Â┘▒▒˘├ą░¨▓§░¨▓╣▒Ŕ▒Ŕ┤ă░¨│┘ for Januar-September 2014 (Dansk)

- 1. 3. kvartal 2014 2014-10-29

- 2. 3. kvartal 2014 2 ┬ž Positiv v├Žkst i e-handel ┬ž Fortsat markante fald i brevm├Žngderne ┬ž Fortsat h├ąrd konkurrence p├ą logistikmarkedet ┬ž L├Şnsomhedsniveauet stadig for lavt ┬ž Besparelsesprogrammer iv├Žrks├Žttes Ôłĺ Ca. SEK 500 mio. i ├ąrlig besparelse Ôłĺ 700-800 personer inden for administration og supportfunktioner ┬ž Nyt center i Rosersberg taget i brug ┬ž Nye kundeaftaler: Ôłĺ Koordinering af lager- og distributionsvirksomhed for CDON i Ljungby, Sverige Ôłĺ Udvidet aftale inden for tredjepartslogistik med Stadium, Sverige Ôłĺ Aftale med Spendrups inden for tungere logistik PostNord AB (publ), 3. kvartal 2014

- 3. Eventuelt frasalg af Str├ąlfors 3 ┬ž PostNord har besluttet at analysere foruds├Žtninger for et eventuelt frasalg af virksomheden Str├ąlfors ┬ž Et frasalg af Str├ąlfors vil frig├Şre kapital og give PostNord foruds├Žtningerne for yderligere at s├Žtte fokus p├ą den fastlagte strategiske kurs ┬ž For Str├ąlfors vedkommende vil en ├Žndret ejersituation eventuelt kunne medf├Şre bedre muligheder for at deltage fuldt ud i den dynamiske udvikling p├ą det nordeurop├Žiske kommunikationsmarked PostNord AB (publ), tredje kvartalet 2014

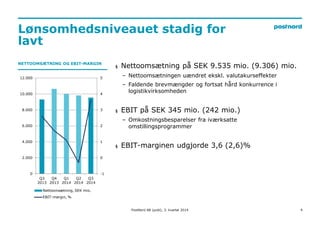

- 4. L├Şnsomhedsniveauet stadig for lavt 4 NETTOOMS├ćTNING OG EBIT-MARGIN ┬ž Nettooms├Žtning p├ą SEK 9.535 mio. (9.306) mio. ÔÇô Nettooms├Žtningen u├Žndret ekskl. valutakurseffekter ÔÇô Faldende brevm├Žngder og fortsat h├ąrd konkurrence i logistikvirksomheden ┬ž EBIT p├ą SEK 345 mio. (242 mio.) ÔÇô Omkostningsbesparelser fra iv├Žrksatte omstillingsprogrammer ┬ž EBIT-marginen udgjorde 3,6 (2,6)% PostNord AB (publ), 3. kvartal 2014 5 4 3 2 1 0 -1 12.000 10.000 8.000 6.000 4.000 2.000 0 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Nettooms├Žtning, SEK mio. EBIT-margin, %

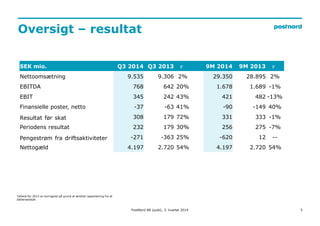

- 5. 5 Oversigt ÔÇô resultat SEK mio. Q3 2014 Q3 2013 r 9M 2014 9M 2013 r Nettooms├Žtning 9.535 9.306 2% 29.350 28.895 2% EBITDA 768 642 20% 1.678 1.689 -1% EBIT 345 242 43% 421 482 -13% Finansielle poster, netto -37 -63 41% -90 -149 40% Resultat f├Şr skat 308 179 72% 331 333 -1% Periodens resultat 232 179 30% 256 275 -7% Pengestr├Şm fra driftsaktiviteter -271 -363 25% -620 12 -- Nettog├Žld 4.197 2.720 54% 4.197 2.720 54% PostNord AB (publ), 3. kvartal 2014 Tallene for 2013 er korrigeret p├ą grund af ├Žndret rapportering fra et datterselskab

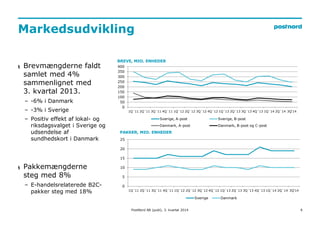

- 6. 400 350 300 250 200 150 100 50 0 1Q┬┤11 2Q┬┤11 3Q┬┤11 4Q┬┤11 1Q┬┤12 2Q┬┤12 3Q┬┤12 4Q┬┤12 1Q┬┤13 2Q┬┤13 3Q┬┤13 4Q┬┤13 1Q┬┤14 2Q┬┤14 3Q'14 Sverige, A-post Sverige, B-post Danmark, A-post Danmark, B-post og C-post Markedsudvikling 6 ┬ž Brevm├Žngderne faldt samlet med 4% sammenlignet med 3. kvartal 2013. ÔÇô -6% i Danmark ÔÇô -3% i Sverige ÔÇô Positiv effekt af lokal- og riksdagsvalget i Sverige og udsendelse af sundhedskort i Danmark ┬ž Pakkem├Žngderne steg med 8% ÔÇô E-handelsrelaterede B2C-pakker steg med 18% 25 20 15 10 5 0 1Q┬┤11 2Q┬┤11 3Q┬┤11 4Q┬┤11 1Q┬┤12 2Q┬┤12 3Q┬┤12 4Q┬┤12 1Q┬┤13 2Q┬┤13 3Q┬┤13 4Q┬┤13 1Q┬┤14 2Q┬┤14 3Q'14 Sverige Danmark BREVE, MIO. ENHEDER PAKKER, MIO. ENHEDER PostNord AB (publ), 3. kvartal 2014

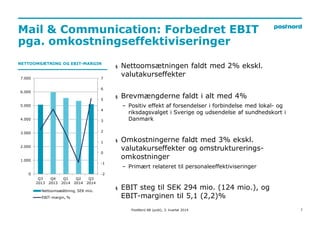

- 7. Mail & Communication: Forbedret EBIT pga. omkostningseffektiviseringer 7 NETTOOMS├ćTNING OG EBIT-MARGIN 7 6 5 4 3 2 1 0 -1 -2 7.000 6.000 5.000 4.000 3.000 2.000 1.000 0 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Nettooms├Ž├Ąttning, SEK mio. EBIT-margin, % ┬ž Nettooms├Žtningen faldt med 2% ekskl. valutakurseffekter ┬ž Brevm├Žngderne faldt i alt med 4% ÔÇô Positiv effekt af forsendelser i forbindelse med lokal- og riksdagsvalget i Sverige og udsendelse af sundhedskort i Danmark ┬ž Omkostningerne faldt med 3% ekskl. valutakurseffekter og omstrukturerings-omkostninger ÔÇô Prim├Žrt relateret til personaleeffektiviseringer ┬ž EBIT steg til SEK 294 mio. (124 mio.), og EBIT-marginen til 5,1 (2,2)% PostNord AB (publ), 3. kvartal 2014

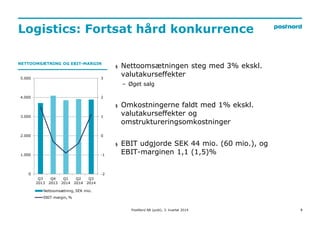

- 8. Logistics: Fortsat h├ąrd konkurrence 8 NETTOOMS├ćTNING OG EBIT-MARGIN 3 2 1 0 -1 -2 5.000 4.000 3.000 2.000 1.000 0 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Nettooms├Žtning, SEK mio. EBIT-margin, % ┬ž Nettooms├Žtningen steg med 3% ekskl. valutakurseffekter ÔÇô ├śget salg ┬ž Omkostningerne faldt med 1% ekskl. valutakurseffekter og omstruktureringsomkostninger ┬ž EBIT udgjorde SEK 44 mio. (60 mio.), og EBIT-marginen 1,1 (1,5)% PostNord AB (publ), 3. kvartal 2014

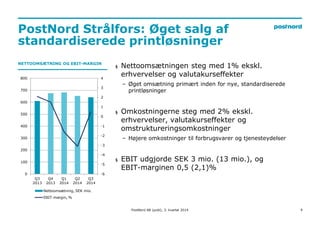

- 9. PostNord Str├ąlfors: ├śget salg af standardiserede printl├Şsninger 9 NETTOOMS├ćTNING OG EBIT-MARGIN 4 3 2 1 0 -1 -2 -3 -4 -5 -6 800 700 600 500 400 300 200 100 0 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Nettooms├Žtning, SEK mio. EBIT-margin, % ┬ž Nettooms├Žtningen steg med 1% ekskl. erhvervelser og valutakurseffekter ÔÇô ├śget oms├Žtning prim├Žrt inden for nye, standardiserede printl├Şsninger ┬ž Omkostningerne steg med 2% ekskl. erhvervelser, valutakurseffekter og omstruktureringsomkostninger ÔÇô H├Şjere omkostninger til forbrugsvarer og tjenesteydelser ┬ž EBIT udgjorde SEK 3 mio. (13 mio.), og EBIT-marginen 0,5 (2,1)% PostNord AB (publ), 3. kvartal 2014

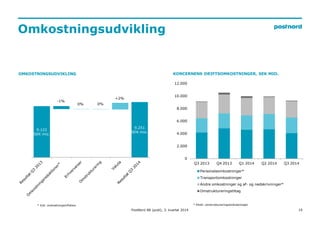

- 10. 10 Omkostningsudvikling KONCERNENS DRIFTSOMKOSTNINGER, OMKOSTNINGSUDVIKLING SEK MIO. * Ekskl. omstruktureringsomkostninger 8.866 SEK mio. 9.117 SEK mio. 12.000 10.000 8.000 6.000 4.000 2.000 0 PostNord AB (publ), 3. kvartal 2014 Q3 2013 Q4 2013 Q1 2014 Q2 2014 Q3 2014 Personaleomkostninger* Transportomkostninger Andre omkostninger og af- og nedskrivninger* Omstruktureringstiltag 9.122 SEK mio. 9.251 SEK mio. -1% 0% 0% +2% * Inkl. omkostningsinflation

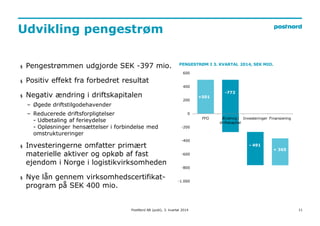

- 11. 11 Udvikling pengestr├Şm PENGESTR├śM I 3. KVARTAL 2014, SEK MIO. 600 400 200 0 -200 -400 -600 -800 PostNord AB (publ), 3. kvartal 2014 +501 -772 - 491 + 365 -1.000 FFO ├ćndring i driftskapital Investeringer Finansiering ┬ž Pengestr├Şmmen udgjorde SEK -397 mio. ┬ž Positiv effekt fra forbedret resultat ┬ž Negativ ├Žndring i driftskapitalen ÔÇô ├śgede driftstilgodehavender ÔÇô Reducerede driftsforpligtelser - Udbetaling af ferieydelse - Opl├Şsninger hens├Žttelser i forbindelse med omstruktureringer ┬ž Investeringerne omfatter prim├Žrt materielle aktiver og opk├Şb af fast ejendom i Norge i logistikvirksomheden ┬ž Nye l├ąn gennem virksomhedscertifikat-program p├ą SEK 400 mio.

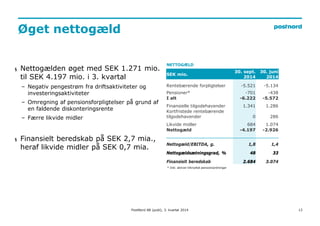

- 12. 12 ├śget nettog├Žld NETTOG├ćLD SEK mio. 30. sept. 2014 30. juni 2014 Renteb├Žrende forpligtelser -5.521 -5.134 Pensioner* -701 -438 I alt -6.222 -5.572 Finansielle tilgodehavender 1.341 1.286 Kortfristede renteb├Žrende tilgodehavender 0 286 Likvide midler 684 1.074 Nettog├Žld -4.197 -2.926 Nettog├Žld/EBITDA, g. 1,8 1,4 Nettog├Žlds├Žtningsgrad, % 48 33 Finansielt beredskab 2.684 3.074 * Inkl. aktiver tilknyttet pensionsordninger ┬ž Nettog├Žlden ├Şget med SEK 1.271 mio. til SEK 4.197 mio. i 3. kvartal ÔÇô Negativ pengestr├Şm fra driftsaktiviteter og investeringsaktiviteter ÔÇô Omregning af pensionsforpligtelser p├ą grund af en faldende diskonteringsrente ÔÇô F├Žrre likvide midler ┬ž Finansielt beredskab p├ą SEK 2,7 mia., heraf likvide midler p├ą SEK 0,7 mia. PostNord AB (publ), 3. kvartal 2014

- 13. 13 Kreditprofil FORFALDSSTRUKTUR, OVERSIGT, KREDITTER, 30. SEPTEMBER 2014 30. SEPTEMBER 2014, SEK MIO. Kredit Samlet v├Žrdi SEK mia. Udnyttet v├Žrdi SEK mia. Revolverende kreditfacilitet, 5 ├ąr, SEK 2,0 0 Virksomhedscertifikater, SEK 3,0 0,6 Realkredit Danmark A/S, ejendomsfinansiering (Post Danmark A/S), DKK 1,2 1,2 MTN-program, SEK 6,0 3,5 I alt udnyttet pr. 30. sept. 2014 5,3 Kreditter med kort forfaldstid 1,2 2.500 2.000 1.500 1.000 500 PostNord AB (publ), 3. kvartal 2014 631 1 214 540 2 000 950 0 2014 2015 2016 2017 2018 2019 2020- Virksomhedscertifikater Overdraft Realkredit DKK MTN SEK En ikke-udnyttet revolverende kredit (RCF) p├ą SEK 2,0 mia. er tilg├Žngelig med forfald i 2017

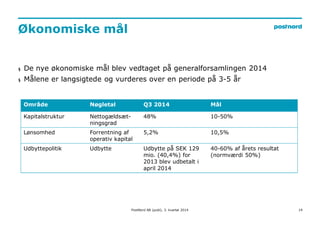

- 14. Omr├ąde N├Şgletal Q3 2014 M├ąl Kapitalstruktur Nettog├Žlds├Žt-ningsgrad 48% 10-50% L├Şnsomhed Forrentning af operativ kapital 5,2% 10,5% Udbyttepolitik Udbytte Udbytte p├ą SEK 129 mio. (40,4%) for 2013 blev udbetalt i april 2014 40-60% af ├ąrets resultat (normv├Žrdi 50%) ├śkonomiske m├ąl 14 ┬ž De nye ├Şkonomiske m├ąl blev vedtaget p├ą generalforsamlingen 2014 ┬ž M├ąlene er langsigtede og vurderes over en periode p├ą 3-5 ├ąr PostNord AB (publ), 3. kvartal 2014

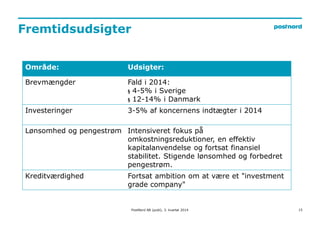

- 15. Fremtidsudsigter Omr├ąde: Udsigter: Brevm├Žngder Fald i 2014: ┬ž 4-5% i Sverige ┬ž 12-14% i Danmark Investeringer 3-5% af koncernens indt├Žgter i 2014 L├Şnsomhed og pengestr├Şm Intensiveret fokus p├ą omkostningsreduktioner, en effektiv kapitalanvendelse og fortsat finansiel stabilitet. Stigende l├Şnsomhed og forbedret pengestr├Şm. Kreditv├Žrdighed Fortsat ambition om at v├Žre et "investment grade company" PostNord AB (publ), 3. kvartal 2014 15

- 16. 16 Disclaimer This document does not contain an offer of securities in the United States or any other jurisdiction; securities may not be offered or sold in the United States absent registration or exemption from the registration requirements under the U.S. Securities Act of 1933, as amended. Any offer of securities will be made, if at all, by means of a prospectus or offering memorandum issued by PostNord. Forward-looking statements Statements made in this document relating to future status or circumstances, including future performance and other trend projections are forward-looking statements. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. There can be no assurance that actual results will not differ materially from those expressed or implied by these forward-looking statements due to many factors, many of which are outside the control of PostNord. Forward-looking statements herein apply only as at the date of this document. PostNord will not undertake any obligation to publicly update or revise these forward-looking statements to reflect future events, new information or otherwise except as required by law. PostNord AB (publ), 3. kvartal 2014

- 17. 17 postnord.com Gunilla Berg, CFO, +46 10 436 28 10 Per Mossberg, kommunikationsdirekt├Şr, +46 10 436 39 15 Susanne Andersson, chef for Investor Relations, +46 10 436 20 86 PostNord AB (publ), 3. kvartal 2014