, which is used to forecast the operating activities and financial position of the business. Deposit mix Deposit mix is the combination of High cost, Low Cost and No Cost Deposits. The deposit mix expected by Head Office of SJIBL is at least 60:40 i.e. 60% high cost deposit and 40% low cost & no cost deposit. If a branch can achieve optimum deposit mix then, it well be easy to achieve profit target by the branch. Optimum deposit mix will help to reduce cost of fund resulting higher spread and higher profitability.

- 29. 29

![Reconciliation of inter-branch transactions:

Books of Account in regard to inter-Bank are reconciled and un-reconciled entries in case of inter-

branch transactions on the reporting date are not mentionable, which are, due to the time-gap before

finalizing the same.

Example of inter-branch transactions:

Cash Deposit in other Branch’s Account (i.e. Online Cash Deposit), the following entries will be

passed:

a) At Originating Branch [Through Cash Mode] :

GLAccount No. GL Name Debit/Credit

9010101010200 Cash in Hand Debit

9010901000000 SJIBL General Account Credit

b) At Home/ Responding Branch [Through Transfer Mode]:

GLAccount No. GL Name Debit/Credit

9010901000000 SJIBL General Account Debit

Respective Customer Account Credit](https://image.slidesharecdn.com/accountingsystems-230305055825-10487cda/85/Accounting-Systems-pptx-16-320.jpg)

![Misreporting

Branch [GB,

Investment,

Foreign

Exchange]

Financial

Administration

Division

Treasury

Division

Alternative

Delivery

Channel (ADC)

– Card Division International

Division

Central

Processing

Center (CPC)

Bangladesh

Automated

Clearing House

(BACH)](https://image.slidesharecdn.com/accountingsystems-230305055825-10487cda/85/Accounting-Systems-pptx-20-320.jpg)

![Example:

Total Income of X Bank Ltd. is Tk. 5,00,00,000 and Operating Expenses is Tk. 4,00,00 000 for the year 2018.

The Bank purchased an office equipment for Tk. 10,00,000/= during this year. Estimated useful life of the

equipment is 5 years. Use straight line method for depreciation. Calculate the Net Profit of the Bank for the year

2018. Rate of Depreciation is 20%.

1. If the cost of equipment is charged as revenue expenses, the result will be:

Particulars Taka Remarks

Operating Income 5,00,00,000

Less: Operating Expenses 4,00,00,000

Operating Profit 1,00,00,000

Less: Depreciation 2,00,000

Net Profit before tax 98,00,000

Income Tax @ 37.5% 36,75,000

Net Profit after Tax 61,25,000

2. If the cost of equipment is charged as capital expenditure, the result will be:

Particulars Taka Remarks

Operating Income 5,00,00,000

Less: Operating Expenses * 4,10,00,000

Operating Profit 90,00,000

Less: Depreciation ----

Net Profit before tax 90,00,000

Income Tax @ 37.5% 33,75,000

Net Profit after Tax 56,25,000

[ * Taka 4,00,00,000+10,00,000 = 4,10,00,000]](https://image.slidesharecdn.com/accountingsystems-230305055825-10487cda/85/Accounting-Systems-pptx-22-320.jpg)