Agricultural income

Download as PPTX, PDF10 likes14,006 views

The document defines agricultural income and non-agricultural income for tax purposes. Agricultural income includes any income derived from land used for agricultural purposes in India, such as rent, crop sales, or farm building income. Non-agricultural income includes income from activities like stone quarries, dairy farming, poultry, fisheries, and brick making. Some incomes are partially agricultural and partially business. For individuals and HUFs with both agricultural and non-agricultural income, tax is calculated by integrating the incomes and comparing to the tax on agricultural income alone.

1 of 7

Downloaded 264 times

Recommended

Agricultural income in Indian Income Tax Act 1961

Agricultural income in Indian Income Tax Act 1961B Satyanarayana Rao

Ěý

This document discusses agricultural income as defined in the Indian Income Tax Act of 1961. It defines agricultural income as income derived from agricultural sources in India. The document outlines the various types of agricultural income, including rents from agricultural land, income from cultivating land, income from processes to make agricultural produce marketable, and income from the sale of agricultural produce. It also discusses the tests to determine what constitutes agricultural income and provides examples of incomes that are considered agricultural versus non-agricultural. The document concludes by explaining the process of integrating agricultural income with non-agricultural income for tax purposes when thresholds are exceeded.Direct tax

Direct taxprasadarun06

Ěý

The document discusses various direct taxes levied in India including income tax, corporation tax, dividend tax, capital gains tax, wealth tax, gift tax, estate duty, land revenue, agricultural income tax, and professional tax. It outlines the introduction and key aspects of each tax. It also discusses direct taxes at the state and local government levels. The document notes both the merits and demerits of direct taxes, such as equity and economy but also possibilities of evasion, complexity, and unsuitability for underdeveloped countries.Taxation of agricultural income

Taxation of agricultural incomePrashant Arsul

Ěý

What is Agricultural Income ?

Section 2 (1A) of the Income tax Act,1961

Agricultural income means :

Revenue generated through rent or lease of a land in India that is used for agricultural purposes ;

Any income derived from commercial sale of produce gained from an agricultural land

Any income from farm building.

Key points to validly classify an income as “agricultural income”

Income should be from an existent piece of land in India ;

Income should be from a piece of land that is used for agricultural operations ;

Income should stem from produce achieved after cultivation of the land. Cultivation of land is a must ;

Income can be from a land that is not under the assessee’s ownership. i.e. ownership of Land is not essential.

Profits and Gains of Business or Profession

Profits and Gains of Business or ProfessionChella Pandian

Ěý

This document provides information about an income tax course taught by Dr. K. Chellapandian. It includes details about the course code, credit hours, outcomes, units covered, textbooks, and assessment details. The key points are:

- The course is Income Tax Law & Practice - II taught by Dr. K. Chellapandian at Vivekananda College.

- It has 5 units covering topics like computation of profits/capital gains, deductions, assessment of individuals/firms, and tax authorities.

- The course aims to enable students to learn income tax provisions and assessment procedures.

- Assessment includes 40% theory and 60% problems, following amendments up to 6 monthsAgricultural income - Relevant Income Tax Issues

Agricultural income - Relevant Income Tax IssuesAmitoz Singh

Ěý

This presentation helps in understanding the meaning of Agriculture Income, its taxability, various issues pertaining to the understanding of agriculture and what will qualify as agriculture income. When the said income will be exempt ?AGRICULTURAL INCOME

AGRICULTURAL INCOME DR ANNIE STEPHEN

Ěý

The document discusses the meaning and definition of agricultural income under the Indian Income Tax Act of 1961.

[1] Agricultural income includes income from agricultural land used for cultivation, processing of produce to render it fit for market, and income from farm houses meeting certain conditions.

[2] It must involve human labor and skill on the land for cultivation, protection, and maintenance to qualify as agricultural income.

[3] Certain incomes like dairy, poultry, livestock are not considered agricultural, while others like tree cultivation, rent from farmland, and crop insurance payouts are.02 agriculture income ay 17 18

02 agriculture income ay 17 18Joseph Puthussery

Ěý

Agriculture income is exempt from income tax, but is included in total income to determine the applicable tax rate for non-agricultural income. Agriculture income includes any rent or revenue from land used for agricultural purposes in India. It also includes income derived from agricultural processes performed on crops and the sale of crops that underwent these processes. Agriculture income exemption can only be claimed by land owners and cultivators. Integration of agriculture and non-agricultural income is done when non-agricultural income exceeds the basic exemption limit and agriculture income exceeds Rs. 5,000. Integration may result in additional tax liability if the total income falls in higher tax slabs.Income from house property

Income from house propertyP.Ravichandran Chandran

Ěý

The document discusses income from house property under the Indian Income Tax Act. It defines income from house property as the annual value of any buildings or lands owned by an assessee. It provides details on computation of gross annual value, deductions allowed, treatment of self-occupied properties, and exempted incomes from house property. The key steps involved in computing income from house property are determining the annual value, calculating the net annual value, and claiming allowed deductions.Income from business or profession

Income from business or professionParminder Kaur

Ěý

The document discusses key aspects of income from business and profession under the Income Tax Act of 1961 in India. It defines business and profession, outlines the basis of charge for income from business/profession, and describes various deductions that are allowed under sections 30-37 of the Act such as rent, repairs, insurance, depreciation, bad debts, and more. It provides explanations and conditions for claiming many of these deductions.Income tax basics

Income tax basicsCA Deepali Gupta

Ěý

Income tax is a tax paid to the government on income. There are different types of taxes including direct taxes like income tax paid directly by taxpayers. Income tax is assessed based on an individual's gross total income, which is the aggregate income from five heads - salaries, house property, business/profession, capital gains, and other sources. Key concepts include taxable income, tax exemption limits, tax rates, residential status, tax deductions, and different types of income like casual income, capital gains income etc.Profit & Gains from Business or Profession.

Profit & Gains from Business or Profession.RAJESH JAIN

Ěý

This document provides an overview of income from business and profession under the Indian Income Tax Act. It defines business and profession, outlines the key points and basis of charge for income from business/profession. It also discusses the computation of income, specific deductions allowed, depreciation rules and amounts that are not deductible. The key information includes definitions of business and profession, income includes profits and losses, relevance of accounting method, and that income from illegal businesses is taxable.Agriculture income

Agriculture incomeCA Bala Yadav

Ěý

Agriculture income derived from land in India used for agricultural purposes is exempt from income tax under Section 10. Agriculture income includes: (1) rent or revenue from land; (2) income derived from land through agriculture or processing agricultural produce; and (3) income from farm buildings used as dwellings or stores by cultivators. Some specific examples of agriculture income outlined in the document are income from crops, livestock, coconuts, grass, flowers, insurance compensation for damaged crops, and sale of seeds grown by the assessee. Non-agriculture income examples provided are income from forests, salt production, stone quarries, dairy, poultry, fisheries, royalties, brick making,Clubbing of income

Clubbing of incomeVinor5

Ěý

The document discusses the concept of clubbing of income under Section 64 of the Indian Income Tax Act. It specifies the persons and scenarios where income can be clubbed, such as transferring income without transferring the asset (Section 60), revocable transfers of assets (Section 61), income of a spouse or minor child, transfers of assets to a spouse, son's wife, or for their benefit without adequate consideration. The purpose is to prevent avoidance of tax liability by transferring income-generating assets to relatives.Income From Other Sources

Income From Other SourcesAmeet Patel

Ěý

This is a presentation made by me to a batch of Indian tax officers at their training academy on 28th May 2012. It is on the head of income called "Income from Other Sources"Income from other sources

Income from other sourcesIshitaSrivastava21

Ěý

Presentation on computation of income from other sources for the benefit of taxation students, based on provisions of Income tax Act 1961Income from other sources

Income from other sources IshitaSrivastava21

Ěý

computation of income from other sources for the benefit of taxation students, based on provisions of Income tax Act 1961Final capital gain (3) di sh

Final capital gain (3) di shwatsalaraj

Ěý

The document discusses the meaning and calculation of capital gains under the Income Tax Act.

Some key points:

- Capital gains arise from the profit earned on the transfer of a capital asset like property, shares, etc.

- It is taxed under a separate head called "capital gains" and is deemed as income of the year in which the transfer took place.

- Capital gains are classified as short-term or long-term depending on the period of holding. Assets held for less than 36 months for immovable property and 12 months for others attract short-term capital gains tax.

- The capital gain amount is calculated by deducting the indexed cost of acquisition and improvement from the sale consideration. VariousIncome from house property

Income from house propertyKshitij Gupta

Ěý

This PPT explains each and every concept of Income from House Property under Direct taxes. It is most suitable for students of BCOM(H) and CA.Set off & carry forward

Set off & carry forwardSomya Chaturvedi

Ěý

The document discusses the rules for set off and carry forward of business losses under the Income Tax Act. It can be summarized as follows:

1) Section 70 allows for set off of losses from one source of income against profits from another source within the same head. Section 71 allows set off of losses under one head against income under another.

2) Business losses can be carried forward for 8 years and set off against future profits of any business. Speculation losses can be carried forward for 4 years against future speculation profits only.

3) Capital losses can be carried forward for 8 years against capital gains. House property losses can be carried forward for 8 years against future house property income. Losses from specified businessesIncome tax act 1961

Income tax act 1961Dr. Hukmaram Pawar

Ěý

Tax is an important source of revenue for governments worldwide. Taxes are collected on income, sales, purchases, and properties to fund government operations. There are two types of taxes: direct taxes which are paid directly by individuals like income tax; and indirect taxes which are passed on through other entities like sales tax. Income tax was first introduced in India in 1860 under British rule to fund expenses from the 1857 rebellion. The current Income Tax Act of 1961 governs income tax in India and has been amended over time. It details the taxation of various types of income for individuals and organizations.Aggregation of income, set off and carry forward

Aggregation of income, set off and carry forwardCA Dr. Prithvi Ranjan Parhi

Ěý

This presentation intents to explain the concepts of Set off and Carry Forward of losses under income tax law to students. For detail understanding of the concept viewers are invited to our YouTube Channel.Income tax basic concepts

Income tax basic conceptsDr.Sangeetha R

Ěý

This document defines key terms related to income tax in India. It explains that the assessment year is the year following the financial year in which income is assessed. The previous year is the financial year in which income is earned. It defines who qualifies as a person, assessee, representative assessee, and deemed assessee for income tax purposes. It also explains how gross total income, total income, casual income, and agricultural income are defined and treated for income tax.Capital gains ppt

Capital gains pptParitosh chaudhary

Ěý

Capital gains tax is levied on profits arising from the transfer of a capital asset. For gains to be taxed under capital gains, there must be a capital asset that is transferred, resulting in profits. Any profits exempted under sections 54-54G are not taxed. Capital assets include all property except certain exceptions like stock-in-trade. Short term capital gains arise from assets held for 36 months or less, while long term gains are for assets held longer. Indexation of cost is used to arrive at capital gains for long term assets by factoring inflation. Profits are taxed differently based on whether the gain is short term or long term.Indirect Tax Basic

Indirect Tax BasicDhananjay Singh

Ěý

This document discusses the concept of indirect taxes. It defines indirect taxes as taxes whose burden can be shifted to others, in part or wholly, through higher prices. Examples given are excise duties, sales tax, service tax, customs duty, and taxes on transportation fares. The objectives of indirect taxes include revenue generation, reducing income inequality, social welfare programs, earning foreign exchange, and regional development. Key features outlined are burden shifting, taxation of commodities/services, and indirect determination of taxpayer ability. Advantages include convenience, disguise of tax effect, difficulty evading, broad tax base, and potential for forced savings. Disadvantages involve regressivity, high collection costs, inflationary effects, and lack of educative valueTAX ASSESSMENT OF ASSOCIATION OF PERSONSB(AOP)/BODY OF IDIVIDUALS (BOI)

TAX ASSESSMENT OF ASSOCIATION OF PERSONSB(AOP)/BODY OF IDIVIDUALS (BOI)Mahi Muthananickal

Ěý

(1) The document discusses the concepts of Association of Persons (AOP) and Body of Individuals (BOI) under the Indian Income Tax Act of 1961.

(2) It provides definitions and differences between AOP and BOI, and describes how to compute tax liability when the shares of members are known (determinate) or unknown (indeterminate).

(3) The maximum marginal tax rate is also explained, which is the highest slab rate used to compute tax on the total income of an AOP or BOI when member shares are unknown.Types of Assessees and Residential Status

Types of Assessees and Residential StatusRajaKrishnan M

Ěý

This document summarizes key concepts related to assessees and residential status under Indian income tax law. It defines an assessee as the person who pays tax to the government and describes the different types of assessees, including ordinary, representative/deemed, and assessee in default. It also outlines the criteria for determining residential status, such as an individual being considered a resident if they are in India for at least 182 days or at least 60 days plus 365 days in the last 4 years. Finally, it provides an example problem of determining residential status for an individual who left India on October 1st and returned on March 10th of the following year.Income from house property ppt

Income from house property pptPADMINIGOVARDHAN

Ěý

The document discusses income from house property under the Indian Income Tax Act. It defines key terms like house property, annual value, basis of charge, and ownership.

Some key points covered are:

- House property means any building owned by the assessee, including residential or commercial properties.

- The basis of charge is the annual value of the property, defined as the expected rental income.

- For a property to be counted as house property, it must consist of a building and land, and the assessee must own it and not use it for their own business.

- Deemed ownership provisions attribute ownership to certain relatives or in cases of transfer without adequate consideration.

- The annual valueIncome under the 5 heads

Income under the 5 headsRishiraj Yadav

Ěý

1) There are 5 heads of income under the Indian Income Tax Act: income from salary, house property, business or profession, capital gains, and other sources.

2) Computation of taxable income involves determining residential status, classifying income, aggregating, applying clubbing provisions, deducting losses, exemptions, and rebates to calculate total tax payable.

3) Income from salary includes wages, pension, gratuity, fees, commissions, perquisites, and advances. Certain allowances like conveyance, education, transport, and house rent are fully or partially exempted.

4) Income from house property is based on annual value, which is the expected rent (municipTaxing Agriculture

Taxing AgricultureArpit Agarwal

Ěý

The document discusses taxing agricultural income in India. It notes that agriculture provides employment to 60% of the population and contributes 20% to GDP. Currently, agricultural tax is determined by state governments according to the constitution. Taxing more agricultural income could add more taxpayers and revenue to support development. The document proposes defining consumption points, using tax revenues for agriculture infrastructure, and addressing potential pitfalls like tax evasion through joint family systems.why agricultural income could not be taxed in pakistan agricultural income ta...

why agricultural income could not be taxed in pakistan agricultural income ta...Nimra Waseem Chaudhry

Ěý

why agricultural income could not be taxed in pakistan agricultural income taxation , problems of agricultural taxation., agricultural income taxation of pakistan agricultural taxation of pakistanMore Related Content

What's hot (20)

Income from business or profession

Income from business or professionParminder Kaur

Ěý

The document discusses key aspects of income from business and profession under the Income Tax Act of 1961 in India. It defines business and profession, outlines the basis of charge for income from business/profession, and describes various deductions that are allowed under sections 30-37 of the Act such as rent, repairs, insurance, depreciation, bad debts, and more. It provides explanations and conditions for claiming many of these deductions.Income tax basics

Income tax basicsCA Deepali Gupta

Ěý

Income tax is a tax paid to the government on income. There are different types of taxes including direct taxes like income tax paid directly by taxpayers. Income tax is assessed based on an individual's gross total income, which is the aggregate income from five heads - salaries, house property, business/profession, capital gains, and other sources. Key concepts include taxable income, tax exemption limits, tax rates, residential status, tax deductions, and different types of income like casual income, capital gains income etc.Profit & Gains from Business or Profession.

Profit & Gains from Business or Profession.RAJESH JAIN

Ěý

This document provides an overview of income from business and profession under the Indian Income Tax Act. It defines business and profession, outlines the key points and basis of charge for income from business/profession. It also discusses the computation of income, specific deductions allowed, depreciation rules and amounts that are not deductible. The key information includes definitions of business and profession, income includes profits and losses, relevance of accounting method, and that income from illegal businesses is taxable.Agriculture income

Agriculture incomeCA Bala Yadav

Ěý

Agriculture income derived from land in India used for agricultural purposes is exempt from income tax under Section 10. Agriculture income includes: (1) rent or revenue from land; (2) income derived from land through agriculture or processing agricultural produce; and (3) income from farm buildings used as dwellings or stores by cultivators. Some specific examples of agriculture income outlined in the document are income from crops, livestock, coconuts, grass, flowers, insurance compensation for damaged crops, and sale of seeds grown by the assessee. Non-agriculture income examples provided are income from forests, salt production, stone quarries, dairy, poultry, fisheries, royalties, brick making,Clubbing of income

Clubbing of incomeVinor5

Ěý

The document discusses the concept of clubbing of income under Section 64 of the Indian Income Tax Act. It specifies the persons and scenarios where income can be clubbed, such as transferring income without transferring the asset (Section 60), revocable transfers of assets (Section 61), income of a spouse or minor child, transfers of assets to a spouse, son's wife, or for their benefit without adequate consideration. The purpose is to prevent avoidance of tax liability by transferring income-generating assets to relatives.Income From Other Sources

Income From Other SourcesAmeet Patel

Ěý

This is a presentation made by me to a batch of Indian tax officers at their training academy on 28th May 2012. It is on the head of income called "Income from Other Sources"Income from other sources

Income from other sourcesIshitaSrivastava21

Ěý

Presentation on computation of income from other sources for the benefit of taxation students, based on provisions of Income tax Act 1961Income from other sources

Income from other sources IshitaSrivastava21

Ěý

computation of income from other sources for the benefit of taxation students, based on provisions of Income tax Act 1961Final capital gain (3) di sh

Final capital gain (3) di shwatsalaraj

Ěý

The document discusses the meaning and calculation of capital gains under the Income Tax Act.

Some key points:

- Capital gains arise from the profit earned on the transfer of a capital asset like property, shares, etc.

- It is taxed under a separate head called "capital gains" and is deemed as income of the year in which the transfer took place.

- Capital gains are classified as short-term or long-term depending on the period of holding. Assets held for less than 36 months for immovable property and 12 months for others attract short-term capital gains tax.

- The capital gain amount is calculated by deducting the indexed cost of acquisition and improvement from the sale consideration. VariousIncome from house property

Income from house propertyKshitij Gupta

Ěý

This PPT explains each and every concept of Income from House Property under Direct taxes. It is most suitable for students of BCOM(H) and CA.Set off & carry forward

Set off & carry forwardSomya Chaturvedi

Ěý

The document discusses the rules for set off and carry forward of business losses under the Income Tax Act. It can be summarized as follows:

1) Section 70 allows for set off of losses from one source of income against profits from another source within the same head. Section 71 allows set off of losses under one head against income under another.

2) Business losses can be carried forward for 8 years and set off against future profits of any business. Speculation losses can be carried forward for 4 years against future speculation profits only.

3) Capital losses can be carried forward for 8 years against capital gains. House property losses can be carried forward for 8 years against future house property income. Losses from specified businessesIncome tax act 1961

Income tax act 1961Dr. Hukmaram Pawar

Ěý

Tax is an important source of revenue for governments worldwide. Taxes are collected on income, sales, purchases, and properties to fund government operations. There are two types of taxes: direct taxes which are paid directly by individuals like income tax; and indirect taxes which are passed on through other entities like sales tax. Income tax was first introduced in India in 1860 under British rule to fund expenses from the 1857 rebellion. The current Income Tax Act of 1961 governs income tax in India and has been amended over time. It details the taxation of various types of income for individuals and organizations.Aggregation of income, set off and carry forward

Aggregation of income, set off and carry forwardCA Dr. Prithvi Ranjan Parhi

Ěý

This presentation intents to explain the concepts of Set off and Carry Forward of losses under income tax law to students. For detail understanding of the concept viewers are invited to our YouTube Channel.Income tax basic concepts

Income tax basic conceptsDr.Sangeetha R

Ěý

This document defines key terms related to income tax in India. It explains that the assessment year is the year following the financial year in which income is assessed. The previous year is the financial year in which income is earned. It defines who qualifies as a person, assessee, representative assessee, and deemed assessee for income tax purposes. It also explains how gross total income, total income, casual income, and agricultural income are defined and treated for income tax.Capital gains ppt

Capital gains pptParitosh chaudhary

Ěý

Capital gains tax is levied on profits arising from the transfer of a capital asset. For gains to be taxed under capital gains, there must be a capital asset that is transferred, resulting in profits. Any profits exempted under sections 54-54G are not taxed. Capital assets include all property except certain exceptions like stock-in-trade. Short term capital gains arise from assets held for 36 months or less, while long term gains are for assets held longer. Indexation of cost is used to arrive at capital gains for long term assets by factoring inflation. Profits are taxed differently based on whether the gain is short term or long term.Indirect Tax Basic

Indirect Tax BasicDhananjay Singh

Ěý

This document discusses the concept of indirect taxes. It defines indirect taxes as taxes whose burden can be shifted to others, in part or wholly, through higher prices. Examples given are excise duties, sales tax, service tax, customs duty, and taxes on transportation fares. The objectives of indirect taxes include revenue generation, reducing income inequality, social welfare programs, earning foreign exchange, and regional development. Key features outlined are burden shifting, taxation of commodities/services, and indirect determination of taxpayer ability. Advantages include convenience, disguise of tax effect, difficulty evading, broad tax base, and potential for forced savings. Disadvantages involve regressivity, high collection costs, inflationary effects, and lack of educative valueTAX ASSESSMENT OF ASSOCIATION OF PERSONSB(AOP)/BODY OF IDIVIDUALS (BOI)

TAX ASSESSMENT OF ASSOCIATION OF PERSONSB(AOP)/BODY OF IDIVIDUALS (BOI)Mahi Muthananickal

Ěý

(1) The document discusses the concepts of Association of Persons (AOP) and Body of Individuals (BOI) under the Indian Income Tax Act of 1961.

(2) It provides definitions and differences between AOP and BOI, and describes how to compute tax liability when the shares of members are known (determinate) or unknown (indeterminate).

(3) The maximum marginal tax rate is also explained, which is the highest slab rate used to compute tax on the total income of an AOP or BOI when member shares are unknown.Types of Assessees and Residential Status

Types of Assessees and Residential StatusRajaKrishnan M

Ěý

This document summarizes key concepts related to assessees and residential status under Indian income tax law. It defines an assessee as the person who pays tax to the government and describes the different types of assessees, including ordinary, representative/deemed, and assessee in default. It also outlines the criteria for determining residential status, such as an individual being considered a resident if they are in India for at least 182 days or at least 60 days plus 365 days in the last 4 years. Finally, it provides an example problem of determining residential status for an individual who left India on October 1st and returned on March 10th of the following year.Income from house property ppt

Income from house property pptPADMINIGOVARDHAN

Ěý

The document discusses income from house property under the Indian Income Tax Act. It defines key terms like house property, annual value, basis of charge, and ownership.

Some key points covered are:

- House property means any building owned by the assessee, including residential or commercial properties.

- The basis of charge is the annual value of the property, defined as the expected rental income.

- For a property to be counted as house property, it must consist of a building and land, and the assessee must own it and not use it for their own business.

- Deemed ownership provisions attribute ownership to certain relatives or in cases of transfer without adequate consideration.

- The annual valueIncome under the 5 heads

Income under the 5 headsRishiraj Yadav

Ěý

1) There are 5 heads of income under the Indian Income Tax Act: income from salary, house property, business or profession, capital gains, and other sources.

2) Computation of taxable income involves determining residential status, classifying income, aggregating, applying clubbing provisions, deducting losses, exemptions, and rebates to calculate total tax payable.

3) Income from salary includes wages, pension, gratuity, fees, commissions, perquisites, and advances. Certain allowances like conveyance, education, transport, and house rent are fully or partially exempted.

4) Income from house property is based on annual value, which is the expected rent (municipViewers also liked (10)

Taxing Agriculture

Taxing AgricultureArpit Agarwal

Ěý

The document discusses taxing agricultural income in India. It notes that agriculture provides employment to 60% of the population and contributes 20% to GDP. Currently, agricultural tax is determined by state governments according to the constitution. Taxing more agricultural income could add more taxpayers and revenue to support development. The document proposes defining consumption points, using tax revenues for agriculture infrastructure, and addressing potential pitfalls like tax evasion through joint family systems.why agricultural income could not be taxed in pakistan agricultural income ta...

why agricultural income could not be taxed in pakistan agricultural income ta...Nimra Waseem Chaudhry

Ěý

why agricultural income could not be taxed in pakistan agricultural income taxation , problems of agricultural taxation., agricultural income taxation of pakistan agricultural taxation of pakistanSteve Davies - Taxation in Pakistan’s Agriculture

Steve Davies - Taxation in Pakistan’s AgricultureInternational Food Policy Research Institute - Development Strategy and Governance Division

Ěý

PSSP Third Annual Conference "Agricultural and Natural Resource Issues and Policy Reform"

Islamabad, Pakistan

April 14, 2015Agriculture

Agriculturecj_gregory

Ěý

A brief look at the environmental impacts of agriculture and specifically, banana production in Costa Rica.AGRICULTURE INCOME

AGRICULTURE INCOMERadhey Rathi

Ěý

This presentation is brief description about how the agriculture income is taxable and whether it should be taxed indirectly....??Agriculturalincome

Agriculturalincome akash gupta

Ěý

This document discusses agricultural income as defined in the Indian Income Tax Act of 1961. It defines agricultural income as income derived from agricultural sources in India. It exempts agricultural income from taxation under section 10(1) of the Act. The document outlines the various types of agricultural income, including income from cultivation, agricultural processes, sale of produce, and renting agricultural property. It also discusses the tests to determine what qualifies as agricultural income and provides examples of agricultural and non-agricultural incomes. The document concludes with an explanation of how agricultural income is integrated with non-agricultural income for taxation purposes when thresholds are exceeded.WORLD TRADE ORGANIZATION

WORLD TRADE ORGANIZATIONKaustubh Gupta

Ěý

The document discusses various topics related to the World Trade Organization (WTO). It begins with listing the names and employee codes of some individuals. It then provides several website URLs related to WTO and international trade. It lists some authors and publications on trade.

The summary continues with details about the WTO such as its founding date, location, and details about the Uruguay Round negotiations. It outlines some of the key WTO agreements covering goods, services, intellectual property and investment measures. It discusses the role and structure of the WTO secretariat. Finally, it ends with several case studies related to disputes brought to the WTO.Wto ppt

Wto pptSaurabh Negi

Ěý

This ppt is all about the world trade organization, Its Role, its existence and all its functions, It also includes the structure of WTO.So kindly go through it and comment below how u liked it.Wto presentation

Wto presentationMamta Singh

Ěý

The document provides information about the World Trade Organization (WTO). It notes that the WTO was established on January 1, 1995 and succeeded the General Agreement on Tariffs and Trade (GATT). The WTO aims to supervise and liberalize international trade between its 153 member countries. It has an annual budget of 196 million Swiss francs and 629 staff members. The WTO seeks to promote free trade and resolve trade disputes between countries.Wto ppt

Wto pptrk2its

Ěý

The document presents an overview of the World Trade Organization (WTO). It discusses the objectives, history, structure, principles, agreements, and role of the WTO. The WTO aims to help trade become more smooth, fair, free and predictable through administering trade agreements and resolving disputes between member nations. It also provides special provisions and assistance to developing countries. The WTO's role is to promote open, fair and undistorted global competition through trade liberalization and economic reforms.why agricultural income could not be taxed in pakistan agricultural income ta...

why agricultural income could not be taxed in pakistan agricultural income ta...Nimra Waseem Chaudhry

Ěý

Steve Davies - Taxation in Pakistan’s Agriculture

Steve Davies - Taxation in Pakistan’s AgricultureInternational Food Policy Research Institute - Development Strategy and Governance Division

Ěý

Similar to Agricultural income (9)

Agricultural income

Agricultural incomeTarun Singhal

Ěý

This document defines agricultural income and its tax treatment under Indian law. It provides:

1) The definition of agricultural income under Section 2(1A) of the Income Tax Act, which includes rent or revenue from agricultural land in India, income from agriculture/processing on that land, and income from farm buildings.

2) Examples of income that are considered non-agricultural and taxable, such as income from forests/trees, salt production, quarries, livestock, dairy, poultry, fisheries, brick making and more.

3) Guidelines for calculating tax when an individual/HUF/AOP/BOI/artificial person earns both agricultural and non-agricNMC AGRI.pdf

NMC AGRI.pdfSubratJain15

Ěý

The document defines key terms related to agricultural income under the Income Tax Act of India. It provides that agricultural income is fully exempt from tax and defines it as income derived from agricultural land in India or farm buildings used for agriculture. It also discusses partial integration of agricultural income for tax purposes when certain thresholds are crossed. The summary discusses the treatment of income from agricultural operations, rent from agricultural land, and income mixed between agricultural and non-agricultural activities.Agri income illustrations

Agri income illustrationsDR ANNIE STEPHEN

Ěý

This document categorizes various types of income as either agricultural income or non-agricultural income. Income from the sale of replanted trees, rent from agricultural land, growing flowers/creepers, sharing profits from a partner's agricultural firm, and interest from capital in an agricultural firm are categorized as agricultural income. Income from activities like stone quarries, spontaneous grown trees, dairy/poultry farming, salt production, mines, and butter/cheese making are categorized as non-agricultural income. Lease rent from land given to tenants for agriculture is also considered agricultural income.unit 1- introduction.pptx

unit 1- introduction.pptxssuseraf80bf

Ěý

This document provides an overview of key concepts in Indian income tax law, including:

- The main sources of tax law in India such as the Income Tax Act of 1961.

- Definitions of terms like assessee, person, previous year, gross total income.

- The different types of assessees such as individuals, HUFs, companies, etc.

- What constitutes agricultural income and exclusions from total income calculations.

- The different heads of income and process for calculating total income.

- Examples of income that would fall under different sources like salary, business, capital gains.AGRICULTURE INCOME NOTES.pptx

AGRICULTURE INCOME NOTES.pptxAnupamaSingh541621

Ěý

Agricultural income refers to income earned from farming, agriculture, or horticulture in India according to section 2(1A) of the Income Tax Act of 1961. It includes income from agricultural land, buildings on agricultural land, and commercial production from horticultural land. Some examples of agricultural income are income from sale of replanted trees, seeds, and rent received for agricultural land. Agricultural income is exempt from taxation if the net income is less than Rs. 5,000. It may be considered for tax purposes if the net agricultural income exceeds Rs. 5,000 and total income excluding agricultural income surpasses basic exemption limits.Primary sector farming

Primary sector farmingProfesora GeografĂa e Historia IES

Ěý

This document provides information about farming and the agricultural system. It begins by defining farming as the production of food and other resources through growing plants and raising animals. It then describes the farming system as having inputs, processes, and outputs. Some of the key inputs discussed include physical factors like climate, soil fertility, and relief of the land. Human factors that are inputs include farm buildings, labor, capital, and subsidies/policies. The document also discusses different types of agricultural systems like arable, pastoral, mixed, extensive, intensive, subsistence, and commercial farming. It concludes by explaining the European Union's Common Agricultural Policy and how it provides subsidies and payments to farmers in member countries.AGRICULTURAL INCOME.docx

AGRICULTURAL INCOME.docxRajiv839406

Ěý

Agricultural income derived from land situated in India is exempt from income tax under section 10(1) of the Income Tax Act of 1961. For income to be considered agricultural income, it must be derived from basic agricultural operations on the land like cultivation, planting, harvesting, etc. and subsequent operations related to making the produce fit for market. The income can be in the form of rent received in cash or kind, or revenue from the land. The land must be used for genuine agricultural purposes and situated in India. The burden of proof that income is agricultural income lies with the taxpayer.Income-tax preliminary

Income-tax preliminaryAugustin Bangalore

Ěý

1. The document defines various types of income such as agricultural income and tax-related terms. It discusses the aggregation of agricultural income with non-agricultural income for tax purposes.

2. An example is provided to illustrate the calculation of appropriate tax payable after accounting for agricultural income.

3. The document also discusses what constitutes agricultural operations and income from them, as well as key court rulings related to agricultural land usage and tax treatment of life insurance policies.Agriculture income under it act ,1961

Agriculture income under it act ,1961Arun Banga

Ěý

The document discusses agricultural income under the Indian Income Tax Act of 1961. It defines agricultural income as income derived from agricultural sources and notes that it is fully exempted under section 10(1) of the Income Tax Act. The summary lists the key types of agricultural income as including rent or revenue from agricultural land, cultivation of land, income from processes to make agricultural produce marketable, and income from the sale of agricultural produce. It also provides tests for determining what constitutes agricultural income and discusses when integration of agricultural and non-agricultural income is required for tax calculation purposes.Recently uploaded (20)

How to use Init Hooks in Odoo 18 - Odoo şÝşÝߣs

How to use Init Hooks in Odoo 18 - Odoo şÝşÝߣsCeline George

Ěý

In this slide, we’ll discuss on how to use Init Hooks in Odoo 18. In Odoo, Init Hooks are essential functions specified as strings in the __init__ file of a module.Blind Spots in AI and Formulation Science Knowledge Pyramid (Updated Perspect...

Blind Spots in AI and Formulation Science Knowledge Pyramid (Updated Perspect...Ajaz Hussain

Ěý

This presentation delves into the systemic blind spots within pharmaceutical science and regulatory systems, emphasizing the significance of "inactive ingredients" and their influence on therapeutic equivalence. These blind spots, indicative of normalized systemic failures, go beyond mere chance occurrences and are ingrained deeply enough to compromise decision-making processes and erode trust.

Historical instances like the 1938 FD&C Act and the Generic Drug Scandals underscore how crisis-triggered reforms often fail to address the fundamental issues, perpetuating inefficiencies and hazards.

The narrative advocates a shift from reactive crisis management to proactive, adaptable systems prioritizing continuous enhancement. Key hurdles involve challenging outdated assumptions regarding bioavailability, inadequately funded research ventures, and the impact of vague language in regulatory frameworks.

The rise of large language models (LLMs) presents promising solutions, albeit with accompanying risks necessitating thorough validation and seamless integration.

Tackling these blind spots demands a holistic approach, embracing adaptive learning and a steadfast commitment to self-improvement. By nurturing curiosity, refining regulatory terminology, and judiciously harnessing new technologies, the pharmaceutical sector can progress towards better public health service delivery and ensure the safety, efficacy, and real-world impact of drug products.Kaun TALHA quiz Prelims - El Dorado 2025

Kaun TALHA quiz Prelims - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ěý

Prelims of Kaun TALHA : a Travel, Architecture, Lifestyle, Heritage and Activism quiz, organized by Conquiztadors, the Quiz society of Sri Venkateswara College under their annual quizzing fest El Dorado 2025. How to Modify Existing Web Pages in Odoo 18

How to Modify Existing Web Pages in Odoo 18Celine George

Ěý

In this slide, we’ll discuss on how to modify existing web pages in Odoo 18. Web pages in Odoo 18 can also gather user data through user-friendly forms, encourage interaction through engaging features. Research & Research Methods: Basic Concepts and Types.pptx

Research & Research Methods: Basic Concepts and Types.pptxDr. Sarita Anand

Ěý

This ppt has been made for the students pursuing PG in social science and humanities like M.Ed., M.A. (Education), Ph.D. Scholars. It will be also beneficial for the teachers and other faculty members interested in research and teaching research concepts.How to attach file using upload button Odoo 18

How to attach file using upload button Odoo 18Celine George

Ěý

In this slide, we’ll discuss on how to attach file using upload button Odoo 18. Odoo features a dedicated model, 'ir.attachments,' designed for storing attachments submitted by end users. We can see the process of utilizing the 'ir.attachments' model to enable file uploads through web forms in this slide.Kaun TALHA quiz Finals -- El Dorado 2025

Kaun TALHA quiz Finals -- El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ěý

Finals of Kaun TALHA : a Travel, Architecture, Lifestyle, Heritage and Activism quiz, organized by Conquiztadors, the Quiz society of Sri Venkateswara College under their annual quizzing fest El Dorado 2025. Rass MELAI : an Internet MELA Quiz Finals - El Dorado 2025

Rass MELAI : an Internet MELA Quiz Finals - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ěý

Finals of Rass MELAI : a Music, Entertainment, Literature, Arts and Internet Culture Quiz organized by Conquiztadors, the Quiz society of Sri Venkateswara College under their annual quizzing fest El Dorado 2025. How to Configure Flexible Working Schedule in Odoo 18 Employee

How to Configure Flexible Working Schedule in Odoo 18 EmployeeCeline George

Ěý

In this slide, we’ll discuss on how to configure flexible working schedule in Odoo 18 Employee module. In Odoo 18, the Employee module offers powerful tools to configure and manage flexible working schedules tailored to your organization's needs.Reordering Rules in Odoo 17 Inventory - Odoo şÝşÝߣs

Reordering Rules in Odoo 17 Inventory - Odoo şÝşÝߣsCeline George

Ěý

In Odoo 17, the Inventory module allows us to set up reordering rules to ensure that our stock levels are maintained, preventing stockouts. Let's explore how this feature works.FESTIVAL: SINULOG & THINGYAN-LESSON 4.pptx

FESTIVAL: SINULOG & THINGYAN-LESSON 4.pptxDanmarieMuli1

Ěý

Sinulog Festival of Cebu City, and Thingyan Festival of Myanmar.QuickBooks Desktop to QuickBooks Online How to Make the Move

QuickBooks Desktop to QuickBooks Online How to Make the MoveTechSoup

Ěý

If you use QuickBooks Desktop and are stressing about moving to QuickBooks Online, in this webinar, get your questions answered and learn tips and tricks to make the process easier for you.

Key Questions:

* When is the best time to make the shift to QuickBooks Online?

* Will my current version of QuickBooks Desktop stop working?

* I have a really old version of QuickBooks. What should I do?

* I run my payroll in QuickBooks Desktop now. How is that affected?

*Does it bring over all my historical data? Are there things that don't come over?

* What are the main differences between QuickBooks Desktop and QuickBooks Online?

* And moreN.C. DPI's 2023 Language Diversity Briefing

N.C. DPI's 2023 Language Diversity BriefingMebane Rash

Ěý

The number of languages spoken in NC public schools.TLE 7 - 3rd Topic - Hand Tools, Power Tools, Instruments, and Equipment Used ...

TLE 7 - 3rd Topic - Hand Tools, Power Tools, Instruments, and Equipment Used ...RizaBedayo

Ěý

Hand Tools, Power Tools, and Equipment in Industrial ArtsHow to Setup WhatsApp in Odoo 17 - Odoo şÝşÝߣs

How to Setup WhatsApp in Odoo 17 - Odoo şÝşÝߣsCeline George

Ěý

Integrate WhatsApp into Odoo using the WhatsApp Business API or third-party modules to enhance communication. This integration enables automated messaging and customer interaction management within Odoo 17.Useful environment methods in Odoo 18 - Odoo şÝşÝߣs

Useful environment methods in Odoo 18 - Odoo şÝşÝߣsCeline George

Ěý

In this slide we’ll discuss on the useful environment methods in Odoo 18. In Odoo 18, environment methods play a crucial role in simplifying model interactions and enhancing data processing within the ORM framework.EDL 290F Week 3 - Mountaintop Views (2025).pdf

EDL 290F Week 3 - Mountaintop Views (2025).pdfLiz Walsh-Trevino

Ěý

EDL 290F Week 3 - Mountaintop Views (2025).pdfKaun TALHA quiz Prelims - El Dorado 2025

Kaun TALHA quiz Prelims - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ěý

Kaun TALHA quiz Finals -- El Dorado 2025

Kaun TALHA quiz Finals -- El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ěý

Rass MELAI : an Internet MELA Quiz Finals - El Dorado 2025

Rass MELAI : an Internet MELA Quiz Finals - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

Ěý

Agricultural income

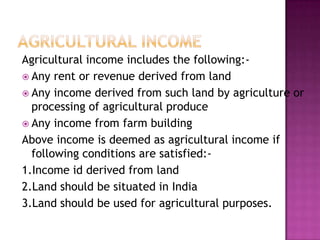

- 2. Agricultural IncomeAgricultural income includes the following:-Any rent or revenue derived from landAny income derived from such land by agriculture or processing of agricultural produceAny income from farm buildingAbove income is deemed as agricultural income if following conditions are satisfied:-1.Income id derived from land2.Land should be situated in India3.Land should be used for agricultural purposes.

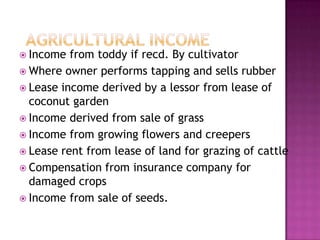

- 3. Agricultural IncomeIncome from toddy if recd. By cultivatorWhere owner performs tapping and sells rubberLease income derived by a lessor from lease of coconut gardenIncome derived from sale of grassIncome from growing flowers and creepersLease rent from lease of land for grazing of cattleCompensation from insurance company for damaged cropsIncome from sale of seeds.

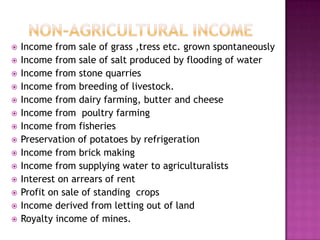

- 4. Non-Agricultural IncomeIncome from sale of grass ,tress etc. grown spontaneouslyIncome from sale of salt produced by flooding of waterIncome from stone quarriesIncome from breeding of livestock.Income from dairy farming, butter and cheeseIncome from poultry farmingIncome from fisheriesPreservation of potatoes by refrigerationIncome from brick makingIncome from supplying water to agriculturalistsInterest on arrears of rentProfit on sale of standing cropsIncome derived from letting out of landRoyalty income of mines.

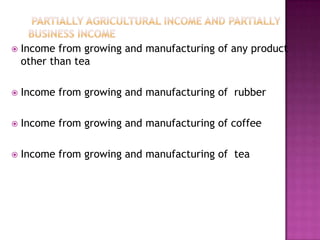

- 5. Partially Agricultural Income and Partially Business IncomeIncome from growing and manufacturing of any product other than teaIncome from growing and manufacturing of rubberIncome from growing and manufacturing of coffeeIncome from growing and manufacturing of tea

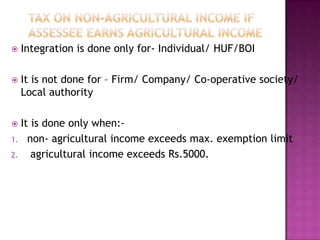

- 6. Tax on Non-Agricultural Income if assessee earns agricultural incomeIntegration is done only for- Individual/ HUF/BOIIt is not done for – Firm/ Company/ Co-operative society/ Local authorityIt is done only when:-non- agricultural income exceeds max. exemption limit agricultural income exceeds Rs.5000.

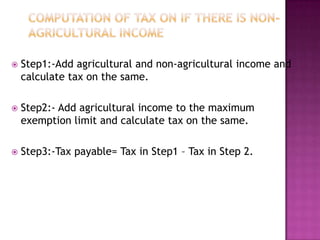

- 7. Computation of Tax on if there is Non-Agricultural IncomeStep1:-Add agricultural and non-agricultural income and calculate tax on the same.Step2:- Add agricultural income to the maximum exemption limit and calculate tax on the same.Step3:-Tax payable= Tax in Step1 – Tax in Step 2.