Presentation interim report january-june 2014

- 2. Second quarter 2014 2 ? EBIT of SEK -30m (-90) ? Declining mail volumes, continued heavy competition within logistics business, restructuring costs ? Continued focus on customized solutions ? New organization as of April 2014 ? Continued decline in mail volumes, but positive impact from EU election in May ? Continued heavy competition within logistics business ? Additional cost savings are required ? Adaptation of postal-specific regulations is essential PostNord AB (publ), second quarter 2014

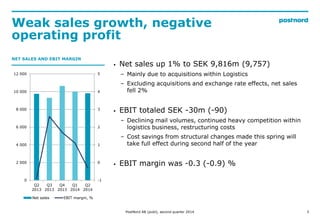

- 3. Weak sales growth, negative operating profit 3 NET SALES AND EBIT MARGIN ? Net sales up 1% to SEK 9,816m (9,757) ¨C Mainly due to acquisitions within Logistics ¨C Excluding acquisitions and exchange rate effects, net sales fell 2% ? EBIT totaled SEK -30m (-90) ¨C Declining mail volumes, continued heavy competition within logistics business, restructuring costs ¨C Cost savings from structural changes made this spring will take full effect during second half of the year ? EBIT margin was -0.3 (-0.9) % PostNord AB (publ), second quarter 2014 -1 0 1 2 3 4 5 0 2 000 4 000 6 000 8 000 10 000 12 000 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Net sales EBIT margin, %

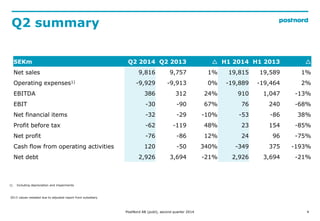

- 4. 4 Q2 summary 1) Including depreciation and impairments PostNord AB (publ), second quarter 2014 SEKm Q2 2014 Q2 2013 ? H1 2014 H1 2013 ? Net sales 9,816 9,757 1% 19,815 19,589 1% Operating expenses1) -9,929 -9,913 0% -19,889 -19,464 2% EBITDA 386 312 24% 910 1,047 -13% EBIT -30 -90 67% 76 240 -68% Net financial items -32 -29 -10% -53 -86 38% Profit before tax -62 -119 48% 23 154 -85% Net profit -76 -86 12% 24 96 -75% Cash flow from operating activities 120 -50 340% -349 375 -193% Net debt 2,926 3,694 -21% 2,926 3,694 -21% 2013 values restated due to adjusted report from subsidiary

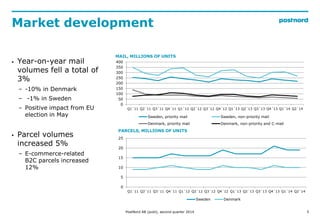

- 5. 0 50 100 150 200 250 300 350 400 Q1?11 Q2?11 Q3?11 Q4?11 Q1?12 Q2?12 Q3?12 Q4?12 Q1?13 Q2?13 Q3?13 Q4?13 Q1?14 Q2?14 Sweden, priority mail Sweden, non-priority mail Denmark, priority mail Denmark, non-priority and C-mail Market development 5 ? Year-on-year mail volumes fell a total of 3% ¨C -10% in Denmark ¨C -1% in Sweden ¨C Positive impact from EU election in May ? Parcel volumes increased 5% ¨C E-commerce-related B2C parcels increased 12% 0 5 10 15 20 25 Q1?11 Q2?11 Q3?11 Q4?11 Q1?12 Q2?12 Q3?12 Q4?12 Q1?13 Q2?13 Q3?13 Q4?13 Q1?14 Q2?14 Sweden Denmark MAIL, MILLIONS OF UNITS PARCELS, MILLIONS OF UNITS PostNord AB (publ), second quarter 2014

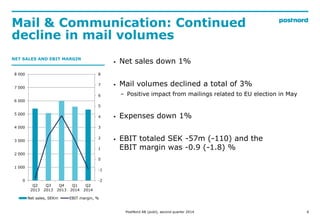

- 6. Mail & Communication: Continued decline in mail volumes 6 -2 -1 0 1 2 3 4 5 6 7 8 0 1 000 2 000 3 000 4 000 5 000 6 000 7 000 8 000 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Net sales, SEKm EBIT margin, % NET SALES AND EBIT MARGIN ? Net sales down 1% ? Mail volumes declined a total of 3% ¨C Positive impact from mailings related to EU election in May ? Expenses down 1% ? EBIT totaled SEK -57m (-110) and the EBIT margin was -0.9 (-1.8) % PostNord AB (publ), second quarter 2014

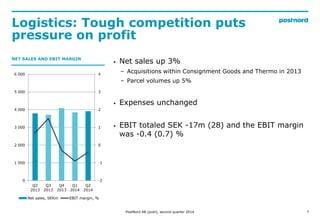

- 7. Logistics: Tough competition puts pressure on profit 7 -2 -1 0 1 2 3 4 0 1 000 2 000 3 000 4 000 5 000 6 000 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Net sales, SEKm EBIT margin, % NET SALES AND EBIT MARGIN ? Net sales up 3% ¨C Acquisitions within Consignment Goods and Thermo in 2013 ¨C Parcel volumes up 5% ? Expenses unchanged ? EBIT totaled SEK -17m (28) and the EBIT margin was -0.4 (0.7) % PostNord AB (publ), second quarter 2014

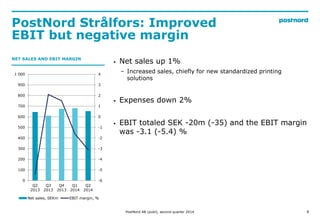

- 8. PostNord Str?lfors: Improved EBIT but negative margin 8 -6 -5 -4 -3 -2 -1 0 1 2 3 4 0 100 200 300 400 500 600 700 800 900 1 000 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Net sales, SEKm EBIT margin, % NET SALES AND EBIT MARGIN ? Net sales up 1% ¨C Increased sales, chiefly for new standardized printing solutions ? Expenses down 2% ? EBIT totaled SEK -20m (-35) and the EBIT margin was -3.1 (-5.4) % PostNord AB (publ), second quarter 2014

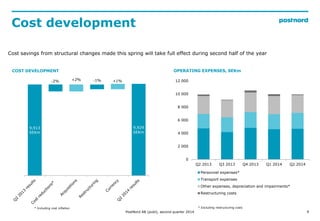

- 9. 9 Cost development * Excluding restructuring costs OPERATING EXPENSES, SEKmCOST DEVELOPMENT 8 866 MSEK 9 117 MSEK PostNord AB (publ), second quarter 2014 0 2 000 4 000 6 000 8 000 10 000 12 000 Q2 2013 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Personnel expenses* Transport expenses Other expenses, depreciation and impairments* Restructuring costs 9,913 SEKm 9,929 SEKm -2% +2% -1% +1% * Including cost inflation Cost savings from structural changes made this spring will take full effect during second half of the year

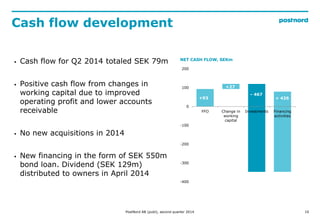

- 10. 10 Cash flow development PostNord AB (publ), second quarter 2014 +93 +27 - 467 + 426 -400 -300 -200 -100 0 100 200 FFO Change in working capital Investments Financing activities NET CASH FLOW, SEKm ? Cash flow for Q2 2014 totaled SEK 79m ? Positive cash flow from changes in working capital due to improved operating profit and lower accounts receivable ? No new acquisitions in 2014 ? New financing in the form of SEK 550m bond loan. Dividend (SEK 129m) distributed to owners in April 2014

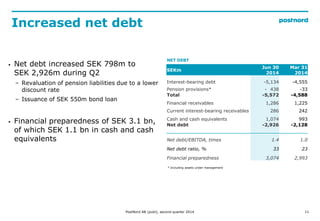

- 11. 11 Increased net debt SEKm Jun 30 2014 Mar 31 2014 Interest-bearing debt -5,134 -4,555 Pension provisions* - 438 -33 Total -5,572 -4,588 Financial receivables 1,286 1,225 Current interest-bearing receivables 286 242 Cash and cash equivalents 1,074 993 Net debt -2,926 -2,128 Net debt/EBITDA, times 1.4 1.0 Net debt ratio, % 33 23 Financial preparedness 3,074 2,993 * Including assets under management NET DEBT PostNord AB (publ), second quarter 2014 ? Net debt increased SEK 798m to SEK 2,926m during Q2 ¨C Revaluation of pension liabilities due to a lower discount rate ¨C Issuance of SEK 550m bond loan ? Financial preparedness of SEK 3.1 bn, of which SEK 1.1 bn in cash and cash equivalents

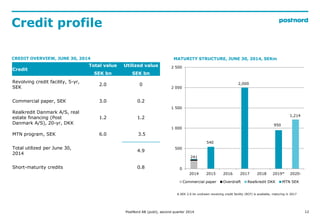

- 12. 12 Credit profile Credit Total value SEK bn Utilized value SEK bn Revolving credit facility, 5-yr, SEK 2.0 0 Commercial paper, SEK 3.0 0.2 Realkredit Danmark A/S, real estate financing (Post Danmark A/S), 20-yr, DKK 1.2 1.2 MTN program, SEK 6.0 3.5 Total utilized per June 30, 2014 4.9 Short-maturity credits 0.8 MATURITY STRUCTURE, JUNE 30, 2014, SEKmCREDIT OVERVIEW, JUNE 30, 2014 PostNord AB (publ), second quarter 2014 241 1,214 540 2,000 950 0 500 1 000 1 500 2 000 2 500 2014 2015 2016 2017 2018 2019* 2020- Commercial paper Overdraft Realkredit DKK MTN SEK A SEK 2.0 bn undrawn revolving credit facility (RCF) is available, maturing in 2017

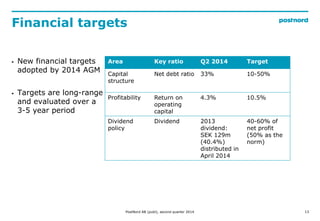

- 13. Area Key ratio Q2 2014 Target Capital structure Net debt ratio 33% 10-50% Profitability Return on operating capital 4.3% 10.5% Dividend policy Dividend 2013 dividend: SEK 129m (40.4%) distributed in April 2014 40-60% of net profit (50% as the norm) Financial targets 13 ? New financial targets adopted by 2014 AGM ? Targets are long-range and evaluated over a 3-5 year period PostNord AB (publ), second quarter 2014

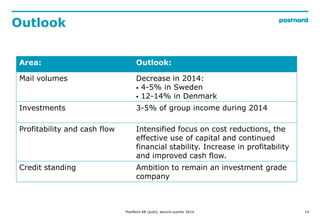

- 14. Area: Outlook: Mail volumes Decrease in 2014: ? 4-5% in Sweden ? 12-14% in Denmark Investments 3-5% of group income during 2014 Profitability and cash flow Intensified focus on cost reductions, the effective use of capital and continued financial stability. Increase in profitability and improved cash flow. Credit standing Ambition to remain an investment grade company Outlook 14PostNord AB (publ), second quarter 2014

- 15. 15 Disclaimer This document does not contain an offer of securities in the United States or any other jurisdiction; securities may not be offered or sold in the United States absent registration or exemption from the registration requirements under the U.S. Securities Act of 1933, as amended. Any offer of securities will be made, if at all, by means of a prospectus or offering memorandum issued by PostNord. Forward-looking statements Statements made in this document relating to future status or circumstances, including future performance and other trend projections are forward-looking statements. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There can be no assurance that actual results will not differ materially from those expressed or implied by these forward-looking statements due to many factors, many of which are outside the control of PostNord. Forward-looking statements herein apply only as at the date of this document. PostNord will not undertake any obligation to publicly update or revise these forward-looking statements to reflect future events, new information or otherwise except as required by law. PostNord AB (publ), second quarter 2014

- 16. 16 postnord.com H?kan Ericsson, President & CEO Lena Larsson, acting CFO, +46 10 436 06 90 Per Mossberg, Chief Communications Officer, +46 10 436 39 15 Susanne Andersson, Head of Investor Relations, +46 10 436 20 86 PostNord AB (publ), second quarter 2014