Norsk produksjon av laks - Carl-Erik Arnesen - Produksjonsutvalget FHL

- 1. Produksjonssituasjonen for laksefisk i Norge Carl-Erik Arnesen Produksjonsforumet, FHL

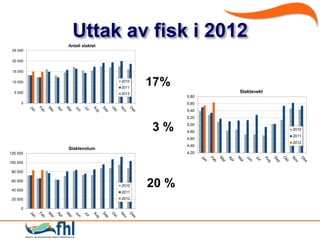

- 4. Uttak av fisk i 2012 Antall slaktet 25 000 20 000 15 000 10 000 2010 2011 17% 5 000 2012 Slaktevekt 5,80 0 5,60 5,40 5,20 3% 5,00 4,80 2010 2011 4,60 2012 4,40 Slaktevolum 120 000 4,20 100 000 80 000 60 000 40 000 2010 20 % 2011 20 000 2012 0

- 5. Slaktevekt 5,30 Snitt 2001 - 2011 2010 2011 5,10 2012 4,90 Snitt slaktevekt (sl├Ėyd vekt) 4,70 4,50 4,30 4,10 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51 Uke

- 6. Uttak av mars Eksport i mars: 102 000 tonn (+ 35 %) Totalt eksportkvantum laks Kilde: SSB, EFF 35 000 30 000 Totalt eksportkvantum (tonn rund vekt) 25 000 20 000 15 000 2010 10 000 2011 5 000 2012 - 1 6 11 16 21 26 31 36 41 46 51 Uke

- 7. Produksjonssituasjonen - unike temperaturer 16 Gjennomsnittstemperatur (┬░C) 14 12 10 8 6 Snitt 2007-2011 4 2010 2011 2 2012 0 Jan Feb Mar Apr Mai Jun Jul Aug Sep Okt Nov Des M├źned 7 6 5 2009 4 2010 2011 3 2012 2 1 0

- 8. Produksjon 200 000 180 000 160 000 140 000 F├┤rbruk (1000 kg) 120 000 2009 100 000 2010 80 000 2011 60 000 40 000 20 000 0 Jan Feb Mar Apr Mai Jun Jul Aug Sep Okt Nov Des

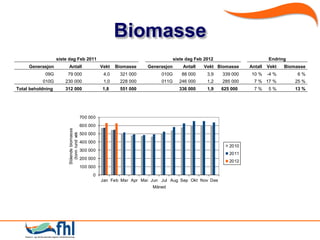

- 9. Biomasse siste dag Feb 2011 siste dag Feb 2012 Endring Generasjon Antall Vekt Biomasse Generasjon Antall Vekt Biomasse Antall Vekt Biomasse 09G 79 000 4,0 321 000 010G 88 000 3,9 339 000 10 % -4 % 6% 010G 230 000 1,0 228 000 011G 246 000 1,2 285 000 7 % 17 % 25 % Total beholdning 312 000 1,8 551 000 336 000 1,9 625 000 7% 5% 13 % 700 000 600 000 St├źende biomasse (tonn rund vek 500 000 400 000 2010 300 000 2011 200 000 2012 100 000 0 Jan Feb Mar Apr Mai Jun Jul Aug Sep Okt Nov Des M├źned

- 10. Forventning til uttak 2012 - per ├źrskifte ’ā╝ V├źr : +5 % i uttak av antall laks ’ā╝H├Ėst : + 8% i uttak av antall laks ’ā╝Totalt: ├Ėkning p├ź 7 % ’ā╝Forutsetter ingen endring i slaktevekt: Slaktekvantum p├ź 1 105 000 tonn (+ 75 000 tonn)

- 11. Forventninger fremover ’ā╝Effekt av god tilvekst ’ā╝├śkt slaktevekt ’ā╝H├Ėyere gjennomsnittsvekt ’ā╝Tidligere uttak ’ā╝Redusert antall slaktet -> forskyvning frem i tid -> ytterligere bidrag til ├Ėkt slaktevekt ’ā╝M├Ėnster for uttak ’ā╝Forventer et ├Ėkt uttak 1. halv├źr ’ā╝Uendret/noe ├Ėkt uttak 2. halv├źr

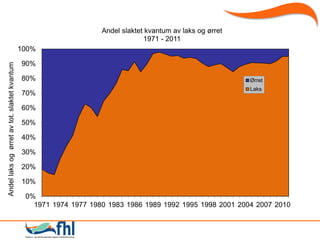

- 13. Andel slaktet kvantum av laks og ├Ė░∙░∙▒│┘ 1971 - 2011 100% 90% Andel laks og ├Ė░∙░∙▒│┘ av tot. slaktet kvantum 80% ├śrret Laks 70% 60% 50% 40% 30% 20% 10% 0% 1971 1974 1977 1980 1983 1986 1989 1992 1995 1998 2001 2004 2007 2010

- 14. Status Regnbue├Ė░∙░∙▒│┘en i Norge ’ā╝Tradisjonelt store variasjoner i produksjon ’ā╝F├”rre som hopper mellom laks og ├Ė░∙░∙▒│┘ ’ā╝F├”rre som driver med ├Ė░∙░∙▒│┘ ’ā╝Gjennomg├źende h├Ėyere priser ’ā╝Utfordring ├ź drive med markedsarbeid med en lavere produksjon

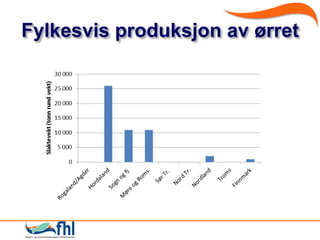

- 15. Fylkesvis produksjon av ├Ė░∙░∙▒│┘

- 16. ▒╩░∙Š▒▓§▓įŠ▒▒╣├ź Pris fersk ├Ė░∙░∙▒│┘ 55.00 50.00 45.00 FOB kr/kg 40.00 35.00 2010 30.00 2011 25.00 2012 20.00 15.00 1 6 11 16 21 26 31 36 41 46 51 Uke

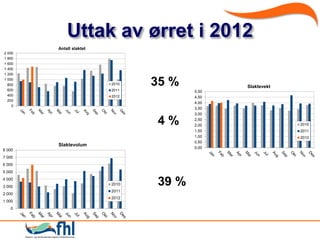

- 17. Uttak av ├Ė░∙░∙▒│┘ i 2012 Antall slaktet 2 000 1 800 1 600 1 400 1 200 1 000 800 600 2010 2011 35 % Slaktevekt 5,00 400 2012 4,50 200 4,00 0 3,50 3,00 4% 2,50 2,00 2010 1,50 2011 1,00 2012 0,50 Slaktevolum 0,00 8 000 7 000 6 000 5 000 4 000 3 000 2010 39 % 2011 2 000 2012 1 000 0

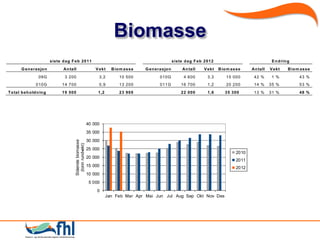

- 18. Biomasse siste d ag F eb 2011 siste d ag F eb 2012 E n d rin g G en erasjo n An tall V ekt B io m asse G en erasjo n An tall V ekt B io m asse An tall V ekt B io m asse 09G 3 200 3,2 10 500 010G 4 600 3,3 15 000 42 % 1 % 43 % 010G 14 700 0,9 13 200 011G 16 700 1,2 20 200 14 % 35 % 53 % To tal b eh o ld n in g 19 500 1,2 23 900 22 000 1,6 35 300 13 % 31 % 48 % 40 000 35 000 30 000 St├źende biomasse (tonn rundvekt) 25 000 2010 20 000 2011 15 000 2012 10 000 5 000 0 Jan Feb Mar Apr Mai Jun Jul Aug Sep Okt Nov Des

- 19. Forventninger fremover ’ā╝Rogninnlegg 2011 = 2012 = 35 mill ’ā╝Forventer at uttaket flater ut ’ā╝├śkning i uttaket fra ’ā╝50 000 tonn i 2011 ’ā╝ca. 63 000 tonn i 2012

- 20. Produksjonsmessige utfordringer ’ā╝Lakselus ’ā╝PD ’ā╝Politisk vilje til ├ź tilrettelegge for vekst

- 21. Carl-Erik Arnesen Firda Seafood / FHL