Erp budget (1)

- 2. Budget âĒ Explain useful of Budget âĒ Show set up steps for - How to create Budget - How to create Budget Organization - How to enter Budget Amounts - How to review and correct Budget Amounts - How to change status of Budgets

- 3. Budget ? âĒ Budget āļāļ·āļ â āļāļēāļĢāļāļĢāļ°āļĄāļēāļāļāļēāļĢāđāļāđāļĢāļ·āļāļāļĢāļēāļĒāđāļāđ āļāđāļēāđāļāđāļāđāļēāļĒ āđāļāļ·āđāļ āđ āđāļāđāļāđāļāđāļēāļŦāļĄāļēāļĒāđāļāļāļēāļĢāļāļģāļēāđāļāļīāļāļāļļāļĢāļāļīāļ āļ§āđāļēāļāļĩāļāļąāļāđāļāļāļ°āļĄāļĩ āļāļģāļēāđāļĢāđāļāļĩāļĒāļāļāļāđāļāļāļēāļĢāļāļģāļēāđāļāļīāļāļāļļāļĢāļāļīāļāļŦāļĢāļ·āļāđāļĄāđ â āļŠāļēāļĄāļēāļĢāļāļ§āļēāļāđāļāļāļāļēāļĢāļāļģāļēāļāļēāļ āļ§āđāļēāļĢāļēāļĒāđāļāđāļāļĩāļŦāļāđāļēāļāļ§āļĢ āđāļāđāļāđāļāđāļēāđāļĢ āđāļĨāļ°āļāđāļāļāļāļļāļĄāļāđāļēāđāļāđāļāđāļēāļĒāļāļĒāđāļēāļāđāļĢ â āđāļāļ·āđāļāđāļāđāđāļāļāļēāļĢāļ§āļąāļāļāļĨāļāļēāļĢāļāļģāļēāļāļēāļāļ§āđāļēāđāļāđāļāđāļāļāļēāļĄ āđāļāđāļēāļāļĩāļāļąāđāļāđāļ§āđāļŦāļĢāļ·āļāđāļĄāđ āđ âĒ āļāļķāđāļāļāđāļāļāļāļģāļēāđāļ Module GL āđāļāļĢāļēāļ° GL āđāļāđāļ āļāđāļē Actual āļāļĒāļđāđāđāļĨāđāļ§āļāļķāļāļĢāļ§āļĄ Budget āđāļ§āđāļāđāļ§āļĒ āđāļāļ·āļāļāđāļēāļĒāđāļāļāļēāļĢāļāļāļāļĢāļēāļĒāļāļēāļāđāļāļĢāļĩāļĒāļāđāļāļĩāļĒāļ āđ āļŦāļēāļāđāļē Variance (FSG)

- 4. Explain useful of Budget (1/3) âĒ āļāļēāļĢāļāļģāļē Budgets āļŠāļēāļĄāļēāļĢāļāļāđāļ§āļĒāđāļŦāđāļāļĢāļēāļāļāļķāļāļāļēāļĢāļāļĢāļ°āļĄāļēāļāļāļēāļĢāļĢāļēāļĒāđāļāđāđāļĨāļ°āļāđāļēāđāļāđ āļāđāļēāļĒāļāļąāđāļāļŦāļĄāļāļāļĩāđāđāļāļīāļāļāļķāļāļāļēāļāļāļēāļĢāļāļģāļēāđāļāļīāļāļāļēāļāļāļāļāļāļĢāļīāļĐāļąāļ āđāļāļĒāļŠāļēāļĄāļēāļĢāļāļāļđāđāļāđāļāļēāļĄ āđ period time āļāļāļāđāļāđāļĨāļ°āđāļāļāļāđāļāļāļĢāļīāļĐāļąāļ âĒ āļāđāļ§āļĒāđāļŦāđāļāļđāđāļāļĢāļīāļŦāļēāļĢāđāļāđāļāļĢāļ°āļŦāļāļąāļāļāļķāļāļāļēāļĢāļāļģāļēāđāļāļīāļāļāļēāļāļāđāļāđāļāļ·āđāļāļāđāļāļ§āļąāļāļāđāļēāļāļŦāļāđāļē āđāļĨāļ° āļŠāļēāļĄāļēāļĢāļāļāļĢāļ°āđāļĄāļīāļāļāļĢāļ°āļŠāļīāļāļāļīāļ āļēāļāļāļāļāđāļāļāļāļĨāļĒāļļāļāļāđāđāļĨāļ°āđāļāļāļāļāļīāļāļąāļāļīāļāļēāļĢāļāļĩāđāļ§āļēāļāđāļ§āđ āđāļāļĒāļāļđāđāļāđāļāļēāļāđāļāļāļāļāļāļĢāļ°āļĄāļēāļāļāļĩāđāđāļāđāļāļąāļāļāļģāļēāļāļķāļāđāļāļ·āļāļ§āļēāļāđāļāļāđāļĨāļ°āļāļĒāļēāļāļĢāļāđāļāļāļĄāļđāļĨ āđ āđ āđ āļāļēāļāļāļēāļĢāđāļāļīāļāļāļāļāļāļĢāļīāļĐāļāļĨāđāļ§āļāļŦāļāđāļē āļą

- 5. Explain useful of Budget (2/3) âĒ āļāļēāļĢāđāļāļĢāļĩāļĒāļāđāļāļĩāļĒāļ budget āļāļąāļāļāļĨāļāļĢāļ°āļāļāļāļāļēāļĢāļāļĩāđāđāļāļīāļāļāļķāđāļāļāļĢāļīāļ āļāļ°āđāļāđāļāļāļąāļ§āļ§āļąāļāļāļĨāļāļēāļĢ āļāļģāļēāđāļāļīāļāļāļēāļĢāļāļāļāļāļļāļĢāļāļīāļāļ§āđāļē āļāļĢāļ°āļŠāļāļāļ§āļēāļĄāļŠāļģāļēāđāļĢāđāļāļāļēāļĄāđāļāđāļēāļŦāļĄāļēāļĒāļāļĩāđāļ§āļēāļāđāļ§āđāļŦāļĢāļ·āļāđāļĄāđ âĒ āļāđāļ§āļĒāđāļāļāļēāļĢāļāļ§āļāļāļļāļĄāļāļēāļĢāļāļģāļēāđāļāļīāļāļāļēāļ āļāļĨāļāļēāļĢāļāļģāļēāđāļāļīāļāļāļēāļāļāļĩāđāđāļāļīāļāļāļķāļāļāļĢāļīāļāļāļ°āļāļģāļēāļĄāļē āđ āđāļāļĢāļĩāļĒāļāđāļāļĩāļĒāļāļāļąāļāđāļāļāļāļāļāļĢāļ°āļĄāļēāļāļāļĩāđāļ§āļēāļāđāļ§āđ āļāļģāļēāđāļŦāđāļāļĢāļēāļāļ§āđāļēāļāļĢāļ°āļŠāļāļāļĨāļŠāļģāļēāđāļĢāđāļ āļĄāļēāļāļāđāļāļĒāđāļāļĩāļĒāļāđāļ āļāļĢāļĢāļĨāļļāđāļāđāļēāļŦāļĄāļēāļĒāļāļāļāļāļīāļāļāļēāļĢāļŦāļĢāļ·āļāđāļĄāđ āļŦāļēāļāđāļĄāđāđāļāđāļāđāļāļāļēāļĄāđāļāđāļē āļŦāļĄāļēāļĒāđāļāļīāļāļāļēāļāđāļāļāļāđāļāļāđāļŠāļēāļĄāļēāļĢāļāđāļāđāđāļāđāļāđāļāļĒāđāļēāļāļāļđāļāļāđāļāļ

- 6. Explain useful of Budget (3/3) âĒ āļāļģāļēāđāļŦāđāđāļāļīāļāđāļĢāļāļāļĢāļ°āļāļļāđāļāđāļāļāļēāļĢāļāļģāļēāļāļēāļ āļĄāļĩāļāļēāļĢāđāļāļĢāļĩāļĒāļāđāļāļĩāļĒāļāļĢāļ°āļŦāļ§āđāļēāļāļāļĨāļāļēāļĢāļāļāļīāļāļąāļāļī āļāļēāļāļāļąāļāđāļāļāļāļēāļāļāļĩāđāļ§āļēāļāđāļ§āđ āļāļģāļēāđāļŦāđāļāļēāļĢāļāļĢāļ°āđāļĄāļīāļāļāļĨāđāļāđāļāđāļāļāļĒāđāļēāļāļāļąāđāļ§āļāļķāļāļāļļāļāļāđāļēāļĒ āļāļģāļēāđāļŦāđāđāļāļīāļāļāļēāļĢāļāļĢāļ°āļāļļāđāļāđāļŦāđāļāļāļĨāļēāļāļĢāļĄāļĩāļāļēāļĢāđāļāđāļāļāļąāļāļāļēāļĢāļāļāļīāļāļąāļāļīāļāļēāļāđāļŦāđāđāļāđāļāđāļāļāļēāļĄāđāļāđāļē āļļ āļŦāļĄāļēāļĒ āđāļāļ·āļāļāļ°āđāļāđāļĢāļąāļāļāļĨāļāļāļāđāļāļāļāļēāļāļāļēāļĢāļāļĢāļ°āđāļĄāļīāļāļāļĨāļāļēāļĢāļāļāļīāļāļąāļāļīāļāļēāļāđāļŦāđāļāļĒāļđāđāđāļ āđ āđāļāļāļāđāļāļĩāđāļāļĩāļāļĨāļāļāđāļ§āļĨāļē âĒ āļāđāļ§āļĒāđāļāļāļēāļĢāđāļāđāļāļŠāļĢāļĢāļāļāļāļĢāļ°āļĄāļēāļ (Allocating Budget) āđāļāļ·āđāļāļāļāļēāļāļāļēāļāļāļĢāļīāļĐāļąāļāļĄāļĩ āļāļāļāļĢāļ°āļĄāļēāļāļāļģāļēāļāļąāļāđāļĨāļ°āļāļ°āļāđāļāļāļāļđāļāļāļģāļēāđāļāđāļāđāđāļŦāđāđāļāļīāļāļāļĢāļ°āđāļĒāļāļāđāļŠāļđāļāļŠāļļāļ āļāļĢāļ°āļāļ§āļāļāļēāļĢ āļāļąāļāļāļģāļēāļāļāļāļĢāļ°āļĄāļēāļāļāļķāļāļāđāļ§āļĒāđāļŦāđāđāļāđāļĨāļ°āļāđāļēāļĒāđāļāđāļĢāļąāļāļāļēāļĢāļāļąāļāļŠāļĢāļĢāļāļāļāļĢāļ°āļĄāļēāļāļāļĒāđāļēāļ āđāļŦāļĄāļēāļ°āļŠāļĄ

- 7. Budget Component âĒ Budget āļāļĢāļ°āļāļāļāļāđāļ§āļĒ 3 Component âĒ Period āļāļ·āļ āļĢāļ°āļĒāļ°āđāļ§āļĨāļēāļāļĩāđāļāļģāļēāļŦāļāļāļ§āđāļē budget āļĄāļĩāļāļĨāļāļĢāļāļāļāļĨāļļāļĄ āļĢāļ°āļĒāļ°āđāļ§āļĨāļēāļāļąāđāļāđāļāđ āđāļĄāļ·āđāļāđāļŦāļĢāđāļāļķāļāđāļĄāļ·āđāļāđāļŦāļĢāđ âĒ Account āļāļ·āļ Account āļāļĩāđāđāļĢāļēāļāđāļāļāļāļēāļĢāļāļąāđāļāļāļāļāļĢāļ°āļĄāļēāļ āđāļāđāļ āļŠāļīāļāļāļĢāļąāļāļĒāđ āļĢāļēāļĒāđāļāđ āļāđāļēāđāļāđāļāđāļēāļĒ âĒ Amount āļāļ·āļ āļāļģāļēāļāļ§āļāđāļāļīāļāļāļĩāđāļāļąāđāļāļāļāļāļĢāļ°āļĄāļēāļāļāļēāļĢāđāļŦāđ Account āļāļąāđāļ āđ

- 8. Budgeting Accounting Cycle Step 1 âĒDefine budgets and budget organization Step 5 Step 2 âĒ Report on âĒ Enter budget budgets amount Step 4 Step 3 âĒ Freeze âĒ Review and budgets correct budgets

- 9. How to create Budget Define Budget âĒ āđāļŠāđāļāļ·āđāļāđāļĨāļ° Description - Budget āļāļ§āļĢāđāļŠāđāļāļ·āđāļāļāļĩāļĢāļ°āļāļļāđāļ§āđāļāđāļ§āļĒāđāļāļ·āļāļāđāļēāļĒāđāļāļāļēāļĢ āđ āļāđāļāļŦāļēāđāļāđāđāļ āļĢāļ°āļāļļ Status âĒ Open āļāļĢāđāļāļĄāđāļāđāļāļēāļ āļŠāļēāļĄāļēāļĢāļāļāļĢāļāļāļāļąāļ§āđāļĨāļāđāļāđ âĒ Current āļāļĢāđāļāļĄāđāļāđāļāļēāļ āđāļĨāļ° āđāļāđāļ Default āļāļāļāļĢāļ°āļāļ āļāļ·āļ āļāļ°āļāļģāļēāļāļēāļĢāļāļĢāļāļ Budget āļāļąāđāļāļāļ°āđāļŠāļāļāļāļķāļāļĄāļē āđāļāļĒ Budget āļĄāļĩāđāļāđāļŦāļĨāļēāļĒ status āđāļāđ Status āđ Current āļāļ°āļĄāļĩāđāļāđāļāļąāļāđāļāļĩāļĒāļ§āđāļāļĢāļēāļ°āđāļāđāļ Default âĒ Frozen āđāļĄāđāđāļŦāđāđāļāđāđāļāđāļāļĢāļ°āļāļąāļ Budget

- 10. How to create Budget âĒ āļāļļāđāļĄ Require Budget Journal (JE = Journal Entry) āļāđāļē Enable āļāļ°āđāļāļĨāļ§āđāļē āļāļēāļĢāļāļĢāļāļāļāđāļē Budget āļāļąāđāļāļāļ°āđāļāđāļĄāļēāļāļēāļāļāļēāļĢ Create Journal āđāļāđāļēāļāļąāđāļ âĒ āļĢāļ°āļāļļ Period āļ§āđāļēāđāļŦāđāđāļāđāļāđāļāļāļāļąāđāļāđāļāđāđāļŦāļāļāļķāļāđāļŦāļ āļāļķāđāļāļĄāļĩāļŠāļđāļāļŠāļļāļāđāļāđ 60 Period (5āļāļĩ) âĒ āļāļĨāļīāļāļāļļāđāļĄ Open Next Year āđāļāļ·āļāđāļāļīāļāđāļāđāļāļēāļ āđ

- 11. How to create Budget Budgets Define Budget

- 12. How to create Budget

- 13. How to create Budget âĒ (M) View > Requests to ensure the concurrent process completes successfully.

- 14. How to create Budget âĒ Budget Using FSG Reports āđāļĄāļ·āđāļāļĄāļĩāļāļāļĄāļđāļĨāļāļĒāļđāđāđāļĨāđāļ§āđāļĢāļēāļŠāļēāļĄāļēāļĢāļāļāļģāļēāļĄāļēāļāļāļāļĢāļēāļĒāļāļēāļāđāļāđ āđāļāļĒ GL āļāļ°āđāļāđ Tools āđ FSG āđāļāļāļēāļĢāļāļāļāļĢāļēāļĒāļāļēāļ âĒ Multiple Versions of Budget āđāļāļĒāđāļĢāļēāļŠāļēāļĄāļēāļĢāļāļĄāļĩ Budget āđāļāļ·āđāļāļāļĢāļ°āļĄāļēāļāļāļēāļĢāđāļāđāļŦāļĨāļēāļĒāđāđāļ§āļāļĢāđāļāļąāļ āđāļāđāļ āļāđāļē āđāļĻāļĢāļĐāļāļāļīāļāļāļĩāļāļķāļāđāļāļ A āļĄāļēāđāļāđ āļŦāļĢāļ·āļāļāđāļēāđāļĻāļĢāļĐāļāļāļīāļāđāļĄāđāļāļĩāļāļķāļāđāļāļ B āļĄāļēāđāļāđ āđāļāļĒāđāļĄāđ āļŠāļēāļĄāļēāļĢāļāļĨāļ Budget āļāļĩāđāļŠāļĢāđāļēāļāđāļ§āđāđāļāđ (āļāļēāļāļāļģāļēāļāļēāļĢ Freeze āđāļāļāđāļāđ)

- 15. How to create Budget Organization âĒ āļāļāļāļāļķāļāđāļĢāļ·āđāļāļ Account āļ§āđāļēāļāļ°āļāļ§āļāļāļļāļĄ Budget āļāđāļ§āļĒāļāļ°āđāļĢ āđāļāđāļ Cost center āļāļ·āļ cost center A āđāļŦāđāļāļāļāļĢāļ°āļĄāļēāļāļāļķāļāđāļĨāļ° Cost center B āđāļŦāđāļāļĩāļāļāļāļāļĢāļ°āļĄāļēāļāļāļķāļ

- 16. How to create Budget Organization

- 17. Features of Budget Organization

- 19. How to create Budget Organization

- 20. How to create Budget Organization Account Range

- 21. How to create Budget Amounts Budget Entry Method Journal Entry Created? Budget Amounts No Budget Journals ï Yes Budget Formulas No MassBudget Journals ï Yes Transferred Budget Amounts ï Yes Budget Wizard No Journal Wizard ïï Yes Upload Budgets No

- 22. How to enter Budget Amounts

- 23. How to enter Budget Amounts

- 24. How to enter Budget Amounts

- 25. How to enter Budget Amounts

- 26. How to enter Budget Amounts

- 27. How to enter Budget Amounts âĒ Budget Rule āļāļąāļ§āļāđāļ§āļĒāđāļāļāļēāļĢāļŦāļĒāļāļāļāđāļē Amount āļāļ°āļĄāļĩāđāļŦāđāđāļĨāļ·āļāļāļŦāļĨāļēāļĒāļ§āļīāļāļĩ āļāļąāļāļāļĩāđ

- 28. How to enter Budget Amounts

- 29. How to enter Budget Amounts

- 30. How to enter Budget Amounts

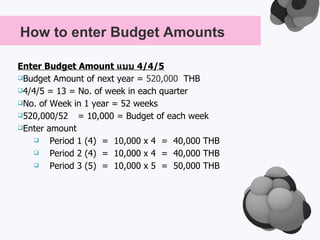

- 31. How to enter Budget Amounts Enter Budget Amount āđāļāļ 4/4/5 ïąBudget Amount of next year = 520,000 THB ïą4/4/5 = 13 = No. of week in each quarter ïąNo. of Week in 1 year = 52 weeks ïą520,000/52 = 10,000 = Budget of each week ïąEnter amount ïą Period 1 (4) = 10,000 x 4 = 40,000 THB ïą Period 2 (4) = 10,000 x 4 = 40,000 THB ïą Period 3 (5) = 10,000 x 5 = 50,000 THB

- 32. How to review and correct Budget Amounts āļ§āļīāļāļĩāļāļēāļĢāļāļđāļāđāļēāļāļĩāđ Generate ïąBudget Amount āļāļđāļāļĩāđ Budgets>Enter>Amount āđāļĨāđāļ§āļāđāļŠāļēāļĄāļēāļĢāļāđāļĨāļ·āļāļāļāļđāđāļāđāđāļĨāļĒ āđāļāđāļāđāļēāđāļāđāļāļāļēāļĢ ïąCalculate āļāļ°āļāđāļāļāļāļģāļēāļāļēāļĢāđāļāđāļēāđāļāļāļĩāđ Inquiry > Account āļāļēāļāļāļąāđāļāđāļĨāļ·āļāļāļāļĢāļ Primary Balance Type āđāļāđāļ Budget āđāļĨāđāļ§āļāđāļāļāļĢāļ°āļāļļāļāđāļ§āļĒāļ§āđāļē Budget āđāļŦāļāđāļāļĢāļēāļ°āđāļĢāļē āļĄāļĩāđāļāđāļŦāļĨāļēāļĒ Budget āđāļĨāļ°āļāļģāļēāļāļēāļĢāļāļģāļēāļŦāļāļ Account āļāđāļ§āļĒ

- 33. How to review and correct Budget Amounts

- 34. How to review and correct Budget Amounts

- 35. How to review and correct Budget Amounts

- 36. How to review and correct Budget Amounts Transfer Budget âĒ Transfer budget amounts between accounts: âĒ In different budget organizations âĒ Within the same budget organization Transfer by: âĒ Budget Amounts âĒ Percentages

- 37. How to review and correct Budget Amounts Transfer Budget 01 200 5800 01 400 5800 Journal Import Post Journal

- 38. How to review and correct Budget Amounts Transfer Budget 01 200 5800 $500 01 400 5800 Before: 01.200.5800 $1500 01.400.5800 $700 After: 01.200.5800 $1000 01.400.5800 $1200

- 39. How to review and correct Budget Amounts Transfer Budget 01 200 5800 10% 01 400 5800 Before: 01.200.5800 $1500 01.400.5800 $700 After: 01.200.5800 $1350 01.400.5800 $850

- 40. How to review and correct Budget Amounts Transfer Budget

- 41. How to review and correct Budget Amounts Transfer Budget

- 42. How to change status of Budgets Use the Freeze Budget window To Freeze a budget âĒ Budget organization âĒ Budget formula batch âĒ Range of budget of account

- 43. How to change status of Budgets ï― āļ§āļīāļāļĩāļāļēāļĢ Freeze Budget 1. (N)Budget > Define > Budget āđāļāļĨāļĩāđāļĒāļ Status āđāļŦāđāđāļāđāļ Frozen

- 44. How to change status of Budgets âĒ 2. (N)Budget > Freeze User āļŠāļēāļĄāļēāļĢāļāđāļāđāļēāđāļ Freeze āđāļāļĢāļ°āļāļąāļ Formula āđāļĨāļ° Budget Org. āđāļāļĒāļāļēāļĢ āļāļīāđāļāļāļđāļāļāļĩāđ Frozen

- 45. Summary

- 46. QUESTION?