Monetising Mobile 2: Wireless Expertise

- 1. Statistical Overview of the Indian Telecoms & Value Added Services Market Anuj Khanna , CEO, Wireless Expertise Monetising Mobile Conference, London, September 2010

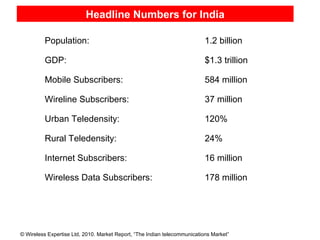

- 2. Population: 1.2 billion GDP: $1.3 trillion Mobile Subscribers: 584 million Wireline Subscribers: 37 million Urban Teledensity: 120% Rural Teledensity: 24% Internet Subscribers: 16 million Wireless Data Subscribers: 178 million Headline Numbers for India

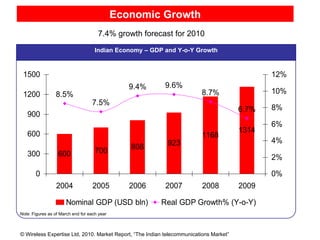

- 3. Economic Growth Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) 7.4% growth forecast for 2010 Indian Economy ŌĆō GDP and Y-o-Y Growth Note : Figures as of March end for each year

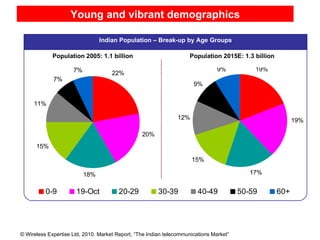

- 4. Young and vibrant demographics Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Indian Population ŌĆō Break-up by Age Groups Population 2005: 1.1 billion Population 2015E: 1.3 billion

- 5. Mobile Subscriber Growth Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) 20 million new subscribers being added every month Indian Mobile Market - Subscribers and Y-o-Y Growth Note : All figures as of March end for each year

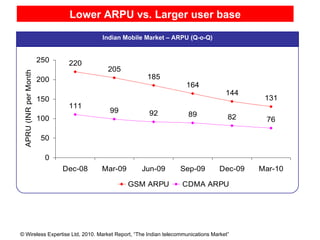

- 6. Lower ARPU vs. Larger user base Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Indian Mobile Market ŌĆō ARPU (Q-o-Q)

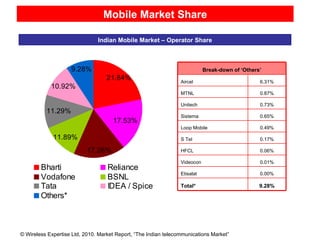

- 7. Mobile Market Share Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Indian Mobile Market ŌĆō Operator Share Note*: Total does not match due to rounding-off Note*: Total does not match due to rounding-off 0.73% Unitech 0.65% Sistema Break-down of ŌĆśOthersŌĆÖ Aircel 6.31% MTNL 0.87% Loop Mobile 0.49% S Tel 0.17% HFCL 0.06% Videocon 0.01% Etisalat 0.00% Total* 9.28%

- 8. Indian film content drives mobile entertainment Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Note*: Total does not match due to rounding-off Note*: Total does not match due to rounding-off Ringtones Ringbacktones Images Animations Competitions Trvia Games Videos

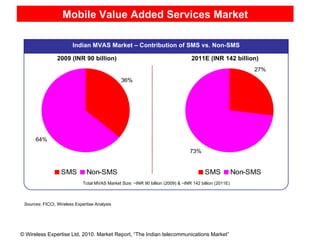

- 9. Mobile Value Added Services Market Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Note*: Total does not match due to rounding-off Note*: Total does not match due to rounding-off Indian MVAS Market ŌĆō Contribution of SMS vs. Non-SMS 2009 (INR 90 billion) 2011E (INR 142 billion) Total MVAS Market Size: ~INR 90 billion (2009) & ~INR 142 billion (2011E) Sources : FICCI, Wireless Expertise Analysis

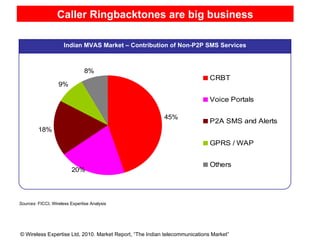

- 10. Caller Ringbacktones are big business Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Note*: Total does not match due to rounding-off Note*: Total does not match due to rounding-off Indian MVAS Market ŌĆō Contribution of Non-P2P SMS Services Sources : FICCI, Wireless Expertise Analysis

- 11. Reality TV drives premium message volumes Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Note*: Total does not match due to rounding-off Note*: Total does not match due to rounding-off IndiaŌĆÖs version of who wants to be a millionaire Big Boss/Brother

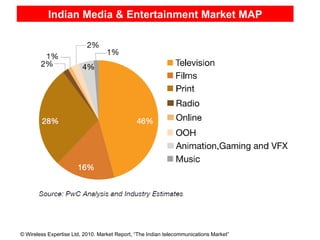

- 12. Indian Media & Entertainment Market MAP Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Note*: Total does not match due to rounding-off Note*: Total does not match due to rounding-off

- 13. Opportunities in India Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Note*: Total does not match due to rounding-off Note*: Total does not match due to rounding-off Large urban high spending user base Growing rural subscriber base Nascent value added services market with a lot of growth opportunities. Young demographics Appetite to partner with western firms who bring in a unique product which can drive volumes. Easy to communicate, English is a commonly used business language in the cities. Consumer demand for basic goods and services is still growing. Large majority of consumers have skipped legacy fixed line services and directly using mobile phones as their main channels of communications. Developing digital media and entertainment industry.

- 14. Advice for entering into the Indian Market Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Sources : TRAI, Federation of Indian Chambers of Commerce and Industry (FICCI) Note*: Total does not match due to rounding-off Note*: Total does not match due to rounding-off 1. Think Big You require volume, scale and a mass market proposition. 2. Visit India Meet the operators, content license owners, aggregators, media houses and platform providers. Think global and act local Localise and customise your product / business model for India. Tweak your pricing strategy to match the Indian consumers buying power. 4. Test the waters Invest a little to test the market. Consider local partnerships 5. India is India Do not compare it with Brazil, China, Europe or anywhere else. Have a long term strategy and be patient.

- 15. Anuj Khanna, Mobile: +44 7916 056 916 Email: [email_address] www.wirelessexpertise.com

![Anuj Khanna, Mobile: +44 7916 056 916 Email: [email_address] www.wirelessexpertise.com](https://image.slidesharecdn.com/monetisingmobile2-wirelessexpertise-101020032717-phpapp02/85/Monetising-Mobile-2-Wireless-Expertise-15-320.jpg)