Mobile.Broadband Maurice.Patrick 101012

- 1. Equity Research Maurice Patrick +44 (0)20 3134 3622 maurice.patrick@barclays .com Barclays, London European Telecom Services Can Anyone Ever Make Money From Mobile Broadband? October 2012 Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. This research report has been prepared in whole or in part by equity research analysts based outside the US who are not registered/qualified as research analysts with FINRA. PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 14.

- 2. Barclays themes ? Beating GDP and deflation ? Fooled by Smartphones ? Watch out for the data MVNOs 2 October 2012

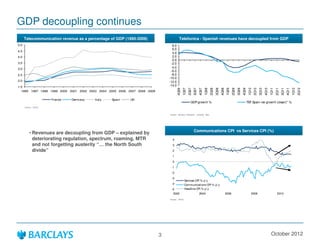

- 3. GDP decoupling continues Telecommunication revenue as a percentage of GDP (1995-2009) Telefonica - Spanish revenues have decoupled from GDP 5.0 8.0 6.0 4.5 4.0 4.0 2.0 0.0 3.5 -2.0 3.0 -4.0 -6.0 2.5 -8.0 -10.0 2.0 -12.0 1.5 -14.0 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12 1995 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 France Germany Italy Spain UK GDP growth % TEF Spain rev growth (clean)* % Source: OECD Source: Barclays Research, company data Communications CPI vs Services CPI (%) ? Revenues are decoupling from GDP ¨C explained by deteriorating regulation, spectrum, roaming, MTR 4 and not forgetting austerity ˇ°ˇ the North South 3 divideˇ± 2 1 0 -1 -2 -3 Services CPI % y/ y -4 Communications CPI % y/ y -5 Headline CPI % y/ y 2002 2004 2006 2008 2010 Source: OECD 3 October 2012

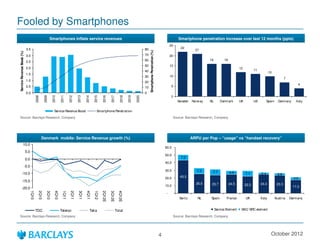

- 4. Fooled by Smartphones Smartphones inflate service revenues Smartphone penetration increase over last 12 months (ppts) 25 3.5 80 22 21 Smartphone Penetration (%) Service Revenue Boost (%) 3.0 70 20 60 16 16 2.5 50 15 2.0 12 40 11 10 1.5 30 10 7 1.0 20 4 0.5 10 5 0.0 0 0 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Sw eden Norw ay NL Denmark UK US Spain Germany Italy Service Revenue Boost Smartphone Penetration Source: Barclays Research, Company Source: Barclays Research, Company Denmark mobile: Service Revenue growth (%) ARPU per Pop ¨C ˇ°usageˇ± vs ˇ°handset recoveryˇ± 10.0 60.0 5.0 50.0 7.3 0.0 40.0 -5.0 30.0 7.3 7.7 -10.0 4.9 7.1 2.4 2.8 20.0 43.2 3.6 -15.0 25.5 23.7 24.5 22.2 24.4 23.3 10.0 17.3 -20.0 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 1Q12 2Q12E 3Q12E 4Q12E - Sw itz NL Spain France UK Italy Austria Germany TDC Telenor Telia Total Service Element SAC/ SRC element Source: Barclays Research, Company Source: Barclays Research, Company 4 October 2012

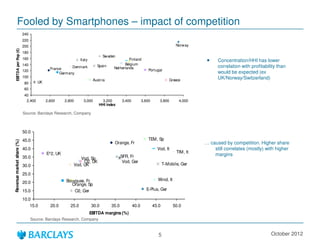

- 5. Fooled by Smartphones ¨C impact of competition 240 220 200 Norway EBITDA per Pop (€) 180 Sweden 160 Italy Finland Concentration/HHI has lower 140 Belgium France Denmark Spain Netherlands correlation with profitability than 120 Portugal Germany would be expected (ex 100 UK/Norway/Switzerland) Austria Greece 80 UK 60 40 2,400 2,600 2,800 3,000 3,200 3,400 3,600 3,800 4,000 HHI index Source: Barclays Research, Company 50.0 45.0 TEM, Sp Revenue market share (%) Orange, Fr ˇ caused by competition. Higher share 40.0 Vod, It still correlates (mostly) with higher E^2, UK TIM, It SFR, Fr margins 35.0 Vod, Sp O2, UK Vod, Ger 30.0 Vod, UK T-Mobile, Ger 25.0 Bouygues, Fr Wind, It 20.0 Orange, Sp 15.0 O2, Ger E-Plus, Ger 10.0 15.0 20.0 25.0 30.0 35.0 40.0 45.0 50.0 EBITDA margins (%) Source: Barclays Research, Company 5 October 2012

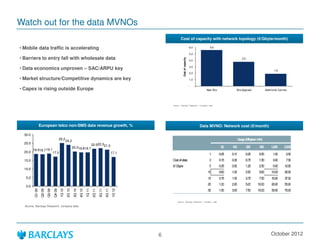

- 6. Watch out for the data MVNOs Cost of capacity with network topology (€/Gbyte/month) ? Mobile data traffic is accelerating 6.0 5.6 5.0 ? Barriers to entry fall with wholesale data Cost of capacity 3.8 4.0 3.0 ? Data economics unproven ¨C SAC/ARPU key 1.9 2.0 ? Market structure/Competitive dynamics are key 1.0 - ? Capex is rising outside Europe New Site Site Upgrade Additional Carriers Source: Barclays Research, Company data European telco non-SMS data revenue growth, % Data MVNO: Network cost (€/month) 30.0 25.2 Usage (Mbytes/ mth) 24.2 25.0 22.022.321.3 20.319.819.7 50 100 250 500 1,000 2,500 18.918.7 19.1 20.0 17.3 17.1 1 0.05 0.10 0.25 0.50 1.00 2.50 15.0 C of data ost 3 0.15 0.30 0.75 1.50 3.00 7.50 €/ Gbyte 5 0.25 0.50 1.25 2.50 5.00 12.50 10.0 10 0.50 1.00 2.50 5.00 10.00 25.00 5.0 15 0.75 1.50 3.75 7.50 15.00 37.50 20 1.00 2.00 5.00 10.00 20.00 50.00 0.0 Q1 09 Q2 09 Q3 09 Q4 09 1Q 10 2Q 10 3Q 10 4Q 10 1Q 11 2Q 11 3Q 11 4Q 11 1Q 12 30 1.50 3.00 7.50 15.00 30.00 75.00 Source: Barclays Research, Company data Source: Barclays Research, company data 6 October 2012

- 7. Analyst Certifications and Important Disclosures Analyst Certification: We, Michael Bishop, Jonathan Dann, San Dhillon, JP Davids, CFA and Maurice Patrick, hereby certify (1) that the views expressed in this research report accurately reflect our personal views about any or all of the subject securities or issuers referred to in this research report and (2) no part of our compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed in this research report. Important Disclosures: Barclays Capital Inc. and/or one of its affiliates does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. The analysts responsible for preparing this research report have received compensation based upon various factors including the firm's total revenues, a portion of which is generated by investment banking activities. This research report has been prepared in whole or in part by equity research analysts based outside the US who are not registered/qualified as research analysts with FINRA. Research analysts employed outside the US by affiliates of Barclays Capital Inc. are not registered/qualified as research analysts with FINRA. These analysts may not be associated persons of the member firm and therefore may not be subject to NASD Rule 2711 and incorporated NYSE Rule 472 restrictions on communications with a subject company, public appearances and trading securities held by a research analystˇŻs account. Barclays Research is a part of the Corporate and Investment Banking division of Barclays Bank PLC and its affiliates (collectively and each individually, "Barclays"). For current important disclosures regarding companies that are the subject of this research report, please send a written request to: Barclays Research Compliance, 745 Seventh Avenue, 17th Floor, New York, NY 10019 or refer to http://publicresearch.barcap.com or call 212-526-1072. Analysts regularly conduct site visits to view the material operations of covered companies, but Barclays policy prohibits them from accepting payment or reimbursement by any covered company of their travel expenses for such visits. In order to access Barclays Statement regarding Research Dissemination Policies and Procedures, please refer to https://live.barcap.com/publiccp/RSR/nyfipubs/disclaimer/disclaimer-research-dissemination.html. The Corporate and Investment Banking division of Barclays produces a variety of research products including, but not limited to, fundamental analysis, equity- linked analysis, quantitative analysis, and trade ideas. Recommendations contained in one type of research product may differ from recommendations contained in other types of research products, whether as a result of differing time horizons, methodologies, or otherwise. Guide to the Barclays Fundamental Equity Research Rating System: Our coverage analysts use a relative rating system in which they rate stocks as Overweight, Equal Weight or Underweight (see definitions below) relative to other companies covered by the analyst or a team of analysts that are deemed to be in the same industry (ˇ°the industry coverage universeˇ±). To see a list of companies that comprise a particular industry coverage universe, please go to http://publicresearch.barcap.com. In addition to the stock rating, we provide industry views which rate the outlook for the industry coverage universe as Positive, Neutral or Negative (see definitions below). A rating system using terms such as buy, hold and sell is not the equivalent of our rating system. Investors should carefully read the entire research report including the definitions of all ratings and not infer its contents from ratings alone. 7 October 2012

- 8. Disclaimer Stock Rating Overweight - The stock is expected to outperform the unweighted expected total return of the industry coverage universe over a 12-month investment horizon. Equal Weight - The stock is expected to perform in line with the unweighted expected total return of the industry coverage universe over a 12-month investment horizon. Underweight - The stock is expected to underperform the unweighted expected total return of the industry coverage universe over a 12-month investment horizon. Rating Suspended - The rating and target price have been suspended temporarily due to market events that made coverage impracticable or to comply with applicable regulations and/or firm policies in certain circumstances including where the Corporate and Investment Banking Division of Barclays is acting in an advisory capacity in a merger or strategic transaction involving the company. Industry View Positive - industry coverage universe fundamentals/valuations are improving. Neutral - industry coverage universe fundamentals/valuations are steady, neither improving nor deteriorating. Negative - industry coverage universe fundamentals/valuations are deteriorating. Distribution of Ratings: Barclays Equity Research has 2487 companies under coverage. 42% have been assigned an Overweight rating which, for purposes of mandatory regulatory disclosures, is classified as a Buy rating; 54% of companies with this rating are investment banking clients of the Firm. 42% have been assigned an Equal Weight rating which, for purposes of mandatory regulatory disclosures, is classified as a Hold rating; 47% of companies with this rating are investment banking clients of the Firm. 13% have been assigned an Underweight rating which, for purposes of mandatory regulatory disclosures, is classified as a Sell rating; 41% of companies with this rating are investment banking clients of the Firm. Guide to the Barclays Research Price Target: Each analyst has a single price target on the stocks that they cover. The price target represents that analyst's expectation of where the stock will trade in the next 12 months. Upside/downside scenarios, where provided, represent potential upside/potential downside to each analyst's price target over the same 12-month period. Barclays offices involved in the production of equity research: London Barclays Bank PLC (Barclays, London) New York Barclays Capital Inc. (BCI, New York) 8 October 2012

- 9. Important Disclosures (continued) Tokyo Barclays Securities Japan Limited (BSJL, Tokyo) S?o Paulo Banco Barclays S.A. (BBSA, S?o Paulo) Hong Kong Barclays Bank PLC, Hong Kong branch (Barclays Bank, Hong Kong) Toronto Barclays Capital Canada Inc. (BCCI, Toronto) Johannesburg Absa Capital, a division of Absa Bank Limited (Absa Capital, Johannesburg) Mexico City Barclays Bank Mexico, S.A. (BBMX, Mexico City) Taiwan Barclays Capital Securities Taiwan Limited (BCSTW, Taiwan) Seoul Barclays Capital Securities Limited (BCSL, Seoul) Mumbai Barclays Securities (India) Private Limited (BSIPL, Mumbai) Singapore Barclays Bank PLC, Singapore branch (Barclays Bank, Singapore) 9 October 2012

- 10. Important Disclosures (continued) Disclaimer: This publication has been prepared by the Corporate and Investment Banking division of Barclays Bank PLC and/or one or more of its affiliates (collectively and each individually, "Barclays"). It has been issued by one or more Barclays legal entities within its Corporate and Investment Banking division as provided below. It is provided to our clients for information purposes only, and Barclays makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to any data included in this publication. Barclays will not treat unauthorized recipients of this report as its clients. Prices shown are indicative and Barclays is not offering to buy or sell or soliciting offers to buy or sell any financial instrument. Without limiting any of the foregoing and to the extent permitted by law, in no event shall Barclays, nor any affiliate, nor any of their respective officers, directors, partners, or employees have any liability for (a) any special, punitive, indirect, or consequential damages; or (b) any lost profits, lost revenue, loss of anticipated savings or loss of opportunity or other financial loss, even if notified of the possibility of such damages, arising from any use of this publication or its contents. Other than disclosures relating to Barclays, the information contained in this publication has been obtained from sources that Barclays Research believes to be reliable, but Barclays does not represent or warrant that it is accurate or complete. Barclays is not responsible for, and makes no warranties whatsoever as to, the content of any third-party web site accessed via a hyperlink in this publication and such information is not incorporated by reference. The views in this publication are those of the author(s) and are subject to change, and Barclays has no obligation to update its opinions or the information in this publication. The analyst recommendations in this publication reflect solely and exclusively those of the author(s), and such opinions were prepared independently of any other interests, including those of Barclays and/or its affiliates. This publication does not constitute personal investment advice or take into account the individual financial circumstances or objectives of the clients who receive it. The securities discussed herein may not be suitable for all investors. Barclays recommends that investors independently evaluate each issuer, security or instrument discussed herein and consult any independent advisors they believe necessary. The value of and income from any investment may fluctuate from day to day as a result of changes in relevant economic markets (including changes in market liquidity). The information herein is not intended to predict actual results, which may differ substantially from those reflected. Past performance is not necessarily indicative of future results. This communication is being made available in the UK and Europe primarily to persons who are investment professionals as that term is defined in Article 19 of the Financial Services and Markets Act 2000 (Financial Promotion Order) 2005. It is directed at, and therefore should only be relied upon by, persons who have professional experience in matters relating to investments. The investments to which it relates are available only to such persons and will be entered into only with such persons. Barclays Bank PLC is authorised and regulated by the Financial Services Authority ("FSA") and a member of the London Stock Exchange. The Corporate and Investment Banking division of Barclays undertakes U.S. securities business in the name of its wholly owned subsidiary Barclays Capital Inc., a FINRA and SIPC member. Barclays Capital Inc., a U.S. registered broker/dealer, is distributing this material in the United States and, in connection therewith accepts responsibility for its contents. Any U.S. person wishing to effect a transaction in any security discussed herein should do so only by contacting a representative of Barclays Capital Inc. in the U.S. at 745 Seventh Avenue, New York, New York 10019. Non-U.S. persons should contact and execute transactions through a Barclays Bank PLC branch or affiliate in their home jurisdiction unless local regulations permit otherwise. 10 October 2012

- 11. Important Disclosures (continued) Barclays Bank PLC, Paris Branch (registered in France under Paris RCS number 381 066 281) is regulated by the Autorit¨¦ des march¨¦s financiers and the Autorit¨¦ de contr?le prudentiel. Registered office 34/36 Avenue de Friedland 75008 Paris. This material is distributed in Canada by Barclays Capital Canada Inc., a registered investment dealer and member of IIROC (www.iiroc.ca). Subject to the conditions of this publication as set out above, Absa Capital, the Investment Banking Division of Absa Bank Limited, an authorised financial services provider (Registration No.: 1986/004794/06. Registered Credit Provider Reg No NCRCP7), is distributing this material in South Africa. Absa Bank Limited is regulated by the South African Reserve Bank. This publication is not, nor is it intended to be, advice as defined and/or contemplated in the (South African) Financial Advisory and Intermediary Services Act, 37 of 2002, or any other financial, investment, trading, tax, legal, accounting, retirement, actuarial or other professional advice or service whatsoever. Any South African person or entity wishing to effect a transaction in any security discussed herein should do so only by contacting a representative of Absa Capital in South Africa, 15 Alice Lane, Sandton, Johannesburg, Gauteng 2196. Absa Capital is an affiliate of Barclays. In Japan, foreign exchange research reports are prepared and distributed by Barclays Bank PLC Tokyo Branch. Other research reports are distributed to institutional investors in Japan by Barclays Securities Japan Limited. Barclays Securities Japan Limited is a joint-stock company incorporated in Japan with registered office of 6-10-1 Roppongi, Minato-ku, Tokyo 106-6131, Japan. It is a subsidiary of Barclays Bank PLC and a registered financial instruments firm regulated by the Financial Services Agency of Japan. Registered Number: Kanto Zaimukyokucho (kinsho) No. 143. Barclays Bank PLC, Hong Kong Branch is distributing this material in Hong Kong as an authorised institution regulated by the Hong Kong Monetary Authority. Registered Office: 41/F, Cheung Kong Center, 2 Queen's Road Central, Hong Kong. This material is issued in Taiwan by Barclays Capital Securities Taiwan Limited. This material on securities not traded in Taiwan is not to be construed as 'recommendation' in Taiwan. Barclays Capital Securities Taiwan Limited does not accept orders from clients to trade in such securities. This material may not be distributed to the public media or used by the public media without prior written consent of Barclays. This material is distributed in South Korea by Barclays Capital Securities Limited, Seoul Branch. All equity research material is distributed in India by Barclays Securities (India) Private Limited (SEBI Registration No: INB/INF 231292732 (NSE), INB/INF 011292738 (BSE), Registered Office: 208 | Ceejay House | Dr. Annie Besant Road | Shivsagar Estate | Worli | Mumbai - 400 018 | India, Phone: + 91 22 67196363). Other research reports are distributed in India by Barclays Bank PLC, India Branch. Barclays Bank PLC Frankfurt Branch distributes this material in Germany under the supervision of Bundesanstalt f¨ąr Finanzdienstleistungsaufsicht (BaFin). This material is distributed in Malaysia by Barclays Capital Markets Malaysia Sdn Bhd. This material is distributed in Brazil by Banco Barclays S.A. This material is distributed in Mexico by Barclays Bank Mexico, S.A. Barclays Bank PLC in the Dubai International Financial Centre (Registered No. 0060) is regulated by the Dubai Financial Services Authority (DFSA). Principal place of business in the Dubai International Financial Centre: The Gate Village, Building 4, Level 4, PO Box 506504, Dubai, United Arab Emirates. Barclays Bank PLC-DIFC Branch, may only undertake the financial services activities that fall within the scope of its existing DFSA licence. Related financial products or services are only available to Professional Clients, as defined by the Dubai Financial Services Authority. 11 October 2012

- 12. Important Disclosures (continued) Barclays Bank PLC in the UAE is regulated by the Central Bank of the UAE and is licensed to conduct business activities as a branch of a commercial bank incorporated outside the UAE in Dubai (Licence No.: 13/1844/2008, Registered Office: Building No. 6, Burj Dubai Business Hub, Sheikh Zayed Road, Dubai City) and Abu Dhabi (Licence No.: 13/952/2008, Registered Office: Al Jazira Towers, Hamdan Street, PO Box 2734, Abu Dhabi). Barclays Bank PLC in the Qatar Financial Centre (Registered No. 00018) is authorised by the Qatar Financial Centre Regulatory Authority (QFCRA). Barclays Bank PLC-QFC Branch may only undertake the regulated activities that fall within the scope of its existing QFCRA licence. Principal place of business in Qatar: Qatar Financial Centre, Office 1002, 10th Floor, QFC Tower, Diplomatic Area, West Bay, PO Box 15891, Doha, Qatar. Related financial products or services are only available to Business Customers as defined by the Qatar Financial Centre Regulatory Authority. This material is distributed in the UAE (including the Dubai International Financial Centre) and Qatar by Barclays Bank PLC. This material is distributed in Saudi Arabia by Barclays Saudi Arabia ('BSA'). It is not the intention of the publication to be used or deemed as recommendation, option or advice for any action (s) that may take place in future. Barclays Saudi Arabia is a Closed Joint Stock Company, (CMA License No. 09141-37). Registered office Al Faisaliah Tower, Level 18, Riyadh 11311, Kingdom of Saudi Arabia. Authorised and regulated by the Capital Market Authority, Commercial Registration Number: 1010283024. This material is distributed in Russia by OOO Barclays Capital, affiliated company of Barclays Bank PLC, registered and regulated in Russia by the FSFM. Broker License #177-11850-100000; Dealer License #177-11855-010000. Registered address in Russia: 125047 Moscow, 1st Tverskaya-Yamskaya str. 21. This material is distributed in Singapore by the Singapore branch of Barclays Bank PLC, a bank licensed in Singapore by the Monetary Authority of Singapore. For matters in connection with this report, recipients in Singapore may contact the Singapore branch of Barclays Bank PLC, whose registered address is One Raffles Quay Level 28, South Tower, Singapore 048583. Barclays Bank PLC, Australia Branch (ARBN 062 449 585, AFSL 246617) is distributing this material in Australia. It is directed at 'wholesale clients' as defined by Australian Corporations Act 2001. IRS Circular 230 Prepared Materials Disclaimer: Barclays does not provide tax advice and nothing contained herein should be construed to be tax advice. Please be advised that any discussion of U.S. tax matters contained herein (including any attachments) (i) is not intended or written to be used, and cannot be used, by you for the purpose of avoiding U.S. tax-related penalties; and (ii) was written to support the promotion or marketing of the transactions or other matters addressed herein. Accordingly, you should seek advice based on your particular circumstances from an independent tax advisor. ? Copyright Barclays Bank PLC (2012). All rights reserved. No part of this publication may be reproduced in any manner without the prior written permission of Barclays. Barclays Bank PLC is registered in England No. 1026167. Registered office 1 Churchill Place, London, E14 5HP. Additional information regarding this publication will be furnished upon request 12 October 2012