Poster - EMS Doctoral Consortium - Luis Almanza - Insights from non-financial factors.pdf

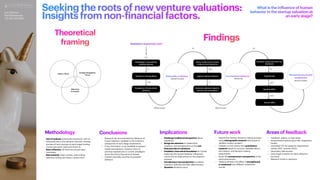

- 1. What is the in f luence of human behavior in the startup valuation at an early stage? Seeking the roots of new venture valuations: Insights from non- f inancial factors. Findings Theoretical framing Methodology Conclusions Implications Future work Unit of analysis: Individuals (investors), with an in f luential role in the valuation decision-making process of tech startups at early-stage funding rounds (pre-seed, seed and Series A) Data collection: 58 Semi-structured open interviews. Data analysis: Open coding, axial coding, selective coding and theory construction ? Research has documented the in f luence of human behavior variables in the investor's perspective at early-stage investments. ? If the information is not available to support model assumptions, investors recur to previous experiences or current paradigms about the future (heuristics & biases). ? Limited rationality and the inconsistent behavior. ? Challenge traditional perspective about valuations. ? Brings the attention of researchers, investors, and entrepreneurs to the non- f inancial side of valuations. ? Establish a theoretical foundation for further exploring this human behavior in f luence's nature and its implications on the valuation process. ? Introducing a new perspective to explore valuation methods and their e ff ectiveness. ? Question dictation voice. ? Explore the investor decision-making process using ethnographic research techniques to validate investor answers. ? Validate current claims with quantitative research based on surveys, available data in the industry, and decision-making experiments. ? Study the entrepreneur's perspective of the same phenomena. ? Observe whether the e ff ect is strengthened or weakened over di ff erent investment rounds. Luis Almanza lma77@case.edu +52 444 510 9619 Areas of feedback ? Feedback, advice, or new ideas. ? Dissemination options (journals, magazines, books). ? Interested VCs for behavior experiments (winter 2021, summer 2022). ? Secondary data access. ? Early-stage investors for data collection (surveys). ? Research funds or sponsors.