Transformation in Progress: A Report from the Trenches - Roger Chiocchi

- 1. ╠²

- 2. Highlights: Online Survey of 150 Boomers How did we get into this mess? 9 Individual Boomer Profiles The End of the World as We Know It?

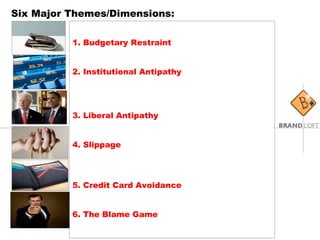

- 3. Six Major Themes/Dimensions: 1. Budgetary Restraint 2. Institutional Antipathy 3. Liberal Antipathy 4. Slippage 5. Credit Card Avoidance 6. The Blame Game

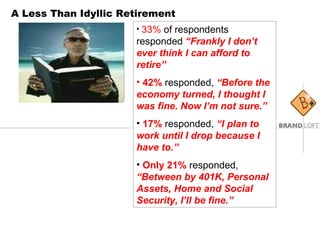

- 4. A Less Than Idyllic Retirement 33% of respondents responded ŌĆ£Frankly I donŌĆÖt ever think I can afford to retireŌĆØ 42% responded, ŌĆ£Before the economy turned, I thought I was fine. Now IŌĆÖm not sure.ŌĆØ 17% responded, ŌĆ£I plan to work until I drop because I have to.ŌĆØ Only 21% responded, ŌĆ£Between by 401K, Personal Assets, Home and Social Security, IŌĆÖll be fine.ŌĆØ

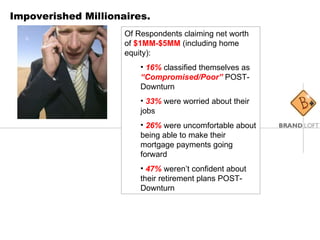

- 5. Impoverished Millionaires. Of Respondents claiming net worth of $1MM-$5MM (including home equity): 16% classified themselves as ŌĆ£Compromised/PoorŌĆØ POST-Downturn 33% were worried about their jobs 26% were uncomfortable about being able to make their mortgage payments going forward 47% werenŌĆÖt confident about their retirement plans POST-Downturn

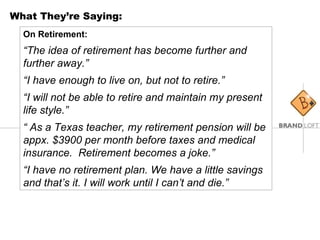

- 6. What TheyŌĆÖre Saying: On Retirement: ŌĆ£ The idea of retirement has become further and further away.ŌĆØ ŌĆ£ I have enough to live on, but not to retire.ŌĆØ ŌĆ£ I will not be able to retire and maintain my present life style.ŌĆØ ŌĆ£ As a Texas teacher, my retirement pension will be appx. $3900 per month before taxes and medical insurance. Retirement becomes a joke.ŌĆØ ŌĆ£ I have no retirement plan. We have a little savings and thatŌĆÖs it. I will work until I canŌĆÖt and die.ŌĆØ

- 7. The Socio-Tectonomic Shift 76% of respondents classified themselves as ŌĆ£Comfortable, Affluent or RichŌĆØ PRE-Downturn . Only 42% classified themselves as ŌĆ£Comfortable/Affluent/RichŌĆØ POST-Downturn . Only 7% classified themselves as ŌĆ£ Compromised/PoorŌĆØ PRE-Downturn. 32% classified themselves as ŌĆ£Compromised/PoorŌĆØ POST- Downturn.

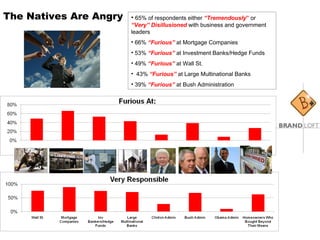

- 8. The Natives Are Angry 65% of respondents either ŌĆ£Tremendously ŌĆØ or ŌĆ£VeryŌĆØ Disillusioned with business and government leaders 66% ŌĆ£FuriousŌĆØ at Mortgage Companies 53% ŌĆ£FuriousŌĆØ at Investment Banks/Hedge Funds 49% ŌĆ£FuriousŌĆØ at Wall St. 43% ŌĆ£FuriousŌĆØ at Large Multinational Banks 39% ŌĆ£FuriousŌĆØ at Bush Administration

- 9. What TheyŌĆÖre Saying: On Blame: ŌĆ£ Really mad at Wall St., big banks, investment firms and mortgage companies. They were all very responsible.ŌĆØ ŌĆ£ Treating homes as casino chips was a poor idea, and packaging loans into traded derivatives was destructive.ŌĆØ ŌĆ£ Small banks that stuck to the tried and true are fine today.ŌĆØ ŌĆ£ IŌĆÖve been fiscally responsible and now IŌĆÖm supporting the slackers.ŌĆØ ŌĆ£ I witnessed the rampant greed and puffery led to the current credit/mortgage situationŌĆ”.there were few controls and zero accountability.ŌĆØ ŌĆ£ Most people in government and executive positions are immoral ŌĆō until that changes our country will go downhill. ŌĆśThe Fall of Rome.ŌĆÖŌĆØ

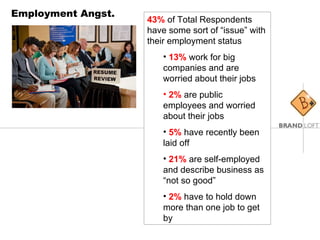

- 10. Employment Angst. 43% of Total Respondents have some sort of ŌĆ£issueŌĆØ with their employment status 13% work for big companies and are worried about their jobs 2% are public employees and worried about their jobs 5% have recently been laid off 21% are self-employed and describe business as ŌĆ£not so goodŌĆØ 2% have to hold down more than one job to get by

- 11. Consumption Consequences: Recent Consumption Changes Three types of spending patterns emerge as a result of the Downturn: Luxury Items: Consumers plan to either ŌĆ£eliminate completely/significantly cutbackŌĆØ on Vacations (46%), Wardrobe (41%), Restaurant Meals (41%) and Leisure Activities (32%) ŌĆ£ Cheap ThrillsŌĆØ: Consumers plan to either ŌĆ£increaseŌĆØ or make ŌĆ£no changeŌĆØ to DVD/Premium Cable (63%), Movies(51%) and HBA (47%) ŌĆ£ EssentialsŌĆØ : Consumers plan to either ŌĆ£increaseŌĆØ or make ŌĆ£no changeŌĆØ to purchases of Med/Pharma (80%), Groceries (48%), Alcohol/Tobacco (56%).

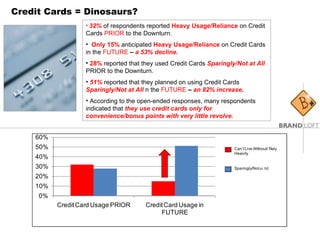

- 12. Credit Cards = Dinosaurs? 32% of respondents reported Heavy Usage/Reliance on Credit Cards PRIOR to the Downturn. Only 15% anticipated Heavy Usage/Reliance on Credit Cards in the FUTURE ŌĆō a 53% decline. 28% reported that they used Credit Cards Sparingly/Not at All PRIOR to the Downturn. 51% reported that they planned on using Credit Cards Sparingly/Not at All n the FUTURE ŌĆō an 82% increase . According to the open-ended responses, many respondents indicated that they use credit cards only for convenience/bonus points with very little revolve .

- 13. What TheyŌĆÖre Saying: On Employment and Consumption Patterns: ŌĆ£ Both my husband and I had jobs eliminated last year.ŌĆØ ŌĆ£ Husband had to fire half of his department and is seeking to take package and leave before companyŌĆÖs benefits decrease.ŌĆØ ŌĆ£ I have cut up most of my cards. I used to pay them off when extra money came in but then the extra money stopped. I found myself with $28K in credit card bills.ŌĆØ ŌĆ£ They decreased my limits on my cards and increased my finance charges. I have decided not to pay.ŌĆØ ŌĆ£ HavenŌĆÖt been to the beauty salon for nearly a year. IŌĆÖve been cutting my own hair and it isnŌĆÖt pretty.ŌĆØ ŌĆ£ All non-essential expenses were reduced significantly or eliminated.ŌĆØ ŌĆ£ The 46 inch flat screen will have to waitŌĆ” A bigger TV doesnŌĆÖt make me happy.ŌĆØ ŌĆ£ WeŌĆÖre going to cut back ŌĆō Anna Wintour was recently quoted at an ostentatious fashion show: ŌĆśThatŌĆÖs so Dubai.ŌĆÖ In other words: ŌĆśthatŌĆÖs so over.ŌĆÖŌĆØ

- 14. Going Forward: Spenders or Spendthrifts? Not one respondent expects to increase their level previous level of spending when the economy rebounds. Only 27% claim that they will return to their previous level of spending 65% claim that they will either cut back ŌĆ£slightlyŌĆØ or ŌĆ£significantlyŌĆØ from their previous level of spending when the economy rebounds. 27% 44% 21%

- 15. Lifestyle Issues: Housing Situation 83% of respondents claim a decrease in home value of 10%+ vs. a year ago; 44% claim a 10%-30% decline. 39% indicate some level of discomfort in being able to stay in their homes going forward.

- 16. Lifestyle Issues: Stress and Activity Levels Response 74% of Respondents claimed either a ŌĆ£Modest,ŌĆØ ŌĆ£Fair AmountŌĆØ or ŌĆ£SignificantŌĆØ amount of Added Stress/Anxiety due to the Downturn. 34% claimed a ŌĆ£SignificantŌĆØ or ŌĆ£OverwhelmingŌĆØ amount of Stress/Anxiety ŌĆ£ Exercise/Workout/Jogging ŌĆØ (26%) and ŌĆ£Yoga/MeditationŌĆØ (11%) exhibited the largest activity increases in response to the Downturn Activity Level Increases Due to Downturn

- 17. What TheyŌĆÖre Saying: On Declining Home Values and Stress: ŌĆ£ Pity the people who lost their investments plus the house decreases and they if they lose their job ŌĆō times will be very tough.ŌĆØ ŌĆ£ If I lose my job, my house will be foreclosed within two months.ŌĆØ ŌĆ£ The only way to get assistance is to stop paying the mortgage, which I donŌĆÖt want to do. ŌĆ£ I always worry about my job.ŌĆØ ŌĆ£ I definitely feel more stressed about my retirement savings. IŌĆÖm hoping I wonŌĆÖt have to work until IŌĆÖm 80! ŌĆ£ IŌĆÖm mad as hell and I donŌĆÖt know who to complain to.ŌĆØ

- 18. Baby Boomer Survival Guide

- 19. How Can Boomers Possibly Survive? Cut Back on Spending NOW! Fill in the GAP. Re-Invent Yourself Seek Out Affordable Living Alternatives

- 20. Baby Boomer Marketing Opportunities

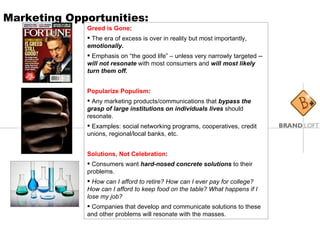

- 21. Marketing Opportunities: Greed is Gone : The era of excess is over in reality but most importantly, emotionally. Emphasis on ŌĆ£the good lifeŌĆØ ŌĆō unless very narrowly targeted -- will not resonate with most consumers and will most likely turn them off. Popularize Populism : Any marketing products/communications that bypass the grasp of large institutions on individuals lives should resonate. Examples: social networking programs, cooperatives, credit unions, regional/local banks, etc. Solutions, Not Celebration : Consumers want hard-nosed concrete solutions to their problems. How can I afford to retire? How can I ever pay for college? How can I afford to keep food on the table? What happens if I lose my job? Companies that develop and communicate solutions to these and other problems will resonate with the masses.

- 22. Marketing Opportunities (contŌĆÖd): De-Stress the Distress : Short term opportunity to position a variety of products/services as stress-relievers. Examples: health clubs, meditation regimens, certain food products, short term getaways, etc Programs for the Self-Employed : 35% of respondents classify themselves as self-employed. Opportunity to develop innovative programs that cater to this group