Depository system.pptx FOR BBA AND MBA STUDENTS

Download as PPTX, PDF0 likes3 views

Depository system HISTORY MEANING Depositories in India REGULATION Types of depositories Functions of a depository Importance of the depository system

1 of 13

Download to read offline

Recommended

Depositories Act Presentation.pptx

Depositories Act Presentation.pptxvikas118186

╠²

The document discusses the Depositories Act in India. It provides a legal framework for the establishment of depositories to help investors buy and sell securities electronically. Before depositories, investors faced issues with paper certificates like bad deliveries, losses, and delays. Depositories now allow electronic trading and transfer of securities, eliminating paperwork. National Securities Depository Limited and Central Depository Services (India) Limited are the two depositories that maintain electronic records of shares and debt instruments in India. Depository participants act as intermediaries between depositories and investors.SU Ch2 M.Sc AcFn551 FMI 2022 sem2 Depository Financial Institution.pptx

SU Ch2 M.Sc AcFn551 FMI 2022 sem2 Depository Financial Institution.pptxProfDrAnbalaganChinn

╠²

This document provides information about depository financial institutions. It defines depository institutions as organizations that accept currency deposits for safekeeping, such as banks and savings associations. The document outlines different types of depository institutions including commercial banks, microfinance institutions, savings banks, and credit unions. It also discusses the importance of financial institutions in mobilizing savings and investments.SU Ch2 M.Sc AcFn551 FMI 2022 sem2 Depository Financial Institution.pptx

SU Ch2 M.Sc AcFn551 FMI 2022 sem2 Depository Financial Institution.pptxProfDrAnbalaganChinn

╠²

This document provides information about depository financial institutions. It defines depository institutions as organizations that accept currency deposits for safekeeping, such as banks and savings associations. The document outlines different types of depository institutions including commercial banks, microfinance institutions, savings banks, and credit unions. It also discusses the importance of financial institutions in mobilizing savings and investments.Depositary partcipent

Depositary partcipentyash nahata

╠²

The document provides information on the depository system in India. It discusses key aspects such as what is a depository participant, the two depositories in India (NSDL and CDSL), how securities are held in dematerialized form through a beneficial owner account with a depository participant, and the processes of dematerialization and rematerialization of securities. The depository system eliminates risks associated with physical certificates and provides various benefits to investors such as convenient transfer of securities and safe custody of holdings.Depository System

Depository Systemjyothi B O

╠²

The document discusses India's depository system. It explains that a depository is an organization that holds securities electronically to facilitate paperless trading. India has two depositories - NSDL and CDSL. The depository system was introduced in 1996 to address issues like bad deliveries, fake certificates, and delays in trading physical shares. It allows investors to dematerialize physical shares and trade shares electronically through a depository participant.Depository system

Depository systemAbdul Khalique

╠²

The document discusses India's depository system for holding securities electronically. A depository holds securities on behalf of investors in electronic form, eliminating problems with physical certificates like fake or lost certificates. There are currently two registered depositories - NSDL and CDSL. Depository participants like banks and brokers interface between investors and the depository. Depositories provide benefits like quick transfers, reduced risks and costs, and faster settlement compared to physical certificates.STOCK MARKET OPERATIONS UNIT V FOR B. COM STUDENTS PPT UNIT V.pptx

STOCK MARKET OPERATIONS UNIT V FOR B. COM STUDENTS PPT UNIT V.pptxKalpana Santhi

╠²

THIS TOPIC DISCUSSED THE FINANCIAL INTERMEDIARIES, DERIVATIVE, FUTURE CONTRACT, FORWARD CONTRACT AND BUY BACK OF SHARES ETC.Unit 1 primary market

Unit 1 primary marketDeepika S.R.

╠²

This document provides an overview of financial markets and the primary and secondary markets. It defines financial markets and their role in economic development. It describes the structure of capital markets and the primary and secondary market segments. It outlines the various players in the primary market, including issuers, intermediaries, and investors. It also discusses the various instruments that can be traded in financial markets, including shares, debentures, warrants, IDRs, ADRs, and others.Depositories

DepositoriesVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

╠²

The document discusses India's depository system for electronic trading and settlement of securities. It describes how the earlier physical system was inefficient and led to problems. To address this, the Depositories Act of 1996 was passed to dematerialize securities and facilitate electronic transfers through depositories like NSDL and CDSL (National Securities Depository Limited and Central Depository Services Limited). The system aims to make transfers faster, more accurate and secure by maintaining electronic records of ownership rather than physical certificates.Depositories

DepositoriesVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

╠²

The document discusses India's depository system for electronic trading and settlement of securities. It describes how the earlier physical system was inefficient and led to problems. To address this, the Depositories Act of 1996 was passed to dematerialize securities and facilitate electronic transfers through depositories like NSDL and CDSL (National Securities Depository Limited and Central Depository Services Limited). The system aims to make transfers faster, more accurate and secure by maintaining electronic records of ownership rather than physical certificates.Financial services(alok swingh kanpur)

Financial services(alok swingh kanpur)Alok Singh

╠²

The document provides information on various financial services like factoring, leasing, merchant banking, and mutual funds. It defines factoring as the selling of invoices or receivables to a third party for cash, explains the key steps in factoring, and discusses the types and costs/benefits. It defines leasing and distinguishes operating vs financial leases. It defines merchant banking as providing various financial services and outlines their roles. It defines mutual funds as a pool of money from investors that is invested in securities according to the fund's objectives.ITFT - Depository

ITFT - Depositorymmaninderkkaur

╠²

The document discusses India's depository system for securities trading. It defines a depository as an organization that holds securities deposited by others and facilitates exchanges. India adopted an electronic book entry system to replace the paper-based process for trading securities. The key features of India's depository system include a multi-depository structure, depository participants providing services, dematerialization of securities, fungibility of holdings, and free transferability of shares.Depository System

Depository SystemDisha Bhatia

╠²

Meaning, need and benefits of depository system in India, difference between demat and physical share, depository process, functioning of NSDL and SHCIL Importance of Debt market in capital market, participant in the debt market, types of instrument treated in the Debt market, primary and secondary segments of debt market. FINANCIAL INSTITUTIONS & Role In Development In SSIs / MSME Sectors.pptx

FINANCIAL INSTITUTIONS & Role In Development In SSIs / MSME Sectors.pptxkittustudy7

╠²

Financial institutions play an important role in national economies and come in various types. They include central banks that oversee other financial institutions, commercial banks that serve individuals and businesses, and non-banking financial institutions that provide alternative services like investment and brokerage. Other types are credit unions owned by members, investment entities that help organizations raise capital, thrift institutions focused on lending to owners, and insurance companies that protect against financial risks. Overall, financial institutions regulate money supply, provide banking and investment services, offer advice, and help keep economies active.Merchant Banking- My3 Management of Financial services

Merchant Banking- My3 Management of Financial servicesMaithriPRao

╠²

Merchant banking finance Industry , services banking sector Overview of financial services and management

Overview of financial services and managementYogesh Dhoke

╠²

Overview of financial services and management Development of financial institutions in Nepal

Development of financial institutions in NepalPawan Kawan

╠²

Financial institutions play a key role in the economy by facilitating transactions and the flow of money. In Nepal, there are various types of financial institutions that serve different functions:

- Commercial banks accept deposits and provide business loans and basic investment services. Nepal's first commercial bank was Nepal Bank Ltd.

- Development banks like the Nepal Development Bank Limited provide medium and long-term financing to support sectors like industry and agriculture.

- Other financial institutions in Nepal include finance companies, microcredit banks, cooperatives, and non-governmental organizations. As of 2012 there were over 300 registered financial institutions operating in Nepal.Lecture 3 Investment Basics Stock Exchange_ Depository.ppt

Lecture 3 Investment Basics Stock Exchange_ Depository.pptlavkumar420720

╠²

The document defines key terms related to stock exchanges and the process of dematerialization. It explains that a stock exchange is a platform for trading financial instruments and connecting buyers and sellers. Companies must meet listing requirements to trade on an exchange. It also outlines the purpose of exchanges is to raise capital and promote good governance. Additionally, it defines that a depository holds financial securities electronically and a depository participant acts as an intermediary between investors and the depository. The process of dematerialization involves opening a demat account and converting physical shares into electronic form by submitting share certificates to the depository participant.Trading ppt

Trading pptVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

╠²

Here is a short note on trading in the capital markets:

Trading refers to the buying and selling of securities such as stocks and bonds. There are two main types of trading - delivery based trading and intraday trading. Delivery based trading involves purchasing securities and selling them only after receiving their delivery in the demat account. It is considered a safer approach. Intraday trading refers to buying and selling securities within the same trading day, with the net position at the end of the day remaining unchanged. It is a riskier form of trading.

Trading can take place on a stock exchange via a broker or over-the-counter without an exchange. Exchanges like NSE facilitate trading through a electronic matching system that matches buy andRole of financial markets ands institutions

Role of financial markets ands institutionsKnhantu

╠²

Financial markets allow individuals and organizations to trade financial assets like stocks and bonds. They facilitate the flow of funds from those with savings to those who need financing. Financial institutions like banks and non-bank financial institutions further help this process by channeling funds from savers to borrowers and helping to determine prices through supply and demand. Bangladesh has both traditional banks and non-bank financial institutions that operate under regulation to efficiently mobilize resources in the economy.Drug Store & Business Management Banking & Finance .pptx

Drug Store & Business Management Banking & Finance .pptxJyoti937923

╠²

Banking & finance include types, function of bank & types of financefinancial economics ppt.pptx

financial economics ppt.pptxMonyRrr

╠²

The Indian financial system plays a vital role in the country's economic development by facilitating savings, investment, and capital formation. It consists of four main components: financial institutions that act as intermediaries between savers and borrowers, financial assets that are traded in markets, financial services provided by asset managers, and financial markets where trading of money, bonds, and shares occurs. The key financial institutions are banks, which accept deposits and provide loans, and non-banking institutions like insurance companies. Important financial assets include treasury bills, certificates of deposit, and commercial paper.Financial services

Financial servicesDhiraj Jain

╠²

Financial services refer to services provided by the finance industry, such as banking, insurance, investment funds, and more. There are two main types of financial services - fund or asset based services, which involve raising and investing funds, and fee based services, where companies earn income through fees. Fund based services include leasing, housing finance, credit cards, venture capital, factoring, forfeiting, and bill discounting. Fee based services involve activities like issue management, corporate advisory, credit ratings, mutual funds, and stock broking.fin_literacy.pptx

fin_literacy.pptxKahkashaDilkash

╠²

There are two types of financial institutions - depository and non-depository. Depository institutions accept deposits and provide loans. The main depository institutions are commercial banks, savings institutions, and credit unions. Commercial banks accept deposits and provide business and personal loans. Savings institutions focus on mortgages and personal loans. Credit unions serve member groups and provide loans and lower credit card rates. Non-depository institutions provide financial services without federal deposit insurance, such as finance companies, securities firms, insurance companies, and investment companies.GST vs previous tax FOR BBA AND MBA STUDENTS PPT

GST vs previous tax FOR BBA AND MBA STUDENTS PPTpankajka85

╠²

GOODS AND SERVICES TAX (GST) IN INDIA

Concept of GST

When was GST Launched in India?

Why was GST Introduced in India?

Existing Tax structure in India

Proposed Tax Structure in India

Model of GST

GST vs Previous Taxes

Impact of GST on Indian EconomyRBI ACT.pptx FOR BBA AND MBA STUDENTS PPT

RBI ACT.pptx FOR BBA AND MBA STUDENTS PPTpankajka85

╠²

RBI ACT

Formation Of RBI

Objectives and Reasons For Establishment of RBI

Functions of RBI

More Related Content

Similar to Depository system.pptx FOR BBA AND MBA STUDENTS (20)

Unit 1 primary market

Unit 1 primary marketDeepika S.R.

╠²

This document provides an overview of financial markets and the primary and secondary markets. It defines financial markets and their role in economic development. It describes the structure of capital markets and the primary and secondary market segments. It outlines the various players in the primary market, including issuers, intermediaries, and investors. It also discusses the various instruments that can be traded in financial markets, including shares, debentures, warrants, IDRs, ADRs, and others.Depositories

DepositoriesVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

╠²

The document discusses India's depository system for electronic trading and settlement of securities. It describes how the earlier physical system was inefficient and led to problems. To address this, the Depositories Act of 1996 was passed to dematerialize securities and facilitate electronic transfers through depositories like NSDL and CDSL (National Securities Depository Limited and Central Depository Services Limited). The system aims to make transfers faster, more accurate and secure by maintaining electronic records of ownership rather than physical certificates.Depositories

DepositoriesVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

╠²

The document discusses India's depository system for electronic trading and settlement of securities. It describes how the earlier physical system was inefficient and led to problems. To address this, the Depositories Act of 1996 was passed to dematerialize securities and facilitate electronic transfers through depositories like NSDL and CDSL (National Securities Depository Limited and Central Depository Services Limited). The system aims to make transfers faster, more accurate and secure by maintaining electronic records of ownership rather than physical certificates.Financial services(alok swingh kanpur)

Financial services(alok swingh kanpur)Alok Singh

╠²

The document provides information on various financial services like factoring, leasing, merchant banking, and mutual funds. It defines factoring as the selling of invoices or receivables to a third party for cash, explains the key steps in factoring, and discusses the types and costs/benefits. It defines leasing and distinguishes operating vs financial leases. It defines merchant banking as providing various financial services and outlines their roles. It defines mutual funds as a pool of money from investors that is invested in securities according to the fund's objectives.ITFT - Depository

ITFT - Depositorymmaninderkkaur

╠²

The document discusses India's depository system for securities trading. It defines a depository as an organization that holds securities deposited by others and facilitates exchanges. India adopted an electronic book entry system to replace the paper-based process for trading securities. The key features of India's depository system include a multi-depository structure, depository participants providing services, dematerialization of securities, fungibility of holdings, and free transferability of shares.Depository System

Depository SystemDisha Bhatia

╠²

Meaning, need and benefits of depository system in India, difference between demat and physical share, depository process, functioning of NSDL and SHCIL Importance of Debt market in capital market, participant in the debt market, types of instrument treated in the Debt market, primary and secondary segments of debt market. FINANCIAL INSTITUTIONS & Role In Development In SSIs / MSME Sectors.pptx

FINANCIAL INSTITUTIONS & Role In Development In SSIs / MSME Sectors.pptxkittustudy7

╠²

Financial institutions play an important role in national economies and come in various types. They include central banks that oversee other financial institutions, commercial banks that serve individuals and businesses, and non-banking financial institutions that provide alternative services like investment and brokerage. Other types are credit unions owned by members, investment entities that help organizations raise capital, thrift institutions focused on lending to owners, and insurance companies that protect against financial risks. Overall, financial institutions regulate money supply, provide banking and investment services, offer advice, and help keep economies active.Merchant Banking- My3 Management of Financial services

Merchant Banking- My3 Management of Financial servicesMaithriPRao

╠²

Merchant banking finance Industry , services banking sector Overview of financial services and management

Overview of financial services and managementYogesh Dhoke

╠²

Overview of financial services and management Development of financial institutions in Nepal

Development of financial institutions in NepalPawan Kawan

╠²

Financial institutions play a key role in the economy by facilitating transactions and the flow of money. In Nepal, there are various types of financial institutions that serve different functions:

- Commercial banks accept deposits and provide business loans and basic investment services. Nepal's first commercial bank was Nepal Bank Ltd.

- Development banks like the Nepal Development Bank Limited provide medium and long-term financing to support sectors like industry and agriculture.

- Other financial institutions in Nepal include finance companies, microcredit banks, cooperatives, and non-governmental organizations. As of 2012 there were over 300 registered financial institutions operating in Nepal.Lecture 3 Investment Basics Stock Exchange_ Depository.ppt

Lecture 3 Investment Basics Stock Exchange_ Depository.pptlavkumar420720

╠²

The document defines key terms related to stock exchanges and the process of dematerialization. It explains that a stock exchange is a platform for trading financial instruments and connecting buyers and sellers. Companies must meet listing requirements to trade on an exchange. It also outlines the purpose of exchanges is to raise capital and promote good governance. Additionally, it defines that a depository holds financial securities electronically and a depository participant acts as an intermediary between investors and the depository. The process of dematerialization involves opening a demat account and converting physical shares into electronic form by submitting share certificates to the depository participant.Trading ppt

Trading pptVikram Sankhala IIT, IIM, Ex IRS, FRM, Fin.Engr

╠²

Here is a short note on trading in the capital markets:

Trading refers to the buying and selling of securities such as stocks and bonds. There are two main types of trading - delivery based trading and intraday trading. Delivery based trading involves purchasing securities and selling them only after receiving their delivery in the demat account. It is considered a safer approach. Intraday trading refers to buying and selling securities within the same trading day, with the net position at the end of the day remaining unchanged. It is a riskier form of trading.

Trading can take place on a stock exchange via a broker or over-the-counter without an exchange. Exchanges like NSE facilitate trading through a electronic matching system that matches buy andRole of financial markets ands institutions

Role of financial markets ands institutionsKnhantu

╠²

Financial markets allow individuals and organizations to trade financial assets like stocks and bonds. They facilitate the flow of funds from those with savings to those who need financing. Financial institutions like banks and non-bank financial institutions further help this process by channeling funds from savers to borrowers and helping to determine prices through supply and demand. Bangladesh has both traditional banks and non-bank financial institutions that operate under regulation to efficiently mobilize resources in the economy.Drug Store & Business Management Banking & Finance .pptx

Drug Store & Business Management Banking & Finance .pptxJyoti937923

╠²

Banking & finance include types, function of bank & types of financefinancial economics ppt.pptx

financial economics ppt.pptxMonyRrr

╠²

The Indian financial system plays a vital role in the country's economic development by facilitating savings, investment, and capital formation. It consists of four main components: financial institutions that act as intermediaries between savers and borrowers, financial assets that are traded in markets, financial services provided by asset managers, and financial markets where trading of money, bonds, and shares occurs. The key financial institutions are banks, which accept deposits and provide loans, and non-banking institutions like insurance companies. Important financial assets include treasury bills, certificates of deposit, and commercial paper.Financial services

Financial servicesDhiraj Jain

╠²

Financial services refer to services provided by the finance industry, such as banking, insurance, investment funds, and more. There are two main types of financial services - fund or asset based services, which involve raising and investing funds, and fee based services, where companies earn income through fees. Fund based services include leasing, housing finance, credit cards, venture capital, factoring, forfeiting, and bill discounting. Fee based services involve activities like issue management, corporate advisory, credit ratings, mutual funds, and stock broking.fin_literacy.pptx

fin_literacy.pptxKahkashaDilkash

╠²

There are two types of financial institutions - depository and non-depository. Depository institutions accept deposits and provide loans. The main depository institutions are commercial banks, savings institutions, and credit unions. Commercial banks accept deposits and provide business and personal loans. Savings institutions focus on mortgages and personal loans. Credit unions serve member groups and provide loans and lower credit card rates. Non-depository institutions provide financial services without federal deposit insurance, such as finance companies, securities firms, insurance companies, and investment companies.More from pankajka85 (17)

GST vs previous tax FOR BBA AND MBA STUDENTS PPT

GST vs previous tax FOR BBA AND MBA STUDENTS PPTpankajka85

╠²

GOODS AND SERVICES TAX (GST) IN INDIA

Concept of GST

When was GST Launched in India?

Why was GST Introduced in India?

Existing Tax structure in India

Proposed Tax Structure in India

Model of GST

GST vs Previous Taxes

Impact of GST on Indian EconomyRBI ACT.pptx FOR BBA AND MBA STUDENTS PPT

RBI ACT.pptx FOR BBA AND MBA STUDENTS PPTpankajka85

╠²

RBI ACT

Formation Of RBI

Objectives and Reasons For Establishment of RBI

Functions of RBI

Presentation of financial institution PPT FOR BBA AND MBA STUDENTS

Presentation of financial institution PPT FOR BBA AND MBA STUDENTSpankajka85

╠²

Presentation of financial institution

Co-operative banks

Structure of co-operative banks

No of Cooperative Banks in india

What is harcobank

Financial position of harco bank

Regional Rural Bank

No of Regional Banks in India

Schemes offered by RRB

A CASE STUDY ON WORLD RICHEST PERSON JEFF BEZOS ppt for bba and mba students

A CASE STUDY ON WORLD RICHEST PERSON JEFF BEZOS ppt for bba and mba studentspankajka85

╠²

A CASE STUDY ON WORLD RICHEST PERSON JEFF BEZOS

JEFF BEZOS Invested In

Companies purchased by Amazon

Amazon market capitalization

10 things about JEFF BEZOS

Jaguar Land Rover TREASURY MANAGEMENT.pptx for bba and mba students

Jaguar Land Rover TREASURY MANAGEMENT.pptx for bba and mba studentspankajka85

╠²

Jaguar Land Rover

clear project structure

Best practice and innovation

Treasury Transformation Through the years at Conduent group.pptx for bba and ...

Treasury Transformation Through the years at Conduent group.pptx for bba and ...pankajka85

╠²

Treasury Transformation Through the years at Conduent group

Utah State Treasury

The Challenges

The solution

The resultCHINA AND US TRADE WAR FOR BBA AND MBA STUDENTS

CHINA AND US TRADE WAR FOR BBA AND MBA STUDENTSpankajka85

╠²

CHINA AND US TRADE WAR FOR BBA AND MBA STUDENTS

Data

Us exports to china

China exports to U.S.

Reasons for trade war

Why is president TRUMP doing this

MADE IN CHINA 2025

Made in china

U.S. STRENGTH

China Strength

Who this hurting the most

SHORT TERM PAIN ŌĆō LONG TERM PAIN

Vijay Mallya Bank Fraud.pptx for bba and mba students

Vijay Mallya Bank Fraud.pptx for bba and mba studentspankajka85

╠²

Vijay Mallya Bank Fraud

Introduction

Kingfisher Airlines

UB Group

Bank Frauds

Reason of Downfall

Responsible for Fraud

ConclusionBandhan bank and gruh finance merger.pptx for bba and mba students

Bandhan bank and gruh finance merger.pptx for bba and mba studentspankajka85

╠²

Bandhan bank and gruh finance merger

What it means to the promoters of Bandhan bank

What it means to HDFC

Business Rational

Transections FOREIGN INVESTMENT IN INDIA.pptx FOR BBA AND MBA STUDENTS

FOREIGN INVESTMENT IN INDIA.pptx FOR BBA AND MBA STUDENTSpankajka85

╠²

FOREIGN INVESTMENT IN INDIA.pptx FOR BBA AND MBA STUDENTS

Direct vs Indirect Foreign Investments

FDI

GREENFIELD INVESTMENT

BROWNFIELD INVESTMENT

MERGER & ACQUISITION

FPI

FII

Foreign Investment Policy in India

SARADHA CHIT FUND PONZI SCAM FOR BBA AND MBA STUDENTS

SARADHA CHIT FUND PONZI SCAM FOR BBA AND MBA STUDENTSpankajka85

╠²

SARADHA CHIT FUND PONZI SCAM

HOW THE SCHEME WORKED?

WHAT THEY DID WITH MONEY?

ACTION BY SEBI

CONVICTION AND SENTENCES

WHY INDIAN PEOPLE INVEST IN SUCH FRAUDULENT SCHEMES?

How much does a poor family invest on an average in such chit fund companies?

What can people do to avoid this?

What should investor do to prevent chit fund scam?

Conclusion

QUESTIONS

WHAT IS INVENTORY MANAGEMENT.pptx FOR BBA AND MBA STUDENTS

WHAT IS INVENTORY MANAGEMENT.pptx FOR BBA AND MBA STUDENTSpankajka85

╠²

WHAT IS INVENTORY MANAGEMENT

TYPES OF INVENTORY

Objectives of Inventory Management

Need for Inventory Management

CASH ASSOCIATED WITH INVENTORY

CASH MANAGEMENT TECHNIQUES

CITIZENSHIP AMENDMENT ACT.pptx FOR BBA AND MBA STUDENTS

CITIZENSHIP AMENDMENT ACT.pptx FOR BBA AND MBA STUDENTSpankajka85

╠²

CITIZENSHIP AMENDMENT ACT.pptx FOR BBA AND MBA STUDENTS

IN THIS WE GET TO KNOW ABOUT WHAT IS CITIZENSHIP AMENDMENT ACT

CAA EXPLAINED

INNER LINE PERMIT

EXCLUSION OF MUSLIMS

WHY CAA IS NECESSARY

IS CAA ACTUALLY AGAINST INDIAN MUSLIM?

Will illegal Muslim immigrants from these three countries be deported under the CAA?

Is NRC linked to CAA?

What is NRC and itŌĆÖs purpose?

Why is there CAA and NRC protest especially in Muslim dominated parts of Delhi?

Why CAA protests are neither spontaneous nor a studentŌĆÖs movement?

demonetisation.pptx for BBA AND MBA STUDENTS

demonetisation.pptx for BBA AND MBA STUDENTSpankajka85

╠²

demonetisation.pptx for BBA AND MBA STUDENTS to get to know above demonetisation history, recent demonetisation in india, advantages and disadvantages.Recently uploaded (20)

Year 10 The Senior Phase Session 3 Term 1.pptx

Year 10 The Senior Phase Session 3 Term 1.pptxmansk2

╠²

Year 10 The Senior Phase Session 3 Term 1.pptxHow to Modify Existing Web Pages in Odoo 18

How to Modify Existing Web Pages in Odoo 18Celine George

╠²

In this slide, weŌĆÖll discuss on how to modify existing web pages in Odoo 18. Web pages in Odoo 18 can also gather user data through user-friendly forms, encourage interaction through engaging features. A PPT Presentation on The Princess and the God: A tale of ancient India by A...

A PPT Presentation on The Princess and the God: A tale of ancient India by A...Beena E S

╠²

A PPT Presentation on The Princess and the God: A tale of ancient India by Aaron ShepardQuickBooks Desktop to QuickBooks Online How to Make the Move

QuickBooks Desktop to QuickBooks Online How to Make the MoveTechSoup

╠²

If you use QuickBooks Desktop and are stressing about moving to QuickBooks Online, in this webinar, get your questions answered and learn tips and tricks to make the process easier for you.

Key Questions:

* When is the best time to make the shift to QuickBooks Online?

* Will my current version of QuickBooks Desktop stop working?

* I have a really old version of QuickBooks. What should I do?

* I run my payroll in QuickBooks Desktop now. How is that affected?

*Does it bring over all my historical data? Are there things that don't come over?

* What are the main differences between QuickBooks Desktop and QuickBooks Online?

* And moreBlind Spots in AI and Formulation Science Knowledge Pyramid (Updated Perspect...

Blind Spots in AI and Formulation Science Knowledge Pyramid (Updated Perspect...Ajaz Hussain

╠²

This presentation delves into the systemic blind spots within pharmaceutical science and regulatory systems, emphasizing the significance of "inactive ingredients" and their influence on therapeutic equivalence. These blind spots, indicative of normalized systemic failures, go beyond mere chance occurrences and are ingrained deeply enough to compromise decision-making processes and erode trust.

Historical instances like the 1938 FD&C Act and the Generic Drug Scandals underscore how crisis-triggered reforms often fail to address the fundamental issues, perpetuating inefficiencies and hazards.

The narrative advocates a shift from reactive crisis management to proactive, adaptable systems prioritizing continuous enhancement. Key hurdles involve challenging outdated assumptions regarding bioavailability, inadequately funded research ventures, and the impact of vague language in regulatory frameworks.

The rise of large language models (LLMs) presents promising solutions, albeit with accompanying risks necessitating thorough validation and seamless integration.

Tackling these blind spots demands a holistic approach, embracing adaptive learning and a steadfast commitment to self-improvement. By nurturing curiosity, refining regulatory terminology, and judiciously harnessing new technologies, the pharmaceutical sector can progress towards better public health service delivery and ensure the safety, efficacy, and real-world impact of drug products.EDL 290F Week 3 - Mountaintop Views (2025).pdf

EDL 290F Week 3 - Mountaintop Views (2025).pdfLiz Walsh-Trevino

╠²

EDL 290F Week 3 - Mountaintop Views (2025).pdfRass MELAI : an Internet MELA Quiz Prelims - El Dorado 2025

Rass MELAI : an Internet MELA Quiz Prelims - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

╠²

Prelims of Rass MELAI : a Music, Entertainment, Literature, Arts and Internet Culture Quiz organized by Conquiztadors, the Quiz society of Sri Venkateswara College under their annual quizzing fest El Dorado 2025. Blind spots in AI and Formulation Science, IFPAC 2025.pdf

Blind spots in AI and Formulation Science, IFPAC 2025.pdfAjaz Hussain

╠²

The intersection of AI and pharmaceutical formulation science highlights significant blind spotsŌĆösystemic gaps in pharmaceutical development, regulatory oversight, quality assurance, and the ethical use of AIŌĆöthat could jeopardize patient safety and undermine public trust. To move forward effectively, we must address these normalized blind spots, which may arise from outdated assumptions, errors, gaps in previous knowledge, and biases in language or regulatory inertia. This is essential to ensure that AI and formulation science are developed as tools for patient-centered and ethical healthcare.N.C. DPI's 2023 Language Diversity Briefing

N.C. DPI's 2023 Language Diversity BriefingMebane Rash

╠²

The number of languages spoken in NC public schools.Eng7-Q4-Lesson 1 Part 1 Understanding Discipline-Specific Words, Voice, and T...

Eng7-Q4-Lesson 1 Part 1 Understanding Discipline-Specific Words, Voice, and T...sandynavergas1

╠²

Understanding Discipline-Specific Words, Voice, and Technical TermsAPM People Interest Network Conference - Oliver Randall & David Bovis - Own Y...

APM People Interest Network Conference - Oliver Randall & David Bovis - Own Y...Association for Project Management

╠²

APM People Interest Network Conference 2025

- Autonomy, Teams and Tension

- Oliver Randall & David Bovis

- Own Your Autonomy

Oliver Randall

Consultant, Tribe365

Oliver is a career project professional since 2011 and started volunteering with APM in 2016 and has since chaired the People Interest Network and the North East Regional Network. Oliver has been consulting in culture, leadership and behaviours since 2019 and co-developed HPTM┬«ŌĆ»an off the shelf high performance framework for teams and organisations and is currently working with SAS (Stellenbosch Academy for Sport) developing the culture, leadership and behaviours framework for future elite sportspeople whilst also holding down work as a project manager in the NHS at North Tees and Hartlepool Foundation Trust.

David Bovis

Consultant, Duxinaroe

A Leadership and Culture Change expert, David is the originator of BTFAŌäó and The Dux Model.

With a Masters in Applied Neuroscience from the Institute of Organisational Neuroscience, he is widely regarded as the ŌĆśGo-ToŌĆÖ expert in the field, recognised as an inspiring keynote speaker and change strategist.

He has an industrial engineering background, majoring in TPS / Lean. David worked his way up from his apprenticeship to earn his seat at the C-suite table. His career spans several industries, including Automotive, Aerospace, Defence, Space, Heavy Industries and Elec-Mech / polymer contract manufacture.

Published in LondonŌĆÖs Evening Standard quarterly business supplement, James CaanŌĆÖs ŌĆśYour businessŌĆÖ Magazine, ŌĆśQuality WorldŌĆÖ, the Lean Management Journal and Cambridge Universities ŌĆśPMAŌĆÖ, he works as comfortably with leaders from FTSE and Fortune 100 companies as he does owner-managers in SMEŌĆÖs. He is passionate about helping leaders understand the neurological root cause of a high-performance culture and sustainable change, in business.

Session | Own Your Autonomy ŌĆō The Importance of Autonomy in Project Management

#OwnYourAutonomy is aiming to be a global APM initiative to position everyone to take a more conscious role in their decision making process leading to increased outcomes for everyone and contribute to ŌĆ£a world in which all projects succeedŌĆØ.

We want everyone to join the journey.

#OwnYourAutonomy is the culmination of 3 years of collaborative exploration within the Leadership Focus Group which is part of the APM People Interest Network. The work has been pulled together using the 5 HPTM® Systems and the BTFA neuroscience leadership programme.

https://www.linkedin.com/showcase/apm-people-network/about/How to attach file using upload button Odoo 18

How to attach file using upload button Odoo 18Celine George

╠²

In this slide, weŌĆÖll discuss on how to attach file using upload button Odoo 18. Odoo features a dedicated model, 'ir.attachments,' designed for storing attachments submitted by end users. We can see the process of utilizing the 'ir.attachments' model to enable file uploads through web forms in this slide.The Constitution, Government and Law making bodies .

The Constitution, Government and Law making bodies .saanidhyapatel09

╠²

This PowerPoint presentation provides an insightful overview of the Constitution, covering its key principles, features, and significance. It explains the fundamental rights, duties, structure of government, and the importance of constitutional law in governance. Ideal for students, educators, and anyone interested in understanding the foundation of a nationŌĆÖs legal framework.

Rass MELAI : an Internet MELA Quiz Prelims - El Dorado 2025

Rass MELAI : an Internet MELA Quiz Prelims - El Dorado 2025Conquiztadors- the Quiz Society of Sri Venkateswara College

╠²

APM People Interest Network Conference - Oliver Randall & David Bovis - Own Y...

APM People Interest Network Conference - Oliver Randall & David Bovis - Own Y...Association for Project Management

╠²

Depository system.pptx FOR BBA AND MBA STUDENTS

- 2. History ŌĆó The first depository was setup way back in 1947 in Germany. ŌĆó In India it is a relatively new concept introduced in 1996 with the enactment of depositories act 1996. ŌĆó Their operations are carried out in accordance with the regulations made by SEBI, bye-laws and rules of depositories act and SEBI(depositories and participants) regulation act 1996.

- 3. Meaning ŌĆó The term depository means a place where deposit of money, securities, property etc. is deposited for safekeeping under the terms of depository agreement. ŌĆó A depository is an entity which helps an investor to buy or sell securities such as stocks and bonds in a paper less manner. Securities in depository accounts are similar to the funds in bank accounts. ŌĆó The shares here are held in the form of electronic accounts i.e. dematerialized form and the depository system revolves around the concept of paper-less or script-less trading. ŌĆó It holds the securities of the investors in the form of electronic book entries avoiding risks associated with paper. ŌĆó It is not mandatory and is left to the investors to decide.

- 4. ŌĆó A depository works as a link between the listed companies which issue shares and shareholders. ŌĆó It issues these shares through agents associated with it called depository participants or DPs. ŌĆó A DP can be a bank, financial institution, a broker, or any entity eligible as per SEBI norms and is responsible for the final transfer of shares from the depository to investors. ŌĆó The investors, at the end of a transaction receives a confirmation from the depository.

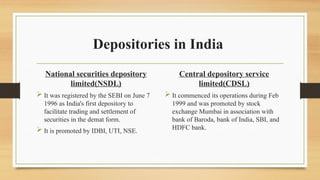

- 5. Depositories in India National securities depository limited(NSDL) ’āś It was registered by the SEBI on June 7 1996 as India's first depository to facilitate trading and settlement of securities in the demat form. ’āś It is promoted by IDBI, UTI, NSE. Central depository service limited(CDSL) ’āś It commenced its operations during Feb 1999 and was promoted by stock exchange Mumbai in association with bank of Baroda, bank of India, SBI, and HDFC bank.

- 6. Regulation ŌĆó The securities and exchange board of India (SEBI) is responsible for the registration, regulation and inspection of the depository. ŌĆó A depository is also answerable to the SEBI. It can be operational only after registration with SEBI post recommendation by NSDL or CDSL.

- 7. Types of depositories ŌĆó The three main types of depositories institutions are: a. Credit unions b. Savings institutions c. Commercial banks The main source of funding for these institutions is through deposits from customer. ŌĆó Credit unions:- are non profit companies highly focused on customer services. Customer make deposit into a credit union account, which is similar to buying shares in that credit union. The credit union earnings are distributed in the form of dividend to every customer.

- 8. ŌĆó Savings Institutions:- are for-profit companies also known as savings and loan institutions. These institutions focus primarily on consumer mortgage lending but may also offer credit cards and commercial loans. Customer deposit money into an account, which buys shares in the company. ŌĆó Commercial banks:- are for-profit companies and are the largest type of depository institutions. These banks offers a range of services to consumers and businesses such as checking accounts, consumer and commercial loans, credit cards, and investment products. These institutions accept deposits and primarily use the deposits to offer mortgage loan, commercial loans, and real estate loans.

- 9. Functions of a depository ŌĆó Transferring the ownership of shares from one investorŌĆÖs account to another account when a trade is executed is one of the primary functions of a depository. This helps reduce the paperwork for executing a trade and speeds up the transfer process. ŌĆó Another function of depository is the elimination of risk of holding the securities in physical form such as theft, loss, fraud, damage, or delay in deliveries. ŌĆó These institutions accepts customerŌĆÖs money and pay interest on their deposits overtime. While holding the customerŌĆÖs money, the institutions lend it to others in the form of mortgage or business loans, generating more interest on the money than the interest paid to customers.

- 10. ŌĆó An investor who wants to purchase precious metal can purchase them in physical bullion or paper form. Gold or silver bars can be purchased from a dealer and kept with a third party depository. ŌĆó Depository services also include checking and saving accounts, and the transfer of funds and electronic payments through online banking or debit cards. Customer gives their money to a financial institution with the belief the company holds it and give it back when the customer requests the money.

- 11. Importance of the depository system ŌĆó The first and most important advantage of the depository is it eliminates the risk of holding physical securities. Previously, the buyers had to keep checking if the shares had been transferred or not. But since the depository system came about such risks had been reduced to great extent as everything is now done through electronic mode. ŌĆó Huge paperwork which was related with the same also got reduced and from 1998 demat trading was also made compulsory. This also makes the foreign investors confident to invest in the Indian market as it fewer the chances of any kind of forgery and delays. ŌĆó The transfer take place immediately unlike physical transfer. The beneficial owner also transfers as soon as the shares are transferred from one account to the other.

- 12. ŌĆó It only holds the security listed in particular stock exchange. ŌĆó The issue of fake certificates, the problems related to bad delivery or any kind of issue related to signature are also reduced. ŌĆó Now there is no need to fill a transfer form and affix share transfer form in order to transfer share. ŌĆó The electronic system is time saving. ŌĆó The fear of losing the certificate or issue of fraud certificates are also eliminated.

- 13. Thank you