How to Divide the Pie? Dynamic Equity Share by Mike Moyer

Download as ODP, PDF6 likes2,265 views

This is presentation held at the Tokyo Business Meetup on June 27th. Topic of the presentation; how to make sure that all particpants in a start-up get their fair share. Method by Mike Moyer - Slicing Pie

1 of 51

Downloaded 108 times

Recommended

Startup Equity - Startup summer camp, 2014

Startup Equity - Startup summer camp, 2014Pankaj Saharan

╠²

This document provides information about equity splits for startup founders. It discusses that founders typically own 100% of equity initially but may split it among co-founders. A 50-50 split is rarely fair as contributions can vary. Factors like ideas, expected future work, and experience should determine equity. Unequal splits require vesting to prevent founders leaving with large shares. The document warns that founder disputes can damage startups and outlines tools to help founders determine a strategic, fair split.Perfect Equity Splits for Startup Companies

Perfect Equity Splits for Startup CompaniesMike Moyer

╠²

Learn how to create a perfect equity splits for early stage companies. Contrary to popular belief, there is a way to determine exactly how much equity each person in your company deserves. Based on the book, Slicing Pie (SlicingPie.com), by Mike Moyer (mikemoyer.com)Firing up your dream team

Firing up your dream teamtlesselin

╠²

Being able to fire up a dream team first implies to have good team foundations: the right co-founders, the proper shareholder agreement, a well accepted equity split. Then comes the recruitment of A+ people, and the key triggers of team motivation.How to Split Equity in a Company

How to Split Equity in a CompanyLawTrades

╠²

This document provides guidance on how to split equity in a company and compensate employees with equity. It outlines three major issues to consider: how much equity to give employees, when to give it, and ensuring employees can access their equity. For how much, it recommends either an equity formula approach or segmentation approach. For when to give, it advocates a vesting schedule to motivate employees over time. And to ensure access, it suggests long exercise windows so employees can access equity rights over many years to avoid tax burdens. The document was created by Raad Ahmed in April 2015 to help startup founders properly structure employee equity plans.Managing startup equity (Equity For Startups)

Managing startup equity (Equity For Startups)Kesava Reddy

╠²

Among the more important decisions that an entrepreneur makes is that of raising capital. Many choices have to be made in this context: Debt versus Equity. Own funds versus Funding from outside investors and so on. These choices have long term implications for the entrepreneur as well as the start-up. Equity funding is essential for the growth of a startup. Apart from providing critical funding equity investors also often bring added value by way of connections and strategic advice.

At the same time raising equity capital means sharing control and sharing wealth with the investors in the firm. Allowing investors to engage with the management of the startup calls for a certain degree of compatibility between the investor and the management of the enterprise. Absence of such compatibility can lead to unhappy relationships between the investor and the management team.

All things considered, managing the equity of a start-up is among the most critical decisions that an entrepreneur needs to make. It involves many trade-offs on the entrepreneurial journey. Which makes Managing the Equity of A Start Up a challenge. What does dilution of equity mean? How does the arithmetic of dilution work? How does an entrepreneur decide on when to raise equity? And how much of equity to raise?Slicing Pie: Funding Your Company Without Funds

Slicing Pie: Funding Your Company Without FundsMike Moyer

╠²

This document introduces a method called "Slicing Pie" for fairly allocating equity in startups based on each person's contributions. It advocates converting all contributions, both monetary and non-monetary, into "Slices" using fair market valuations. An individual's equity is then calculated as their number of Slices divided by the total Slices. The framework is designed to be flexible and self-adjusting over time as contributions and team members change. It also includes guidelines for what happens when people leave the startup or when the pie is "frozen" after major funding events.Building A Stable, Fundable Startup

Building A Stable, Fundable Startupportlandten

╠²

The document discusses how private equity investors evaluate startups based on their ratio of assets to liabilities and progress over time. It identifies four basic startup styles - three that are largely unfundable (Stagnant, Corporate, Sexy) and one that is fundable (Stable). The Stable style has high resources/assets and high progress, avoiding common pitfalls like slowing down or shifting to less desirable styles. While not as glamorous initially, Stable startups provide solid metrics and potential for continued growth and return on investment, making them the most attractive to investors. Choosing an operating style that stacks up to investment standards can help prevent errors and maximize a startup's potential for long-term success and sustainability.Startups: Attracting and Retaining Talent (updated 3/6/13)

Startups: Attracting and Retaining Talent (updated 3/6/13)Patrick Seaman

╠²

White Paper on attracting and retaining talent for your startup. Based on my own experiences in many startups and early stage companies. Topics include: Introduction 3

Insanity & Genius 4

Founders & a Whiteboard 5

Wearing Many Hats 7

First Hires 9

Prototype 10

Beta 11

Pre-Launch 12

Launch / A-Round 13

State of the Team 14

Growing and Growing 15

Startups are Nimble 16

Startups ŌĆōvs- Corporate Culture 17

Networking 20

Referral Incentives 21

Events 22

Interns & College/Universities 24

Compelling? 26

Who works for a Startup? 27

Early Employees 28

Poaching? 29

Location & Recruiting 31

Flex 32

Compensation 33

Options Value 34

Compensation Plans 35

Retention 36

The Simple Things 39

Family 41

Perks & Bennies 44

Change of Control 47

Flush with Cash 50

Or not 51

About the Author 52

About Pepperwood Partners 53

Employee equity incentives

Employee equity incentivesBart Greenberg

╠²

This document summarizes key considerations for designing an employee equity incentive plan, including business purpose, ownership structure, company financials, tax implications, and specific plan elements like type of equity grant, eligibility, vesting schedules, and voting rights. It was presented by Bart Greenberg of Haynes and Boone LLP to the Tech Coast Venture Network on employee equity incentives.Common Entrepreneur Mistakes

Common Entrepreneur MistakesBart Greenberg

╠²

This document summarizes common mistakes made by entrepreneurs presented by Bart Greenberg of Haynes and Boone, LLP. It discusses mistakes related to business structure, intellectual property protection, improper use of equity, failure to maintain corporate formalities, and underestimating capital needs. The presentation provides advice on selecting the right business structure and state of incorporation, properly protecting intellectual property, using equity judiciously, following corporate formalities, accurately projecting financial needs, and having contingency plans.Kaplowitch equity dos and donts

Kaplowitch equity dos and dontsBFBootcamp

╠²

The document discusses equity compensation for startups, including stock options, restricted stock, and Section 83(b) elections. It defines key terms like stock options, vesting, and exercise price. It explains the tax treatment and requirements for incentive stock options and nonqualified stock options. It also discusses how restricted stock is taxed, and the benefits of making a Section 83(b) election, such as converting ordinary income to capital gains. The document concludes with recommendations around record keeping, different stock classes, and other equity-based compensation plans.Succession Planning using Equity Incentive Plan and ESOPs

Succession Planning using Equity Incentive Plan and ESOPswifilawgroup

╠²

The document discusses succession planning strategies for privately held companies using equity incentive plans and employee stock ownership plans (ESOPs). It outlines challenges in implementing equity plans, different types of equity awards such as phantom stock and stock appreciation rights, and tax issues related to profits interests in LLCs. Case studies examine using incentive shares or phantom stock appreciation rights to incentivize employees prior to an exit. A final case study looks at establishing an LLC and awarding profits interests to management. The document also reviews how ESOPs can facilitate transferring ownership while deferring capital gains tax.Guaranteed vs Incentive Pay - What's the Right Balance?

Guaranteed vs Incentive Pay - What's the Right Balance?The VisionLink Advisory Group

╠²

Most business leaders believe that some portion of employee pay should be in the form of incentives, but are left struggling to find answers to key questions: How much of someoneŌĆÖs pay should be variable? And who should have incentive pay as part of their mix? How much of the incentive should be short-term and how much should be based on long-term performance? What type of incentive(s) should it be? What if I donŌĆÖt pay incentives and just pay higher salaries than my competitors? Will that work just as well?

If these are questions you are facing, donŌĆÖt miss this presentation!10 Movies Every Entrepreneur Should Watch

10 Movies Every Entrepreneur Should WatchLawTrades

╠²

This document recommends 10 movies that every entrepreneur should watch, including Citizen Kane, Wall Street, and The Pursuit of Happiness. It argues that great movies can provide inspiration, which is something entrepreneurs need. The list also includes Office Space, The Social Network, Thank You for Smoking, Art & Copy, Indie Game, Glengarry Glen Ross, and Enron: The Smartest Guys in the Room.Negotiating as Consultant

Negotiating as ConsultantJamie Lee

╠²

This presentation was given at "Hands-on Workshop for Negotiation Prowess" and geared towards women consultants and solopreneurs. We discussed ways to get over the fear of "No", negotiation frameworks, and experts scripts for making concessions and for raising your rate as a consultant. Converting Employees to Owners: Employee Share Purchase Plans

Converting Employees to Owners: Employee Share Purchase PlansNow Dentons

╠²

This presentation offers an overview of types, formation, implementation and administration of ESPPs.ESOPs LEGAL & PROCEDURAL ASPECTS

ESOPs LEGAL & PROCEDURAL ASPECTSCorporate Professionals

╠²

Employee stock option plans (ESOPs) are used by companies to attract, motivate, and retain employees. There are several types of ESOPs that provide equity incentives like stock options, stock purchase plans, restricted stock units, and stock appreciation rights. Key aspects of ESOPs include how they are granted and vested over time, tax implications, regulatory requirements, and accounting treatment. ESOPs must be implemented according to the rules for listed and unlisted companies set out by the Companies Act, Income Tax Act, SEBI, and other regulatory bodies to ensure proper governance and compliance.Raising Your Seed Round Financing: Should You Use Convertible Notes or Prefe...

Raising Your Seed Round Financing: Should You Use Convertible Notes or Prefe...Bart Greenberg

╠²

This slide show outlines and discusses the basic differences between preferred stock and convertible notes and the pros and cons to the issuer and the investor in using one over the other.Startup MBA 3.1 - Funding, equity, valuations

Startup MBA 3.1 - Funding, equity, valuationsFounder-Centric

╠²

This document discusses different types of startup funding including revenue, debt, and equity. It focuses mainly on equity funding, explaining the typical stages of funding from sweat equity to a Series A round. It provides advice on valuation ranges, giving up equity to investors and employees, and practical considerations for fundraising like timelines, dilution calculations, and negotiating terms. The key points are that equity funding involves giving ownership stakes to investors in exchange for cash, fundraising is distracting, and founders should understand valuation impacts and protect themselves in legal agreements.Avoiding Common Business Plan Mistakes

Avoiding Common Business Plan MistakesBart Greenberg

╠²

This presentation showcases the more common business plan mistakes made by entrepreneurs in new, start-up ventures.Equity Incentives and Bonus Plans for Employees, Consultants & Advisors

Equity Incentives and Bonus Plans for Employees, Consultants & AdvisorsChirag Charlie Patel, PMP

╠²

The document discusses options for attracting, retaining, and incentivizing talent including offering equity incentives through an option or equity incentive plan. The main types of equity incentives that can be granted are options, restricted stock, and stock appreciation rights. Options allow an employee to purchase company stock at a set price for a period of time. Restricted stock transfers shares that vest over time if employment continues. Stock appreciation rights provide a cash payment based on stock value increases. Tax implications vary based on option type and timing of stock sales.How to split equity among founders

How to split equity among founderspankajg05

╠²

50-50 is not a 'fair' split of equity. Understand the right formula to split equity among co-founders, which is fair and can keep everyone happy.Presentation1 on 01-12-14

Presentation1 on 01-12-14George Masih

╠²

This document introduces an opportunity for financial freedom through a network marketing company called Life Changing Shoppe. It promotes joining as a customer or independent business developer to earn unlimited income by referring friends. Various ways to earn income are described such as binary income from sales pairs, royalty income for achieving 4000 pairs, and rewards for sales milestones like cars and property. The overall message is that anyone can start building wealth through this opportunity by referring others for advice which is free, unlike cooperating which requires more time and relationship building.MEMSI June 2018: Building a company: Equity, Fundraising and more

MEMSI June 2018: Building a company: Equity, Fundraising and moreElaine Chen

╠²

In this session we discuss considerations when dividing up the founder equity between multiple founders. We then have a look at the current fundraising landscape for hardware startups, and discuss do's and don'ts.Presentation1 on 13 03-141

Presentation1 on 13 03-141George Masih

╠²

The document introduces an opportunity for financial freedom through a multi-level marketing company called Life Changing Shoppe. It promotes joining as a customer or independent business developer (IBD) for no investment and significant earnings, including from binary income, royalty income, and rewards. IBDs can earn by referring friends and helping to build their team. The document provides details on income potential from different levels of the binary tree and rewards for pairs and time thresholds. The overall message is that anyone can start and achieve financial success through this opportunity.How I Quit My Job, Started a Small Firm and Built a Life I Love

How I Quit My Job, Started a Small Firm and Built a Life I LoveAccountingfly

╠²

Jason Blumer, CPA has an incredible story to tell you. Small firms can be lucrative and can give you flexibility to have a life! It takes some courage, a plan and some great mentors. Jason can help you gather each of these. JasonŌĆÖs firm is 100% remote, 100% results only work environment, and he has learned the art of running a virtual firm. Even if you never start a firm, you will be highly entertained and learn a ton from Jason.Salary

SalaryAvisekBera1

╠²

This document discusses the benefits of knowing your coworkers' salaries. It argues that pay secrecy can create gaps and distortions, while transparency reduces inequalities and helps people negotiate better. Specifically, transparency could help close the gender pay gap, empower salary negotiations, and create a more positive work environment for employees and employers alike. Overall, the document promotes pay transparency as a way to foster trust, engagement, and better business outcomes for all.What does entrepreneurship after 50 entail (2)

What does entrepreneurship after 50 entail (2)AtheethBelagode

╠²

We all are apprehensive about venturing into entrepreneurship after 50. I mean itŌĆÖs only human to think so right? But thatŌĆÖs what makes it an exciting adventure too.

With age comes experience and with experience comes expertise. It might be something you wanted to do for a long time. And if you think the timing is right now.

Now is when you should take the next step. Seek the niche you really enjoy and donŌĆÖt be afraid to go for it.

Because, At or after 50, you donŌĆÖt stop dreaming. Age is just a number, itŌĆÖs all about what you want and when you want it. So entrepreneurship at 50? I say hell yes! District76 Spring Conference 2015 - Evaluation Workshop - Ed Kuiters 2015

District76 Spring Conference 2015 - Evaluation Workshop - Ed Kuiters 2015Ed Kuiters

╠²

1. The document discusses how to effectively evaluate a speech or presentation by preparing evaluation points in advance, observing the speaker and audience during the presentation, and providing constructive feedback afterwards in a concise yet helpful manner.

2. It recommends contacting the speaker beforehand to understand the objectives, preparing an evaluation format or key points to focus on, and observing without taking extensive notes during the presentation.

3. The evaluation should then focus outward on how to improve, using specific examples, and thank the speaker for the opportunity to provide feedback in a way that encourages growth.141207 pioneer debate

141207 pioneer debateEd Kuiters

╠²

This document provides information about how to structure and participate in a debate. It outlines the format which includes three rounds with openings speeches and rebuttals from both sides. Key aspects emphasized are using evidence to support arguments, avoiding personal attacks, and being open to changing one's view. The debate process, from preparing arguments to delivering speeches and rebuttals, is broken down step-by-step. Tips are provided such as evenly distributing time among points and sources. An example debate proposition is given at the end regarding relocating a regular meeting venue.More Related Content

Viewers also liked (13)

Employee equity incentives

Employee equity incentivesBart Greenberg

╠²

This document summarizes key considerations for designing an employee equity incentive plan, including business purpose, ownership structure, company financials, tax implications, and specific plan elements like type of equity grant, eligibility, vesting schedules, and voting rights. It was presented by Bart Greenberg of Haynes and Boone LLP to the Tech Coast Venture Network on employee equity incentives.Common Entrepreneur Mistakes

Common Entrepreneur MistakesBart Greenberg

╠²

This document summarizes common mistakes made by entrepreneurs presented by Bart Greenberg of Haynes and Boone, LLP. It discusses mistakes related to business structure, intellectual property protection, improper use of equity, failure to maintain corporate formalities, and underestimating capital needs. The presentation provides advice on selecting the right business structure and state of incorporation, properly protecting intellectual property, using equity judiciously, following corporate formalities, accurately projecting financial needs, and having contingency plans.Kaplowitch equity dos and donts

Kaplowitch equity dos and dontsBFBootcamp

╠²

The document discusses equity compensation for startups, including stock options, restricted stock, and Section 83(b) elections. It defines key terms like stock options, vesting, and exercise price. It explains the tax treatment and requirements for incentive stock options and nonqualified stock options. It also discusses how restricted stock is taxed, and the benefits of making a Section 83(b) election, such as converting ordinary income to capital gains. The document concludes with recommendations around record keeping, different stock classes, and other equity-based compensation plans.Succession Planning using Equity Incentive Plan and ESOPs

Succession Planning using Equity Incentive Plan and ESOPswifilawgroup

╠²

The document discusses succession planning strategies for privately held companies using equity incentive plans and employee stock ownership plans (ESOPs). It outlines challenges in implementing equity plans, different types of equity awards such as phantom stock and stock appreciation rights, and tax issues related to profits interests in LLCs. Case studies examine using incentive shares or phantom stock appreciation rights to incentivize employees prior to an exit. A final case study looks at establishing an LLC and awarding profits interests to management. The document also reviews how ESOPs can facilitate transferring ownership while deferring capital gains tax.Guaranteed vs Incentive Pay - What's the Right Balance?

Guaranteed vs Incentive Pay - What's the Right Balance?The VisionLink Advisory Group

╠²

Most business leaders believe that some portion of employee pay should be in the form of incentives, but are left struggling to find answers to key questions: How much of someoneŌĆÖs pay should be variable? And who should have incentive pay as part of their mix? How much of the incentive should be short-term and how much should be based on long-term performance? What type of incentive(s) should it be? What if I donŌĆÖt pay incentives and just pay higher salaries than my competitors? Will that work just as well?

If these are questions you are facing, donŌĆÖt miss this presentation!10 Movies Every Entrepreneur Should Watch

10 Movies Every Entrepreneur Should WatchLawTrades

╠²

This document recommends 10 movies that every entrepreneur should watch, including Citizen Kane, Wall Street, and The Pursuit of Happiness. It argues that great movies can provide inspiration, which is something entrepreneurs need. The list also includes Office Space, The Social Network, Thank You for Smoking, Art & Copy, Indie Game, Glengarry Glen Ross, and Enron: The Smartest Guys in the Room.Negotiating as Consultant

Negotiating as ConsultantJamie Lee

╠²

This presentation was given at "Hands-on Workshop for Negotiation Prowess" and geared towards women consultants and solopreneurs. We discussed ways to get over the fear of "No", negotiation frameworks, and experts scripts for making concessions and for raising your rate as a consultant. Converting Employees to Owners: Employee Share Purchase Plans

Converting Employees to Owners: Employee Share Purchase PlansNow Dentons

╠²

This presentation offers an overview of types, formation, implementation and administration of ESPPs.ESOPs LEGAL & PROCEDURAL ASPECTS

ESOPs LEGAL & PROCEDURAL ASPECTSCorporate Professionals

╠²

Employee stock option plans (ESOPs) are used by companies to attract, motivate, and retain employees. There are several types of ESOPs that provide equity incentives like stock options, stock purchase plans, restricted stock units, and stock appreciation rights. Key aspects of ESOPs include how they are granted and vested over time, tax implications, regulatory requirements, and accounting treatment. ESOPs must be implemented according to the rules for listed and unlisted companies set out by the Companies Act, Income Tax Act, SEBI, and other regulatory bodies to ensure proper governance and compliance.Raising Your Seed Round Financing: Should You Use Convertible Notes or Prefe...

Raising Your Seed Round Financing: Should You Use Convertible Notes or Prefe...Bart Greenberg

╠²

This slide show outlines and discusses the basic differences between preferred stock and convertible notes and the pros and cons to the issuer and the investor in using one over the other.Startup MBA 3.1 - Funding, equity, valuations

Startup MBA 3.1 - Funding, equity, valuationsFounder-Centric

╠²

This document discusses different types of startup funding including revenue, debt, and equity. It focuses mainly on equity funding, explaining the typical stages of funding from sweat equity to a Series A round. It provides advice on valuation ranges, giving up equity to investors and employees, and practical considerations for fundraising like timelines, dilution calculations, and negotiating terms. The key points are that equity funding involves giving ownership stakes to investors in exchange for cash, fundraising is distracting, and founders should understand valuation impacts and protect themselves in legal agreements.Avoiding Common Business Plan Mistakes

Avoiding Common Business Plan MistakesBart Greenberg

╠²

This presentation showcases the more common business plan mistakes made by entrepreneurs in new, start-up ventures.Equity Incentives and Bonus Plans for Employees, Consultants & Advisors

Equity Incentives and Bonus Plans for Employees, Consultants & AdvisorsChirag Charlie Patel, PMP

╠²

The document discusses options for attracting, retaining, and incentivizing talent including offering equity incentives through an option or equity incentive plan. The main types of equity incentives that can be granted are options, restricted stock, and stock appreciation rights. Options allow an employee to purchase company stock at a set price for a period of time. Restricted stock transfers shares that vest over time if employment continues. Stock appreciation rights provide a cash payment based on stock value increases. Tax implications vary based on option type and timing of stock sales.Similar to How to Divide the Pie? Dynamic Equity Share by Mike Moyer (7)

How to split equity among founders

How to split equity among founderspankajg05

╠²

50-50 is not a 'fair' split of equity. Understand the right formula to split equity among co-founders, which is fair and can keep everyone happy.Presentation1 on 01-12-14

Presentation1 on 01-12-14George Masih

╠²

This document introduces an opportunity for financial freedom through a network marketing company called Life Changing Shoppe. It promotes joining as a customer or independent business developer to earn unlimited income by referring friends. Various ways to earn income are described such as binary income from sales pairs, royalty income for achieving 4000 pairs, and rewards for sales milestones like cars and property. The overall message is that anyone can start building wealth through this opportunity by referring others for advice which is free, unlike cooperating which requires more time and relationship building.MEMSI June 2018: Building a company: Equity, Fundraising and more

MEMSI June 2018: Building a company: Equity, Fundraising and moreElaine Chen

╠²

In this session we discuss considerations when dividing up the founder equity between multiple founders. We then have a look at the current fundraising landscape for hardware startups, and discuss do's and don'ts.Presentation1 on 13 03-141

Presentation1 on 13 03-141George Masih

╠²

The document introduces an opportunity for financial freedom through a multi-level marketing company called Life Changing Shoppe. It promotes joining as a customer or independent business developer (IBD) for no investment and significant earnings, including from binary income, royalty income, and rewards. IBDs can earn by referring friends and helping to build their team. The document provides details on income potential from different levels of the binary tree and rewards for pairs and time thresholds. The overall message is that anyone can start and achieve financial success through this opportunity.How I Quit My Job, Started a Small Firm and Built a Life I Love

How I Quit My Job, Started a Small Firm and Built a Life I LoveAccountingfly

╠²

Jason Blumer, CPA has an incredible story to tell you. Small firms can be lucrative and can give you flexibility to have a life! It takes some courage, a plan and some great mentors. Jason can help you gather each of these. JasonŌĆÖs firm is 100% remote, 100% results only work environment, and he has learned the art of running a virtual firm. Even if you never start a firm, you will be highly entertained and learn a ton from Jason.Salary

SalaryAvisekBera1

╠²

This document discusses the benefits of knowing your coworkers' salaries. It argues that pay secrecy can create gaps and distortions, while transparency reduces inequalities and helps people negotiate better. Specifically, transparency could help close the gender pay gap, empower salary negotiations, and create a more positive work environment for employees and employers alike. Overall, the document promotes pay transparency as a way to foster trust, engagement, and better business outcomes for all.What does entrepreneurship after 50 entail (2)

What does entrepreneurship after 50 entail (2)AtheethBelagode

╠²

We all are apprehensive about venturing into entrepreneurship after 50. I mean itŌĆÖs only human to think so right? But thatŌĆÖs what makes it an exciting adventure too.

With age comes experience and with experience comes expertise. It might be something you wanted to do for a long time. And if you think the timing is right now.

Now is when you should take the next step. Seek the niche you really enjoy and donŌĆÖt be afraid to go for it.

Because, At or after 50, you donŌĆÖt stop dreaming. Age is just a number, itŌĆÖs all about what you want and when you want it. So entrepreneurship at 50? I say hell yes! More from Ed Kuiters (10)

District76 Spring Conference 2015 - Evaluation Workshop - Ed Kuiters 2015

District76 Spring Conference 2015 - Evaluation Workshop - Ed Kuiters 2015Ed Kuiters

╠²

1. The document discusses how to effectively evaluate a speech or presentation by preparing evaluation points in advance, observing the speaker and audience during the presentation, and providing constructive feedback afterwards in a concise yet helpful manner.

2. It recommends contacting the speaker beforehand to understand the objectives, preparing an evaluation format or key points to focus on, and observing without taking extensive notes during the presentation.

3. The evaluation should then focus outward on how to improve, using specific examples, and thank the speaker for the opportunity to provide feedback in a way that encourages growth.141207 pioneer debate

141207 pioneer debateEd Kuiters

╠²

This document provides information about how to structure and participate in a debate. It outlines the format which includes three rounds with openings speeches and rebuttals from both sides. Key aspects emphasized are using evidence to support arguments, avoiding personal attacks, and being open to changing one's view. The debate process, from preparing arguments to delivering speeches and rebuttals, is broken down step-by-step. Tips are provided such as evenly distributing time among points and sources. An example debate proposition is given at the end regarding relocating a regular meeting venue.Evaluation workshop pioneer_tmc

Evaluation workshop pioneer_tmcEd Kuiters

╠²

This document provides guidance on how to conduct evaluations for speeches. It discusses that evaluations are meant to help speakers improve by providing constructive feedback. The evaluator should contact the speaker beforehand to understand their goals, carefully review the speech, and focus on both the speaker and audience during the delivery. When providing the evaluation, the evaluator should use a "sandwich" method of starting and ending positively while respectfully providing improvement areas. The document outlines different evaluation formats and factors to consider when looking for areas of improvement. It emphasizes that the goal of evaluations is to help speakers grow.SeaNect Impression

SeaNect ImpressionEd Kuiters

╠²

This document outlines features of the SeaNect software which allow users to: add equipment to ships, assign jobs to that equipment, outsource jobs to partners, share equipment histories, and cross-reference solutions from other users. It encourages contacting SeaNect to learn more about how their software could benefit an organization.090725 Eng School Sugiyama

090725 Eng School SugiyamaEd Kuiters

╠²

The document compares the size of the Netherlands and Japan. It also provides links to YouTube videos about bike rush hour in the Netherlands, how the Dutch dike system works, the Kinderdijk windmills, and the Keukenhof flower gardens.090318 Progressive Laws Nl

090318 Progressive Laws NlEd Kuiters

╠²

The document discusses progressive laws and policies in the Netherlands related to euthanasia, same-sex marriage, drugs, and immigration. It provides historical context and arguments for and against each issue. Statistics are presented on drug use, marriages, and immigration trends. Lessons for other countries are discussed, questioning if Japan could implement any similar laws given differences in history, culture and political situations.090227 Credit Crisis

090227 Credit CrisisEd Kuiters

╠²

Banks took on increasingly risky loans to profit from rising housing prices, but could not repay debts when borrowers defaulted and housing prices fell. This caused major banks like Lehman Brothers and Freddie Mac to fail, wiping out over $1 trillion in wealth. While bailouts stabilized the system, they did not address the root causes of greed and risky behavior that will likely lead to future crises.090214 Fail Software Development

090214 Fail Software DevelopmentEd Kuiters

╠²

How to learn from your mistakes in software projects. Presentation at Yokohama IT Business Meetup 14 feb 2009.Recently uploaded (20)

Carousel - Five Key FinTech Trends in 2025

Carousel - Five Key FinTech Trends in 2025Anadea

╠²

The financial technology landscape is evolving at an unprecedented pace, and 2025 promises to be a transformative year for the industry. From AI-driven banking to decentralized finance, the future of FinTech is brimming with innovation. In this carousel, we explore the five key trends that will shape the FinTech ecosystem in 2025. Stay ahead of the curve and discover how these advancements will redefine the way we manage, invest, and interact with money. Swipe through to dive into the future of finance! ¤Æ│¤ÜĆHolden Melia - An Accomplished Executive

Holden Melia - An Accomplished ExecutiveHolden Melia

╠²

Holden Melia is an accomplished executive with over 15 years of experience in leadership, business growth, and strategic innovation. He holds a BachelorŌĆÖs degree in Accounting and Finance from the University of Nebraska-Lincoln and has excelled in driving results, team development, and operational efficiency.¤ö╣ SWOT Analysis: Boutique Consulting Firms in 2025 ¤ö╣

¤ö╣ SWOT Analysis: Boutique Consulting Firms in 2025 ¤ö╣Alexander Simon

╠²

In an era defined by Consulting 5.0, boutique consulting firmsŌĆöpositioned in the Blue OceanŌĆöface both unprecedented opportunities and critical challenges.

Their strengths lie in specialization, agility, and client-centricity, making them key players in delivering high-value, tailored insights. However, limited scale, regulatory constraints, and rising AI-driven competition present significant barriers to growth.

This SWOT analysis explores the internal and external forces shaping the future of boutique consultancies. Unlike Black Ocean firms, which grapple with the innovatorŌĆÖs dilemma, boutiques have the advantage of flexibility and speedŌĆöbut to fully harness Consulting 5.0, they must form strategic alliances with tech firms, PE-backed networks, and expert collectives.

Key Insights:

Ō£ģ Strengths: Agility, deep expertise, and productized offerings

ŌÜĀ’ĖÅ Weaknesses: Brand visibility, reliance on key personnel

¤ÜĆ Opportunities: AI, Web3, and strategic partnerships

Ōøö Threats: Automation, price competition, regulatory challenges

Strategic Imperatives for Boutique Firms:

¤ōī Leverage AI & emerging tech to augment consulting services

¤ōī Build strategic alliances to access resources & scale solutions

¤ōī Strengthen regulatory & compliance expertise to compete in high-value markets

¤ōī Shift from transactional to long-term partnerships for client retention

As Consulting 5.0 reshapes the industry, boutique consultancies must act now to differentiate themselves and secure their future in a rapidly evolving landscape.

¤ÆĪ What do you think? Can boutique firms unlock Consulting 5.0 before Black Ocean giants do?Digital Marketing Roadmap - PPT Template and Guide

Digital Marketing Roadmap - PPT Template and GuideAurelien Domont, MBA

╠²

In the ever-evolving landscape of digital marketing, having a well-structured roadmap is essential for achieving success. HereŌĆÖs a comprehensive digital marketing roadmap that outlines key strategies and steps to take your marketing efforts to the next level. It includes 6 components:

1. Branding Guidelines Strategy

2. Website Design and Development

3. Search Engine Optimization (SEO)

4. Pay-Per-Click (PPC) Strategy

5. Social Media Strategy

6. Emailing Strategy

This PowerPoint presentation is only a small preview of our content. For more details, visit www.domontconsulting.com Transfer API | Transfer Booking Engine | Transfer API Integration

Transfer API | Transfer Booking Engine | Transfer API Integrationchethanaraj81

╠²

FlightsLogic is a leading╠²travel technology company╠²offering╠²Transfer API╠²and other services to the travel market. By integrating your travel website with our transfer API, you can take benefit of various international transfer services from airports, hotels, resorts, cars, etc. Our Transfer API comes with full documentation with technical support and it supports both B2C and B2B solutions. With the transfer API solution developed by FlightsLogic, the user can easily book their transport from the airport to the travel place. For more details, pls visit our website: https://www.flightslogic.com/transfer-api.php

Will-Skill Matrix PowerPoint Template and Guide

Will-Skill Matrix PowerPoint Template and GuideAurelien Domont, MBA

╠²

The Will-Skill Matrix is an essential framework for managers and consultants aiming to optimize team performance. This model divides employees into four quadrants based on their levels of motivation (Will) and competencies (Skill):

1.Contributors (Guide): High Will, Low Skill

2.High Performers (Challenge): High Will, High Skill

3.Low Performers (Direct): Low Will, Low Skill

4.Potential Detractors (Motivate): Low Will, High Skill

This PowerPoint presentation is only a small preview of our content. For more details, visit www.domontconsulting.com Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)

Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)Lviv Startup Club

╠²

Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)

Lemberg AIPM School 3.0

Website ŌĆō https://lembs.com/aipmschool

Youtube ŌĆō https://www.youtube.com/startuplviv

FB ŌĆō https://www.facebook.com/pmdayconferenceTaylor Swift The Man Music Video Production

Taylor Swift The Man Music Video Productioneclark941

╠²

For my school project, I analyzed Taylor Swift's "The Man" music video. I explored how it critiques gender inequality by depicting Taylor Swift as a man to highlight the double standards and societal expectations placed on men and women. The video uses satire and symbolism to comment on issues of power and privilege2025_Dominion Presentaci├│n_Corporativa_Larga (ENG)_web.pdf

2025_Dominion Presentaci├│n_Corporativa_Larga (ENG)_web.pdfdominionglobalanalyt

╠²

Presentaci├│n Corporativa en ingl├®s 2025Illuminati brotherhood in Uganda call +256789951901/0701593598

Illuminati brotherhood in Uganda call +256789951901/0701593598removed_43fc2846aef7ee8f2a43e6bb3648f7c3

╠²

Illuminati brotherhood in Uganda call +256789951901/0701593598Smart Logistics Integrating Freight, Trucking & Warehousing ŌĆö Prospect Logis...

Smart Logistics Integrating Freight, Trucking & Warehousing ŌĆö Prospect Logis...prospectsingapore

╠²

Businesses must optimize their supply chain to remain competitive. Seamlessly integrating freight forwarding, trucking, and warehousing services can significantly improve efficiency, reduce costs, and enhance customer satisfaction. A well-coordinated logistics strategy is essential for businesses dealing with large shipments, furniture storage, and distribution operations.

The Importance of an Integrated Logistics Approach

A logistics service provider in Singapore must ensure a seamless flow of goods from the manufacturer to the end customer. This process involves multiple stages, including freight forwarding, trucking, and warehousing. When these elements operate in isolation, inefficiencies arise, leading to delays and increased costs. However, integrating them into a cohesive system offers several benefits:

Cost Efficiency: Reduced handling, storage, and transportation costs through streamlined operations.

Faster Delivery: Optimized transit times due to better coordination between different logistics components.

Improved Inventory Management: Centralized storage and real-time tracking enhance stock control.

Better Resource Utilization: Trucks and warehouses are used efficiently, reducing idle time and wastage.

Enhanced Scalability: Businesses can scale operations more effectively by utilizing integrated logistics services.

Customer Satisfaction: Faster deliveries and accurate order fulfillment enhance the overall customer experience.

Freight Forwarding: The First Step in Logistics Optimization Freight forwarding is the backbone of global supply chains. It involves managing the transportation of goods across international borders using various modes, including air, sea, and land. A logistics service provider specializing in freight forwarding plays a crucial role in:

Customs Clearance: Handling documentation and compliance requirements to ensure smooth international trade.

Carrier Selection: Choosing the most cost-effective and reliable transportation options.

Cargo Consolidation: Combining smaller shipments to optimize container space and reduce costs.

Route Optimization: Selecting the best routes to minimize transit time and costs.

Risk Management: Identifying and mitigating potential risks such as delays, damage, and unforeseen expenses.

By partnering with a reliable freight forwarder, businesses can streamline their global shipping processes and reduce the risks associated with international logistics.

Trucking: Bridging the Gap Between Freight and Warehousing

Once goods arrive at ports or distribution centers, trucking services become essential for last-mile delivery. Efficient trucking operations ensure timely deliveries and minimize disruptions. Key strategies for optimizing trucking include:

Fleet Management: Using GPS tracking and route optimization software to reduce delays and fuel consumption.

Load Optimization: Maximizing truck capacity to lower transportation costs per unit.

Timely Scheduling: Coordinating trucProject Status Report - Powerpoint Template

Project Status Report - Powerpoint TemplateAurelien Domont, MBA

╠²

Project Status Report Template that our ex-McKinsey & Deloitte consultants like to use with their clients.

For more content, visit www.domontconsulting.com

In the fast-paced world of business, staying on top of key projects and initiatives is crucial for success. An initiative status report is a vital tool that provides transparency, accountability, and valuable insights to stakeholders. By outlining deadlines, costs, quality standards, and potential risks, these reports ensure that projects remain on track and aligned with organizational goals. In this article, we will delve into the essential components of an initiative status report, offering a comprehensive guide to creating effective and informative updates.BusinessGPT - Privacy first AI Platform.pptx

BusinessGPT - Privacy first AI Platform.pptxAGATSoftware

╠²

Empower users with responsible and secure AI for generating insights from your companyŌĆÖs data.ŌĆŗ Usage control and data protection concerns limit companies from leveraging Generative AI.ŌĆŗ For customers that donŌĆÖt want to take any risk of using Public AI services.ŌĆŗ For customers that are willing to use Public AI services but want to manage the risks.ŌĆŗCCleaner Pro 6.33 Crack + Key Free Download 2025

CCleaner Pro 6.33 Crack + Key Free Download 2025kortez3

╠²

Direct License file Link Below¤æē https://up-community.net/dl/

CCleaner Pro Crack is the industry-leading system optimization tool trusted by millions to clean, optimize, and protect their computers.Top Social Media Marketing Trends in 2025

Top Social Media Marketing Trends in 2025bulbulkanwar7070

╠²

Social media marketing trends is now being very crucial.REACH OUT TO SALVAGE ASSET RECOVERY TO RECOVER SCAM OR STOLEN CRYPTOCURRENCY

REACH OUT TO SALVAGE ASSET RECOVERY TO RECOVER SCAM OR STOLEN CRYPTOCURRENCYleooscar735

╠²

WEBSITE.......https://salvageassetrecovery.com

TELEGRAM---@Salvageasset

Email...Salvageassetrecovery@alumni.com

WhatsApp+ 1 8 4 7 6 5 4 7 0 9 6

I Thought IŌĆÖd Lost Everything, My Crops, My Savings, My Future! I'm a third-generation farmer, and like most of my family, I have weathered storms, both the literal and economic varieties. Nothing, though, could have prepared me for the flood that swept through my farm and nearly drowned my future. Over the past five years, I had amassed a $120,000 Bitcoin buffer in silence as a hedge against unstable crop prices. It was my shield against poor harvests and market crashes.

And then the flood came. It wasn't rain, it was the wrath of nature. Water flooded into my office, turning documents into pulp and sending my computers floating around like lumber. My hardware wallet, the sole bulwark between me and that $120,000, was submerged in muddy water. When the skies finally cleared, I held the waterlogged device in my hand, praying fervently that it would still work. It didn't.

Panic ensued. The soybeans were ruined, the barn needed to be repaired, and now my electronic savings, the one thing I thought was sacrosanct was gone. I couldn't tell my wife; she had already been up to her knees helping shovel sludge out of our home.

Desperate, I had put it on an agriculture technology site. I had cried and written, praying that someone somewhere would know what to do. A user responded with a username that turned out to be my savior, Salvage Asset Recovery.

I called them the next day, preparing for robot voice or a bait-and-switch sales pitch. But to my surprise, I spoke with human compassion, patience, and understanding. I unloaded my story, and they listened like neighbors calling after a tornado. They worked immediately, using fancy data reconstruction tools I couldn't even understand.

Every day, they updated me in simple terms. I was anxious, but their professionalism calmed me down. On the ninth day, I got the call. They had recovered my wallet. All the Bitcoins were intact. I was so relieved that I nearly kissed my filthy boots.

When they heard about the flooding damage, they even discounted part of their fee. That touched me more than the rain. Salvage Asset Recovery didn't just restore my savings, they restored my trust in people. They are heroes in my book, and thanks to them, my family's future is once again set on stable ground.Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)

Rostyslav Chayka: ąŻą┐čĆą░ą▓ą╗č¢ąĮąĮčÅ ą║ąŠą╝ą░ąĮą┤ąŠčÄ ąĘą░ ą┤ąŠą┐ąŠą╝ąŠą│ąŠčÄ AI (UA)Lviv Startup Club

╠²

Illuminati brotherhood in Uganda call +256789951901/0701593598

Illuminati brotherhood in Uganda call +256789951901/0701593598removed_43fc2846aef7ee8f2a43e6bb3648f7c3

╠²

Smart Logistics Integrating Freight, Trucking & Warehousing ŌĆö Prospect Logis...

Smart Logistics Integrating Freight, Trucking & Warehousing ŌĆö Prospect Logis...prospectsingapore

╠²

How to Divide the Pie? Dynamic Equity Share by Mike Moyer

- 1. How to Divide the Pie? - Ed Kuiters

- 5. But.. I have no money to hire.. ..YET.. Equity

- 6. ?

- 7. ŌĆ£50/50ŌĆØ

- 8. ŌĆ£60/40ŌĆØ

- 9. ŌĆ£80/20ŌĆØ

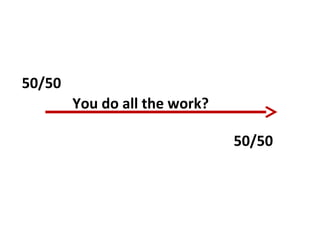

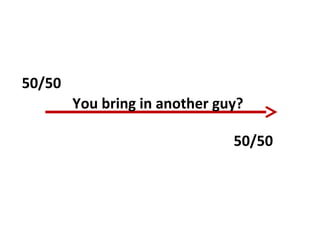

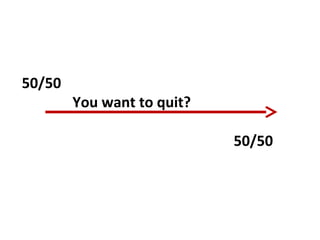

- 10. 50/50 50/50

- 12. 50/50 50/50 You do all the work?

- 13. 50/50 50/50 You bring in another guy?

- 14. 50/50 50/50 Your partner wants to quit?

- 15. 50/50 50/50 You want to quit?

- 18. Wait!.. What if there was a fair & effective way to divide the pie?

- 19. Dynamic Equity Split Mike Moyer ŌĆō 'Slicing Pie'

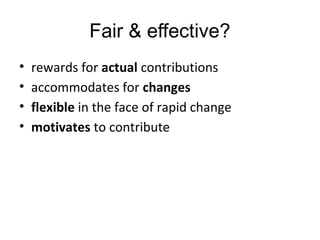

- 20. Fair & effective? ŌĆó rewards for actual contributions ŌĆó accommodates for changes ŌĆó flexible in the face of rapid change ŌĆó motivates to contribute

- 21. Work hard now Get what you deserve.. later Fair

- 22. Your Share Reflects What You Actually Contribute

- 23. You Contribute 50% = You Should Get 50%

- 24. You Contribute 10% = You Should Get 10%

- 25. You Contribute 69.2% = You Should Get 69.2%

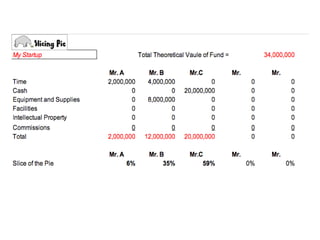

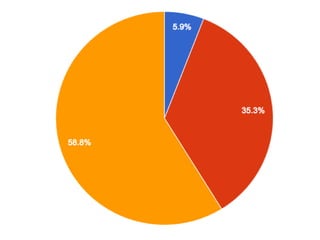

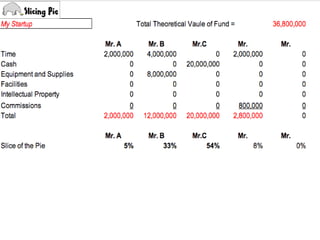

- 26. How it works 1. Assign a leader you can trust 2. Assign a theoretical value to the various inputs provided by each participant 3. Individual Value ├Ę Total Value= Shares %

- 27. 1. Get a Trustworthy Leader ŌĆó Holds all ŌĆ£equityŌĆØ ŌĆó Manages your ŌĆ£equity fundŌĆØ ŌĆó Deals with people who are departing

- 28. 2. Assign Theoretical Values

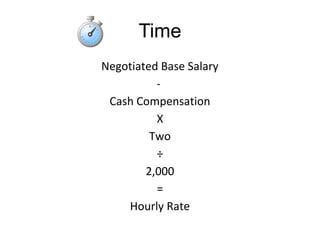

- 29. Time Negotiated Base Salary - Cash Compensation X Two ├Ę 2,000 = Hourly Rate

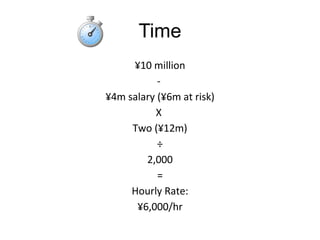

- 30. Time ┬ź10 million - ┬ź4m salary (┬ź6m at risk) X Two (┬ź12m) ├Ę 2,000 = Hourly Rate: ┬ź6,000/hr

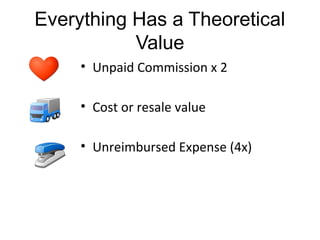

- 32. Everything Has a Theoretical Value ŌĆó Unpaid Commission x 2 ŌĆó Cost or resale value ŌĆó Unreimbursed Expense (4x)

- 33. People Contribute Different Things Person 2Person 1 Person 3 Jr. Developer Founder Rich Uncle

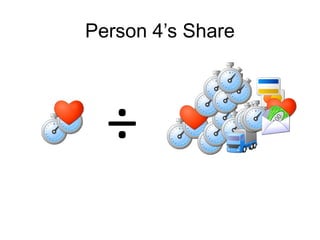

- 40. Sales Guy Person 4 A new guy..?

- 43. Person 1ŌĆÖs Share* ├Ę *If the Person Does Nothing Else

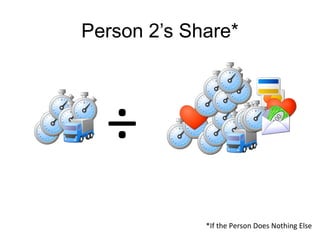

- 44. Person 2ŌĆÖs Share* ├Ę *If the Person Does Nothing Else

- 45. Person 3ŌĆÖs Share* ├Ę *If the Person Does Nothing Else

- 49. What You Get ŌĆó Fair ŌĆó Rewards for contributions ŌĆó Motivation to contribute ŌĆó Accommodates changes in the team

- 50. Outgrowing Dynamic Equity ŌĆó Real revenues ŌĆó Positive cash flow ŌĆó Organization gets too big (diminishing returns) ŌĆó Significant investment

- 51. .. or ed@kuiters.net Mike Moyer ŌĆ£Slicing PieŌĆØ ($8 at Amazon)

Editor's Notes

- #2: Ed Kuiters Netherlands Software company Collaborate with a Russian software company Maritime maintenance, Meteorological Institutes Latest project; easy to use accounting software for small business. How to divide the pie? How give all participants in a start-up a fair share .

- #3: I have new business ideas all the time. Everywhere I look I see opportunities for better products, improved services.. and I bet there are many people like me here tonight. People who are running or are considering to run there own business?

- #4: So what happens if you get a new idea? Quick business plan.. Huge growth potential? Hostile takeover Google?

- #5: Talk with friends, experts & you discover that your sales skills may not be enough to get your business going, or that you will need a programmer for a prototype or someone who knows the industry you are targeting inside out.. You need partners

- #6: But you did not make any money yet.. you need people who are willing to work for free? Is that possible? Yes; equity.. allow people who believe in your idea & are willing to contribute to share in future revenues.. What do you need is: Persuade people about your idea Make clear how you are going to share profits with them..

- #7: OK, your plan is brilliant.. so your business will generate a lot of pie (profit).. but how are you going to share it with them?

- #8: Well.. 50/50 is fair..

- #9: But it was my idea..

- #10: Hey, but I have much more experience than you. Also, I know this market. You only had the idea. Without me you will have nothing. Hmm..

- #11: Let's assume we agree that we both get 50% of the shares

- #17: Basically you are STUCK.. you agreed on the division of shares.. no way to get out of this.. This is a very complex problem. Both parties will have arguments why their share should be bigger.. And we don't have a Crystal ball.. I saw this go wrong in my own business and in the businesses of friends. This is so difficult..

- #18: Perhaps it is better to do it myself.. ?? NOT a good idea. There is a rather big chance that you are NOT superman; not the best sales man, marketing man, software developer, people manager in the world.. Collaboration is good to compensate for your weaker points, make use of connections, get advise from experienced business men, etc, etc.. BUT, I cannot pay them & I don't know how many shares I should give them..

- #19: Today I will show you a fair and effective way to divide the pie. Why is this so VERY important? Because it will stimulate you to engage in partnerships, seek help from others and create synergy.. like Jobs & Wozniak at Apple, Allen & Gates at Microsoft, Page & Brin at Google Don't be discouraged, dividing the pie in a fair & effective way is much easier than you may think.

- #20: I had the same problem in my latest project. Four people; 2 accountants & 2 IT people want to start a new business.. but we first need a prototype and test our ideas & our market before we are going to make any money.. OK, we need equity.. but HOW are we going to divide the pie later on?? This is how & when I found a book from Mike Moyer. He is a serial entrepreneur and found a great way to split equity among start-up members..

- #28: This does not have to be the leader of your new business or the founder.. this is just a person who you all trust.

- #29: There are many things a start up needs, for example .. time, work captital, relations, office space, make expenses, capital, etc.. These contributions needed for your start-up or project need to be assigned a value as early as possible..

- #30: Annual salary => you do not get a salary.. but you hope to be compensated later.. This is a risk, that's why you need to put a markup on your salary => * 2

- #31: Example

- #39: Total Theoretical Value: sum of all contributions Mr A: hours Mr B: hours (at a higher rate) & equipment Mr C: investment Contribution of Mr A is 2 mln on a total theoretical contribution to the company of 34 mln = 6%

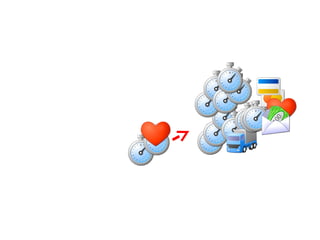

- #48: Mr D has a 4 million sales * 10% * 2

- #52: If you have a brilliant idea & decide you are going to pursue it.. unless your dream is to become a street musician there is a fairly big chance that finding 1 or more partners who can bring something extra to the table is be a good idea. Even if you do not make money to pay them yet, you may be able to a) convince them of the brilliance of your idea & b) explain to them how their efforts will be rewarded.. If you need any help with b).. go out and buy this book. You may also contact me and ask about my experiences with the methods described in here. Before you know it, you might be targeting Google for a hostile take over...